Before we begin writing this article, let’s set a couple of things straight:

“Goreng Saham” (literal translation: frying a stock; proper translation: price manipulation) refers to the act of an entity or a group of people in a consortium agreeing and executing the jacking up of a price from price X to target price Y where Y > X.

We are not saying that there is an entity that “goreng” BREN. We don’t know and we don’t want to know.

This article’s purpose is to conduct a fun thought experiment; if there is one entity that goreng BREN, how much would it cost roughly?

As always, we are not recommending you to buy or sell or hold BREN or any other stocks that are mentioned. Never construe information presented in this article as a recommendation. Do your own research to see if it’s a suitable investment for you.

Why are we discussing BREN? Let’s discuss about the company a little bit. BREN or Barito Renewable is an energy company that is part of Barito Pacific owned by Prajogo Pangestu (a conglomerate in Indonesia). BREN is a holding company that focuses on long-term strategy in provisioning clean energy so that Indonesia can transition into Net Zero Emission.

Net Zero Emission comes from the argument that climate change is anthropogenic (caused by human). Usage of fossil fuels emits an enormous amount of carbon into the atmosphere. Simply put, an additional layer of carbon is said to cause entrapment of solar radiation that increases global temperature.

Why is this important? In 2018, Gretta Thunberg tweeted an eerie warning:

“A top climate scientist is warning that climate change will wipe out all of humanity unless we stop using fossil fuels over the next five years”.

So, if that top climate scientist referred to in the tweet is correct, then we are all going to be wiped out by climate change because it is already 2024 and I, like many others, am still using Pertalite from Pertamina. But I am digressing.

Let’s Talk About BREN’s Price Action

BREN had its IPO on the 9th of October 2023 and it has seen an absolutely wild price action, perhaps comparable to Bitcoin and only a tad shy away from Doge’s or Shiba Inu’s price action in a crypto bull market. The IPO price was Rp 780 and just about 2.5 months later, the price went up all the way to ~Rp 8.200 at its highest. That is a respectable gain of 10.5x in 2.5 months.

Although if you FOMO buy at the top, you are down about 40% as of January 2024. But we can all time the market now, don’t we? (just joking: we usually cannot time the market)

Some more interesting stats aside from price action:

At its highest price, the market capitalisation of BREN surpassed Bank Rakyat Indonesia (BBRI) by almost double.

At its highest price, the market capitalisation of BREN almost overtook Bank Central Asia (BBCA), the biggest bank in Indonesia with market cap IDR ~1,000 Trillion. Yes, that’s with a T.

At its highest price, BREN’s Price to Earnings ratio is ~400x. That’s similar to Tesla’s PE during COVID bull mania.

Size of Indonesia’s GDP in 2023 is USD 1,420 Billion. Market cap of BREN (at its December highs) is USD 65 Billlion. So the market cap is ~5% of the entire Indonesia GDP.

I can go on with the interesting stats, but I want to highlight that this is not some penny stock that gets goreng-ed by a local bandar (price manipulator) who is just starting out his career. This is a big stock. So big that it moves our index and you can definitely call it a “blue chip”.

But we hope that this makes it interesting enough for a Recompound content 🙂

How Much Does it Cost to Goreng BREN?

Not saying that someone goreng*-s* BREN, but if all the price action is attributed to one entity, let’s see how much it costs that entity.

There are three types of costs entailed:

Transaction fee: as the entity transacts (buy/sell) to move the stock price, it will incur transaction fee paid to the brokerage firm

Capital: this is the actual money used to buy/sell to move the stock price

Orchestration fee: there are definitely other costs such as paying the project manager to orchestrate the operation, the traders that are engaged to execute bid offer, utility, and facility. But that calculation would involve too wild of an assumption and we’d like to underestimate the cost rather than blowing it up. So we ignore this.

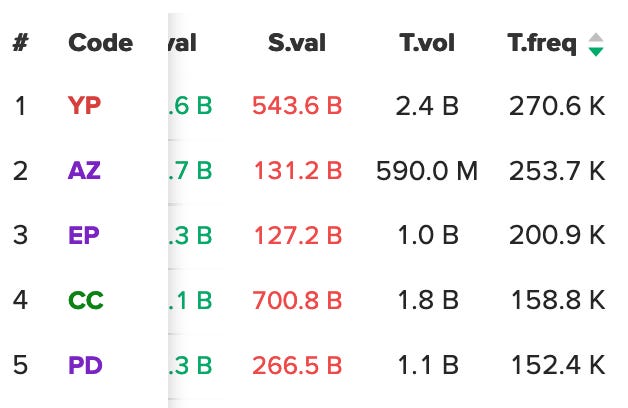

Let’s start with the transaction fee. It is fairly simple to compute. We can get Top Broker data (covering cumulative transaction data from IPO date until 17 Jan 2024) from Stockbit (note that this data may change significantly as more activity is recorded, so I have created a snapshot alongside with calculations here). Then we can take a look at the transaction value and then multiplying it by their respective transaction fee. Below is a snippet of the table:

Some assumptions are made in performing the calculation.

There are in total 90 brokerage firms that transact BREN (wow, almost all) but I set an arbitrary cut-off transaction value of above IDR 50 billion to be included in the computation. So that’s 45 brokerage firms.

Each brokerage firm has their transaction fees (buy fee and sell fee) as well. Not all transaction fee information is available online, so I assume the fee to be 0.15% buy and 0.25% sell for those that don’t publish the info.

Also, if there are two types of transaction fees (using a dealer and buying it online), I assume that the transaction fee is the one that is charged when using a dealer. I don’t think you would want to input transaction yourself especially if you are doing, up to roughly ~3,000 transactions per day.

In this calculation, we assume that retails’ (that are not nominee) and fund managers’ contribution to the overall transaction is negligible. We think it is a rather reasonable assumption given that retail and local fund manager money is small.

Retails that have strong penchant for speculating the stock market in 2023-2024 sideways market is small in number, bearing in mind that IHSG daily transaction value has dropped significantly from 20-30T in 2020-2021 during COVID bull mania to just about 7-8T in 2023.

Furthermore, local fund managers would mostly (at most) allocate 5-6% of BREN so that they don’t lose out to the index. Given the IDR 15 T of AUM of equity mutual fund, position of local fund manager in BREN should generously be IDR 1.5 T. They also usually do not go into and out of positions as frequently as retails do, bearing in mind that usually they have 50+ other stocks to rebalance on a daily basis.

Methodology

So the cost is computed in a couple of steps:

Get the broker data that contains

Broker code (to get out transaction fee)

Buy value

Sell value

Get buy fee and sell fee based on brokerage firm

Based on the information and assumptions made, the from transaction fee alone to create this price action (from 9 October 2023 to 17 January 2024) is

IDR 48.5 billion.

Reminder: you can take a look at the detailed calculation here.

Okay, that’s the transaction cost. But how much capital do you need to generate that kind of price action?

You can technically get a hand on this “working capital” with public data. We can take a look at the buy value of each brokerage firm from the broker data. The buy value of all 45 brokerage firm included in the calculation is roughly IDR 11 Trillion. But that’s ignoring the fact that you can use margin facility from the brokerage firm. So let’s assume you can borrow 10x for each because it is a big project. Then you roughly will need IDR 1.1 Trillion to create that buy value.

I have to admit that this is a very simplistic way of computing. Because the order in which you buy and then sell and then buy again may end up allowing you to need much less capital. But hopefully overestimation inaccuracy is somewhat cancelled out by assuming all brokerage firms offer a generous 10x margin facility and we assume that all trades use the margin. Plus the margin fees are also not considered.

In summary, these are the amount of money used to goreng BREN (based on my model):

Putting the numbers into perspective

To me as an average Joe, IDR 48.5 billion is a crazy amount of money that one would spend just to transact stocks. With that amount of money most can retire peacefully and probably have enough money for a few more life times (assuming money is invested properly and inflation don’t go too crazy).

But let’s not forget that I mentioned earlier BREN’s market cap reached IDR 1,000 Trillion in December 2023. It almost surpassed BBCA. You only need to spend ~IDR 1 Trillion (1/1000) to achieve that huge of a market cap?

Well, lets remember that the amount of stocks that is in circulation available to the public at the start is only 3% of total stocks outstanding based on its e-ipo prospectus. This means out of IDR 1,000 Trillion in market cap, only a meagre IDR 3 Trillion worth of the stocks are out there in circulation for the public to buy or sell.

If that IDR 3 Trillion represents a larger % of stocks in circulation (let’s say 70% of shares available for public to trade like GOTO), then the actual market cap would be smaller, ~IDR 40 T. That’s a huge market cap, but not huge enough to move the index to an extent that it is doing today.

Closing Remarks

We hope that this article sheds light on how we can get a very very rough calculation of moving stock prices up and down. While it is a fun exercise to do, it enables us to gain more perspective on the irrationality of the market. A lot of money in the market seems to be used to speculate on stock price rather than the actual fundamentals of the company.

Our job as rational investors is to not be influenced by market irrationality too much, stick to our principles and hopefully make a nice profit over the long run 🙂 Let’s go!