Hi 👋 welcome to Recompound Blog - The Investment Mindshift. We help you better your mindset on investment and economics one article at a time. More: Our Values | Advisory | Get to know us | Picks

Disclaimer: this post is meant for educational purposes only and does not constitute financial advice.

I recently noticed about a movie that got popular these days which is Sore. Many of us would wonder:

If only I had a “Wife from the Future”

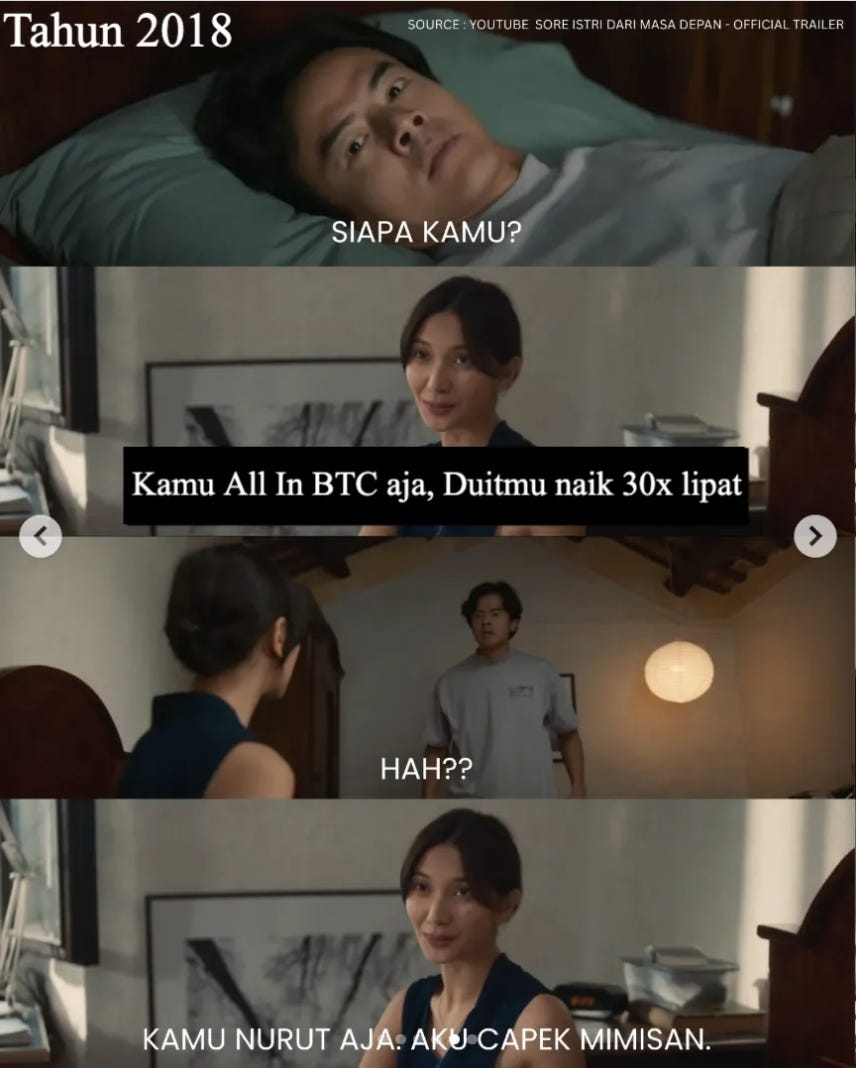

Imagine if I have a spouse (oops Gracia) who travelled back in time—like the meme taken from the movie Sore: Istri dari Masa Depan.

She leans in and whispers to you in 2018, “Just go all‑in on BTC—your money will rise 30×,” and I hit buy without a second thought.

I would be so rich that I might not need to work anymore. But that seems so easy isn’t it? Just hold BTC for a 7 years and my money will rise 30x. And I know that most of you who missed the opportunity to hold BTC for 7 years (including me) might feel unpleasant. But why?

I think it is because of one emotion

That emotion is regret that is amplified from hindsight bias. I have known about BTC for so long. But why do I not have the conviction to do a simple damn thing and hold it for 7 years and be rich? Although I also know that very very few people have done this. But that’s besides the point.

The point is, when we make a decision under uncertainty, we definitely will make a mistake at some point. And it sucks, it really does.

For example, I sold stock A at a 10% profit to switch to a different stock which I feel have a much better prospect. Then that stock A continue to rally. And I would feel:

I should have not sold that damn thing…. #taugitu

But whenever I feel this way, I will ask if I want to be regretful and let this emotion take over me. Then, I will start thinking about my favourite investment guru. Yes, Mr. Howard Marks. He never fails to remind us: the future cannot be known; our job is to act under that cloud of uncertainty.

We never truly know what any asset—stocks, bonds, gold, or crypto—will be worth, especially in the short term. So here are the three things I think about to make myself feel better and act rational again.

Number One: Investing Is a Probability Game

Every decision is a probability, not a certainty. Things that should happen do not always happen. All we have is a range of scenarios, each carrying its own likelihood.

Investing isn’t binary. You have to allow for multiple outcomes, each with its own probability.

When you view the world this way, you often discover a scenario you are unwilling to accept—maybe a 50 % price drop, a debt restructuring, or a regulatory change. That is the starting point of risk management: make sure your portfolio survives if that worst‑case shows up.

Number Two: The Danger of Averages

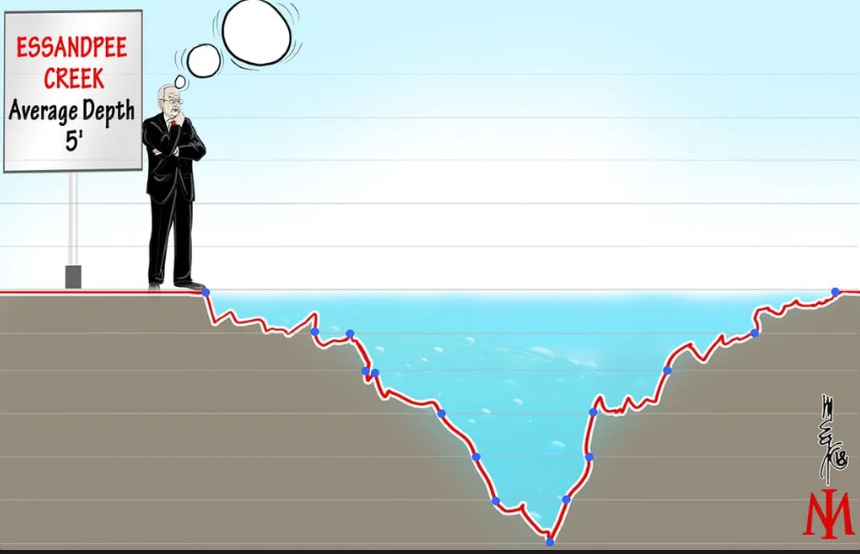

Howard Marks jokes about the six‑foot‑tall man who drowned while crossing a river whose depth averaged only five feet.

Averages deceive; they blur the extremes. Market charts of average returns look smooth, but in reality they are a collage of very good and very bad days.

Your portfolio has to endure the bad days so you don’t panic‑sell at the bottom, and your decisions need time to prove themselves.

Number Three: Opposite of Regret is Gratefulness

I might sound super woo woo saying this but I believe that gratefulness is the opposite of regret. Whenever I make a decision, especially to sell, I will remind myself to be grateful. I am in a privileged position to pursue my passion to becoming an exceptional stock investor. I am in a privileged position to help other people invest, better.

Do I have to be bogged down by regret for a thing that is beyond my control? Of course not.

As long as I keep my focus on long term survival

I know that I am already doing my best and I am already happy to keep doing what I do. But how do we do this?

Disciplined risk management

We demand large margins of safety in stock selection. To put our challenges into perspective, September 2024 to March 2025 put that belief to the test: the Indonesian equity market fell roughly 35 %. Our portfolio’s drawdown was far smaller. And we managed to stay afloat and survive.

When the market rallied to new highs, we were still on the field to collect the upside.

Hunt for under-appreciated assets

We’ve also learned that the greatest risk‑adjusted returns rarely come from the headlines. Assets that are still under‑appreciated and underestimated by the crowd usually trade at valuations that leave room for pleasant surprises.

Conversely, buying whatever everyone is already talking about often means paying a price that assumes perfection—and perfection is rare.

Put bluntly, the ugly truth of markets is this: the biggest gains come from purchasing what the majority dismisses, while the biggest losses stem from chasing what the majority already adores.

That principle guides our allocation decisions every day.

We avoid overpaying for the latest market darling.

Performance-based, not pay per post

Our approach is simple: we only win when our clients win. Why? Our readers might think that this is done only so that we are fair and so on. But it also serves another purpose. So that we don’t become complacent.

If the portfolio is up, we share in the upside; if it is flat or down, we earn nothing - and have to scramble and think hard into making your portfolio goes to all time high again.

Our compensation is performance‑based, so not only our incentives are perfectly aligned with yours, but also so that we are always on our toes.

That philosophy is the exact opposite of the typical “fin‑influencer” model—creators who charge a fixed subscription or sponsorship fee whether you make money or not, and who disappear when their investment tips go south.

Because our livelihood depends on long‑term capital growth, we cannot afford blow‑ups. Avoiding catastrophic loss is not just a principle; it is a business necessity.

Key Takeaways

I am a human. I do feel the regret for making decisions that turn out to be incorrect under uncertainty. When I feel this say, I stand on the shoulder of giants:

Respect probabilities. Stay humble; even the most likely scenario can miss.

Know the full distribution—not just the average but both the left and right tails.

Be grateful. Regret is real, being grateful allows us to stay sane and rational.

I will then continue to prioritise long term survival by going back to principles:

Build a buffer. A healthy margin of safety buys breathing room when reality disappoints.

Seek the overlooked. Under‑appreciated assets carry the best upside‑to‑downside ratio.

Align incentives. A performance‑based fee structure keeps us responsible for results, not rhetoric, not what ifs.

Closing Thoughts

I may not have a wife from the future whispering asset prices, I am grateful for my own wife thank you. But I do believe that discipline, probabilistic thinking, and risk management—backed by a fee structure that rewards success and punishes complacency.

In an uncertain world, these are the tools that let us keep moving forward—without drowning in a five‑foot river.