Recompound is bunch of IDIOTS🤡 for Missing out on Crypto & US stocks

Don’t worry we are not that stupid. We like to play with clickbaity titles to get your attention. They say attention is the new economy 😃

If you notice, for now we are only investing in the Indonesian stock market, and you may have this remark in your mind:

Wow these guys are bunch of IDIOTS 🤡, they can only make money from their clients’ profits and they are missing out on the bull runs of Crypto & US Stocks !! Why are they so stubborn & keep hodling their lousy Indo stocks ??

It’s so easy to sense that too much FOMO, greed and euphoria are in the air with so many influencers talking about Crypto:

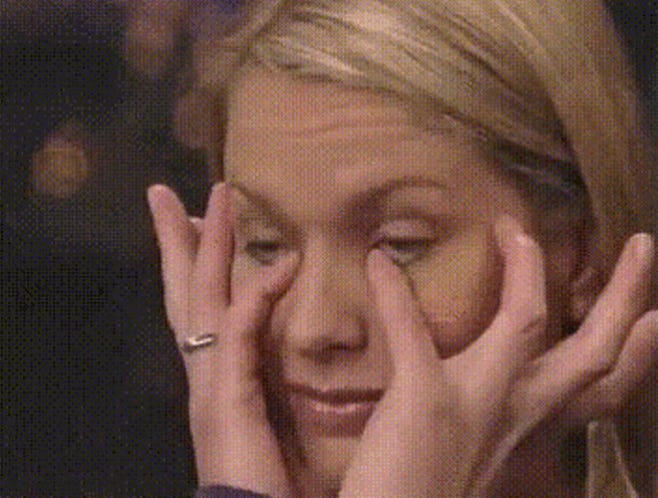

Moreover, during this FOMO-mania, some of our clients have churned to invest in US stocks / Crypto:

Why We Have not Been Investing in Crypto / US Stocks

The reason is very simple: we do not have the circle of competence in those areas!

It is extremely dangerous FOMO-ing into another asset class we don’t master, while everybody has already been in euphoria mode.

If Cryptocurrency investment were inside our circle of competence, we could have asked our clients to buy BTC at 25k - 30k USD, and most definitely NOT now…

Remember, boys and girls: buy low sell high, not the opposite.

The Importance of staying within your circle of competence

If I were to be asked on my favorite investing principle, it would easily be Warren Buffett & Charlie Munger’s mental model on “Circle of Competence”, because it has been so relevant for the past few years (especially since 2020).

Here’s what those 2 legends said on the concept:

Buffett in his 1996 Berkshire Hathaway annual letter:

What an investor needs is the ability to correctly evaluate selected businesses. Note that word 'selected': You don't have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.

Charlie Munger:

I want to think about things where I have an advantage over other people. I don’t want to play a game where people have an advantage over me. I don’t play in a game where other people are wise and I am stupid. I look for a game where I am wise and they are stupid. And believe me it works better. God bless our stupid competitors. They make us rich.

In simple human terms, this means:

If you want to be successful in long term investing, it is important to stay at what you really know / good at (your circle of competence), and avoid doing stupid stuff at what you think you know, but actually don’t know.

The discipline of staying away from what you don’t know (FOMO) will keep you alive and breathing.

FOMO: The #1 Killer of Your Investment Returns

I really like the concept of “Circle of Competence”, because while the concept seems simple, it is so damn hard for us normal humans to stick with.

Ever since the times of hunters and gatherers, we as humans have been ingrained with herding mentality to survive the harsh nature of the times.

So it is very understandable that we as investors in this modern age easily FOMO (Fear of Missing Out) into other “shiny” assets when our existing investments have been staying flat.

The most successful investors we observe are usually able to fight this natural human instinct:

Keep their heads cool & stay in their circle of competence

Not giving a fuck on “trendy” investments & seeing other people showing off their huge floating profits

Buy undervalued assets (doesn’t have to be stocks btw), when no one is giving any attention on social media

Easiest example: buying BTC at 20k USD when almost every influencer on the internet is literally shitting on Crypto & the OG Michael Saylor 🤡

Rule of thumb: when everybody has already been hyping an asset on the social media, it is usually a telltale sign that you are already too late to buy

Case Study: The Fidelity Magellan Fund

We will show you why FOMO is the #1 killer of your long term investment returns:

Okay who’s this skinny santaclauslike-looking guy ? 🎅🏻

Peter Lynch, born January 19, 1944, is an American investor, mutual fund manager, author and philanthropist. As the manager of the Magellan Fund at Fidelity Investments between 1977 and 1990, Lynch averaged a 29.2% annual return, consistently more than double the S&P 500 stock market index and making it the best-performing mutual fund in the world. During his 13-year tenure, assets under management increased from US$18 million to $14 billion.

13 years, 29.2% compounded annual return, sounds sexy 🍑👈🤤…

To illustrate this legendary performance better, here’s a graph showcasing the performance difference of investing in Magellan vs the S&P 500:

So… Any dummy who invested in the fund should have been able to retire rich, right?

Well, not so fast bro.

Here’s an astounding fact: a study by Fidelity Investments found that the average investor lost money under Lynch’s leadership.

Yeah that’s right, rub your eyes and read again:

The average investor lost money in the Fidelity Magellan fund under Peter Lynch’s tenure during a period of time when the fund returned around 29.2% annually.

According to the study, here’s the reason why:

Markets swing up and down. When the market went up, the Magellan fund rose even higher. This excited and enticed investors who rushed to invest. But when the market and the fund declined, investors immediately sold. At every robust period, investors moved money into the fund, and at every decline, they sold – with Magellan’s value swinging lower than before. Recency bias killed Magellan’s performance.

Let me summarize the above sentences for you:

FOMO

Buy High Sell Low

Market timing

Over-optimizing for short term gains

Impatience

Final Remarks

More often than not, success in long term investing relies more on keeping your greediness in check (EQ 😇), rather having a good raw intelligence (IQ 🧠).

Hopefully this post can help you a bit in achieving your investment goals.