Disclaimer: not an investment recommendation to buy, hold or sell any of the tickers mentioned in this post. Article is written to illustrate about investing behaviour in the market.

On the 14th of June 2021, PT Bank Rakyat Indonesia Tbk (BBRI) announced its intention to conduct a right issue. The goal of the right issue is to raise funds so that they can develop financial services for the ultra micro segment (financial inclusion).

This right issue is remarkable because it was the largest right issue in Southeast Asia as the firm managed to amass Rp 41 trillion worth of funds from the public according to Deputy State Owned Enterprise Minister Kartika Wirjoatmodjo.

💡 Quick pause: If you don’t know what a right issue means don’t worry.

The what: It is a method for a public company to raise money from existing shareholders

The how (this is what usually turn people off): Company would invite existing shareholders to buy new shares at an agreed price. The quantity of shares that can be bought depends on how many shares the investors have.So for example, for every share that you own, you can buy another share at price X.

Official definition: An offer to existing shareholders to purchase newly-issued stock, the right to which they can usually exercise or sell on the open market.

Here’s an investopedia link for you to read further.

Simplified Mechanism and Preliminary Thoughts

In a nutshell, shareholders who own BBRI stock by 8th of September 2021 would be given BBRI-R.

For simplicity, for each 100 share, shareholders will get 23 BBRI-R. By owning BBRI-R you have the right to order BBRI at a stipulated price which is Rp 3.400,-. Shareholders who qualify can exercise and purchase on 13th - 22nd September 2021.

Now this price might be attractive considering BBRI shares trades at ~ Rp3.500 - Rp 4.820 in 2021. Who wouldn’t want to get a BBRI discount?

Considering at the time BBRI is the largest state owned bank by market cap and is showing good signs of recovery from the pandemic, the opportunity to buy at Rp 3.400,- (discount) should be quite enticing. If you look at the company from the lens of a fundamentals perspective, we can expect people to buy or hold BBRI from June 2021 all the way to September 2021 where they can exercise their right to buy BBRI at a discount.

Expect price to go up but it tanked..

As illustrated in the chart, there were more sellers than buyers in the period leading up to the corporate action. As a matter of fact, the price dipped by a notable ~17.7%!

When we made our thesis based on BBRI’s fundamentals we made an assumption that everyone in the market wants to buy BBRI at a discount because we assume that everyone wants to maximise their profits long term.

But in reality, different types of market participants have different types of incentives and constraints.

Let’s view Equity Fund Managers

They manage equity mutual fund in Indonesia and let us take a look at their incentive and constraints (at broad strokes) as a fund manager.

Their simplified incentive: to beat the index.

Generally their bonuses is determined by what % can they outperform the index. If they outperform by a lot, they will get more bonus, if they don’t outperform they will get less bonus.

So how do you beat the index?

A common strategy that is employed is to allocate a portion to follow (track) the index and then have another portion in their fund to outperform the index.

For example:

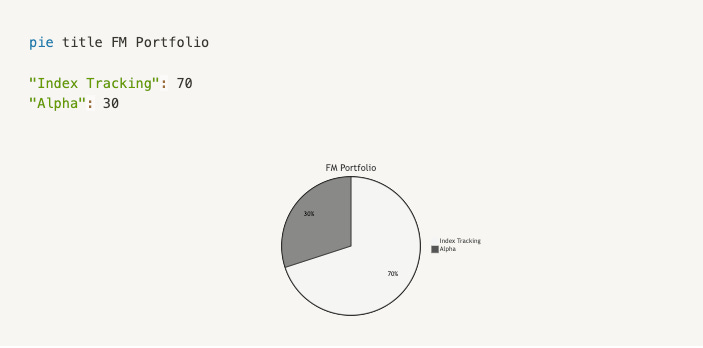

They can allocate 70% of their portfolio that has strong correlation with the market and 30% that has a good likelihood that their performance would beat the market.

How do you track the index?

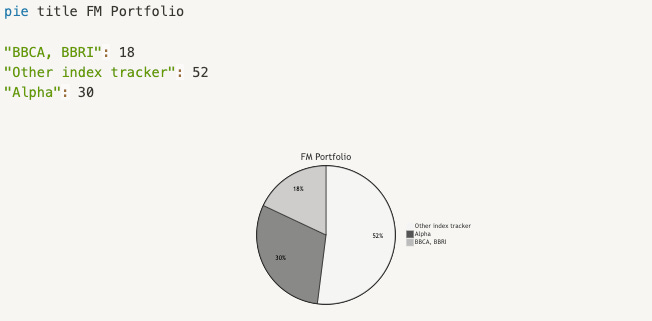

By buying stocks with large market capitalisation, like BBRI. As a matter of fact, the market capitalisation of BBCA and BBRI usually makes up more than 10% of IHSG’s market cap. As of 2023, they make up around 18% of the index.

If the market cap of BBCA and BBRI is 18% of IHSG, fund managers would have to allocate 18% of their portfolio to BBCA and BBRI to effectively track the index to become somewhat like this.

But there’s a catch

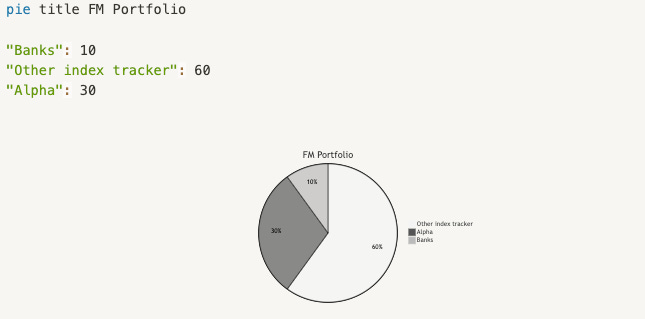

Fund managers of equity mutual fund cannot allocate more than 10% of their portfolio to a given industry. We talked about this in one of our articles as well. So usually they will cap their exposure to banks (including BMRI and BBNI which are also giants) to 10% and their portfolio would look like this

Now that there is a right issue happens with BBRI. This means that the fund managers would know in advance that their ownership of banks will be more than 10% of their portfolio if they buy additional shares at Rp 3.400,-.

So what is the most rational thing for them to do?

They have to sell first at a price that is higher than Rp 3.400,-. Subsequently as the new stocks get issued their allocation will still be at maximum 10% before they can exercise their rights to purchase the new issued stocks at a discount.

What happens when fund managers collectively sell the BBRI stock before right issue happens? Well the price tanked and we can see it in the chart 🙂

Closing Remarks

In investing, it is always worthwhile to try to understand the incentives of the market participants. Not all players have the same rules and flexibility as retail investors. Some are constraint by regulation and others are motivated to achieve different goals than just purely maximising returns.

We might not always do it right, but when we make a correct guess, it would be rewarding (literally).