The picture above depicts a famous quote coined by Warren Buffet, which implies: to amass a fortune from stock market, one must have the courage to invest in a good company during distress.

However, it is easier said than done:

Expectation

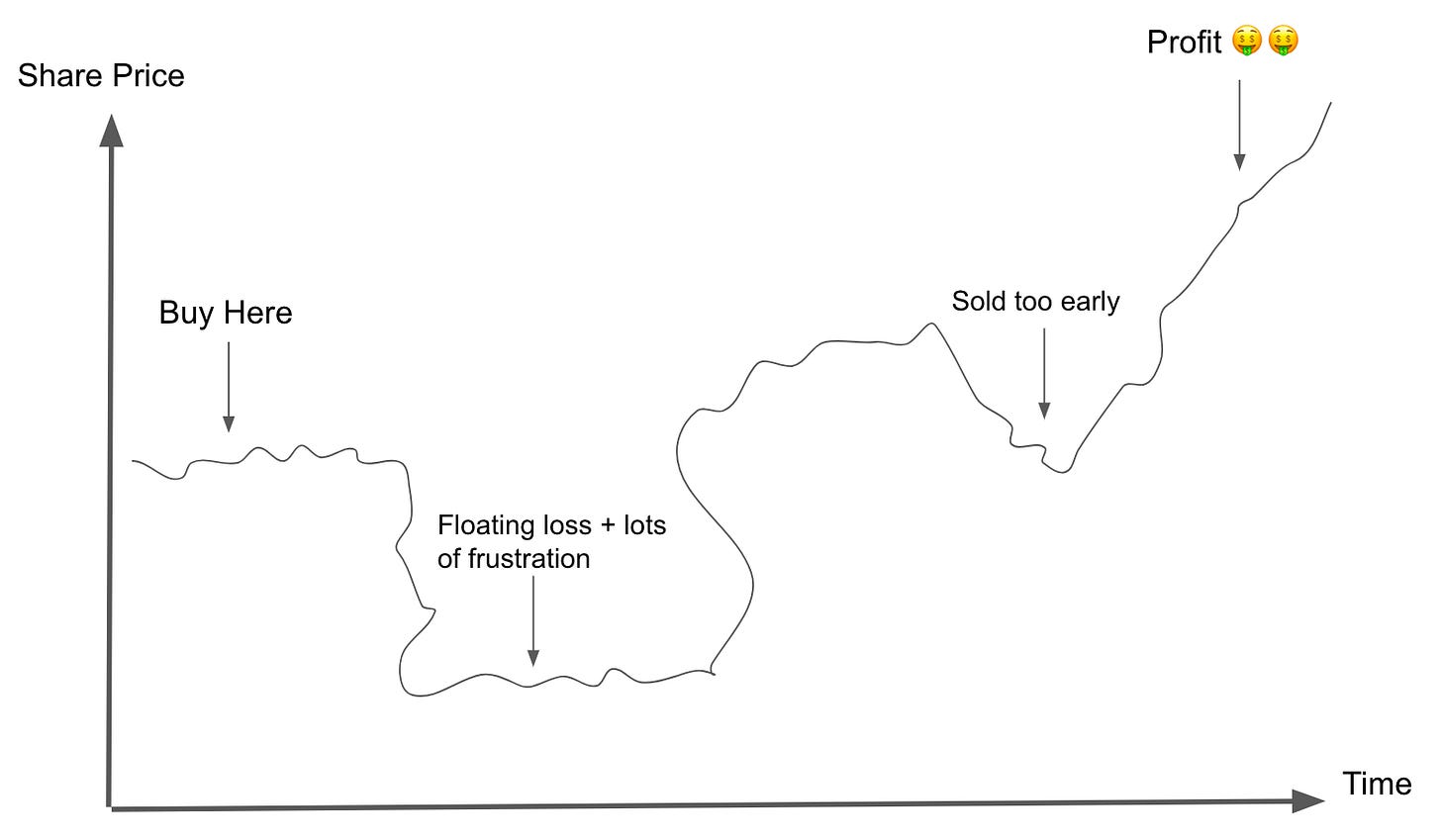

But sometimes the reality is never easy…

Reality

More often than not, the reality is we may have to sustain some unrealized losses before we can reap the rewards.

Why Investing is Hard

When we invest, we may make remarks like these, which we can’t control reliably anyway because we can never time the market accurately all the time:

I should’ve bought at bottom

I should’ve taken some profits at the peak before it goes down

I should’ve sold before it dips and buy back at bottom

I should’ve cashed out before the overall market goes down because Hamas - Israeli war

I should’ve spared some cash and not going all in

I should’ve gone all in knowing the stock price goes up the day after

I should’ve, I should’ve…. 1000x

This, in our opinion, is the hardest part of being an investor.

Investing it is not just about stock-picking and finding opportunities

Investing is Simple.. But Super Hard 🥵

Investing is about:

Keeping our heads cool despite all of the price fluctuations and market madness

Keep hodling while the investment thesis is still intact

Refrain from transacting irrationally without any rational decision

Sounds simple, but never easy… Just like life in general 🙃