This blog could potentially be the most interesting piece to all interested prospects and our existing clients. We are going to openly show how we performed over the past year. This is also timely as March 2024 marks 1 year since we opened our service to selected early adopters.

If you have visited our website, we actually post our first client’s portfolio performance live.

That client is my cool Aunt who trusted us way back before Recompound was a product as we have it today. She is still a Recompound client to this date. Let’s be honest, the chart looks damn good and you might be raising your eyebrow thinking that such performance can easily be made up. It is not made up btw, but the point is, it is not as simple as what the chart shows you. This blog post is a write-up to dive deep into seeing our clients’ performance as it is.

The purpose of us doing this analysis and exposing ourselves to potential praises/criticisms is twofold:

External motivation: to be transparent to potential and existing users about our capability. Also to make clear to these people about what they can and cannot expect from Recompound.

Internal motivation: to reflect on what we did well and not too well. And for portfolios that have not performed, we would develop a plan to rectify them.

Before we talk about performance, let’s talk about our clients. Remember: no clients no performance. Also, having hundreds of clients hopefully demonstrates that “performance” is not as simple as displaying a line chart on our website (but we’ll work on it) 🙂

Our clients

We are happy that the number of people who trust us continue to grow modestly but consistently.

First, we barely spend money on advertising. We do not spend any money on billboards, giving free money (vouchers), or paying influencers. All our marketing efforts is done in-house by the founding members and we rely on two strategies: (1) communicating as transparently and as genuinely as possible; (2) delivering the best service possible to our users, so that our users become our marketers. If we are to be honest with you, the reason we barely spend money on advertising is because we are a new company with minimal resources, and cannot afford to hire marketing experts. Also the reason why our user growth has been modest is perhaps due to our limited marketing knowledge. But we keep on trying and learning, and eventually found that the two aforementioned strategies were the ones that work. (Inputs from marketing experts are very welcome here!)

Second, we attract high-quality people whose values are aligned with ours. These people usually are patient, consistent and realistic.

I am happy to share that our users understand that equity investing is a form of wealth-preservation tool, not a get-rich-quick tool. Most have the patience and long-termist outlook. Talking to them, I am constantly impressed by the work that they do. Some work in the renewable sector, others are top executives in a corporate setting. Quite a few are also budding entrepreneurs like us who understand the struggle of building a company from scratch. In short, I consider myself lucky to be able to learn so much from our early users.

But all of them face the same problem: very difficult to make their investments grow in the capital market.

This is especially when they have no time, interest and expertise to dig deep and allocate their resources well in the capital market. Currently, there is no passive investment solution to help average busy professionals invest in the equity market sustainably. You need to be an ultra rich guy or a conglomerate to have a CIO for yourself. So we want to tap into a market of young busy professionals who already are or will be the big shots of the future (amen).

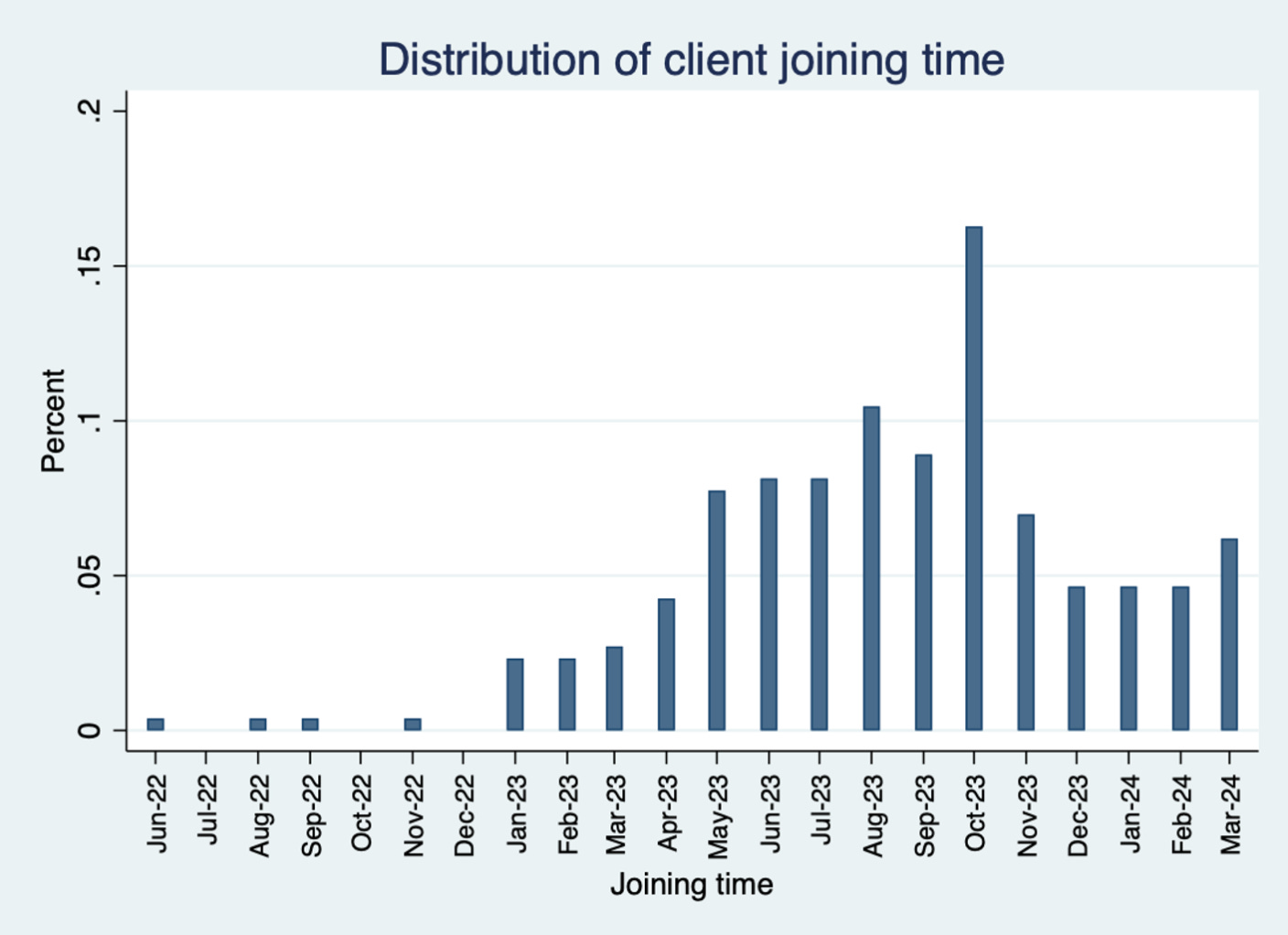

Below is the distribution of clients joining across time.

The join date is important because there are factors that vary with time. Those are:

Market conditions (IHSG outlook, interest rates, before or after elections, etc)

Price of stocks that we are interested in

The former is important, but does not inform us much on how to invest. The latter, however, is really really important. We are very price sensitive because we focus on portfolio growth. So if we deem a stock too expensive, we will stop buying. Otherwise the risk will be more significant.

Let me give you an example. I wrote an extensive article on one of our investments to Adira Multifinance a while ago. Our clients bought Adira in 2023 at around Rp9.000,- to Rp10.000,-. While we still think it is a super good company (disclaimer), share price now is at around Rp 13.500,-. We don’t buy the stocks anymore now, especially for newer clients, as the risk (of the stock price falling) increases with higher prices. So it follows that clients in Dec 2023 would have a different set of stocks compared to clients in March 2023. In turn, their respective performance would also differ.

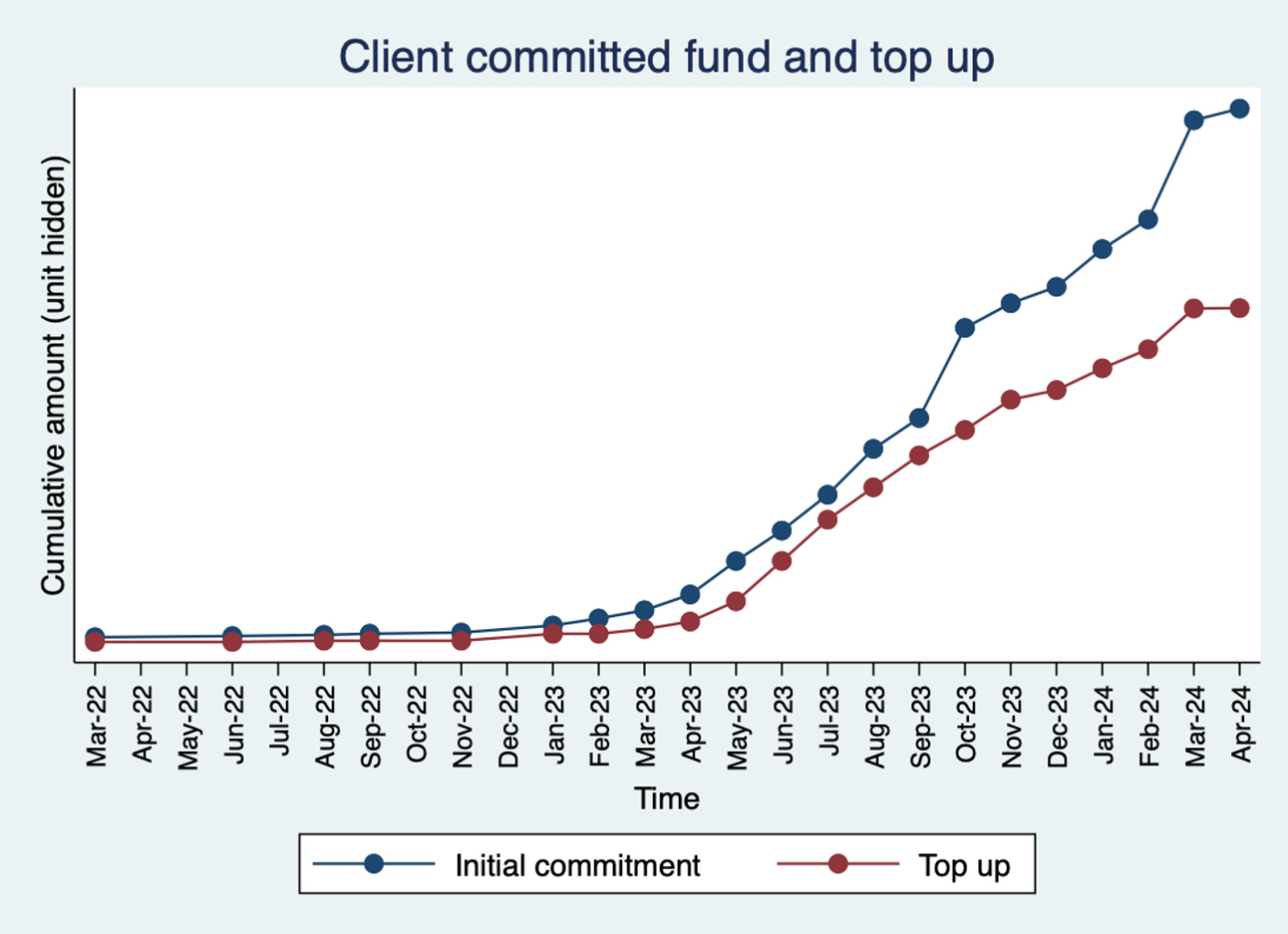

Let’s look at another layer of complexity when representing performance. That is: topups.

Many of our clients start with a small amount, mostly to “test waters”. But over time, they start to add funds.

We’d also like to make the point that we never persuade/force our clients to make any top up (like many salesperson out there). We don’t believe in forcing people to invest, with/without Recompound. If we force people to commit their hot money, and 3 weeks in they need to withdraw this money, but their portfolio is still negative, it is going to be painful for them and for us.

What we notice among people who top up more funds is that they do so for the following reasons:

They are satisfied with our product

After working with us, they realise that we are not here to scam people

They see equity investing as a good wealth-preservation tool

After meeting face to face with Toby, they realy really like Toby (sorry I can be shameless sometimes)

Topups are completely discretionary at this juncture, meaning we don’t control when our clients topup. They do it as and when they want, in whatever amount they want. After the topup is made, how this money that is invested would depend on:

their existing portfollio

amount of topup

price of stocks of interest

Hopefully by now, you have grasped clearly that different clients would have different performance depending on when they join and when they topup / make withdrawals. But our focus remains the same: portfolio growth, because that’s how we mainly make money as a company.

Side note on users who have churned

Recompound is not perfect and is not for everyone. We also have clients who have left us for a wide variety of reasons. As of 31 March 2024, the share of clients who left us is 6%, with the median amount of time with us is 88 days or about 3 months. So far, among the reasons these people left us are:

Want to switch to US stocks or cryptocurrency, which is deemed to be able to generate greater returns at a faster rate

Have their own preference and investment framework

Have shorter investment horizon

Need the money for other life purposes (e.g., buying a new house)

Unsatisfied with our performance and impatient that their portfolio has not grown yet

These are all valid reasons and we do not hold any hard feeling for people who left us. Ultimately, it boils down to whether their values align with ours.

My mentor always tells me: if you like fried rice but I like fried noodles, neither of us is right or wrong. I can’t and shouldn’t force you to like fried noodles and you also can’t and shouldn’t force me to like fried rice.

As always, we wish them well in their life and investing journey.

Our performance

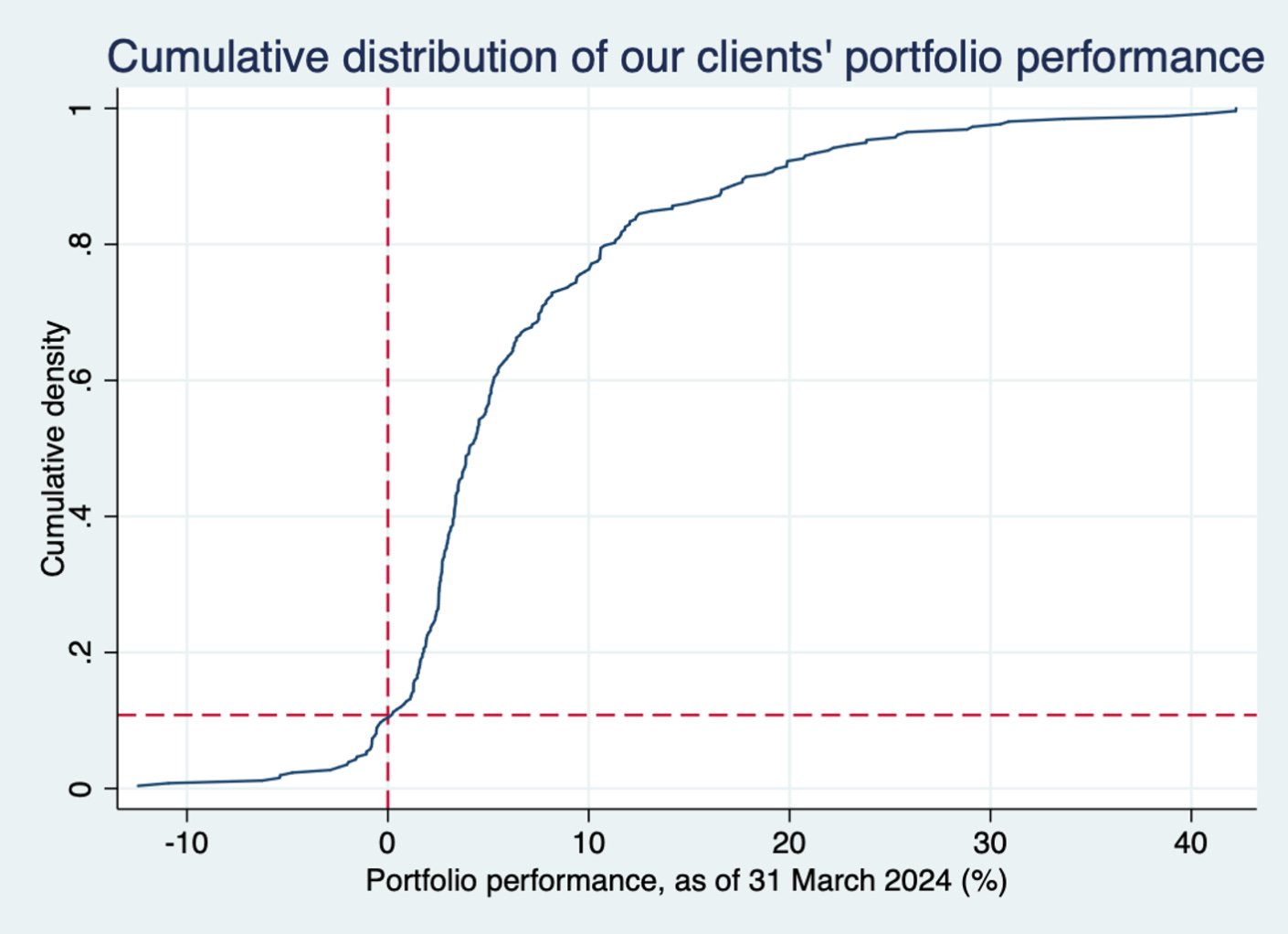

Okay, okay now let’s get onto the most juicy section. The graph below shows the distribution of our clients’ portfolio performance, which you can think of as Recompound’s performance. The graph shows how well/badly Recompound perform in our effort to grow our clients’ portfolio.

At the negative side, the biggest drawdown of our clients’ portfolio is -12.5%. At the positive side, the biggest growth is 42.5%. Our median performance is 4.07% and our average performance is 6.86%. The median and mean numbers don’t seem very appealing as of now, but these numbers also hide a lot of details.

First is the investment horizon. As we’ve mentioned, we only started opening our service to selected early adopters in March 2023, which means that 89% of the portfolios are under 1 year of age.

Second, when we talk about performance, there is also a comparative element. For instance, we can rank 2nd in a class, but out of how many people? If we rank 2nd in a class of 2 people, we are essentially ranked last.

We will address these 2 points extensively in the next section.

The graph below shows the cumulative distribution of Recompound’s performance. When generating this graph, a few things come to our minds:

About 11% of our customers’ portfolio is still experiencing drawdown. And we are not happy with ourselves for this situation. The next step for us is to pay extra attention to these portfolios.

Our company mission is to always shift this graph to the right.

Recompound vs IHSG

As promised, the following graph captures the time element and our performance relative to IHSG that captures comparative element of our performance.

Things we are happy about: for customers who joined us before June 2023, all of their portfolios perform better than IHSG. If we were to reflect on why this happened, we would attribute this to:

Our ability (or a bit of luck) to identify a number of good companies and stick to our value-investing strategy

We pay close attention to our clients’ downside risk. Many believe that investors should focus on returns: the bigger the upside the better. We take the exact opposite approach: the smaller the downside the better.

Things we are not happy about: Our performance is poorer for customers who joined us between June and October 2023. In particular, we have clients with negative returns for those who joined in July and October 2023. If we zoom in to July 2023 batch, almost all our customers’ portfolios perform worse than IHSG. Our reflection on this:

We were too obsessed with our value-investing framework that we underestimated uncertainty from unexpected X factors that can affect investment performance. As a result, we were too confident and overweight on certain stocks with very good fundamentals but were hit negatively by multiple unexpected factors.

We slightly overlooked the importance of keeping spare cash. During those periods, we tended to use up all available funds. However, at the same periods, IHSG experienced strange trends where significant amount of funds flowed from companies with good fundamentals to companies hyped by market makers. As a result, we did not have spare cash to get good bargains when good companies were on a extra discount.

We have actively taken steps to rectify this situation. Among the actions we take are:

Engaging in different kinds of investing strategy, such as some short-term plays. We are continuously on the look out for real talents in the capital market and we are in talks with a number of them to develop more diversified investment strategies.

Be more cognisant on owners’ incentives when analysing a company

Be okay with having spare cash, because allocating spare cash is also part of an investment strategy

Things we are still monitoring: we are still observing the performance of November 2023 and later cohorts because it is still too early to tell for now. These are cohorts that have been subjected to a revised and improved investment strategy since the beginning.

1% improvement every day!

The takeaway

From this self-reflection exercise, Recompound’s internal takeaway is to be honest with ourselves and not to be afraid of admitting our weaknesses and mistakes. We want to face these weaknesses and mistakes head on so that we can continue to improve.

The takeaway we want potential and existing clients to have is that Recompound exists not to guarantee returns. As you’ve seen from the numerous graphs we show, we cannot guarantee every single portfolio of our clients to have 40% returns. When we say past performance does not guarantee future performance, we truly mean it.

In fact, you can experience drawdowns with us. Instead, Recompound’s main objective is to be your chief investment officer whose job is to grow your investment portfolio. But even if your portfolio is experiencing a drawdown, we will be working hard to turn things around for you.

Because we also want to eat and don’t want to fast forever 🙂