Hi 👋 welcome to Recompound Blog - The Investment Mindshift. We help you better your mindset on investment and economics one article at a time. More: Our Values | Advisory | Get to know us | Picks

Disclaimer: this post is meant for educational purposes only and does not constitute financial advice.

Having a burned portfolio sucks. The feeling is usually unpleasant because we are uncertain whether it can recover or not. For me, and most people, the feeling of “helplessness” is the suckiest thing.

I am guessing that usually, when we encounter a problem at work, or a bug in the code base, or a customer complain, there are solutions that we can employ actively. Then the problem will cease being a problem and we are happy to carry on with our lives.

But a burning portfolio is different. You can’t turn on a hose and water the portfolio down to stop the burning. Even after the “actions” have been done, there’s no guarantee that the portfolio will recover. Despite the no guarantees and the immense sense of helplessness, is it really that we cannot do anything about it?

In this post, I will make my very best attempt to explain that there is something that we can do about it rationally. It is going to be a step by step on

How to recover from a burned portfolio

You could do independently at your own discretion with the steps as a reference. So if you are a silent lurker who’s thinking about your burned portfolio, hopefully this blogpost serves as a good reference for you to do something about it.

First things first

An overwhelming majority of investors have experienced a burning portfolio in the past. Warren Buffett is an example when he bought Berkshire Hathaway, the cotton mill, out of spite and did not manage to turn the company around after years of managing it.

So a burning portfolio usually stems from an ill-managed investment portfolio comprising of high risk assets such as stocks or cryptocurrencies.

And again, burning portfolio amongst people who invest in high risk asset is a shared, neigh universal experience (incredibly incredibly incredibly common), that is characterised by a situation of discomfort where we are not happy:

to admit that our portfolio is in trouble

to learn that our future finances might be in trouble because the size of the investment portfolio is a sizeable portion of their overall net worth

to see that (maybe) others are “boasting” about their fantastic portfolio returns

So it is deeply emotional toward the unpleasant side. But behind that unpleasantness, I would say that a little courage is necessary to deal with this.

Without courage, the unpleasantness of the emotions that come when dealing with recovering your portfolio will lead you to unhelpful or even riskier “solutions” that can put your portfolio further in jeopardy. I will explain this more in the later section of the blogpost.

With courage, you are able to be rational and cognisant of the following basic truths:

There is no free lunch. People offering get rich quick schemes, etc are most probably lying OR making you take huge unnecessary risk without you knowing.

To recover a downside, more upside is required. To recover 10% loss, 11% upside is required. To recover a 50% loss, 100% upside is required. So recovering a burned portfolio, is not easy.

Therefore, recovery will likely require more time depending on how burned is the portfolio! Just like when someone is down with the flu can recover within a week. Another someone might need years to recover from a stage 4 colon cancer.

Yet there is a chance that your portfolio will not recover to its initial value and you just have to recoup “the losses”. As someone who could unfortunately pass from their illness, your burned portfolio might also never recover to its original value.

So yep, heavy stuff. But there is something that we could do towards recovery, still. Doing the right logical thing is hard, often times requires (loads of) courage.

Birds Eye View

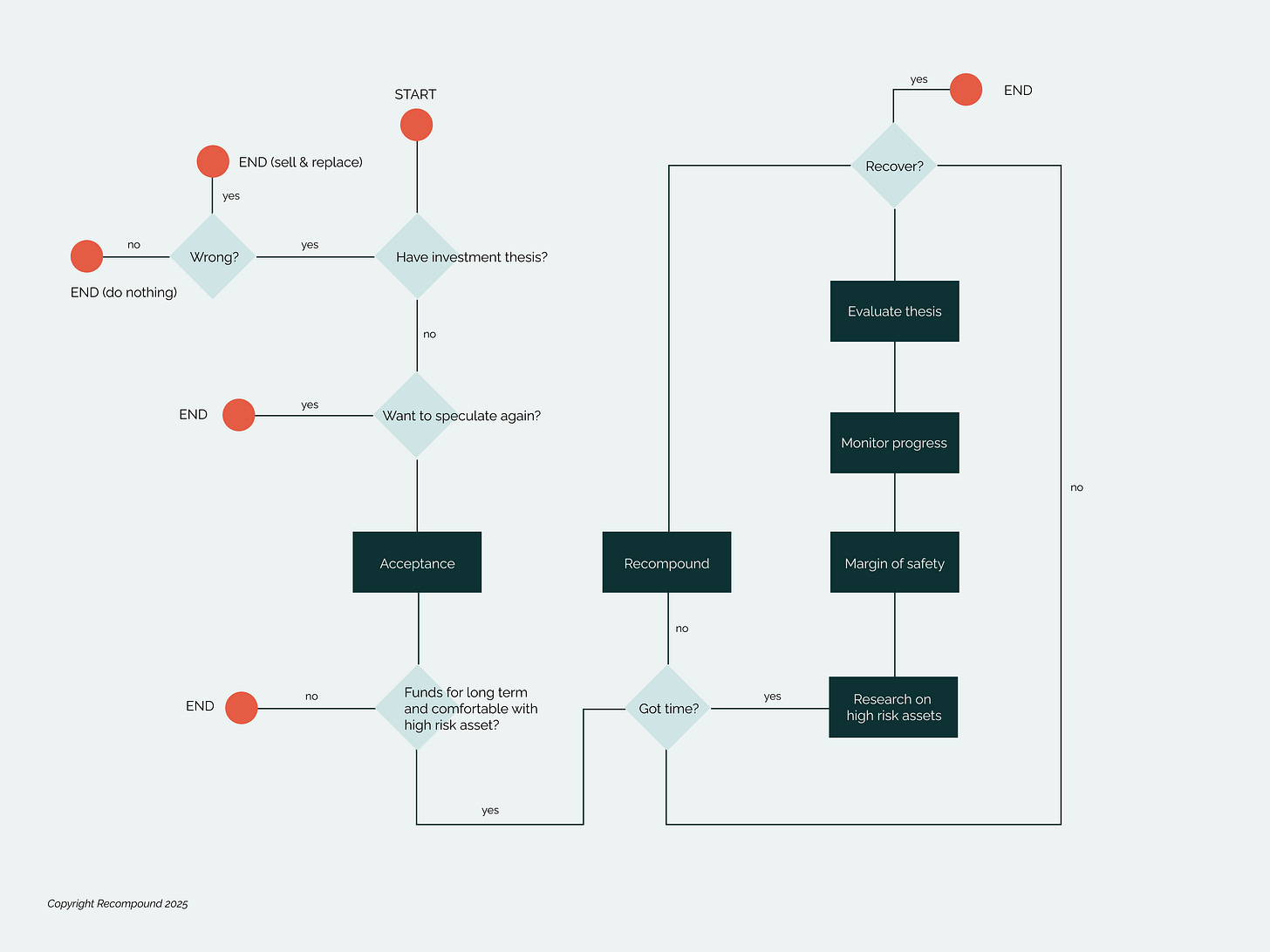

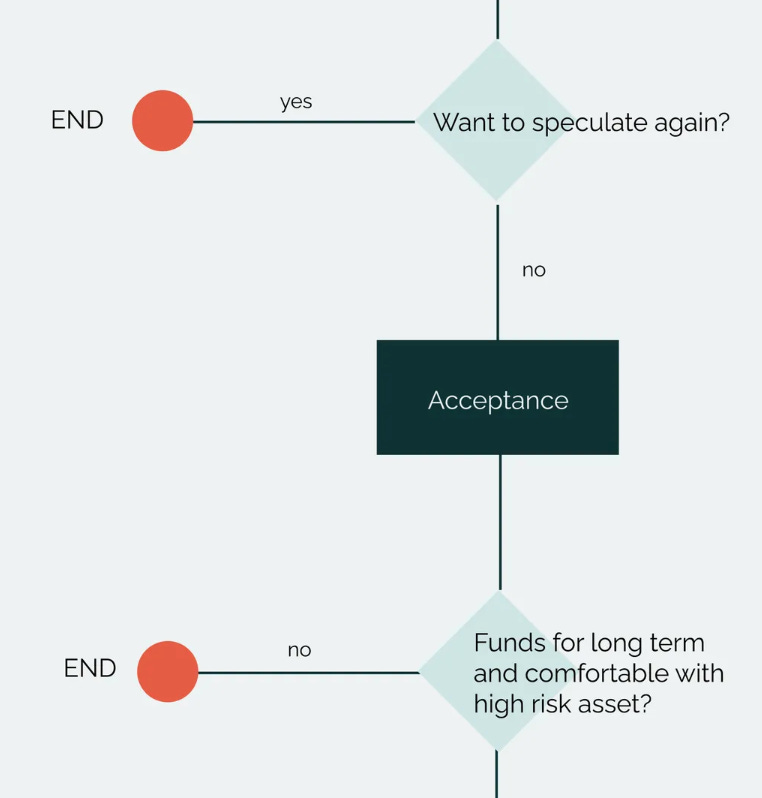

Here’s a complete flowchart that describes the process from the start of having a burned portfolio all the way to recovered end. Which is the ideal end state where your portfolio is no longer burning and even growing.

It is a multi step chart with a number of if-else conditions. Furthermore, as mentioned earlier, not all of the end state is a happy ending. Yet there is a logical path towards recovery and if I were to be shameless a little bit, we have seen multiple people’s portfolio recovered pretty convincingly at Recompound. Therefore I’d say that it is worth understanding how recovering one’s investment portfolio really works 🙂

Birds eye view chart above might seem confusing, so let’s break it down in order with some explanation.

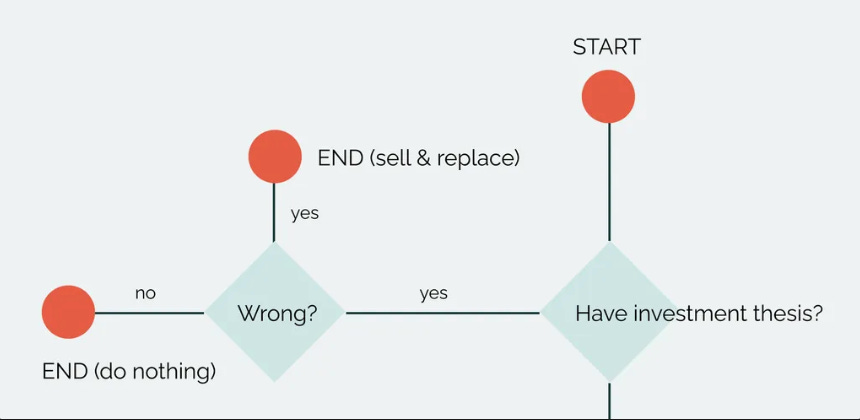

START (Burned Portfolio) → Have investment thesis?

The start of the process is your burned investment portfolio.

Since it is an investment portfolio, it should always have a logical reason why the investments are there in the portfolio itself i.e. investment thesis. Now to be honest, most people who have a burning portfolio and derive a huge amount of unpleasant emotions don’t have an investment thesis. So if you don’t have one, that is okay as it is really really common. You could skip to the next part.

But if you do have an investment thesis. It never hurts to evaluate whether it is wrong or not. Key important point that I’d like to mention when evaluating our own investment thesis is intellectual honesty. Are we letting ego in the way when evaluating our investment thesis? Are we only listening to information that confirms our biases? Are we ignoring crucial information that invalidates our thesis?

But at the same time, are we too worried about noise and meaningless media sentiments? Are we being too cautious of certain things that shouldn’t be too big of a deal?

So if you have an investment thesis, evaluate it. If its wrong, sell the investment and replace with a new investment. If it is not wrong, do nothing (for now) and enjoy the process or stomach the pain.. 😎

Talking about diamond hands, a famous example of doing nothing is Dr. Michael Burry prior to the Global Financial Crisis when he shorted the housing market by buying Credit Default Swaps. His burning portfolio came from the increasing price of mortgage backed securities that he shorted. He was required to pay a monthly premium on the Credit Default Swaps he bought so that he can get a payout when the underlying bonds fail.

According to the movie (The Big Short), he did nothing for a number of years as his investment thesis was in tact and was sitting on hundreds of millions of drawdown before eventually doubling the original investment fund when the mortgage backed securities collapsed in value.

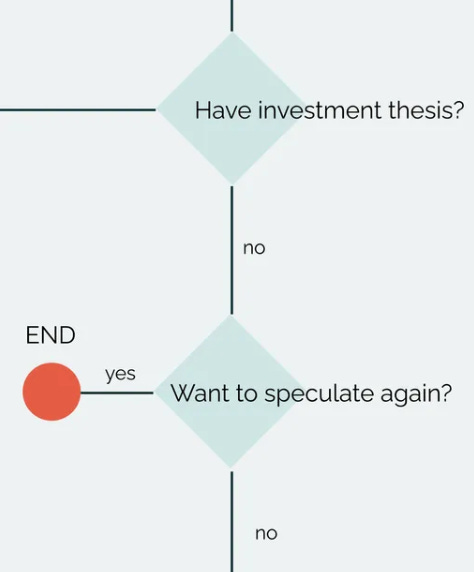

Don’t have thesis → Speculate again?

This step is in my opinion, what separates you from the pack. It is incredibly easy for someone with a burned portfolio to look for speculative bets in the hopes of “recovering their losses” quickly.

But the truth is “recovering losses quickly” is tantamount to “getting rich quickly”. The only difference is the starting point. Let’s say you started with 100 and have lost 50. Then, you want to “recover your losses” quickly. This means that you need to double your money quickly. Therefore, like I have briefly explained in the first things first section, the unpleasant emotions associated with a burning portfolio can lead us to these “recover quickly” suboptimal solution that is really not at all a valid solution for most.

To wit, below are the same action plan but in different manifestations:

Follow what other people are buying blindly (what is promoted on social media) with hopes that this stock or that stock will get jacked up 2x quickly.

Liquidate your assets, go to the casino and gamble in the hopes that you will 2x your funds and recoup losses

Therefore, if you could find a service that can double your money quickly, it is equivalent to finding a service that can make you rich quickly. Yes, the temptation to speculate again is huge because there’s a perceived notion that you have to recover your losses. If you decide you want to speculate again, all I can say is good luck? Maybe this post will be relevant again in the future.

But if after reading this, you commit to steer clear from speculating (unnecessary gambling, blindly copying other people’s investments, etc) I would say that you have managed to do the harder thing that requires discipline and rational behavior. And you have now been separated from the pack.

Yes, you are now the special minority.

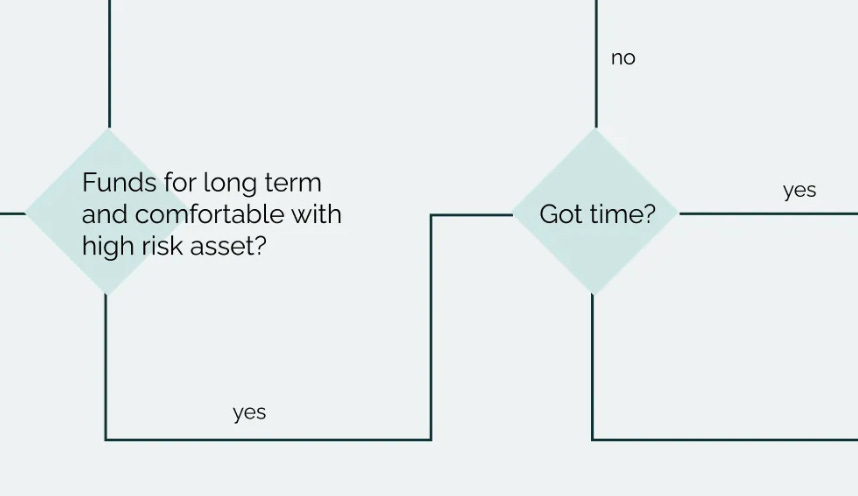

No speculation → Acceptance → Long term?

After you have decided that you are no longer interested in gambling your money away unnecessarily (or at least gambling a sizeable chunk of your net worth away) here comes the 2nd hardest part: acceptance.

This process is 2nd hardest because it involves letting go of that “financial dream or needs” because of this burned portfolio. So you probably will need to increase your active income to have better chance of reaching that financial dream or needs or adjusting that financial dream at the end.

This could be very personal, but here is a simple scenario:

Bob wants to send his son to the United Kingdom to study. He set aside $100,000 to grow 15% per year. So after 10 years, that $100,000 would ideally be around $350,000. But because of the huge drawdown at year 3 for example, his fund might only realistically be at $200,000 after 7 years. So he has 2 main options. Either work harder and get the remaining $150,000. Or send his son to Australia instead where tuition is in Australian Dollars instead of British Pounds. Or encourage his son to get a partial scholarship in the UK.

This illustration also poses a key question to people with burning portfolios. Do you still have time before your financial commitment?

If your fund is needed in the short term, like 3 months, for example. Maybe viewing your portfolio with a mindset of viewing a bankrupt company might help. If you are dealing with bankrupt companies, what you are interested in as a stakeholder is how much can you recoup from this company. Does the company have assets like land, building, equipment, etc that it could sell? How much cash does the company has for me to take? What you are focusing on really is to “salvage” whatever is left to salvage.

Then you could go all out in protecting what you have managed to salvage as you don’t want to risk its value in the short run. People have their ways to protect their wealth, keeping inside the bank, buying precious metals, or buying government bonds, etc. But ideally those assets that don’t have too great of a price fluctuation.

Furthermore, it is also a time for you to ask.

Kapok belum? I.e. Are you still comfortable in investing high risk assets or have you had enough?

Not everyone is comfortable investing in high risk assets as stomaching price volatility tends to be deeply emotional for many people that leads to irrational behaviours in the market. If you have had enough of investing in stocks with its price fluctuations and perceived risks, it is okay to call it quits.

You just have to accept investing in conservative assets like money market funds or government bonds might never recover your portfolio in time, especially if adjusted for inflation.

In it for the long term and I can still invest in high risk assets in the hopes of earning better returns

As you have a long term horizon and you have not had enough of risky assets, investing in risky assets might be a good idea. But before we go into that. The critical question to ask is:

Do I have the time?

Because, you will need the time to come up with a better strategy than your previous or lack there of strategy on your investments.

Yes, that strategy is by optimising your returns, while minimizing risk as much as possible. The next section describes how to do it.

If you don’t have the time, don’t worry as there is a solution as well for this scenario.

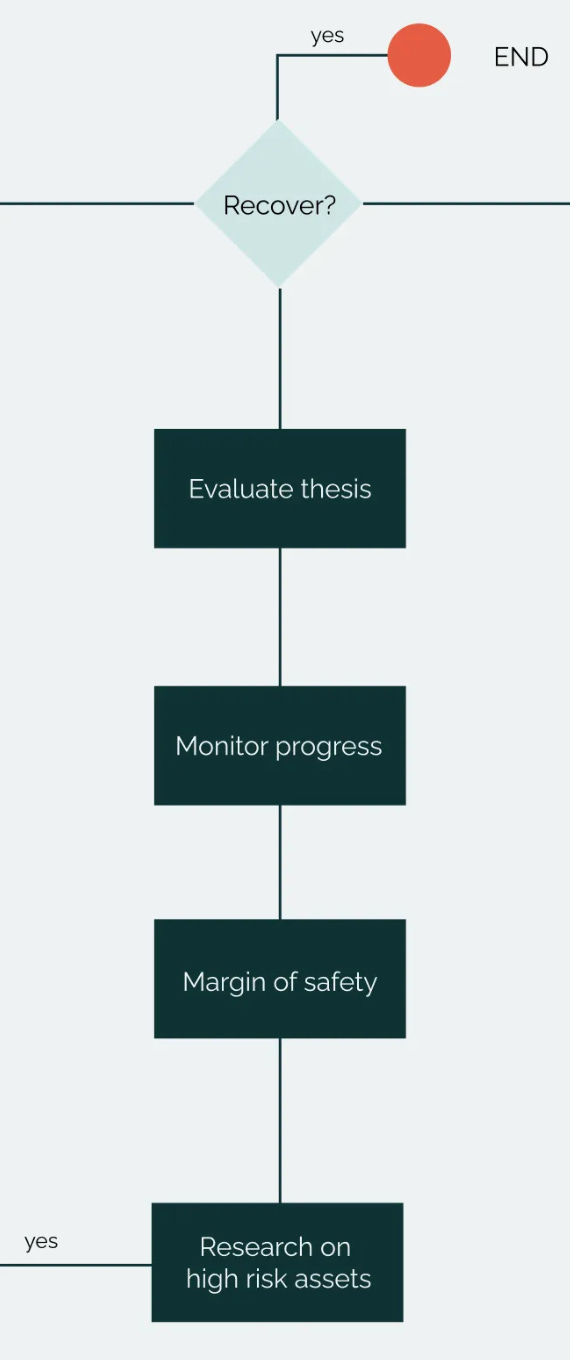

Here’s a step by step of that strategy towards recovery if you have time

Step 1. Research on high risk assets

High risk assets simply means ownership. For example, owning a property, a land, a factory, a slice of a business (a share) is considerably high risk. Because the asset that you purchase it for can go down in value in the future.

In this case, it is highly highly advised to go within your circle of competence. If you are good at analysing stocks, stick to stocks. If you are good at analysing property, stick to property. If you are good at trading crypto, stick to trading crypto (but again, be intellectually honest to yourself).

Why high risk asset? If you are right, the upside is usually unlimited. For example, if you own a share of Google in 2000, there is no body telling you that your upside is capped to 2x.

But what if you are wrong?

Step 2. Make sure margin of safety is high

Here’s where your expertise or circle of competence comes in. If you are wrong, you probably won’t lose much if you have a high margin of safety.

How do you get a high margin of safety? You get high margin of safety when you acquire your asset a price that is cheap relative to its value. Intuitively and super simply:

You are buying a bubble tea shop who operates in one mall. You know that that bubble tea is going to open in another mall.

But you are offered the price of owning one bubble tea shop only. So if the expansion of the second bubble tea fails, you are still getting returns from that one bubble tea. If the expansion succeeds, you get double the returns.

Heads I win, tails I don’t lose much. That’s investing in high risk assets combined with large margin of safety.

So why margin of safety is particularly important?

Remember that you start with a burning portfolio, maybe you have taken too much risk in the past that got you here in the first place. Now is the time for you to gun for returns with risk in mind, not just gun for returns, ignoring all risk.

Step 3, 4. Monitor progress and evaluate thesis

Monitor hows the progress of the assets that you have invested in. So back to the bubble tea example, see if the expansion is successful or taking more time to materialise?

Then evaluate your investment thesis accordingly. Am I still making the correct bet?

Recovery

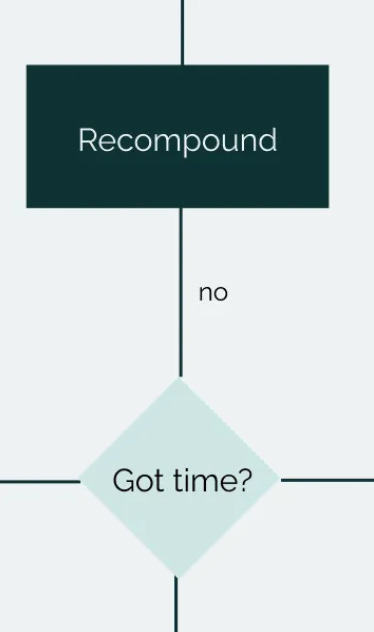

When you spend time do the 4 steps above, you will eventually get some right bets and some wrong bets. The more right bets you make, the closer you are towards recovery. And eventually with luck and patience, I believe that recovering your portfolio is very possible!

But I don’t have time

Well if you could not pay with your time to do research on high risk assets, you could spend money to help you do that and use Recompound. 4 steps that are outlined above is essentially done for you in a complete package. Circle of competence that we bring at the moment is Budi (OJK licensed investment advisor) helping you invest in the Indonesian public market with the principles mentioned.

We have done this many times and seen many of customers’ portfolio recover steadily but more surely even amid choppy markets.

Granted, Recompound is more expensive option compared to if you have the time. So if you have the time to come up with a good rational strategy to manage your investments, you are better off doing it yourself. But our fees are fair to you as we only charge our service when your portfolio grows. So we are aligned in terms of your path to recovery.

Closing Remarks

Burned portfolio sucks. Most shove away their burned portfolio problem into obscurity and do not want to deal with it, ever. A minority would want to take the leap of faith and commit to rectify things in the most logical and disciplined manner. If you have no time, we are here. But if you have the time to help yourself, we are still here to cheer you on.