The world recently

You’re reading the Financial Times, and some {insert_smart_economist} from {insert_cool_bank} are warning you about recession, inflation, market crash, etc. Then comes some market analysis report saying that you should sell all your equity and stay cash.

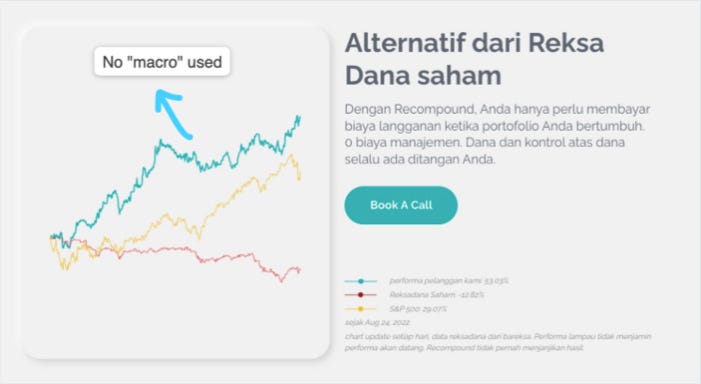

Why we think that basing investment decisions on macroeconomic factors has very little to zero merit

The world is so complex that it is almost impossible to predict. (Even my girlfriend’s mood is impossible to predict, let alone the global economy). Therefore macroeconomic forecasting is a useless exercise.

Super smart economists from super cool institutions like to come up with projections for GDP, inflation, unemployment, etc etc for the next 1 year, 3 years, 5 years, 10 years using super complicated models with scary equations.

Then COVID happens and they throw those numbers to the bin, revising everything downward.

But despite the scares of COVID, unemployment rate in the U.S. drops to a record low, surprising everyone, and they revise those numbers upward again.

Then news on Israel came, and they revise the numbers down.

Then Taylor Swift concert happens, everyone is happy, and the numbers go up again.

We hope you see how macroeconomic forecasting is a waste of time and resources, as anything could really happen.

A more recent example in Indonesia

In the first half of 2024, the Fed raised interest rates and USDIDR exchange rate weakened to 16,000. Based on these macro factors (interest rates and exchange rates), selling all your stocks might seem like a prudent move.

But, in a matter of weeks, a substantial foreign inflow came back to the Indonesian market, strengthening the exchange rate to 15,500. Then large-cap stocks rallied.

It’s unlikely that any macroeconomists could have accurately predicted such a quick reversal in our exchange rate.

If your investment strategy relied solely on those macro factors, you would have missed out on the 10 most profitable days in the Indonesian stock market in 2024.

What happens if you base your investment decisions on macroeconomic factors

One thing that every market participant wants to know is when the bottom of the market is, so that they can buy stocks at this bottom point.

Hence, many people try to time the market, think that they can do so, and believe that their prediction is correct.

And that is exactly what is done by one of our clients.

But almost immediately right after that, the market starts to pick up again. And this is what happened to the portfolio.

So the result of trying to time the market is often costly. One ends up selling out of fear when the market drops, only to miss the subsequent recovery.

Instead, Focus on The “Micro”

That’s why we take a different approach. Instead of trying to be a fortune-teller for the economy, we prefer to concentrate on what we can know in detail — the fundamentals of the companies we invest in. This micro approach involves digging deep into the specific attributes that make a company strong or weak.

Specifically, we think like businesspeople and treat stocks as cash-generating businesses, not just random tickers in a casino. We conduct deep, bottom-up analysis on businesses before deciding to invest in them.

We ensure that we:

Understand the Ultimate Beneficial Owners (UBO) of the business. We want to know if those in charge:

Have a good track record

Are competent in running their business

Are fair to minority shareholders (like us!)

Are prudent in managing their business profits

We assess whether profits are directed towards productive means such as business expansion, dividends, or buybacks, rather than for buying luxury apartments or management's leisure activities.

Understand the business process and prospects. We evaluate the business’s:

Stability

Capital return

Growth

Dividends

Prudence in managing Interest Bearing Debt

Valuation: After performing deep analysis, we buy the businesses (stocks) only when there is a large margin of safety (significant discount) compared to their intrinsic value to reduce the risk of suffering permanent capital loss. Think about: buying a car that is on sale rather than a car that is excessively marked up.

By focusing on these micro factors, we ground our investment decisions on tangible data that represents the reality of the business. This approach reduces the noise and distraction from speculations and allows us to make more informed, rational decisions.

In fact, by following this philosophy, we have achieved a 23.6% compound annual growth rate (CAGR) for one of our clients since August 2022 — without relying on macroeconomic factors.

Capitalizing on Panic-Driven Opportunities

What many investors fail to realize is that market downturns often present some of the best opportunities to buy great businesses at bargain prices.

When the market is gripped by fear from all those doomsday predictions in TVs and newspapers, stocks of fundamentally strong companies can become severely undervalued. This is where patient, disciplined investors can find incredible value.

At Recompound, we take advantage of these moments. When others are selling in panic, we’re buying. We look for high-quality companies selling at a bargain, not because their business fundamentals have deteriorated, but because of the majority of people turning into scaredy cats.

Warren Buffett’s Perspective

We’re not alone in this view. Warren Buffett, the legend, has long advocated for ignoring macroeconomic factors when making investment decisions. Buffett has repeatedly stated that he pays little attention to what the economy might do next. Instead, he focuses on finding great companies at reasonable prices.

His investment philosophy is rooted in the belief that owning a good business will yield positive results over time, regardless of the broader economic environment.

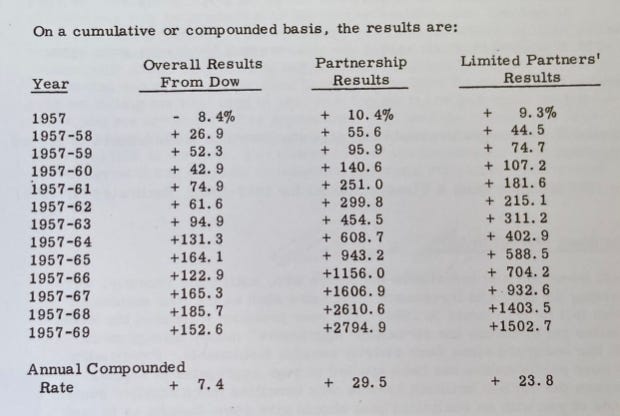

Buffett’s track record is a testament to the success of this approach. As the CEO of Berkshire Hathaway, Buffett has achieved an extraordinary CAGR of approximately 20% over more than five decades. This performance has not only made him one of the wealthiest individuals in the world but has also provided Berkshire Hathaway shareholders with substantial long-term gains.

It’s important to note, however, that in his earlier days, Buffett’s funds were much smaller, his CAGR is actually much higher at 29.5%. As Berkshire Hathaway grew in size, sustaining his high CAGR became increasingly challenging due to the sheer amount of capital involved. Nevertheless, even with this context, Buffett’s long-term performance remains exceptional and illustrates the effectiveness of focusing on company fundamentals rather than macroeconomic predictions.

Peter Lynch’s Perspective

Peter Lynch, another legendary investor, shares this sentiment. In his book "One Up On Wall Street," Lynch stated that if you spend 13 minutes analyzing economic and market forecasts, you've wasted 10 minutes. He believed that trying to predict the stock market's movements based on economic indicators is not only difficult but largely irrelevant to successful investing.

Lynch advocated for a "bottom-up" approach, focusing on thoroughly understanding individual companies rather than being distracted by broader economic conditions. He encouraged investors to concentrate on the fundamentals of a company — such as its earnings, products, and growth prospects — and to buy what they know and understand.

Lynch’s investment track record is equally impressive. As the manager of the Magellan Fund at Fidelity Investments from 1977 to 1990, Lynch achieved a CAGR of 29.2%. This made the Magellan Fund one of the best-performing mutual funds in the world during his tenure. Lynch’s success reinforces the idea that focusing on company fundamentals, rather than macroeconomic predictions, can lead to exceptional investment returns.

The Irony of Macroeconomic Expertise

What’s particularly ironic is that the very economists who dedicate their careers to analyzing economic data seldom achieve wealth through their own investments. Despite their deep knowledge of economic theory and their constant forecasting, most economists still work as salaried employees, often far removed from the wealth-generating power of successful investing.

In contrast, investors like Buffett and Lynch, who largely disregard macroeconomic predictions, become billionaires precisely because they disregard macroeconomic predictions. Their enviable CAGR (something Recompound is striving for) is a testament to the effectiveness of focusing on company fundamentals rather than macroeconomic noise. While economists forecast from their desks and take monthly salaries from churning these numbers, Buffett and Lynch have built empires by simply buying great businesses at good prices.

You can click the link below and watch how Buffett summarized this section beautifully:

https://buffett.cnbc.com/video/2016/02/29/buffett-name-me-one-super-wealthy-economist.html

Conclusion

At Recompound, we align our investment strategy with this philosophy. We believe that trying to predict the unpredictable is not just futile but can lead investors astray. By ignoring macroeconomic noise and focusing on the micro — on the fundamentals of individual companies — we aim to build a portfolio that can weather economic storms.

In investing, as in life, it pays to control what you can and let go of what you can't. That’s why we leave macroeconomics to Entity up there and focus on what truly matters. Our own experience reinforces this, with a 23.6% CAGR on our investments since August 2022, achieved without relying on macroeconomic forecasts.

And remember, when the market is panicking, it might be a good time to find incredible bargains. By capitalizing on others' fears, we can position ourselves for significant long-term gains.