After reading the short editorial on the AI bubble, perhaps this video about our client handling market panic like a pro is going to pique your interest.

TL;DR

Is AI revolutionary? Hell yeah !

Will investors be disappointed a few years from now? Likely.

Why everyone’s excited

AI can read, write, talk, see, and code. It already helps in search, ads, customer service, medicine, software and self driving cars.

That is real, and it is big world-changing.

I mean personally as I used to be a data scientist, data exploration, analysis, visualization used to be a big chore. Now I am seeing how an AI can perform those tasks much better than me within a much shorter timeframe. Yes, without the lunch breaks.

The money firehose

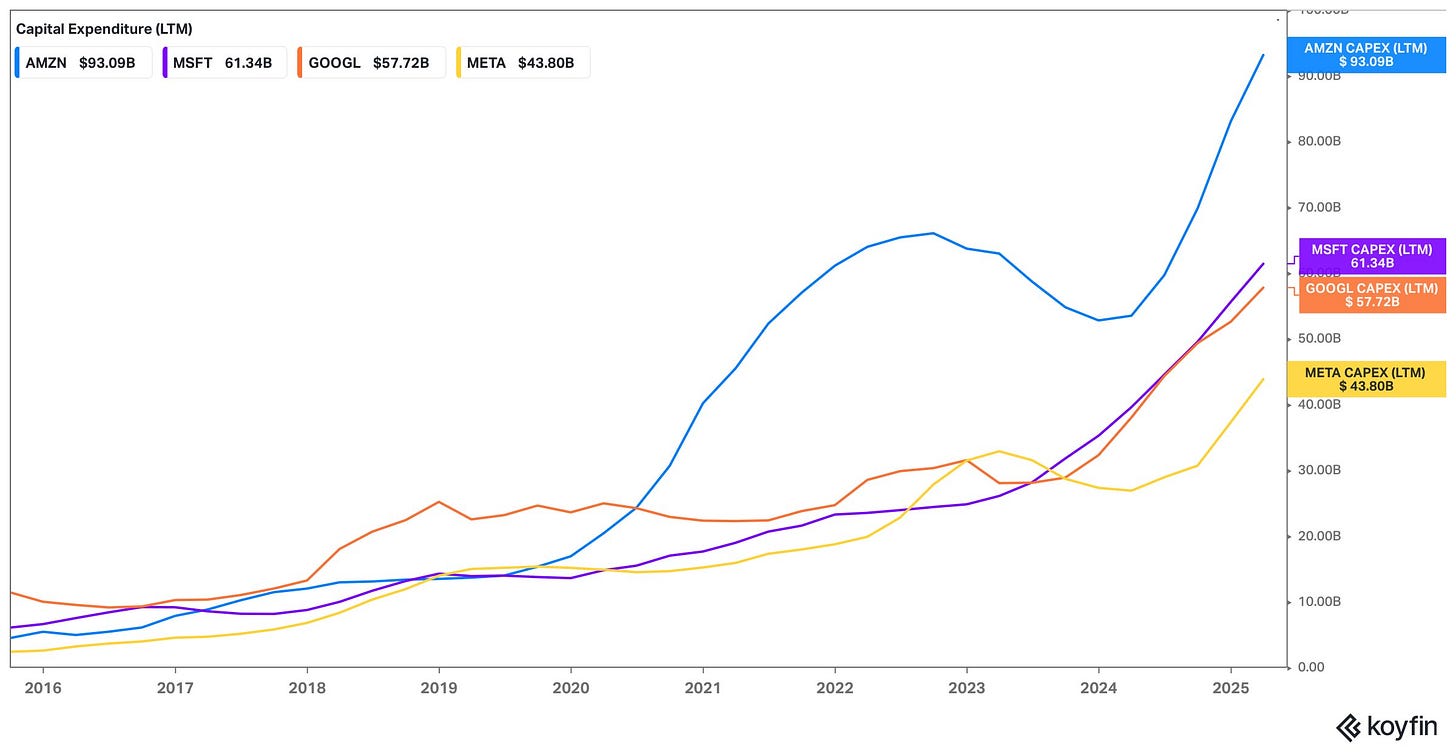

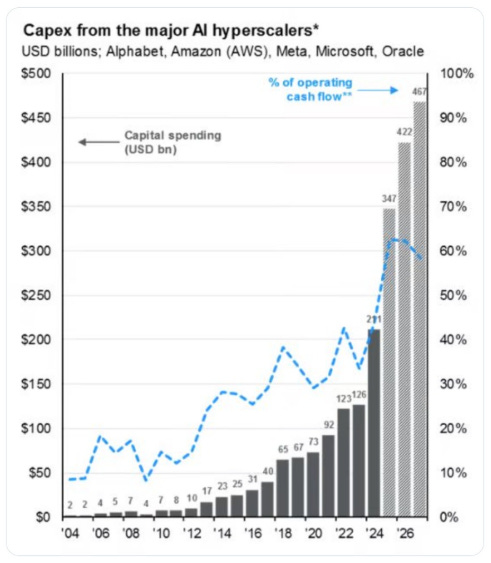

The biggest tech companies are spending CapEx of hundreds of billions on AI data centers (chips, buildings, power).

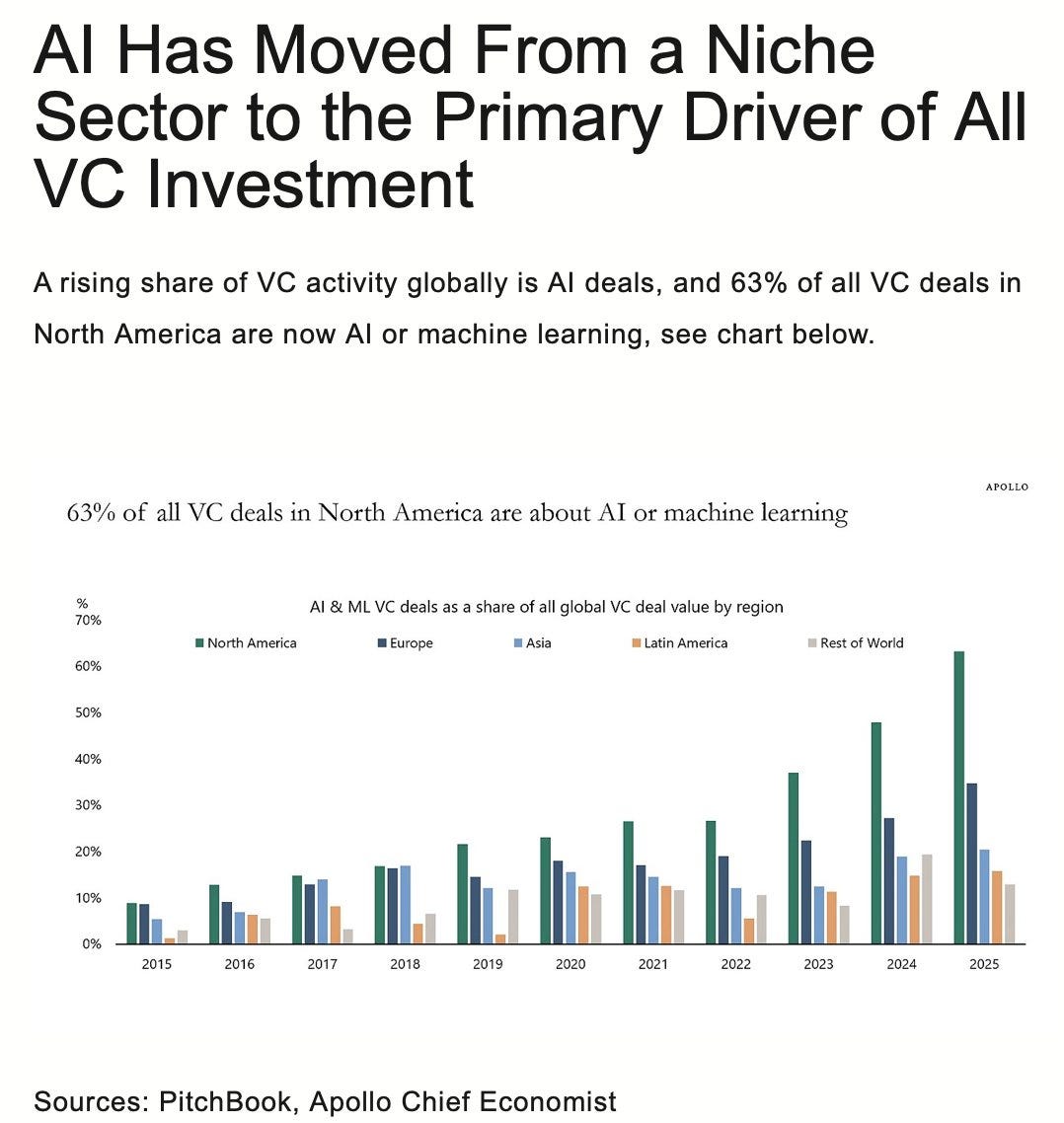

Venture capital is also pouring money into AI startups.

Why this matters: Cash goes out now (to build). Profits show up later (if things work). That gap is where investors can get hurt.

What we are hearing on the field

A friend of ours who manages money in the U.S. says AI startup valuations in Silicon Valley are nuts.

Example he’s seeing: a startup with $1 million ARR getting valued at $200 million.

Amazing if the company grows into it; painful if growth slows.

What could go wrong (even if AI wins)

Big build, slow payback

If customers don’t show up fast enough, those GPU farms sit under-used.

Accounting drag

New hardware gets expensed over time as depreciation. If equipment wears out faster or earns less, profits fall.

Thin early margins

Running giant models is expensive. If prices fall faster than costs, cloud profits get squeezed.

Return on capital math

If profits grow slower than the asset base, ROIC (Return on Invested Capital) drops—even when revenue is rising.

Where earnings really come (as of today)

For Mag 7, most profits still come from the old cash engines:

Microsoft: Office/Windows + Azure

Alphabet (Google): Search + YouTube ads

Amazon: AWS + Retail/Ads

Meta: Ads (Family of Apps)

Apple: iPhone + Services

Tesla: Cars

These fund the AI CapEx.

If AI pays quickly → great.

If it pays slowly → free cash flow gets squeezed, depreciation rises, buybacks slow, and valuations compress.

No bust required—just meh returns.

The Mag 7 entered a mega build-out phase. Annual spend is set to more than double in just a couple of years.

Even these giants are using a sizeable chunk of their cash flow (peaking ~60%+) to fund AI. That means less leftover for buybacks, dividends, and non-AI projects—unless AI starts paying for itself quickly.

Think of this as building a nationwide highway system before the toll booths are earning much. If traffic (AI demand and pricing) arrives fast, it’s a great investment.

If it arrives slowly, profits and free cash flow might be squeezed—investors can be disappointed even while the technology changes the world.

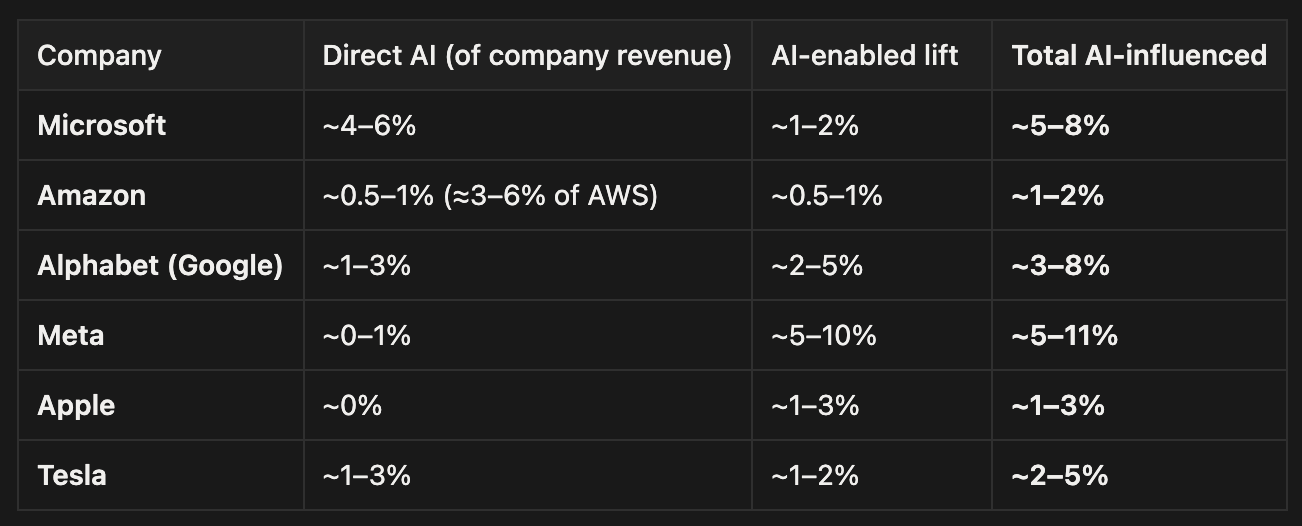

Rough guesses: how much is AI directly contributing to Mag 7 Revenue (exc. NVDA)?

Two buckets:

Direct AI = things customers pay for as AI (Copilot, AWS/Google AI services, FSD).

AI-enabled = AI that quietly boosts existing lines (better ad targeting, stickier devices).

These are directional guesses based on public commentary; they’ll change as disclosures improve.

Capex booms: a caution from history

CapEx booms have almost always led to eventual collapses and a lack of returns for shareholders. This is despite benefiting consumers and the world in general.

Some of the more famous historical references include:

• The US Canal Boom of the early 1800s

• British Railway Mania of the 1840s

• The Dot com boom in the late 1990s

Maybe this time is truly different. But those are some very dangerous words…

Even a world-changing tech can deliver so-so investor returns if spending runs far ahead of profits.