Before continuing, I want to make a full disclosure that I am in no way a neurobiologist and I am certainly not qualified to talk about the mechanism of dopamine as a neurotransmitter, driving people’s behavior on a day to day basis. However, I have read about dopamine from various sources that I am really compelled to talk about it and relate it in ways that you might find interesting. Nothing in this post shall be construed as investment or financial advice. The author’s opinion does not necessarily reflect the Recompound’s opinion.

The book Molecule of More by Daniel Lieberman and Mike Long writes a whole lot about dopamine in a readable fashion. In fact, you could understand about the essence of dopamine just by reading its title.

Dopamine, in an ultra simplified explanation, refers to the molecule (released by your brain) that drives you for more:

More money

More friends

More good food

More {insert_anything_you_like_here}

From an evolutionary perspective, whoever puts dopamine into our system might actually be a genius into making humans take action. As reflected in many societal benchmarks, we are obsessed with more. And you could also argue that the outcome of this very molecule is many of the progress that humans have accomplished thus far.

Granted, there are deleterious effects of dopamine. And there are industries, raking tonnes of dollars specifically by toying with our dopamine system:

Casino

Social media

You could learn more about the vice of over-gambling and over-consumption of social media yourselves as I am pretty sure you are well informed on that front. That will not be the focus of this article.

I want to bring your attention to an important concept about dopamine that many overlook.

What most people overlook about dopamine

The concept of pain.

You see, dopamine works because we humans have a great tendency to seek for pleasure. When we are anticipating more likes on our social media. Or more money in our stock investment portfolio account, we are seeking for more. We experience pleasure as there is a surge in dopamine in anticipation of those events.

But what happens when we don’t get what we seek? Our dopamine levels drop, which creates a lot of pain.

So you could imagine the way dopamine works is somewhat like a careful balance between pleasure and pain just like a coin having heads and tails. Seeking that pleasure is powerful. But the pain of not having that pleasure is often times more overwhelming.

In a simplified way, here’s how dopamine works to keep you to take action and pursue your goals.

You have a goal and imagine it to be really pleasurable when you achieve it

You work super hard to achieve that goal

You made it! Your reach that goal and you get a surge of dopamine

A while later your dopamine level drops, and you feel pain

So you need to redefine a goal that you can chase so that you can once more feel the pleasure

Notice that source of motivation for you to re-define a goal is the pain that you feel when you no longer feel excited about the goal you have achieved. With this pain, you would define another goal (or the same goal but more). This would bring you into a cycle of endless pursuit.

Without this pain, people will be satisfied with what they have achieved and want that pleasurable thing (food, money, social media) no more.

Is financial freedom an endless pursuit?

Financial freedom is a concept that is offered by many influencers in the 21st century. The notion that what you need to do is to save up a huge amount of capital and live of from the yields and cover your expenses.

I have asked countless of people about this very notion of financial freedom. The question is simple. Suppose I give you X amount of dollars (however much you need to declare yourself financially free), and I ask them:

What would you do for the rest of your life?

Here are some of the top answers:

Not work (relax all day)

Travel around the world

Play video games

Ride a private jet

Buy luxury items

I can’t help but to think, if that is really your plan, you are unlikely to sustain the financial freedom that you have achieved. Why?

Let’s do a small simulation.

You have done a crazy amount of work to accumulate Rp 20 Billion. That’s a lot of money.

Now let’s say you put that Rp 20 Billion into a risk free instrument like government bonds, with a nice yield of 5% per annum. That means per year, you get to earn Rp 1 Billion passively. Per month, you get somewhere in the ballpark of Rp 80 million (not too shabby).

With this setup, how long does it take for you:

to be not financially free? (a point where you start eating into your capital) and;

to be broke?

Before we start answering the above questions, we need to make assumptions.

We start at spending Rp 70 million per month (that’s already Rp 10 million less than your Rp 80 million income)

The savings you make on that month, will be put into the same risk free instrument and it will increase your capital overall

Risk free rate: 5% (without doing anything, you get 5% from your capital annually)

Inflation rate: 4% (10 year inflation in Indonesia is at 4% up till 2022)

Annual expense growth rate: 10% (your wants would grow overtime because of dopamine)

With this very reasonable assumption and expense growth, you will start eating up your reserves in month 52 (or about 4 years). You are no longer financially free because your passive income can no longer sustain your life expense.

If you choose to not work and eat up your savings, with the expense growth, you will be broke by month 85 or about 7 years after you have accumulated that Rp 20 Billion.

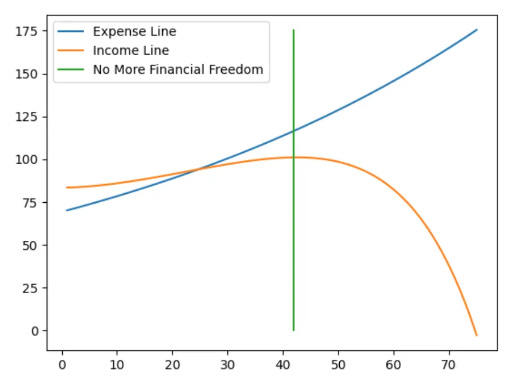

Below is a graph to illustrate the answers to the 2 questions.

Some explanations and observations:

No more financial freedom line refers to the point where your expense is large enough to start burning your initial saved up capital (Rp 20 Billion).

Your income line initially would increase since you manage to increase your capital as your expense < income.

As you start burning your savings, your income will rapidly decrease because your savings would yield less income.

When income is 0, your capital is 0 because you earn only from your capital in this simulation.

7 years is a short period of time. If you have a child that was born when you got financially independent, that child will only finish 2nd grade when you become broke. You can go broke even sooner if there is a slight change to external condition to your disservice. Let’s say inflation is now 8% instead of 4%.

With the same expense and income pattern, you will be broke in just over 5 years.

I can make you broke even sooner by taxing your income, factoring unexpected events that happen to you that is not covered by insurance and many more. Yet in a conservative scenario, this simulation says that you will be broke in year 7.

So yes, I think this simple simulation is a clear illustration that chasing your financial freedom bounds to be an endless pursuit for most.

Getting to Rp 20 Billion for almost all people is not easy

Staying relaxed on that pile of money only supports you for a little while

and then you will likely not be financially free much quicker than you think if you don’t do anything

But as this notion is frequently broadcasted on our daily lives, now we have large swathes of people (powered by dopamine) chasing that as a common goal.

What is the tool that might serve this goal? Short term trading/speculating that masquerades as investing.

Mobile trading app

Your favourite mobile trading app might often be marketed as the gateway to financial freedom. Mobile trading app is revolutionary because with a small amount of capital, you could become an investor and participate the theoretical limitless upside of public company earnings.

In practice, however, I argue it plays into people’s dopamine that induce speculative behaviour.

How it plays with people’s dopamine:

Looking at prices that is unpredictable and can change every second → like refreshing social media page and counting unpredictable likes you get from your friends of a recent post you made

Waking up in the morning excited to see if your investments is green or red → like going to casino

Constantly wanting to do more of something, with that something being buying/selling, in the illusion that by doing this “something”, they are actively doing a good thing in a bid to grow their wealth

All 3 points are related as a whole that enables the endless pursuit of buying and selling stocks to achieve one’s never ending financial goals.

Looking at prices

Stock market is a place (market) where many buyers and many sellers gather to transact stocks from one another. It is way more liquid than more traditional asset classes like real estate because a single stock can have plenty of buyers and sellers. When you have many different buyers and sellers quoting a price for a stock, you naturally would get price volatility.

One moment the price could be 1% higher when buyer A shows up, and another the price could plummet and be 5% lower when seller B shows up.

Such movement in price attracts traders that want to be on the right side of the trade by buying at a price and then selling at a higher price. But the side effect of this very price fluctuation is a compulsive behaviour to check on prices every moment. Why? Because you get a burst of dopamine when you see that the price is up.

Next: spicing things up with colour of price

If price goes up, the color of your holding is green.

If price goes down, the color of your holding is now red.

Below is a sample portfolio with no colors:

Are your stock prices up or down at the moment? I think it is quite easy to say that your stock price is down at the moment.

But now consider another sample portfolio with colors:

Now, you would reach the conclusion that your stock price is down at the moment much quicker than if you see the portfolio without any color differentiation.

But also, red and green have a side effect that is may not always be helpful to your investments. That side effect is: people always associate price going down as bad (red) and price going up as good (green). So in the case above, how do we make our investment portfolio good?

Easy peasy, we sell the red (bad) stocks

We sell stocks B, C, and E and now our portfolio is “good” again. Well isn’t it good? We only have greens and we are on our way towards that coveted financial freedom.

Not exactly, this is because after selling B, C and E your overall portfolio value would still be the same after you sell B, C and E assuming price A and D do not change and 0 transaction feee.

I want to highlight that nothing good or bad has changed to your wealth after you take action.

Besides, price going down can mean good if you want to buy more of that stock (more discount). Concurrently, price going up can mean bad if you want to buy more of that stock (more expensive).

If you say:

But Toby, I have cut loss and prevented B, C and E from further going down so I am saving my wealth.

Then I will ask you:

How do you know B, C and E will definitely go down from this point onwards?

So you see, that display of your stock portfolio with colors naturally induce more action from you. When you get rid of your red stocks, you are left with green stocks and you feel happy. Unfortunately, feeling happy does not necessarily mean that you get more wealthy.

So how should the display be like if you want to invest and not transact too often?

Perhaps something like this (if you know, you know):

This ensures that:

We are not overly fixated on the current price of the stock

We are informed with the allocation of stocks in our portfolio

We are informed with the average price of stocks we own so that we know we are not buying the stocks at a too expensive of a price overall

This also has a side effect of us looking at the stock as a company, but not as a moving ticker that can change from good to bad and then to good again in the matter of seconds.

Closing Remarks

I am definitely not saying that interface that is provided by brokerage firms are bad. If you are a serious trader that need a constant price signal, such interface may be good for you. Furthermore, brokerage firms make money from people’s transactions. So they have a business interest to leverage on people’s dopamine and make them trade as frequently as possible.

However, when people invest with a long time horizon, short term price fluctuations usually do not matter as much. What matters more is the quality of the companies that they invest and at what price.

I think that an alternative interface, thoughtfully designed for investors, can be useful to remind people that they are investing, not doing short term trades.