There has been plenty of conversations regarding the Federal Reserve. Prominent influencers or KOLs might say about the impending collapse of the economy because of rising interest rates.

Others are saying that the Federal Reserve prints too much money during Covid times which causes high inflation. To dampen it, Federal Reserve needs to raise interest rates.

This blog post is going to cover in broad strokes about the system and mechanism of Federal Reserve. You folks perhaps need a cool take during a conversation with your peers or loved ones. Having a better knowledge on this might give you a refreshing idea 😎

Assets and Liabilities

We start with assets and liabilities as that is a key component of a running organisation. For those who do not have an accounting background, asset is an object (tangible or intangible) that has economic value. For example, a land that you own can be sold at a price (has economic value) so that is an asset.

Liability is what is owed. So if you owe $10,000 to Sally, you have $10,000 liability + interest because you need to pay her back.

So far so easy.

Federal Reserve has Assets and Liabilities?

Of course! In fact, it is intuitive to understand because it has a similar balance sheet structure to a normal commercial bank.

Furthermore, it is an independent organisation that is independent from the United States government. So remember, Federal Reserve is not equal to the U.S. government. They are different entities although they work very closely together.

Liabilities of the Fed:

Bank deposits, known as “reserves”, from commercial banks which the Fed pays interest on (similar to how you put your money into the bank, and the bank pays you interest).

Cash account of the U.S. treasury (it’s like you having a checking account with Bank BCA and you can spend that money using your debit card). The U.S. treasury has that account to spend money.

There are other liabilities like reverse repo operations, and all physical cash but these are not that relevant to this article.

Assets of the Fed

Mortgage backed securities (MBS). Essentially a financial instrument that is backed by interest payment of a mortgage. If you buy a house using KPR and pays interest, that interest is paid to the people who gives you the loan. This very activity can be turned into a security and be traded in the market.

U.S. government bonds. It represents money the U.S. government owes and in return would pay interest and its principal after maturity.

How does the Fed get their assets? The Fed can create a bank reserve for itself and then use that reserve to buy MBS or U.S. government bonds. This operation is technically known as quantitative easing but it is commonly known as “money printer go brrr”.

How much does the Fed Earn?

Because it has interest bearing assets, if the interest earned from their assets is more than the interest it needs to pay on its liabilities, then it is earning money.

In fact, in 2021 the Federal Reserve earned more than $100 billion in net interest income.

Where does this money go?

Dividends! To the commercial banks which are the shareholders of the Federal Reserve

Operating expense (salary, rent, utilities, etc)

And the majority of the earning goes to the U.S. Treasury, also known as remittance. A checking account that is spendable (discussed earlier as a liability to the Fed).

That is correct, the Fed is one source of income to the U.S. government. Again, we would like to highlight that the Fed is independent, or at least mostly, from the U.S. government.

So is the Fed broke?

Well no and yes.

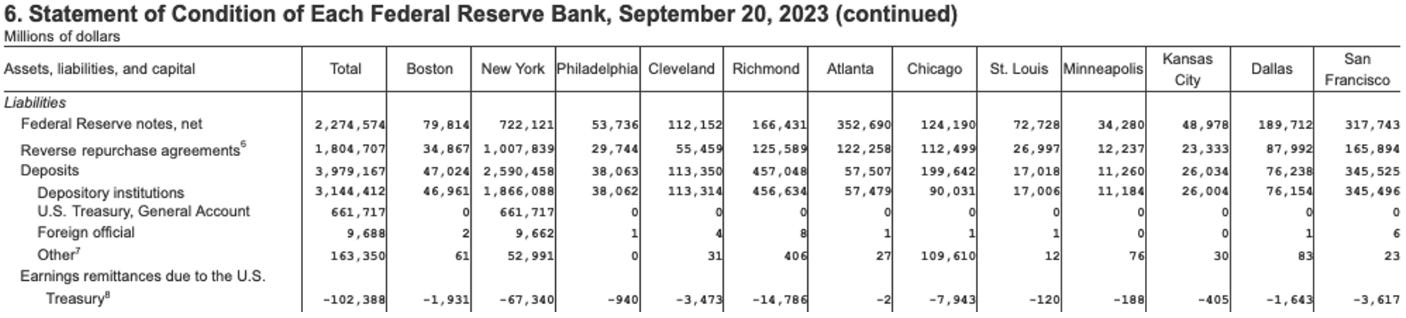

You can take a look at their webpage at the releases section every week. It details all the assets and liabilities of the Federal Reseve. If you look at the consolidated assets vs liabilities, it is clear as of Sept 2023 their assets exceed their liabilities by about $42.7 billion.

So they have a positive equity? That’s cool.

But hang on a second, lets take a look at one component of their liabilities. It says Earning remittances due to the U.S. treasury.

In the note section it is described as:

“The Federal Reserve Banks remit residual net earnings to the U.S. Treasury after providing for the costs of operations, payment of dividends, and the amount necessary to maintain each Federal Reserve Bank's allotted surplus cap. Positive amounts represent the estimated weekly remittances due to U.S. Treasury. Negative amounts represent the cumulative deferred asset position, which is incurred during a period when earnings are not sufficient to provide for the cost of operations, payment of dividends, and maintaining surplus. The deferred asset is the amount of net earnings that the Federal Reserve Banks need to realize before remittances to the U.S. Treasury resume.”

Remember the previous section when we discuss about how much the Federal Reserve earns? Majority of earnings of a Federal Reserve goes to U.S. Treasury as a checking account that is spendable. In the balance sheet, this is counted as a liability.

Because of high interest rates, among others, the Fed’s real liabilities (interest payable to commercial banks, interest paid in reverse repo operations, etc) exceeds their real assets (MBS and government bonds). This causes them to operate on a loss. Their cumulative losses is counted as negative remittance or negative liability to the U.S. treasury. They promise to resume remittance when they operate profitably.

How much is this negative liability? As the table states: $102 billion.

What is negative liability?

In the words of the Federal Reserve, it is called “deferred asset”. So the fact that the Federal Reserve is unable to remit funds to the U.S. treasury, it is calculated as an “asset”. Then they can safely report that they have a positive equity.

Although in actual fact, the net equity reported of $42.7 billion is less than the negative liability of $102 billion.

Closing Remarks

So this is an example of an accounting gimmick, done at the highest level. If we look over the reported data at a glance, we might notice that it is painting picture A. Picture A being the Fed is not broke.

But if we look at the numbers more closely, we would notice that it is painting a different picture B. Picture B being the Fed is broke (operating at a loss).

We hope that this article is an interesting conversation starter. Or at the very least, when you read a financial statement, remember to be cognizant of these gimmicks. Numbers that are looked at more closely might paint a vastly different picture.