Introduction

The end of the year is always a good time for reflection. Recompound has grown so much in the past year. We went through good times and difficult times, but overall we are so proud of what we have achieved this year. We are also extremely thankful for our clients - for those who stay with us, for those who top up, for those who refer their friends and family to us. These actions mean a whole lot to us and they keep us going even when things get tough, even when we start feeling the burn out, even when many parties are skeptical about our endeavors.

Ultimately, our goal remain the same — to do right by investing.

And doing right by investing means we want to uphold the highest degree of transparency and honesty — about what we can do and what we cannot do, about our strengths and weaknesses, how we are still lacking today and how we will continue to be better day by day.

So in the spirit of December, here is the second edition of our Recompound performance analysis (we did something similar earlier this year too).

Recompound’s growing AUM

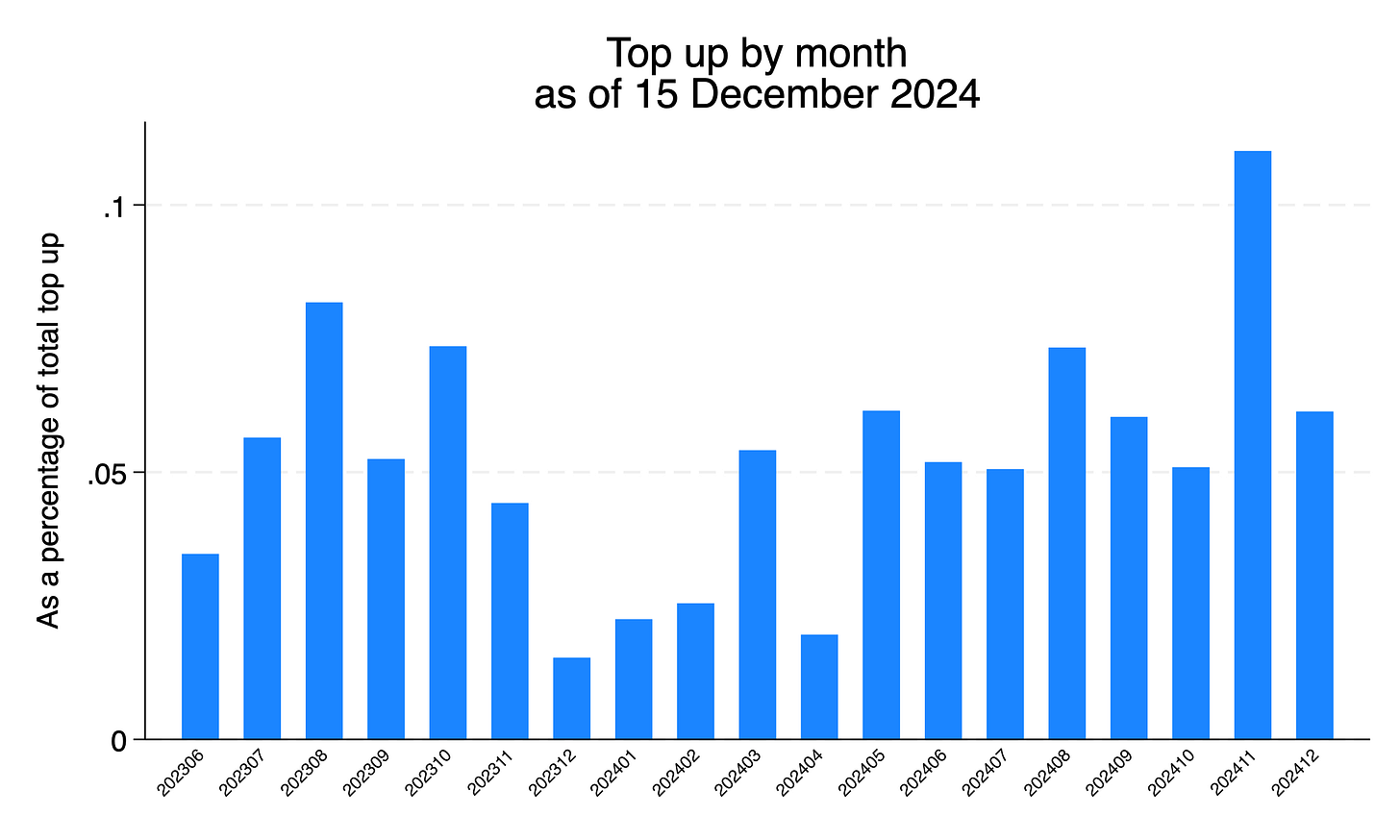

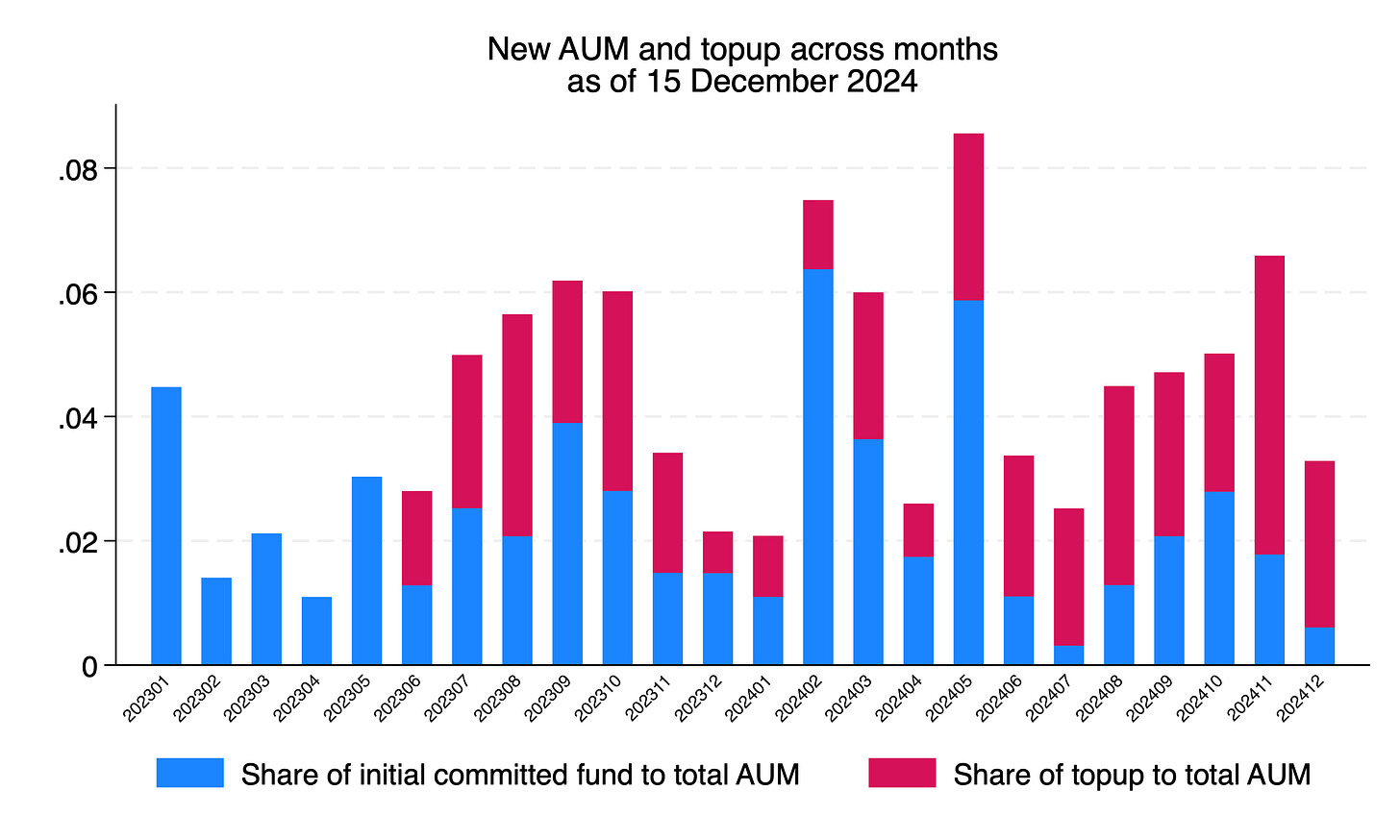

We are happy that the number of people who trust us and the extent of trust continue to grow. We continue to receive new AUM (asset under management) month by month, as shown in figure 1. Despite slowing growth in new AUM in the second half of 2024, the amount of top up from our existing client overshadows the slowdown in new AUM (see figure 2). To us, top up from existing clients is a testimony of the intensity of trust and satisfaction, so we are even more happy to receive them.

Comparing 2023 and 2024, our total AUM (accounting for initial committed fund and top up) shows positive growth (see figure 4). This is an indication to us that what we are doing is generating value to our customers, given the fact that we are spending minimal money in marketing efforts. This encourages us to continue delivering service that helps and generates value to people.

Understanding our clients

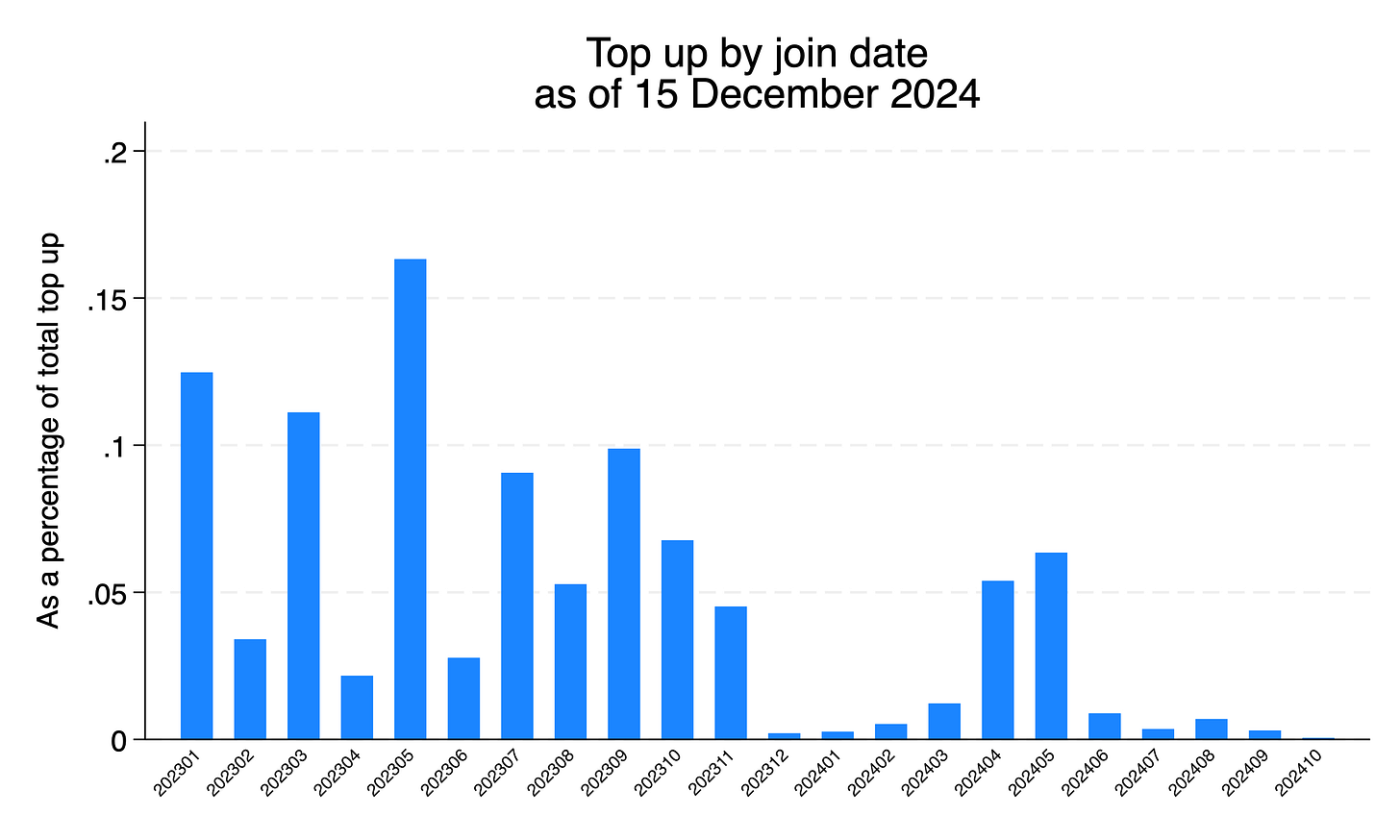

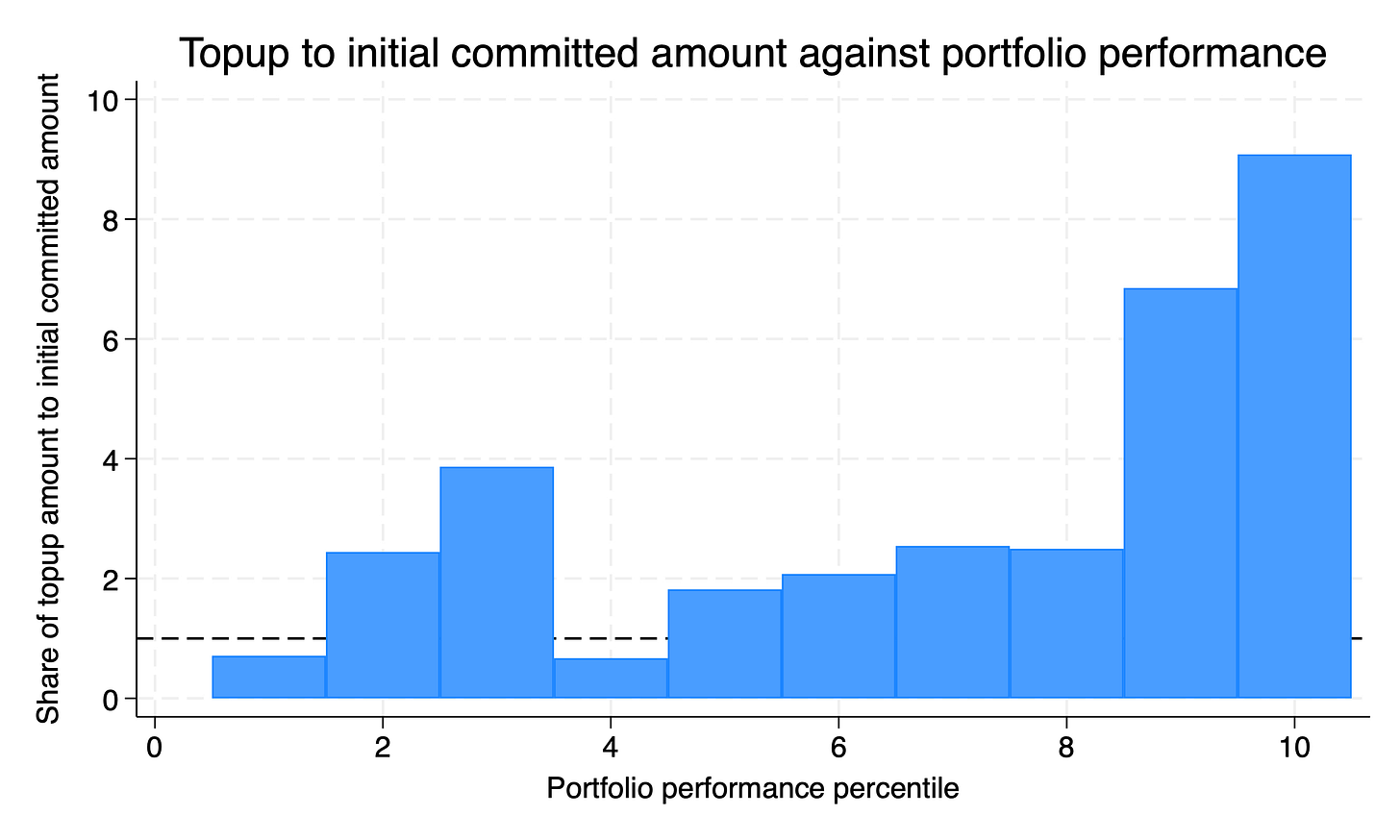

We want to understand how we can grow and build stronger trust with our clients. A quick analysis shows that time indeed plays a strong role in trust building. Figure 5 shows that clients who have been with us for more than a year top up more than those who just joined us. Surprisingly, while performance plays some role, the correlation between the performance of our clients’ portfolio and their top up decision is only somewhat modest (see figure 6).

But perhaps the metric above masks some caveats. Of all our clients, 50% made at least 1 top up. Just looking at those who topped up at least once, these people end up with AUM more than 2x their initial committed fund. On average, the amount of top up our clients make are 3.24 times the initial fund they committed (table 1).

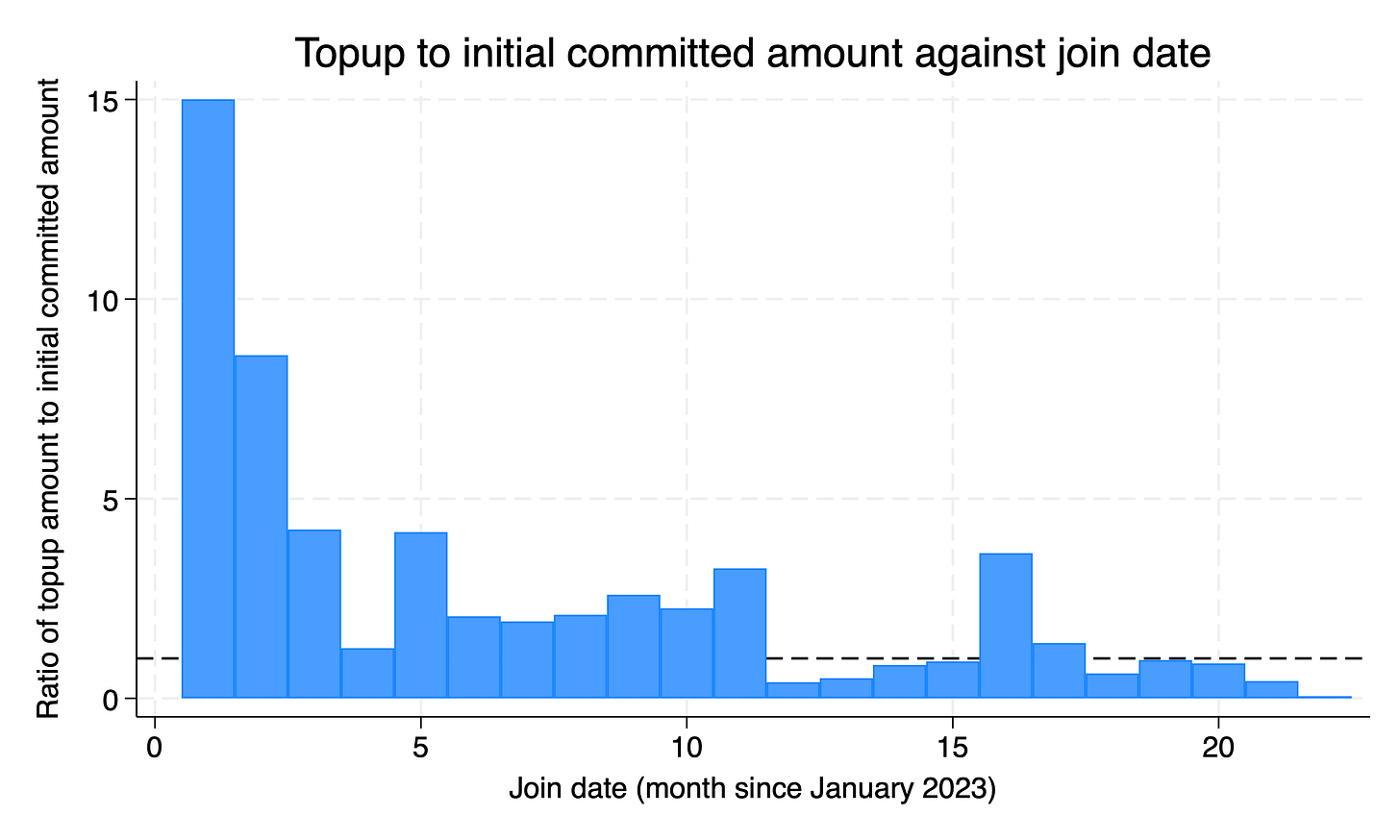

Again, topup/initial ratio is higher for clients who have been with us for more than a year (figure 7). More importantly, their portfolio performance is strongly correlated with their topup/initial ratio (figure 8).

To us, this is a sign that trust is not built overnight. A strong relationship with our clients need time. Of equal importance is our ability to deliver. While our clients can reasonably have high expectations for us to deliver, we also seek for their patience and give us the time we need to slowly grow their investment seeds into fruition.

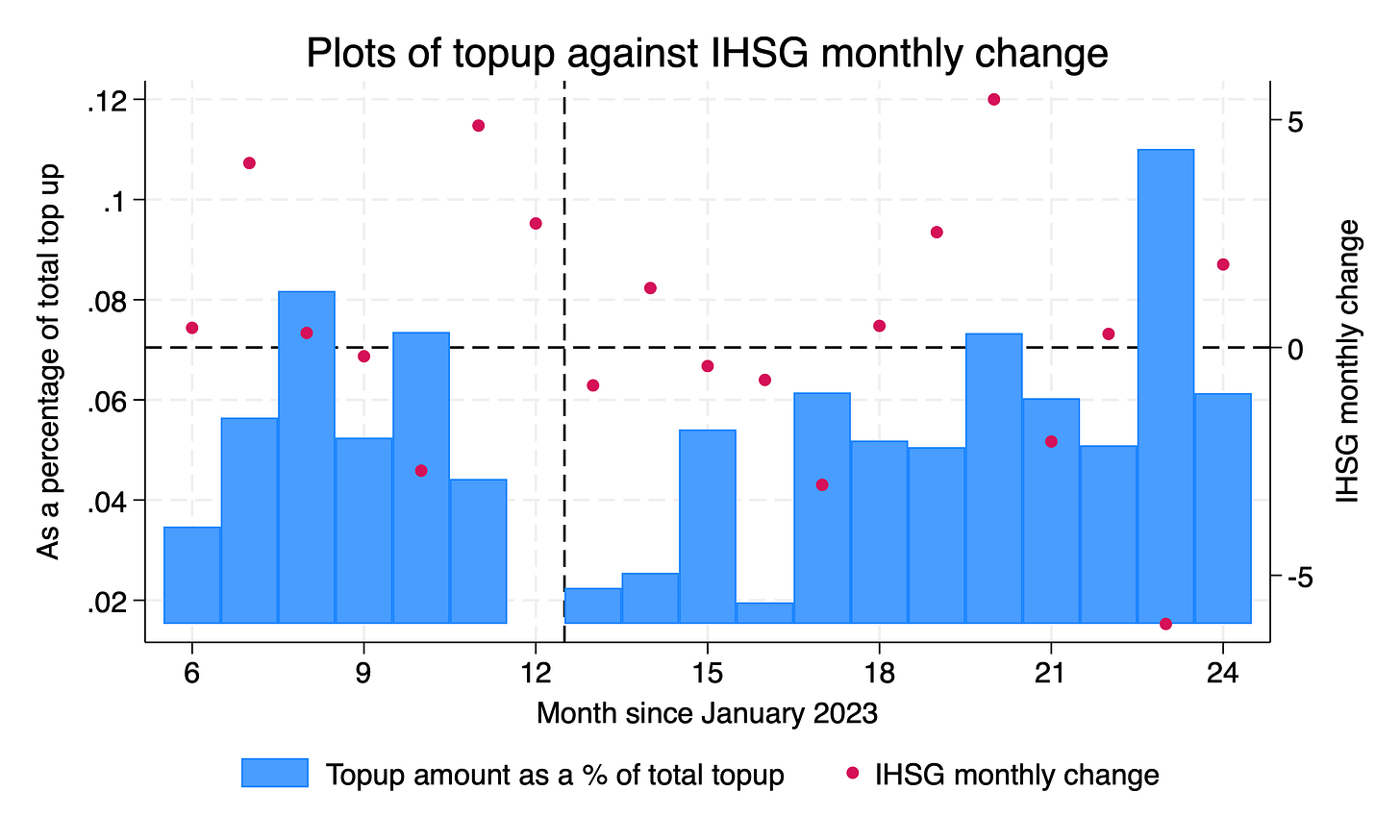

Our clients are also smart people — they mostly understand what investing is all about and the basic principle of investing, which is buy low sell high (not buy high sell low). During months of downturn (see months 10, 17, 23 in particular), our clients are not faltered at all and instead grab the opportunity to purchase companies at a bargain.

Recompound performance

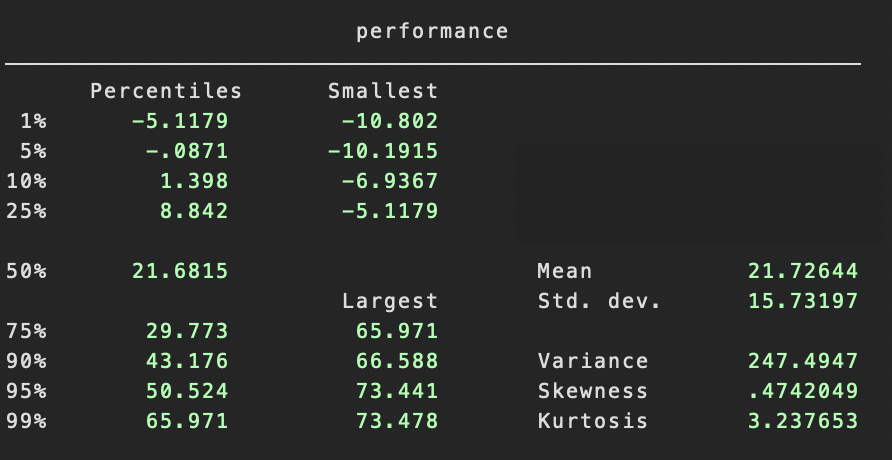

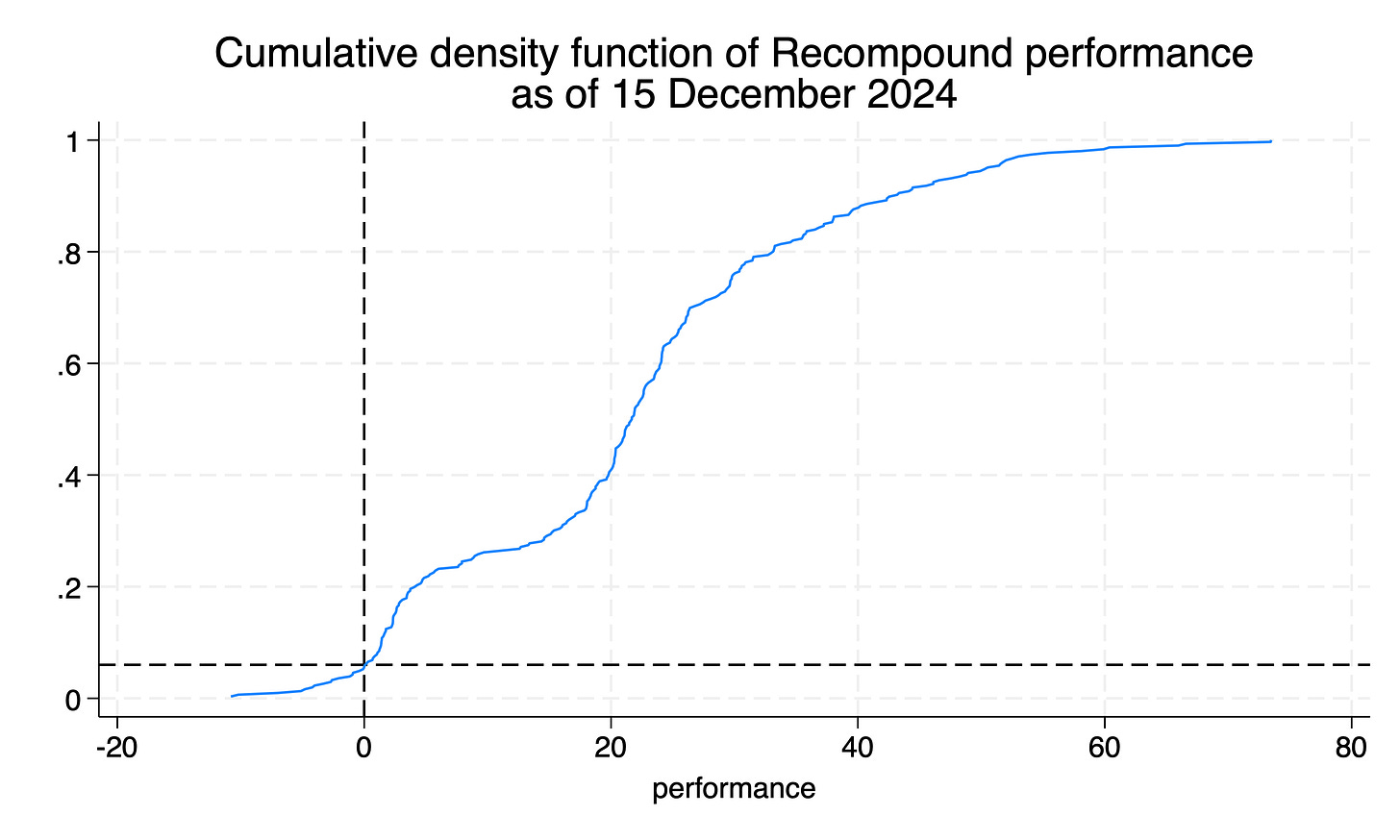

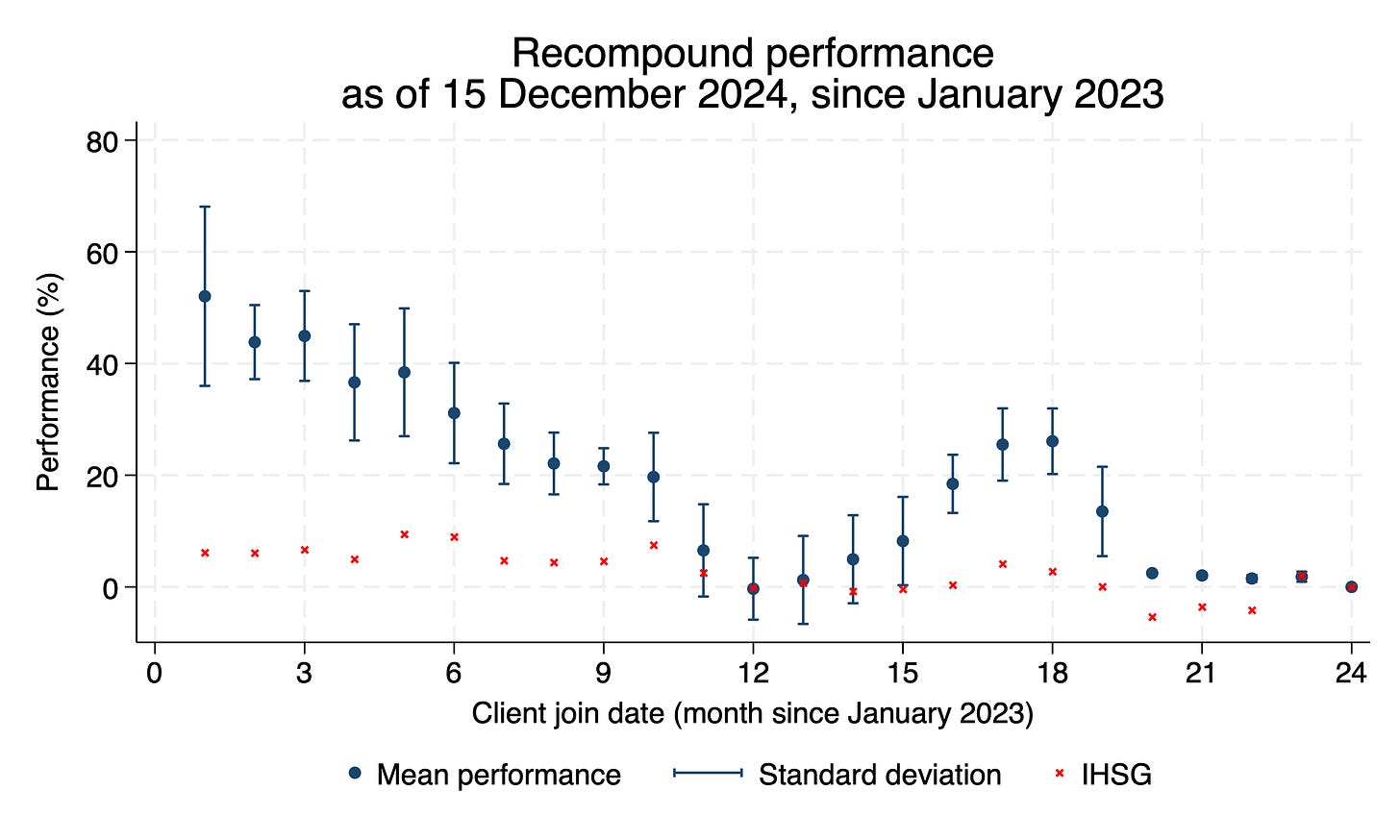

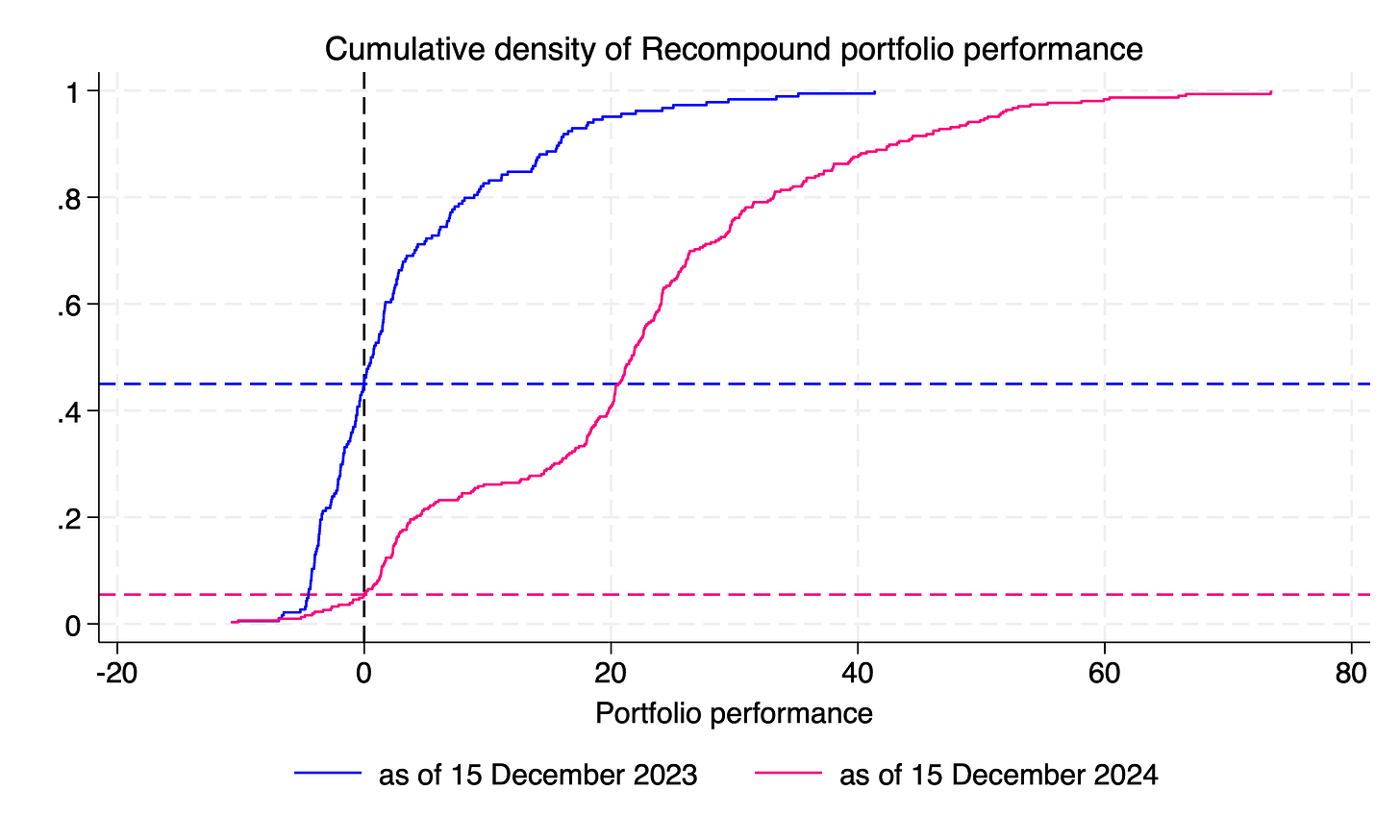

Table 2 below shows that the mean performance of our clients’ portfolio is 21.7%. The greatest drawdown is -10.8% and the biggest growth is 73.5%. Figure 8 shows that about 6% of our clients’ portfolio is still in the red (still making losses), with 94% already making positive returns,

How are we performing against IHSG? A fair comparison would be to look at 2 scenarios:

Our clients invest through Recompound

Our clients invest wholly in IHSG

Given the fact that our clients join us at different times, we compare the outcomes for each batch of client should they invest through Recompound versus if they invest wholly in IHSG. Taking an example of clients who join us in January 2023 (those who join us in month 1):

Our clients’ mean portfolio performance is at about +51.8%, with a standard deviation of 16%.

Should these clients invest wholly in IHSG, their returns by 15 December 2024 would be at +6.1%.

Overall, Recompound is doing better than IHSG for all months except for the batch of clients who join us in the period between November 2023 and February 2024 (figure 11). We will keep these clients in extra care and make it our big priority to turn their portfolio around.

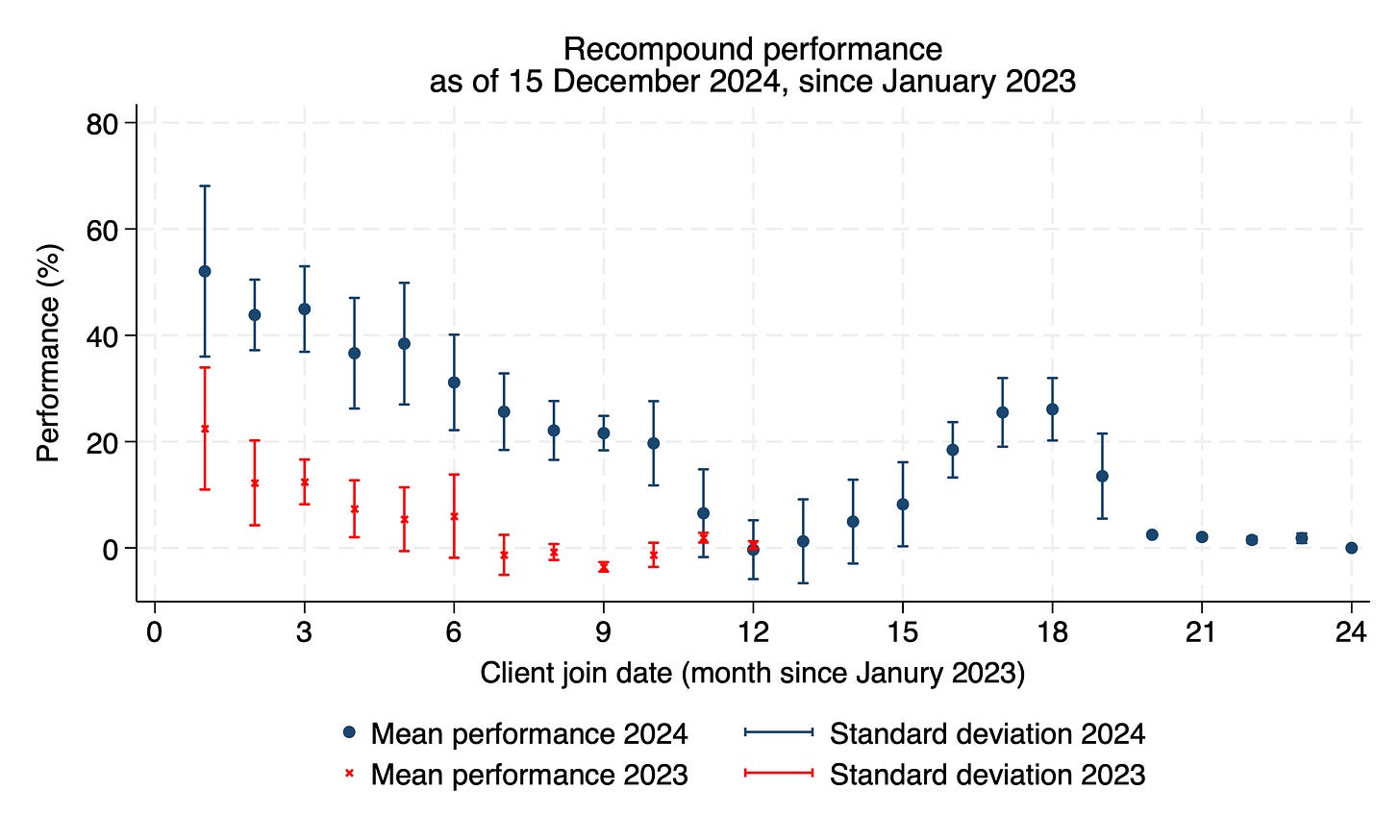

Comparing 2023 and 2024, we are quite happy that we have made improvements in terms of our portfolio performance. The red line in figure 12 shows the portfolio performance of clients with different joining time by 15 December 2023; the blue line shows the same metric by one year later, 15 December 2024. All portfolio (except for clients joining in November and December 2023) improve from December 2023 to 2024.

Figure 13 shows that we have successfully shift the portfolio performance distribution to the right (meaning higher returns / better performance). Although about 6% of our portfolio is still making losses, this is a marked improvement from more than 40% in December 2023.

Moving onwards

Our priority for 2025 and onwards:

Turn all negative portfolio to become positive

Shift our performance upwards for all clients

Deliver better experience to our clients