Disclaimer: This post is not an invitation to buy, sell, or hold the said public company. It is a post purely for educational purposes regarding Gudang Garam’s capital allocation. This is a guest post from Jeffry Shandy, KelaSaham. Views expressed in the materials do not necessarily reflect views of Recompound. If you’d like to learn more, check out kelasaham.id!

Prudent capital allocation is one of the most critical factors for long-term value creation for shareholders. There are various ways for a company to allocate its capital, such as investing in its core business, acquiring new businesses, paying off debt, distributing dividends, or conducting share buybacks.

"Over time, the skill with which a company’s managers allocate capital has an enormous impact on the enterprise’s value."

Berkshire Hathaway Annual Letters 1994

Each capital allocation choice comes with its own set of benefits and risks. For example, when a company chooses to reinvest profits into its core business for expansion, there is the potential to increase future earnings. However, there is also the risk of over-expansion, which could lead to suboptimal utilization and less-than-optimal shareholder returns.

Similarly, if a company distributes all its profits as dividends, it might miss opportunities for expansion and future profit growth. This is why management needs skill and wisdom in capital allocation to achieve optimal results.

Among all the potential capital allocations, acquiring new businesses often proves to be less successful. In his book “One Up on Wall Street”, Peter Lynch introduced the term "diworsification" to describe corporate diversification into areas unrelated to the company's core business.

One example of this can be seen with PT Gudang Garam Tbk (GGRM). GGRM is one of the largest cigarette companies in Indonesia. However, in recent years, the company has made significant investments in new businesses unrelated to its core operation, specifically in the airport and toll road sectors.

Over the past five years, GGRM's stock price has fallen by 80%. In 2019, GGRM recorded a profit of IDR 10.9 trillion, a 40% increase from the previous year. The rise in Average Selling Price (ASP), record sales volume of 95.9 billion sticks, and the absence of an excise tax increase that year acted as tailwinds for GGRM.

GGRM's strength at that time led many to overlook one crucial aspect: the company's plan to enter the airport business. This diversification would later draw criticism from many of its investors.

"When they were about to build this airport, what made me stand in awe was when Mr. Susilo, Director of Gudang Garam, said that all the money would come from him. They just needed permission from the government."

Luhut Binsar Pandjaitan, 2022

Given the 2019 profits and the ongoing dividend payments, the airport construction was considered part of the company’s CSR (Corporate Social Responsibility).

"Building an airport for IDR 10 trillion is nothing for GGRM, just the company's annual profit." That's what people said at the time.

Perhaps this statement was influenced by management's comments during the 2019 public expose: "The airport and infrastructure projects are not purely profit-driven business units."

Then COVID-19 hit. GGRM's 2020 profit still reached IDR 7.6 trillion, but management decided not to distribute dividends. But one thing was clear at that time: GGRM continued its infrastructure projects and injected an additional IDR 2.2 trillion into two of its subsidiaries, PT Surya Dhoho Investama (IDR 1.4 trillion) and PT Surya Kerta Agung (IDR 800 billion).

Years passed with the hope that conditions would recover, volumes would return to normal, and GGRM could pass on the excise tax increases to customers. However, since then, GGRM's performance has continued to decline. Although volume rebounded in 2021, GGRM's sales volume has steadily decreased since 2022.

In the recent GMS (General Meeting of Shareholders), GGRM decided not to distribute dividends from its 2023 profits, even though its profit increased from the previous year.

What’s really going on? Why is GGRM no longer distributing dividends?

In our view, one of the reasons is GGRM's capital allocation, which is currently being directed towards its infrastructure business—airports and toll roads.

Let’s first discuss the Dhoho Airport. The development of Dhoho Airport can be traced back to October 2016 when GGRM established PT Surya Dhoho Investama with an initial capital injection of IDR 100 billion. Since then, GGRM has continued to inject capital annually, reaching IDR 14 trillion!

GGRM's 2023 profit was IDR 5.3 trillion, while at the same time, GGRM injected IDR 4.1 trillion into PT Surya Dhoho Investama!

This capital injection represents 77% of the 2023 net profit! This may be one reason why GGRM is reluctant to distribute dividends; they need to allocate the profits to invest in the airport business.

Let’s assume GGRM has "finished" injecting capital into this business since Dhoho Airport has also begun operations.

What about the Kediri-Tulungagung Toll Road business?

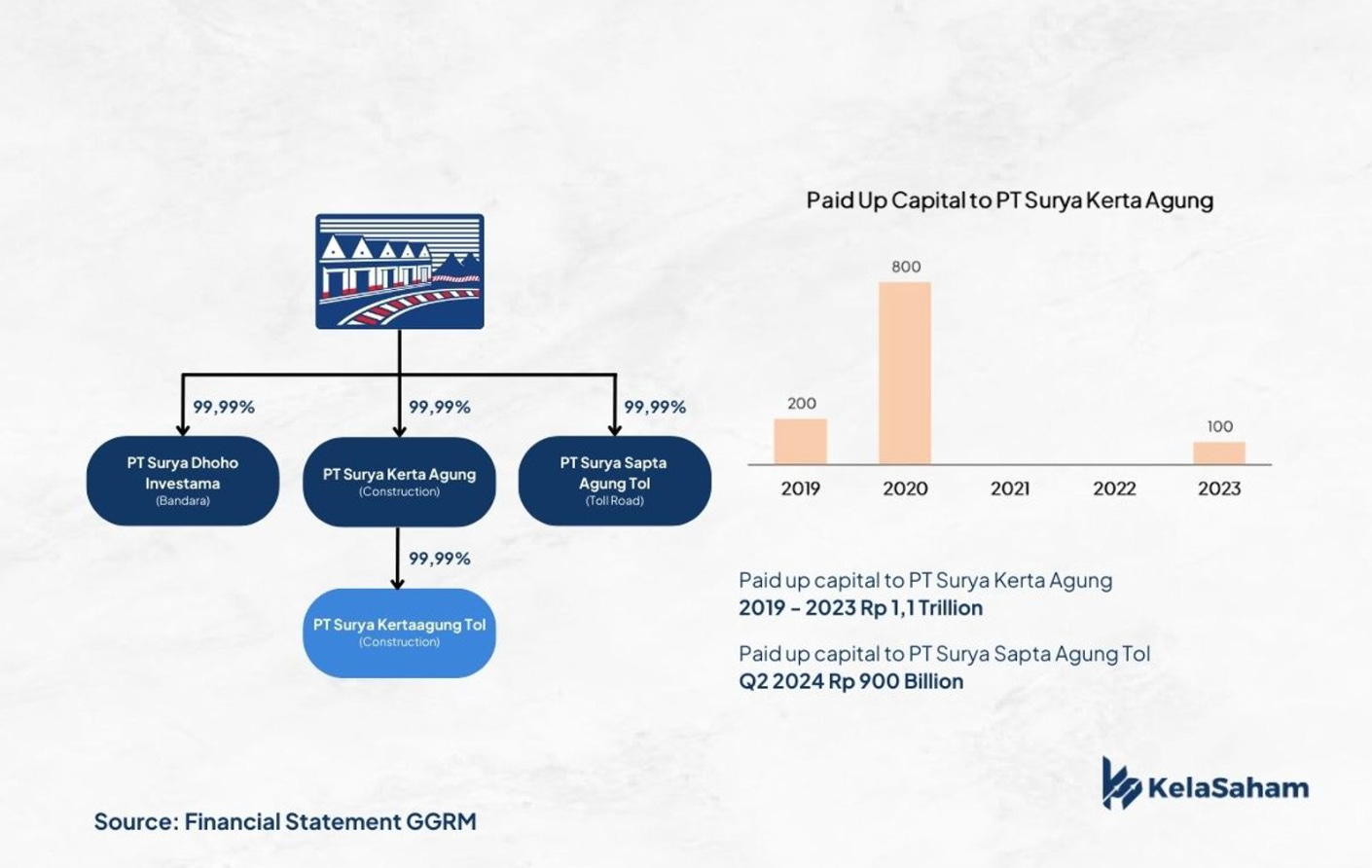

To answer this, let's look at the total capital GGRM has injected into the two subsidiaries formed: PT Surya Kerta Agung, established in 2019 for construction activities, and the latest in 2024, PT Surya Sapta Agung Tol, as the Toll Road Business Entity (BUJT). • PT Surya Kerta Agung: IDR 1,100 billion • PT Surya Sapta Agung Tol: IDR 900 billion

So, GGRM has already injected IDR 2 trillion into this toll road business. According to various sources, the contract value and investment for the Kediri-Tulungagung Toll Road project will reach IDR 9.9 trillion, rounded up to IDR 10 trillion. So, there is still about IDR 8 trillion that GGRM needs to top up into this 44 km toll road business entity.

To verify this, we can look at the disclosure of information regarding capital increases. GGRM will conduct a rights issue in PT Surya Kerta Agung worth IDR 7 trillion, while the issued and paid-up capital of PT Surya Sapta Agung Tol is IDR 2 trillion (GGRM has only injected IDR 900 billion as of Q2 2024).

So, where will the remaining IDR 8 trillion come from?

It could come from profits or interest-bearing debt.

If it comes from profits, will GGRM forgo dividend distribution again in the coming years?

It’s possible.

The cigarette industry, increasingly pressured by the government, and GGRM's capital allocation in the coming years must be closely watched.

"We have no intention of diversifying into infrastructure as our core business. The airport and other infrastructure projects we are entering are part of our participation in the government's infrastructure development. Philosophically, we are not pursuing profit in these projects."

GGRM Public Expose 2019

Consider the management’s words.

IDR 14 trillion for the construction of Dhoho Airport is equivalent to 23% of GGRM's equity! Coupled with around IDR 10 trillion for the toll road, that’s about IDR 24 trillion of GGRM’s capital invested in this business! Can we still overlook GGRM's diversification, thinking that its future performance will only be affected by its cigarette business?

Are you sure?

The construction of Dhoho Airport is recorded as an Intangible Asset with an acquisition cost of IDR 13 trillion. With a 50-year concession period, the amortization of the Airport Concession Rights will amount to around IDR 260 billion per year. This means that Dhoho Airport must generate a profit of IDR 260 billion per year so that GGRM doesn’t incur significant losses.

But the question is, can Dhoho Airport generate IDR 260 billion in profit per year?

To answer this, let’s look at the performance of eight operational airports in Indonesia.

From the eight airports analyzed, we can see that many airports are not profitable, as they are still operating at a loss from an operating profit standpoint—let alone covering other non-operational expenses.

Large airports like Soekarno Hatta, I Gusti Ngurah Rai, and Juanda are exceptions, as these airports can generate high operating profit margins. However, many airports are actually not profitable, as they are still operating at a loss even at the operating profit level—let alone covering other non-operational expenses.

Returning to the question, can Dhoho Airport generate IDR 260 billion in net profit?

Judging by the performance of other airports, it seems unlikely in the near future.