Hi 👋 welcome to Recompound Blog - The Investment Mindshift. We help you better your mindset on investment and economics one article at a time. More: Our Values | Advisory | Get to know us | Picks | YouTube

Remember guys, not financial advice. But hopefully it will be a post to help you think about the topic more deeply if you haven’t already :)

Today is a longer blogpost, so maybe set aside about 30mins to 1 hour to truly read and absorb the ideas. Or read it multiple sittings is also fine.

Before you bash me, hear me out.

Devils is in the details and you will understand my argument when you read the entirety of the post 🙂

I honestly feel that “financial freedom” has been the holy grail of many people, not just in Indonesia, but globally. Many seem to want to earn that FU money and retire early. Manifestation would involve side-gigs, speculating in the stock market, cryptocurrency or other high risk assets.

But I am arguing that chasing financial freedom is commonly misunderstood and could be potentially one of the most dangerous ideas of our time. Especially when we see patterns of people achieving financial freedom too early often collapse.

Let’s take a look at football players

It is an extreme group of people. But understanding such phenomena can we grasp the potential pitfall of naively chasing financial freedom.

So a Premier League player (you got me I am a Man Utd fan) on average earns £35,000 per week — roughly £1.8 million per year. Even with a short 5-year career, that’s £9 million in earnings. After expenditure and taxes, maybe £4 million lands in their pocket when they retire.

At a 5% annual return, they could live on:

£200,000 per year — forever.

That’s pure financial independence for 99% of the people on the planet before hitting the age of 30. Yet the data according to BBC is quite shocking:

2 in 5 players go bankrupt within five years of retiring.

This is not even within the life time of the player. You give them 5 years and 40% of them go broke. Let that sink in for a moment. Now you can imagine if a sizeable portion of the population of working adults get to financial freedom but a good chunk of that free people end up broke then depressed. That’s a problem.

Clearly lack of money is not an issue here. You might be thinking that there’s something psychological:

They live very luxurious lifestyle

They have no financial education

and more

I don’t buy these arguments as it is too simple. Premier League footballers might be one of the toughest nuts you could find on earth. They are not just talented, but level of discipline, focus and intelligence need to also be there. Otherwise they won’t be playing in the Premier League.

Need to learn financial literacy? I don’t think they are stupid enough, especially when resources is that abundant. You could literally go on to YouTube and educate yourself about finances. You could even hire a financial advisor to help you do investments in the financial market while you focus on other areas of life.

Need to stay away from flashy lifestyle? If they could be disciplined in preparing for matches, I also think that discipline is transferrable to many areas of life.

So it seems that the issue of professional footballers getting broke goes deeper than those superfluous explanations. I think it is biological. We’ll talk about dopamine next.

The Molecule That Drives Your Entire Life

Most people understand dopamine as the molecule that drives pleasure. That’s not entirely correct. According to Dr. Andrew Huberman of Stanford Medicine, dopamine is the molecule of pursuit, craving, motivation, and forward movement — not pleasure.

It is released when you:

work toward mastery

improve at something

anticipate achievement

And here’s the first crucial insight that is the most important thing for you to remember today:

Dopamine is the chase, not the reward. Pleasure is what comes after — from other brain chemicals.

Dopamine is what drives you toward the thing in the first place.

That cute girl in the office that you see (if you are single of course), you might want to get her number. That’s dopamine.

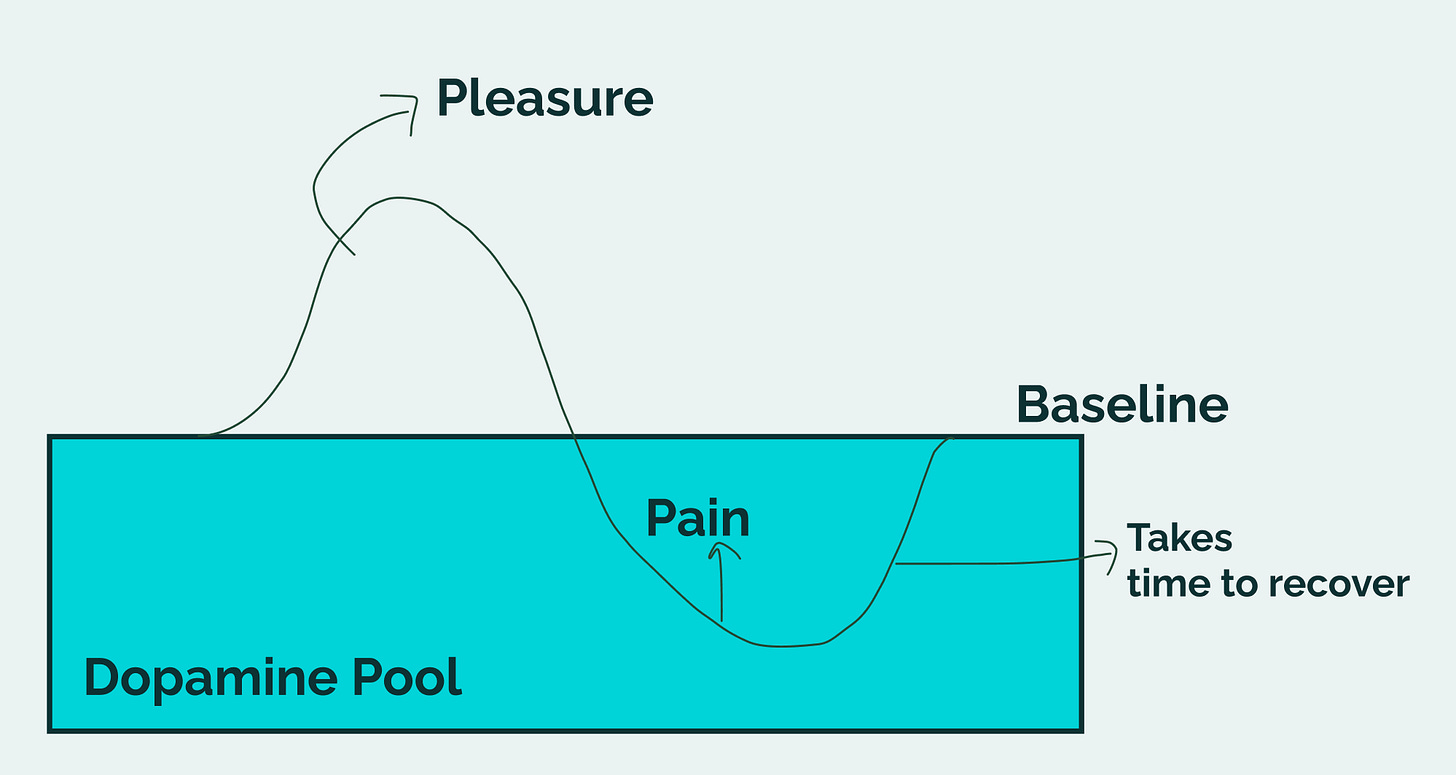

Now Huberman explains that dopamine exists in two forms:

baseline dopamine = your daily sense of motivation

peak dopamine = short bursts when you achieve something, win something, or get excitement

You can imagine it as a pool filled with water. Baseline is when the water is relatively still. Peak is when there is a wave in the pool, which will create an inevitable crash (level below the baseline).

You experience a dopamine spike (peak).

Immediately after, dopamine drops below your baseline.

Then baseline gradually recovers to its original level…

Now here’s the important bit - your baseline level determines your motivation

The lower the baseline, the lower the daily motivation. And according to Huberman, this baseline could be lowered by a crazy crash from peak dopamine.

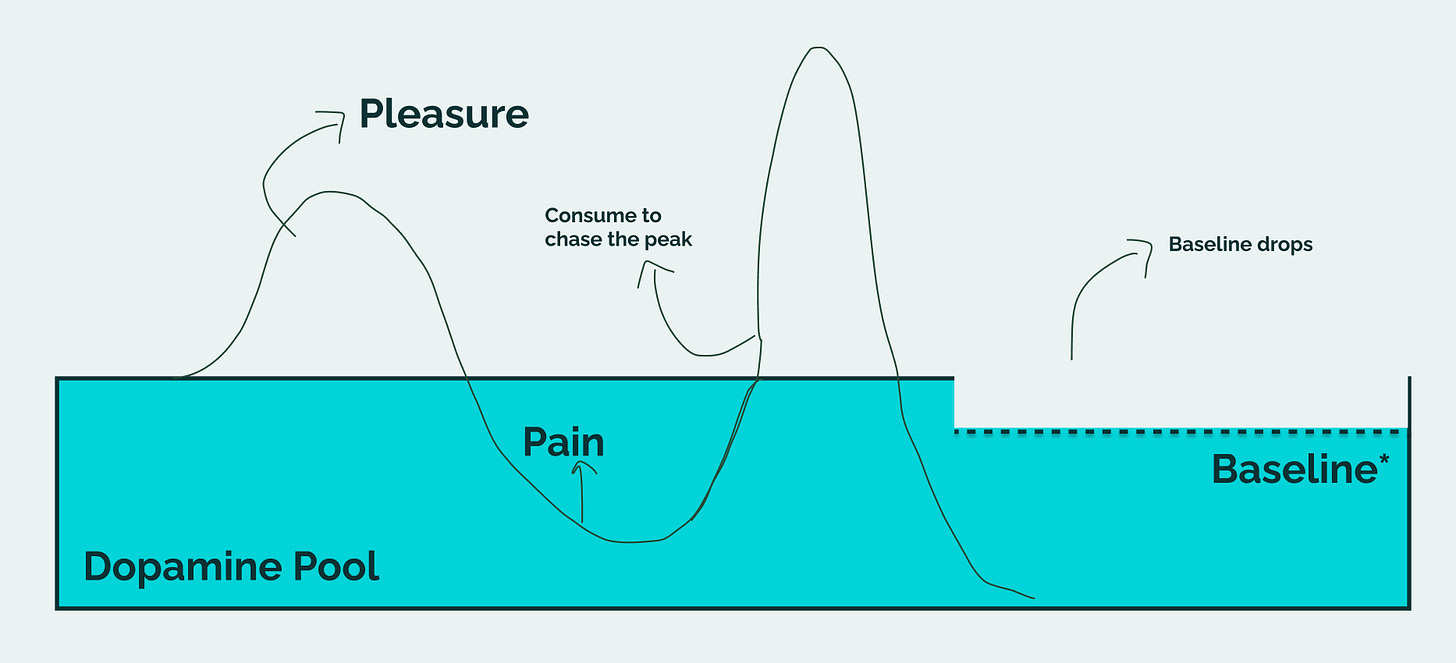

How do you have a crazy crash? Consumption that causes a steep rise to the peak which is followed by a steeper crash. This causes the “water” to be taken out from the pool and the resulting baseline would decrease.

What kind of consumption?

gambling

drugs

alcohol

you know

But why consume? Again, because the feeling of not having the pleasure, below the dopamine baseline level is pain. We do not like pain so we are compelled to do things to get rid of it. And consumption is a magical and temporary cure that allows us to get rid of that pain and go for those peak dopamine levels.

But why consuming indefinitely is a problem?

Law of diminishing marginal returns

In economics, the more you consume something, the less joy you get from each additional unit of consumption.

The first ice cream is amazing.

The tenth is bland.

The eleventh? You might want to pay a mukbang person to eat it for you.

So imagine you getting your financial freedom today. And you have said to the world that you are going to be a foodie that hunts for new hidden gem place every day.

Year 1 of being a foodie feels incredible. You get to try hidden gems, all sorts of cuisine

Year 2 not so bad.

Year 10. Maybe eating food would already stop giving you that same pleasure you initially started.

Year 30? Maybe you just want to eat home cooked food.

The worst part is that once you’ve realised that your life is miserable after so many years of consumption and you want to return to productive work, the inertia will be that much bigger and harder. Because it so happens that consumption gives you that comfort that also blunts your skill.

So let’s tie everything together sequentially to show the sync between neuroscience and economics. Most people chase money, imagining that once they “arrive,” they can sit back and consume forever. I’d argue that this is a dangerous idea.

Money → enables consumption. Once you arrive, you think you can buy anything.

Consumption → creates dopamine peaks. Every indulgence gives a short-lived spike (food, luxury, gambling, entertainment, etc.)

Dopamine peak → triggers a crash below baseline. After every peak, baseline dopamine drops temporarily.

Crash → generates pain. This is the “post-high emptiness” Huberman describes.

Pain from crash → compels more consumption. Brain thinks: “consume more to fix this pain” but that reinforces the problem.

Repeated consumption → deeper baseline depletion. The readily releasable pool of dopamine becomes depleted. Baseline takes longer to recover. Joy becomes harder to feel.

Lower baseline → lower drive, lower motivation. Huberman explicitly says: Low dopamine = low motivation, low excitement, low desire to engage.

Lower motivation → life feels depressing. This is why footballers, lottery winners, and retired athletes often spiral downwards.

Lower motivation → makes more consumption feel like the ONLY escape

And…. more consumption need? More money.

The worst part is consumption can deplete baseline which becomes a self-destructive loop:

money → consumption → peak → crash → pain → more consumption → deeper crash → lower baseline → lower motivation → more consumption → financial ruin

In other words, consulting law of diminishing marginal utility, “pleasure” you get from the same type of consumption activity diminishes as you get more of it. You’d want more to consume more extravagantly to “make up” for that dopamine crash.

it becomes either:

you spend more to consume more stuff OR

you feel pain and misery because of dopamine crash that is returning to baseline levels

Either way it is unsustainable. But this is not a doom and gloom blogpost that offers no solution. I think it’s good for you to achieve financial freedom by focusing on production that you genuinely enjoy.

How about production?

Now compare consumption with production.

When you produce — when you build, create, solve problems, serve others — something completely different happens:

Your skill compounds.

Your reputation compounds.

Your relationships compound.

Your impact compounds.

Your fulfillment compounds.

Your identity strengthens.

Your dopamine becomes sustainable.

Economically and neurobiologically, production is self-reinforcing:

The more value you create, the more dopamine-rich the process becomes — and the more value you are capable of creating next.

It has a compounding effect.

This is the opposite of consumption.

Think of:

a chef whose dishes improve every year

a writer whose clarity deepens with every essay

a coach whose players grow season after season

an entrepreneur who builds something thousands use

an investor whose circle of competence compounds

These people feel more alive the more they pursue their craft. Their dopamine is tied to effort and progress — exactly how the brain is designed to function. This is why many peak performers are happiest not at the destination, but during the years they are building toward it.

But there’s a catch: you can only produce indefinitely if you enjoy the process

You can only sustain production and enjoy compounding dopamine if you genuinely enjoy the craft itself.

If the work energises you, if the pursuit itself feels meaningful, if the effort feeds your dopamine instead of draining it:

you don’t burn out

you don’t need to escape

you don’t collapse after milestones

you don’t chase consumption for stimulation

your sense of meaning grows richer with time

This is why some people can work joyfully for decades while others burn out in two years. The joy of the process is the fuel that makes compounding possible.

So..

the better you get, the more valuable you become

the more valuable you become, the more people you can help

the more people you help, the more meaningful your life becomes

the more meaningful your life becomes, the deeper your dopamine reservoir

and the deeper your dopamine reservoir, the more motivation you have to create value (going back to point 1)

This is the compounding loop of a meaningful life. And the money?

Money becomes the by-product

You don’t need to chase it because it is pulled toward you by the value you create. And you will create that value because the work itself feels intrinsically rewarding. Not because you’re forcing yourself, but because your brain’s dopamine system is aligned with the pursuit.

Closing remarks

Some food for thoughts for the weekend if you are reading this on a Friday. Are you chasing financial freedom and early retirement because you truly have something that you enjoy doing and pursuing that is of value to other people? Or is it largely because you want to consume for the entirety of your life? Or is it because you are simply working with the wrong people that you no longer enjoy your work?

If its a people problem, but you enjoy your work, means that you will need to figure out to clean your environment up :) or relocate to a better one. Either way, financial freedom is likely to not be the answer. Chasing it naively as this essay has explained can be dangerous.

So instead of chasing financial freedom, why not chase productive work that you truly enjoy and could do indefinitely? Financial freedom then comes as a bonus, a by-product of that.