Disclaimer: This is a guest post and the author’s opinion does not necessarily reflect Recompound’s opinion. Nothing in this post shall be construed as financial advice or a method for you structure your personal finance. Always consult your financial advisor to suit your needs. Information presented in this article is editorial in nature for the purposes of education and discussion based on facts and multiple accounts of anecdotes from the author’s personal experience.

Gracia: My parents almost disowned me for becoming an insurance agent

A little bit of background about myself.

After graduating from university, I worked in the sales and trading department of a renowned multinational bank in Jakarta. With this exposure to the finance industry, I began to grow some financial curiosity, one of which relates to insurance.

My first exposure to the world of insurance was the casual remarks often made by my parents:

Insurance is useless. It’s just like throwing money into the sea.

All agents are the same (i.e. scammers, liars, [insert_more_insults])

Despite their negative and mean perception of the insurance industry, they still bought insurance products. They did not do so because they wanted to, but rather to show support to our extended family members (who are insurance agents) or to maintain good relationship with their relationship manager at the banks.

But their mean comments piqued my curiosity. I began to learn more about the insurance industry and indeed, found that their comments were well-grounded. There are contexts where insurance products serve no good purpose whatsoever for the buyers (e.g. life insurance is almost undisputedly useless to a 5 year-old, unless the 5 year-old the grandchild of a HNWI conglomeracy where succession and inheritance issue is critical - but that’s a different story), and there are a lot of agents who (intentionally or unintentionally) scam their clients. But just like how the existence of cancer induces people to find the cure for cancer, this malignant tumor in the insurance industry motivates me to find the cure as well.

Imagine the shock my parents faced when they figured out that I had discreetly put one feet, and later both feet, into the insurance industry. In hope to find the cure to this cancer (or become the cure myself), four years into my cushy and prestigious job at the bank, I resigned and became a full-time insurance agent in 2022. And I intend to stay with no foreseeable end date.

Context

In this blog post, I would like to share what I discovered as I plunged into the murky waters of the insurance industry. These are four things I will share:

I will validate my parents’ assertion that “insurance is a scam all agents are scammers”. But I will also explain why this statement is true only under certain (not all) conditions.

I will also show that part of the “insurance is scam” complaint is self-inflicted by clients

After establishing that under certain condition “insurance is not a scam and some agents are not scammers”, comes the million dollar question: do you need insurance? Just a spoiler for you, my question back to you is:

Do you prefer to: (i) lose IDR 250 million for certain, or (ii) lose IDR 0 with 50% chance and lose IDR 500 million with 50% chance

Not saying that one option is better than the other. This is just a reflection of your risk preference.

Finally, I will share with you my prescription for the cure of this cancer in the insurance industry.

The problems with insurance agents

Throughout my time as an insurance agent, I have heard so much complaints and insults thrown to my fellow agents. But just like how there are (sour) lemons and (sweet) apples, most of these complaints are about the lemons. And here are the 4 deadly sins committed by lemon insurance agents.

Sin #1: Mis-selling products

Selling things that you don’t need

True story: selling life insurance to a 5 year-old 🤯

I was recently reviewing a policy for a family with four children in Pekanbaru. Many years back, the mother was worried that if anything ever happen to her, her children would not be able to continue their education. So she bought a life insurance product that promised to offer a payout if she were to die.

In 2022, I met this mother of four and reviewed the life insurance policy she had bought. Turns out, she had bought a life insurance for her youngest child such that if her child had died, she (the mother) would receive the insurance payout 🤦🏼♀️

Selling insurance product as investment product

The fact that there exist 2 different words for insurance and investment already tells you that insurance ≠ investment.

Insurance is an expense incurred regardless of whether you need to spend on the things you are insured against. On the other hand, investment is an asset or item that is purchased with the hope that it will generate income or appreciate. What this means that don’t expect to make money from insurance!

But many insurance agents or bank RMs out there, in hope of luring you to buy an insurance policy from them, will present to you some attractive investment products that guarantee X% returns in Y years, when in actual fact they are selling you insurance products with no clause guaranteeing any return. If you blindly sign the papers, you might end up being disappointed 5 years later when you want to liquidate your “investments”.

Suppose you buy an “investment” product where you have to put in IDR 5 million/month for a year.

month 1: IDR 5 million

month 2: IDR 5 million

…

By the end of the year, you would have put in IDR 60 million.

Five years later you might want to cash out your investments. By right, you should get back IDR 60 million + X% returns as promised.

But you will be disappointed when you only get IDR 20 million in returns. That’s because you have to pay IDR 40 million for the protection you received in the past 5 years.

So don’t be fooled!

Sin #2: Sell and run

Letting the insurance policy expire without communicating to the client.

I have seen many cases where people bought an insurance policy and a few years down the road, something happened and they wanted to make a claim from their insurance company. But when the time comes, the insurance company told them that their policy had expired. Obviously clients don’t keep track of what is happening with their insurance policy (their lives are hectic enough, and that’s exactly the point of having an insurance agent right?); and their agent also do not bother telling them.

Abandoning the client

It is also a common case where an agent comes to you like an angel when they try to sign you as a customer. Bring you to fancy restaurants, send you birthday hampers, buy you the new viral pastry in town, etc etc.

As soon as you’ve signed the document, they disappear. No more fancy meals, hampers, gifts. And obviously they would have stopped working as an insurance agent when you need to make a claim 2 years later. Who should you call then? Who can help you? Well, it is the least of that agent’s concern 💁🏼♀️

Sin #3: Stating that “everything can be claimed”

The biggest red flag of an insurance agent is one who says: “you can get any medical treatment (including medical check up) for free, both in local and international hospitals.”

If you ever meet one who says the above, give him/her a big tight slap on the face.

At the end of the day, insurance companies are profit-maximising companies, not charity. They are in the business of making money, not giving out money. And the premise of insurance product is to protect you against unexpected and unfortunate events, not help you maintain you health nor get elective (good to have) treatments. This means that there are many nitty-gritty details and footnotes on what can and cannot be covered by insurance policies. If “everything is covered”, you won’t be getting a 50-page document on your insurance policy.

Sin #4: Lying about clients’ prior health conditions

One of the biggest bummer for insurance agents is to buy you fancy meals (although don’t expect this from me as I do most meetings online), work very hard to convince you to buy a product, spend tedious hours filling in the paper work, get you to do medical check up, only to have your application rejected if you have any underlying medical condition. There goes the commission that they would’ve received. What a bummer!

So what many lemon agents do is to tell their gullible clients to just “tick no” to every question on prior medical condition. While this seems to benefit both client and agent in the immediate term — client gets accepted and pay lower premium; agent gets commission — the client will be the one who suffers in the future. When something does happen and the client needs to make a claim from the insurance company within 1-2 years, the insurance company has the right to investigate whether the client has any pre-existing condition (prior to the purchase of the insurance policy). If the insurance company finds out that there is indeed a pre-existing condition, the company has the right to refuse paying this claim.

Now the client will be angry and complain to the insurance agent, who will then put all the blame to the insurance company. Now the client is the biggest loser here, while the agent still receives that big fat commission fee in his/her bank account.

How insurance agents make money? And how much?

The previous section covers quite a bit of sins made by insurance agents. But why are these sins committed in the first place?

The answer is always related to how much agents stand to make and the commission structure that they get for selling insurance products. I posit that root cause of all of this mess is caused by short-term thinking when creating wealth. This leads to wrong incentive alignment amongst insurance agents, insurance companies and clients. Let me explain.

Commission, commission, commission

Note: scenario below is simplified for the purposes of illustration in this post

Agents can make money from two commission options:

Receive IDR 25 million/year for 5 years

Receive IDR 50 million/year for 2 years

Pop quiz: which one do you prefer?

Scenario 1 offers more money in total, but you get less money per period of time. Scenario 2 offers less money overall, but you get more money per unit time.

Despite scenario 1 offering more money overall, many insurance agents prefer option 2 because they care more about making money today and tomorrow. Agents need the money now, for wedding expenses, vacation to Paris, house renovation, their child’s pre-school enrolment, etc. So this creates an ecosystem where many BU (butuh uang, or those in urgent need of money) agents get into the insurance industry to make big bucks for a few years and later on find something else that they really like to do.

Indeed, selling insurance can make people rich rather quick. For example, if hypothetically the commission rate for insurance agent is 14% of the annual premium paid by clients, how do you get rich as quickly as you can? Simple:

Get as many clients as possible

Sell product with the highest commission rate

To put a concrete example, how do you get a IDR 70 million monthly income?

Get 10 clients

For each client, sell a plan with an annual premium of IDR 50 million

For each client, you get IDR 7 million multiply that by 10, you get IDR 70 million

Easy peasy? If you close one client every 3 days with a product priced at IDR 50 million annual premium, you are stacking some serious income there. Corporate workers with their fancy suits and dresses would look like losers.

But this is exactly the problem. Commission structure of the insurance industry works really well to motivate insurance agents to get clients (good for the insurance company and the insurance agent), but it induces agents to optimise for the wrong things:

Sell products with the highest commission rates → sin #1

Get as many clients as possible → sin #3 and #4

Attract agents who are in for all the wrong reasons → sin #2

The problems with clients

While there are many problems with insurance agents, clients are not blame-free too. But as with agents, there are lemon clients and apple clients too.

Before becoming an insurance agent, I only think from the perspective of the client. Of course, my objective as a client is to act for my self-interest.

If I were a client, I would of course want to pay lowest premium possible for the highest coverage possible.

Little did I know that these self-interested acts are later creating more harm for myself. These are the 2 acts:

“Just say that I don’t have any medical condition. Make sure to do this so that my insurance premium is low”

This relates to the problem from the agent side (sin #3). One way to pay the lowest premium is to show the insurance company that I am as healthy as Popeye, even if that means I have to lie in the process.

“Dental scaling and whitening is not covered by my insurance. But the dentist is my cousin, so I can ask him to put down my treatment under implant due to accident instead”

This is an even more pervasive problem. Again, in order to get the highest coverage possible, many clients collude with hospitals and doctors to misreport treatments not covered by their insurance policies into those that can be covered.

Digression: how insurance companies make money

Before I explain how the 2 actions above are going to harm clients themselves, let’s digress a little and talk about how insurance companies make money.

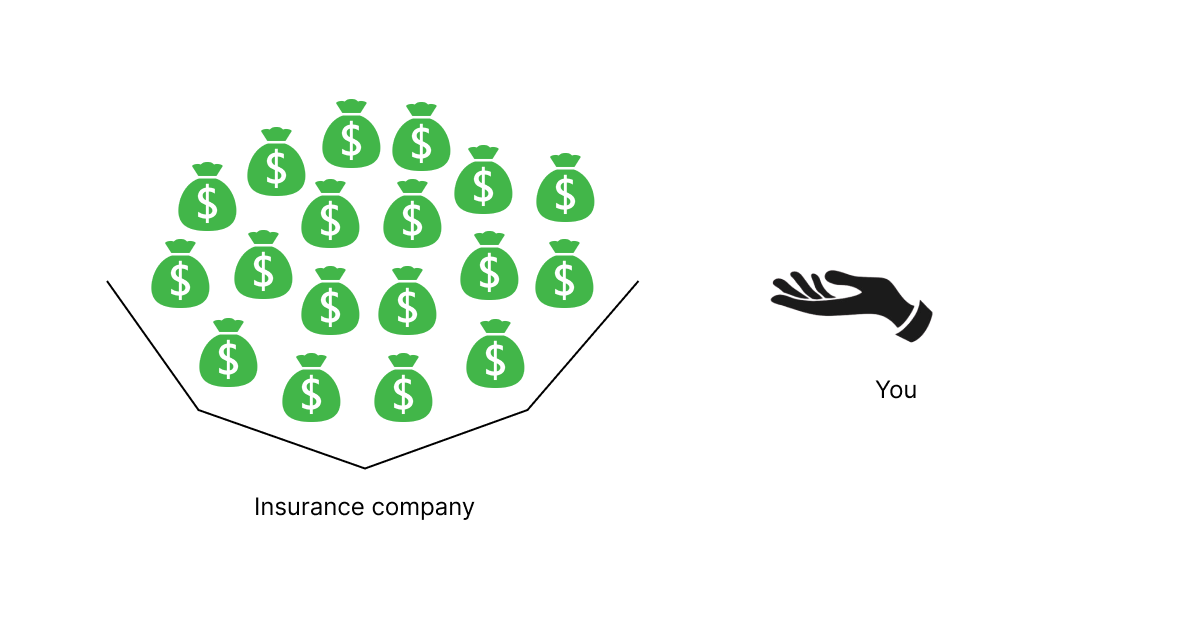

Without you realising, insurance companies and clients have a mutualistic relationship. Clients can only make claims if insurance companies exist. Insurance companies can only exist if they can make money from clients. Now you may wonder: how can insurance companies make money if they promise to pay out IDR 1 billion to me, even when I am only paying them IDR 100 million?

The answer is by aggregation. Insurance company acts by aggregating IDR 100 million from many people (people who buy insurance products). But given that unexpected and unfortunate circumstance covered by the policy happens with low probability, there will be less people making claims that people paying premium. So the key premise for the existence of insurance company is:

Premium received > claims paid out

Consequence of self-interested acts: re-pricing of insurance premium

Now what happens if clients commit the 2 acts of trickery above?

The more clients who commit act #1, the lower the premium received and the higher likelihood the claims paid out to these “healthy” clients.

The more clients who commit act #2, the higher the claims paid out.

There reaches a point where premium received < claims paid out. And this is precisely what is happening in the Indonesian insurance industry to date. What happens then, when premium received < claims paid out? Insurance companies’ profitability and existence are threatened and they react by doing the following:

Reducing the treatment coverage of their insurance products

Raising insurance premium (re-pricing)

And that is precisely what is happening right now. My advise to clients: don’t dig your own graves!

Do you actually need to buy insurance?

This section is contributed by Shania Mustika

The likelihood of me falling gravely sick is very low

As someone who likes math and data, I can’t help but question the need to buy insurance.

My argument is as such. Data shows that the probability distribution for healthcare expenditure seems to be a normal distribution.

In human words: there is low probability that you will incur high healthcare expenses, and high probability that you will incur moderate healthcare expenses (somewhere near the mean). Just to show an example from a research paper, on average a person’s healthcare expense in Finland is about EUR 2,706 (IDR 46 million) annually. But note that this number is high because it is in Europe that it is specific to the research participants (those in more contact with hospital systems).

The data for Indonesia shows that the health expenditure per person in Indonesia in 2020 was USD 414 (IDR 5.5 million, based on 2017 exchange rate). This seems to be much lower than the IDR 20 million annual premium for insurance product, doesn’t it? If the average annual healthcare expense is IDR 5.5 million, and assuming that the standard deviation is also IDR 5.5 million (this is an arbitrary number that I picked since this data is not publicly available), the probability that you would need to incur more than IDR 20 million in 1 particular year on healthcare is 0.4%** (see figure 3 below).

** Note that this number will change depending on the (i) distributional assumption and (ii) the standard deviation. But the idea stays the same.

So my skeptic mind says that as long as I can be sure that I am not in the extreme right side of the x-axis — someone who is super unhealthy, super unlucky, at high risk (e.g. older people, or have pre-existing conditions) — I can skip healthcare insurance entirely.

Buying insurance = buying feeling of security

But then I wonder: using my argument above, then the rational thing to do is for only 0.4% of the Indonesian population (1 million people) to buy insurance policies. But the data shows that 20 million people in Indonesia are covered by private healthcare insurance. Why is this so? Is it because:

These 19 million people are dumb?

These 19 million people are scammed by insurance agents?

Or there is something more about insurance that gives value to these 19 million people?

After talking more to Gracia, I conclude that buying insurance = buying the feeling of security. It is akin to having the following options:

Lose IDR 20 million for certain

Lose <IDR 20 million with 80% chance***

Lose >IDR 20 million with 20% chance***

*** Note that the probability above is one that I pick arbitrarily.

So if you prefer option (i), you can go ahead and buy that insurance.

But if you prefer option (ii), you can skip.

Note that both option (i) and (ii) are completely valid here. There is no right or wrong, just preferences. I like ice cream and you might like doughnuts, all is well.

The potential cure for cancer in the insurance industry

Back to Gracia.

My take on buying an insurance (as a certified financial planner and as a person who sells insurance products myself):

Understand the purpose of buying insurance

NOT TO: make you rich, give you returns, pay for maintenance or elective treatments (regular health check, aesthetics treatment like dental scaling or botox injection)

BUT TO: help cover your expenses in case of unexpected and unfortunate events

Buy insurance only if you can and need one

Buy a private insurance policy only if you have the means to do so. It does not make sense for a person who is making IDR 10 million a month to pay for insurance premium of IDR 5 million a month. Many people don’t know, but BPJS is quite a good insurance program that is underutilised, especially if you are in less-populated area.

Buy a private insurance policy if you don’t want to take the X% risk of having to dig up your family savings to pay for unexpected healthcare expenses, hence jeopardising your family’s livelihood. But also remember that while this X% is small when you are young, this X% is likely to increase as you get older; and when this X% reaches a point where it becomes significant (e.g. the risk of getting cardiovascular disease among the US population is 40% for those at 40-59 years age group), it might already be too late to purchase an insurance policy.

If you think you are a super healthy individual or a super lucky person who is not likely to fall sick or don’t mind facing the risk of incurring high healthcare expense in the unlikely event, then you might skip health insurance.

Note: While a lot of data shared here are for cases of basic health insurance, it is not the only product type and often insurance is used by High Net Worth individuals as cost-effective way to do wealth transfer to their children, grandchildren, etc.

Find the right company, product and agent. What you want to avoid:

Buying insurance products from companies that cannot pay out your claims (because the money bags they receive is not large enough - see figure 1 above)

Buying the wrong product (things that you don’t need, or won’t give you what you need)

Buying from the wrong person (who commit the 4 deadly sins above).

Be a responsible client

Instead of having this mindset: I want to pay the lowest premium possible for the highest coverage possible.

Have this mindset instead: I want myself and others to be able to be protected by our insurance policies when unexpected and unfortunate events happen.

Also, be a smart client: make sure that what the agent says is in accordance to the clauses in the paper you are going to sign.

Shameless plug

If you would like to learn more about insurance (without getting chased afterwards), or have any specific questions, you can fill the form (Here)

If you are like me who love to stalk people first, you can check out my Instagram and Linkedin.