Navigating Indonesia’s Investment Terrain

Halloween special, with some scary truth bombs inside

You work hard, you save diligently, you invest in the Indonesian stock market... and your wealth shrinks. You’re not alone. This is not bad luck; it’s a feature of the terrain we are playing in. (Un)fortunately, Indonesia is an emerging market that is characterised by:

Depreciating currency against the US Dollar

Low trust society

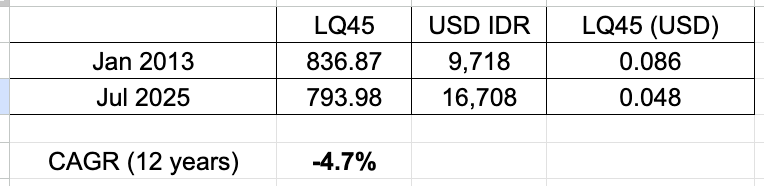

Declining equity market for the past 12 years in USD terms (I believe LQ45 more, not IHSG)

This piece will attempt to describe features of the landscape in a clear manner so that we know what might be a reasonable game play, if you’d like to invest in Indonesia.

hint: buying low cost index fund is likely not the answer. Because no body here, at least per this post was posted, wants to buy the index.

I am sorry foreign reader or average investor in developed countries, your solution wouldn’t seem to work here.

Let’s begin

Picture yourself as a working adult in your late 20s to mid 30s in Indonesia. Let’s say your name is Bob.

You’ve been in the workforce for a while and perhaps have taken a managerial mid position in your career. Or a business owner who’s business is starting to take shape. Aside from quarter life crisis after asking yourself about what you really want to do, you have found yourself in a uniquely tough spot.

Without you noticing, your life is starting to pull you from so many directions.

Your boss gave you a new unrealistic target to achieve for the next year

Your subordinate (if you are no longer an individual contributor) is not working up to your standards

You start to get piled up with familial obligation such as birth of a new child or marriage

You suddenly have to take care of your parents more. Maybe not financially if you are fortunate, but mentally and physically, as they are getting older by the day

You see your friends getting laid off and having to fight hard in a competitive job market

Maybe a list of hobbies that you had when you were in your early 20s were:

learning Spanish because you watched a bit too much of money heist on Netflix

cycling and participating Tour de Samosir in the beautiful lake Toba because you saw Tour de France on Television as a kid

collecting Pokemon cards

learning and watching educational lecture videos from top universities or top YouTube educational channels like 3blue1brown or Veritasium because they are genuinely interesting

studying a macroeconomics. Studying geopolitics → what is China’s big move in the wake of the COVID lockdowns

stockpicking powered by the internet. Follow an investment discussion about a once in a life time opportunities → decide if that makes logical sense → if yes, buy!

All of the sudden, in your late 20s, your hobbies shrink to:

Maybe run a bit? Do your 1st marathon to prove yourself that you are physically and mentally strong enough to succumb any challenge.

or Padel

And… probably Netflix in the evenings which you might come to regret the next day.

So that’s you.

You are a responsible adult living in an unprecedented age of rapid technological change in a rough emerging market terrain.

How rough? Let’s describe the landscape.

1st Feature: Low Trust Society

For us locals, it needs no explanation that Indonesia is a low trust society. We just get it. But to my foreign friends who are privileged to live in a high trust society, I will give some examples and maybe contrast it a bit between high and low trust societies.

In a high trust society, launch of a sovereign wealth fund will be seen as a prudent decision. For example, if you are a commodity rich country like Norway who sells oil as one of the main source of economic output, you wouldn’t want to have a recession because Donald Trump tweeted “drill baby drill” and the price of oil plummets the next day. So a sovereign wealth fund that acts as an investment vehicle to stabilise GDP growth would be seen as a much welcome strategic move.

In a low trust society, however, launch of a sovereign wealth fund would cause a huge public stir and induce people to suddenly want to migrate out from the country. Saying that the country is dark (have a bleak prospect).

Yup, on X (previously Twitter), there were as many as 104,000 unique accounts using the hashtag #IndonesiaGelap (#DarkIndonesia) with more than 2.5 million mentions. This was during the week of the launch of the sovereign wealth fund, Danantara.

Now, you could ignore the numbers — they don’t really matter.

But even a single scroll through those posts is enough to make anyone feel like the government is a group of bandits scheming to rob the nation’s wealth.

And to this day, some people genuinely still believe that.

So to conclude, description one of the low trust society terrain:

A guy who does good or wants to do good will be met with heavy skepticism. People will try hard to figure out: what’s the catch?

2nd Feature: Depreciating currency against the US Dollar

Let’s raise the difficulty level a notch — life in an emerging market isn’t meant to be easy.

Indonesia’s currency has steadily depreciated against the US dollar, by roughly 3% per year since the early 2000s.

That’s not unique — many emerging markets share the same pattern.

But it’s worth thinking about what this means from an investor’s perspective.

A weakening currency implicitly encourages Indonesians to invest locally — in businesses that earn and spend in rupiah. Why? Because if everyone were encouraged to buy stocks like Apple or NVIDIA, capital would quickly flow out of the country.

So, the government naturally shapes incentives to keep money at home.

One example: the tax-friendly policies of the Indonesian Stock Exchange (IDX), which make investing in local companies more attractive.

3rd Feature: Bearish IDX Market (LQ45)

enough said.

So Bob (yes remember your name is Bob), what is your response to all this?

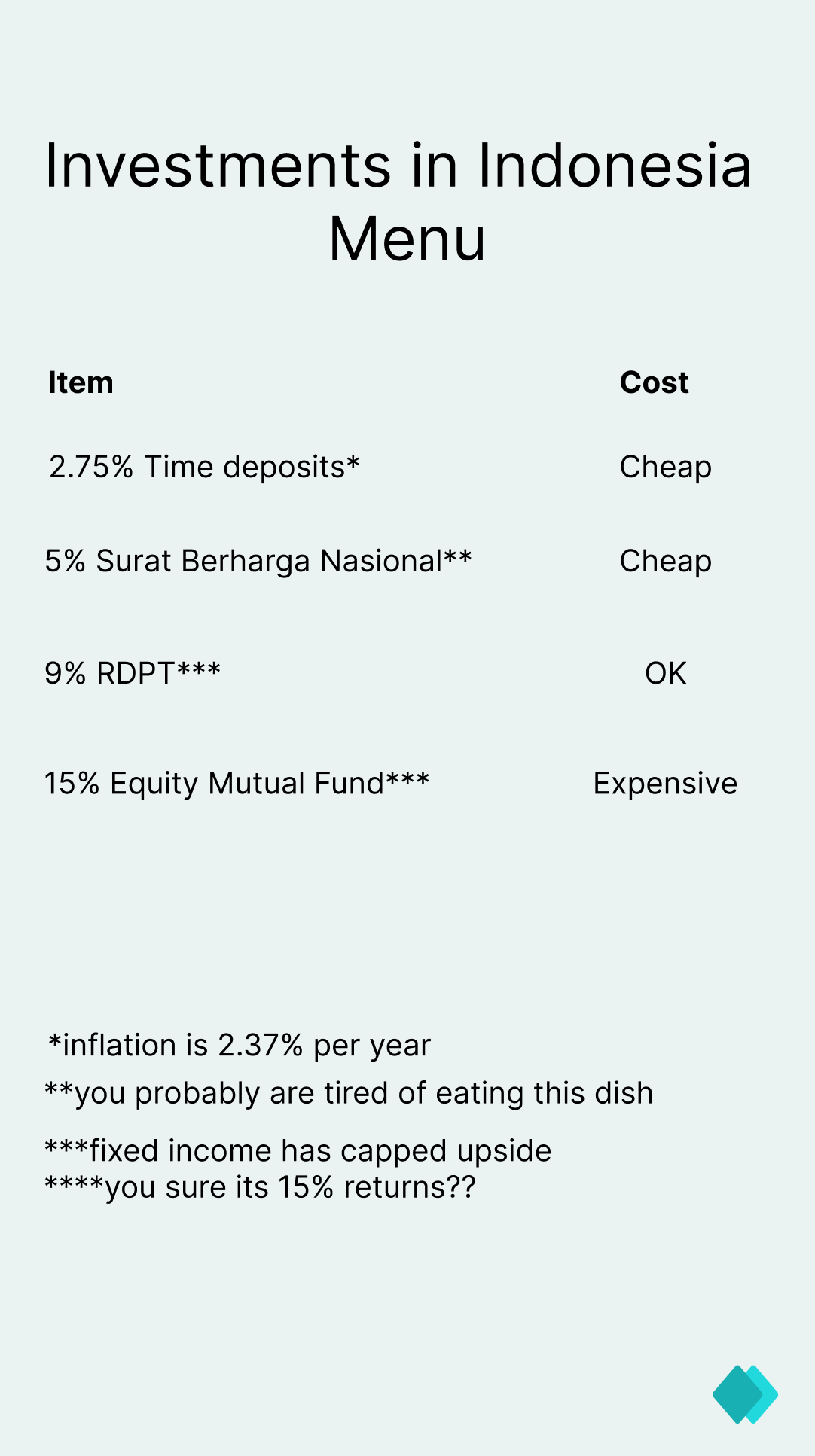

So as a Bob, it is like going to a restaurant called “Investments in Indonesia” and then being handed a menu like this:

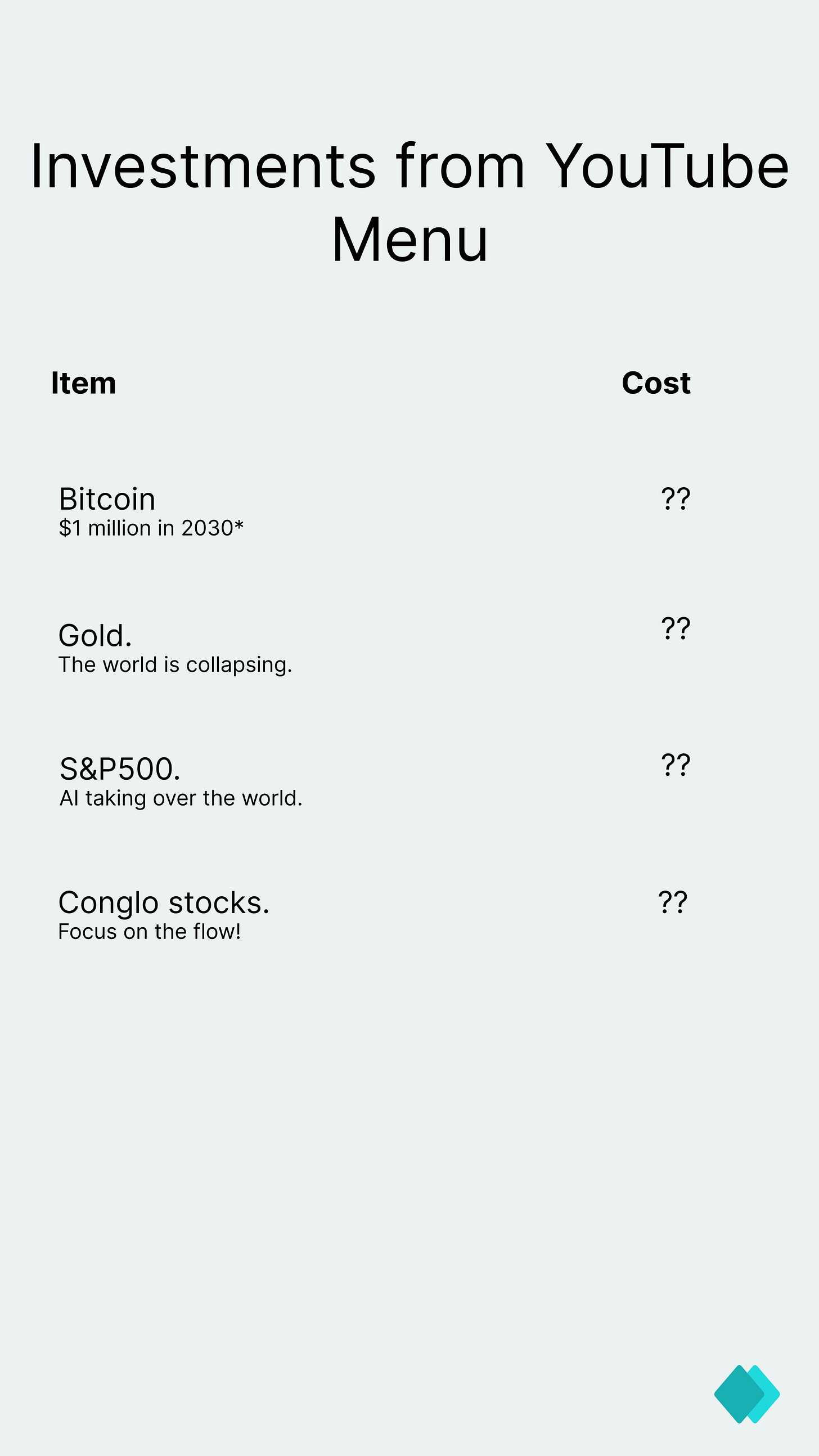

After browsing the menu, you probably realise that you are not that hungry. You must be thinking that there must be an alternative! Let’s go to YouTube. Then being handed another menu like this.

A landscape of choices each with very very convincing arguments from probably very respectable sometimes reputable individuals also that has an incentive to make you more money grab attention. I mean if the arguments are not convincing, they won’t get that many likes subscribes and views.

So Bob turn to his friends and look for other options. Maybe something that is better than the options above. Indeed there are other options:

Padel courts

Cafe

Financing a small farm or garden that sells produce

Kos2an (boarding house or rented room)

On the surface

Bob feels like oh boy that sure does look easy. just buy a conglomerate stock and I could have been up 2 - 3x. What’s the point of locking my funds in time deposits?

Or Bob will be amazed. Wait what? You only put Rp 3.5 billion ($200,000) into 6 court padel?? You could break even in less than a year! Who doesn’t play padel nowadays?

And Bob realizes something.

He feels a bit discouraged.

“Why am I working so hard? Everyone around me—at least on my screen—seems to have it so easy. Am I even moving in the right direction? Am I working smart enough?”

Questions like these pop up from time to time.

“Damn it, I could’ve just bought the S&P 500 and earned 15% a year in USD over the last decade. What am I doing here?”

But in that moment, he casually forgets that even the S&P had to survive through wars, presidential impeachment, a global pandemic, massive debt, and a Federal Reserve running at a loss.

Then another realization hits him.

Even the highly educated, rational ones are starting to question the point of long-term thinking.

Maybe, in a rough terrain like this, the only play is to chase whatever’s hot.

If bubble tea goes viral again tomorrow, maybe you’re supposed to drop everything and catch the wave.

But with every wave comes the crash.

Riding it requires a strange mix of art, skill timing, and luck.

And at the back of your mind, you have to ask — are you ready to take the hit if you catch the wave too late?

Or are we still early enough to ride it?

It sounds logical — to just become a great wave surfer.

But is that really a good strategy for Bob?

Remember, you don’t have a lot of time. Your responsibilities are piling up, your hobbies are shrinking, and your time scarce. It doesn’t feel like uni days where you can conquer the world. What to do?

This post is getting a bit long, so let’s pick this up next time :)