We pay homage to the compounding effect as that is not only the inspiration of our brand name “Recompound” but more so as a mathematical fact that is known to grow numbers really quickly (exponential growth).

In simple mathematical term, compounding is expressed as follows

Where,

FV refers to Future Value

PV refers to Present Value

r refers to annual return rate

t refers to time period

You have read through the least interesting part of this blog post (apologies for middle school math throwback). With this formula in mind though, we can draw an incredibly insightful conclusion that is very often overlooked by investors or any individual who is trying to accumulate wealth. At the end of the day, it is all just numbers.

A Story of Growing Chickens Using Compounding

For a moment let’s forget about wealth, financial goals, investments and other financially related matters that might pop up in your mind right now. Let’s instead focus on one question which is:

How do we get a large number over a fixed time period, given a starting number?

To put it more concretely, say we have 10 years and 10 chickens. What is the rate of growth of the chicken if we want to hit 100 chickens in 10 years time? In other words, how do we 10x the number of chickens that we have right now in 10 years?

The answer is about 26%.

So if you have 10 chickens, and it grows at 26% per year, you would get 10 times the original amount in 10 years. Let us underscore one more time that this is a mathematical fact. It is not magic. To visualise the 26% annual growth is something like this:

As you can see, if you put in the consistent work each year to grow your chickens by 26% (ensuring right nutrients, good health programs, etc), then you can expect to see the above fantastic results in 10 years. In the first few years, it does not look much. However, compounding takes noticeable effect as the amount of chickens get larger and larger.

A Story of “Growing” Chickens Using Magic

Let’s say you start with 10 chickens again. Then there’s a benevolent genie saying

Your wish is my command, I will double your chicken with magic because you are my friend.

That’s awesome! Now you have 20 chickens. That is double the amount of chicken all of the sudden without doing any work. However, after receiving that chicken “for free” you forget to manage your farm properly. You get complacent and you end up not being able to grow your chickens at all over 10 years.

Why do you get complacent? Because you only hope that another genie is going to appear and give you double the amount of chickens. Wake up sir!

What happens next?

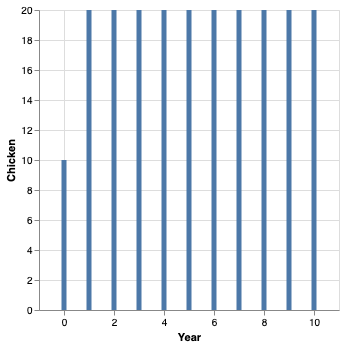

Unfortunately, you cannot use the compounding formula in this example. The calculation is simple. After 10 years, if there is no growth, your chicken is stuck at 20. That’s considered lucky if your chicken is not stolen by your neighbour. Your chart becomes something like this:

As you can see, the jump from year 0 to 1 is incredibly exciting. But it quickly becomes unentertaining when there is no growth. Worse still, you are still somehow hoping and expecting that the chickens will grow by itself.

Key Learnings

From the simple compounding effect, there are a couple humbling points here that we’d like to make:

Compounding is a simple concept but really hard to pull off.

In the context of making use compounding effect in wealth accumulation, extremely few people can pull it off successfully for a notable period of time. This is because it is really hard to do.

Consistency is our friend to grow numbers.

By having a consistent rate of growth, we can make use of the compounding effect to our advantage. That number will get bigger and bigger in a known time period.

The reverse is true. One hit wonder is overrated.

Yes you get an instant tremendous growth but it does not mean much if you cannot sustain the growth or worse still if you lose that number.

We have seen so many of those wizard like individuals who have claimed fame because they made a tremendous gain during the pandemic. Now that the bear market is ensuing, it seems that they are a lot more quiet. We can only wonder why.

Tracking. Tracking. Tracking.

It is good that you are convinced that compounding is the way to go. Unfortunately in the real world, it is not enough. You most definitely have to track your progress. Otherwise, you will not know whether you have achieved your target or not within the time period.

Lihat artikel ini untuk mengenal saham yang bagus untuk investasi jangka panjang

If you do not how to measure the progress of your goal, that is not a goal. That is a dream?