Can “Trusting the Process” be BS?

For those who are committed to achieving their long term goals

Hi 👋 welcome to Recompound Blog - The Investment Mindshift. We help you better your mindset on investment and economics one article at a time.

This is an article for all subscribers. During this time of the year, we hope that it would be of value to those who are willing to start achieving their long term goals or in the process of achieving their long term goals. We wish all the very success for those who are in the midst of compounding whatever good things you are compounding :)

Let’s Begin

If you have been into fitness, you might have seen fitness influencer’s general advice on losing weight. The common ones that I have been seeing lately is the following:

Walk 10,000 steps a day

Resistance training

High protein diet

Do this for a couple of months and you will see the results. Definitely not saying that the approach is wrong, but doing the 3 simple steps above requires us to be patient and to “trust the process”.

Now it has a nice parallel to investments in general. When we want to grow our money overtime in the long term, the general pointers are the following steps:

Find good, investible companies

Buy at cheap

Sell when company reaches fair value

Again, if you do this for a while (usually years), and provided companies remain good and you really bought at cheap, you should be fine (i.e. your investment portfolio would grow). But the waiting requires patience and “trusting the process”.

So a fictional character named Budi has been taking 10,000 steps a day, doing resistance training and eating a high protein diet

He weighs himself every day for a month.

Andd.. He freaks out to find out that his weight still remains about the same.

He ends up giving up and eating back like usual, dialling down on the number of steps and not lifting weights now.

He thought to himself:

I am not patient enough

I am not disciplined enough

Therefore, I cannot reliably lose weight.

He also has been trying out investments

He diligently looks at the company’s earnings, corporate governance, quality of product and future prospects. He patiently waits for the company to reach a valuation that he thinks is cheap. Then he bought in and hold.

But after a couple of months, his portfolio looks terrible.

Budi ended up cutting his losses and quitting investments entirely :( he just can't trust the process of good investing.

So here’s why trusting the process is BS

Trusting the process is BS if the tool we use is not designed to help us to do so.

Instead of pointing the finger at my shortcomings labelling myself such as:

I am not being patient enough

I am not disciplined enough

Therefore, I cannot reliably grow my investment portfolio

We obviously want to see if the harsh self assessment is justified or not. Is Budi really that impulsive? Not disciplined?

To answer, let’s map out Budi’s behavior in his investment journey. Take a careful look at the flowchart of that journey below and see if you could resonate:

From the flowchart above, you can clearly see that on a bad day, Budi is confused, anxious and desperate for reasons he does not know. He does not know why there is a bloodbath and why the price of stock A that he bought plummeted. He desperately wants the price to increase — he wants to control things that he can’t actually control.

He does not have anyone meaningful to turn to. If he goes to a Toby, Toby will say CUT LOSS. If he goes to a fictional character Gracia, she will say hold. If he goes to another fictional character Wilson, he will say buy more brother.

So Budi has to deal with a lot of noise in this situation which if repeated enough times, he is guaranteed to make a suboptimal decision. Yup, social learning can be dangerous.

Now the above scenario is what I call a bad tool that makes Budi’s life that much harder (who’s intention to invest) to invest.

It tells you nothing about Budi as a person. If you go through this emotional roller coaster every day, how would you be able to trust the process of having good investments overtime? I surely can’t personally.

Here’s how trusting the investing process might work

Trusting the process is usually much easier if the tool is explicitly designed for you to do so.

This is absolutely not a shameless plug. But here’s an example of a tool that we think could help you trust the process when you want to invest for the long term.

Note: invest not trade.

Also note: long term (years) not short term (days, weeks, months).

A simple diagram to ease your reading.

You feel the exclusivity for having your own WhatsApp group with a licensed Investment Advisor. You then receive investment thesis in your Client Dashboard that you could independently review. You can access it anytime and even if you don’t secretly understand, you can always ask in your own WhatsApp group.

You are now confident enough to make the investments. Great. But now comes the hardest part of all: waiting and trusting the process.

This is especially hard when you heard market is crashing, people are saying that investing equals gambling and when you Google “IHSG hari ini (today)”, this shows up:

But of course, we are into making the process more trust worthy am I right? So let’s spin up another flowchart of investing with a personal CIO during a bad day and during a good day.

Don’t skip the diagram. Read it first before continuing.

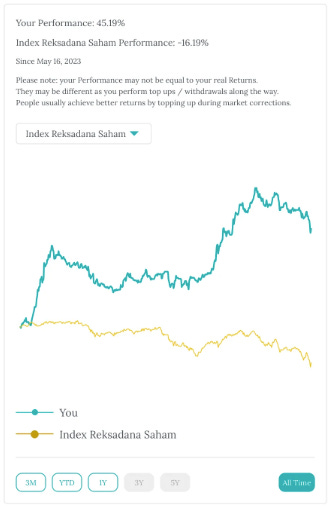

But if you have read it, the diagram above is saying whether you are experiencing a good day with your portfolio like this:

Or a bad day with your portfolio like this:

There is always a clear and actionable plan that safeguards your psychology and fosters your patience — in whatever day you are facing, be it good day or bad day. That way, we think that the process becomes a lot more trust worthy to bring the best out of your investing you.

Because ultimately, maybe you are progressing after all

Just that you’re progressing without realising because of the bad tool you use.

To me this makes it way harder to trust the process. Making your progress more obvious and with a clear action plan is a game changer.

This is so that other people (or worse, you) don’t end up labelling yourself as a failure because you fail to “trust the process” when progress is actually right in front of your eyes.

Lastly, pardon the investment example

This “reflection” piece is applicable to all areas of life that you wish to grow and develop long term. Because I’d argue that achieving great things such as:

Having a great physique

Investing for the long term

Writing well, or

Acquiring any sort of hard and real skills that could potentially be of value to others

necessarily require the right and well-designed tool to ensure that you could keep track of the progress and committed to the process. So when you are in the midst of pursuing those long term goals, we hope that you have the right tools at your disposal to help you achieve those goals (not hinder it). Cheers!