Disclosure by PT Adaro Energy Indonesia Tbk (ADRO) in early September 2024 regarding the planned spin-off of its subsidiary, PT Adaro Andalan Indonesia (AAI), has been a hot topic in the capital market. Many people are weighing the pros and cons of this corporate action.

After divesting AAI, will ADRO benefit?

As ADRO shareholder, is acquiring AAI at a valuation of $2.6 billion considered cheap?

If ADRO loses AAI, where will their future profitability come from?

Is AAI's prospect still bright?

And many other pros and cons questions.

For us, this corporate action reminds us of the story of ADRO’s IPO (Initial Public Offering) back in 2008.

For context, in June 2008, the shares of PT Bumi Resources Tbk (BUMI) reached an all-time high, Rp 8,550 per share! At that time, BUMI's market cap reached Rp 166 trillion, making BUMI the largest company on the exchange and a darling among investors. It was said that many people were rushing to securities firms asking, “How do I buy BUMI shares?” instead of asking how to open a securities account.

Coal prices also reached their peak at that time, exceeding $100 per ton. The momentum and tailwinds in the coal industry were successfully leveraged by PT Adaro Energy (ADRO) to list its shares, marking the largest IPO in the history of the Indonesia Stock Exchange, worth Rp 12.2 trillion! This record was only broken 13 years later by PT Bukalapak.com Tbk (BUKA).

If we take a look back at ADRO's IPO process, there is actually something interesting: the majority of the IPO funds were allocated to increase capital and acquire shares in its subsidiary, PT Alam Tri Abadi (ATA), which would later be renamed PT Adaro Andalan Indonesia (AAI). This is the same entity that ADRO now plans to divest following its shift towards focusing on green energy.

Why did the majority of ADRO's IPO funds “have to” be used for a rights issue to PT Alam Tri Abadi?

That’s the key question

This simple question led us to many more questions, eventually culminating in a summary of the chronology and a mapping of the structure of PT Adaro Indonesia (ADRO) Group at the time. Let's discuss it one by one.

ADRO's Structure Before the IPO

Although it may seem "complicated," this is ADARO Group’s pre-IPO structure, which we’ve simplified. There are many stories to be uncovered from this structure, but let’s focus on one key part first: the position of PT Alam Tri Abadi within ADRO's structure.

PT Alam Tri Abadi was ADRO's direct entity at that time, holding several key entities such as PT Adaro Indonesia, Coaltrade, and PT Indonesia Bulk Terminal.

From this, we can deduce why around 90% of ADRO's IPO funds in 2008 were funneled into PT Alam Tri Abadi.

Let’s highlight the shareholding structure of PT Adaro Indonesia:

PT Alam Tri Abadi - 60.22% (ADRO’s direct entity, 92.02% ownership)

PT Dianlia Setyamukti - 5.83% (A subsidiary of PT Alam Tri Abadi, 100% ownership)

MEC Indo Coal BV - 0.95% (Part of PT Alam Tri Abadi’s entity through ownership in Decimal Investment and its subsidiaries)

From this, we know one clear fact: ADRO already owned 66.07% of PT Adaro Indonesia shares through three entities.

So, where were the remaining 33.93% of PT Adaro Indonesia shares?

They were held by PT Viscaya Investments directly (28.33%) and 4.67% through its subsidiary, Indonesia Coal Pty Ltd.

At that time, PT Viscaya Investment was owned by three shareholders:

Ariane Investments Mezzanine - 76.28%

Agalia Energy Investments Pte Ltd - 23.71%

Arif Rachmat - 0.01%

Now, Ariane Investments and Agalia Energy became the targets of PT Alam Tri Abadi's acquisition because they indirectly held the remaining shares in valuable entities such as PT Adaro Indonesia, Coaltrade, and PT Indonesia Bulk Terminal.

So, the initial question of why more than 90% of ADRO's IPO funds were "given" to ATA has been answered: PT Alam Tri Abadi was tasked with collecting the "remaining shares" by acquiring Ariane Investments and Agalia Energy.

Who owned these two entities?

Shareholders of Ariane Investments Mezzanine:

Ariando FCM (Mauritius) Ltd - 42.31%

Kerry Coal (Singapore) Pte Ltd - 28.85%

Vencap Holdings (1987) Pte Ltd - 13.46%

Goldman Sachs (Asia) Finance - 7.69%

Citigroup Financial Products, Inc - 7.69%

Meanwhile, Agalia Energy Investments Pte Ltd was entirely owned by Agalia Capital.

Here is where things get tricky. The shareholders listed above are primarily asset management companies. As we know, asset management companies manage investors’ funds. So, who were the investors in question?

Once again, this is tricky. Were they part of ADRO’s founding consortium (Thohir Family, Subianto Family, Rachmat Family, and Saratoga)?

This answer remains somewhat unclear for us, as there is no concrete evidence, only assumptions from a few news reports published by Detik in 2005.

Feel free to form your own assumptions: did the founders hold the remaining shares, or was there another party involved?

This is quite important, considering the acquisition value of Ariane Investment & Agalia Energy reached Rp 9.9 trillion!

Jackpot?!

As for whether this corporate action was cheap or expensive, you can draw your own conclusions from ADRO's Q3 2008 financial statements.

What is clear is that this acquisition resulted in the recognition of significant goodwill.

Let’s return to the discussion about the divestment that ADRO will carry out on this entity.

Message from Budi: Before that, if you have read this far and are eager to read even further, consider subscribing to KelaSaham’s services. They offer super comprehensive educational videos for you to learn more and dig deep about value investing. If you are hungry to read quality materials about Indonesian companies such as this, head over to their registration page.

And if you sign up using my code N4E43S, I will be very happy. If you sign up without using my code, I will be equally happy as they really are great people.

Transformation of PT Alam Tri Abadi into PT Adaro Andalan Indonesia

If you read ADRO’s 2023 annual report and those from previous years, you won’t find the name PT Adaro Andalan Indonesia (AAI). While this name is “new,” the entity itself has existed for two decades, having been established at the end of 2004 as PT Alam Tri Abadi.

The name PT Alam Tri Abadi was retained until ADRO’s Q1 2024 financial statements. It was only in the Q2 2024 financial statements that the name PT Adaro Andalan Indonesia first appeared. So, this entity has been around for a long time, only its name has changed.

The divestment of PT AAI is significant and material because PT AAI holds ADRO’s “prime assets.” This claim is quite basic, as if you look at the group structure under PT AAI.

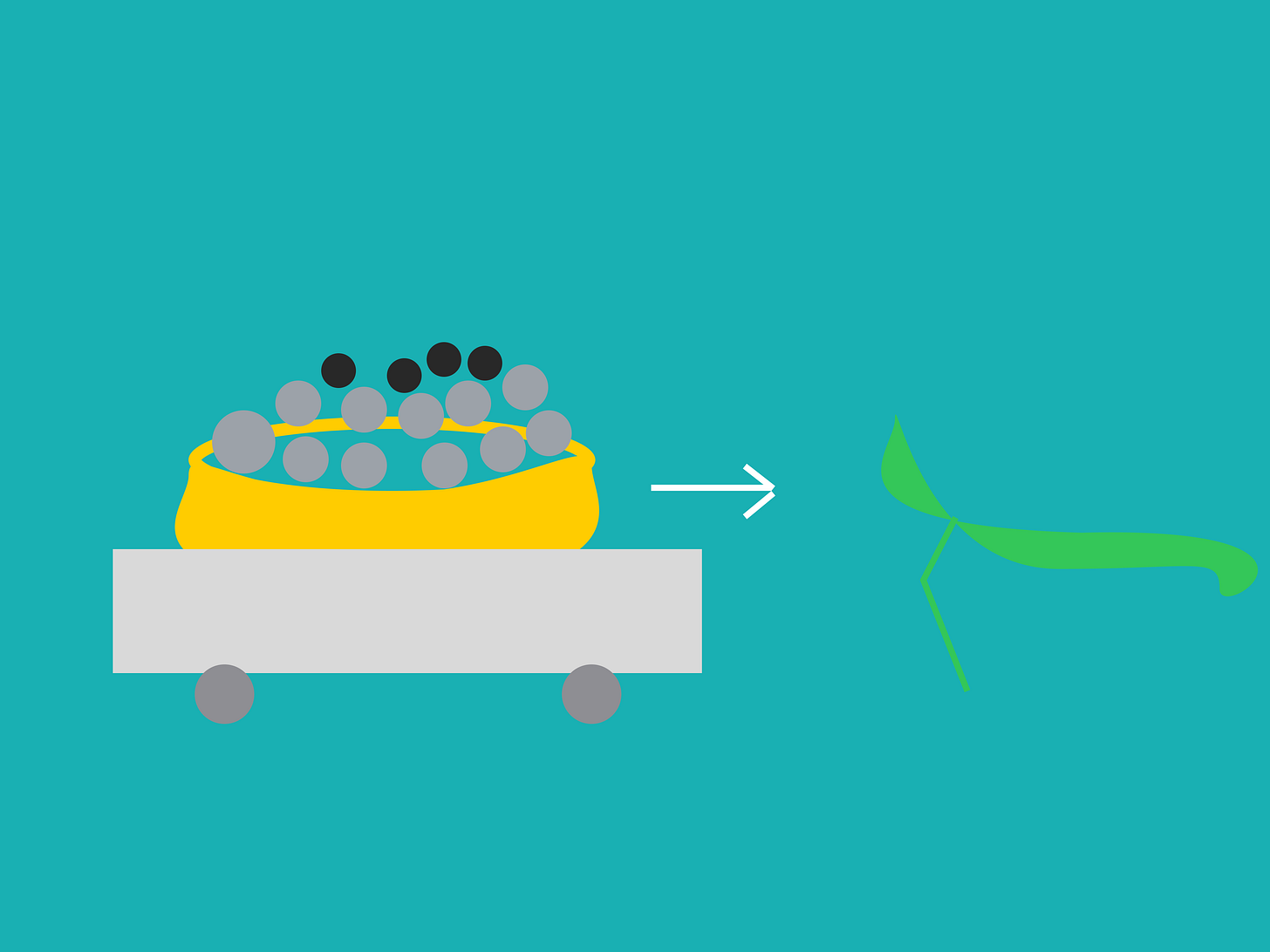

Oh, by the way, ADRO has never explicitly disclosed the structure of its group entities, but based on several ADRO disclosures, we’ve summarized it as shown in the image above. There may be a few entities we missed, but this should not change the fact that AAI holds ADRO’s prime assets.

One of these prime assets is PT Adaro Indonesia. There’s also the Balangan Coal entity, acquired in 2013, consisting of PT Semesta Centramas, PT Laskar Semesta Alam, and PT Paramitha Cipta Saran, along with PT Mustika Indah Permai. In total, the AAI Group contributed 60.8 million tons of ADRO’s 2023 production, or about 92% of ADRO’s overall production.

One entity under AAI that draws attention is Adaro Capital Limited, which was ADRO’s vehicle for acquiring Kestrel Coal, a coking coal producer, in 2018.

This is interesting because AAI's planned divestment is part of ADRO’s move to separate its thermal coal business as it focuses on green energy. Kestrel may either be sold by AAI to ADRO or to PT Adaro Minerals Indonesia (ADMR).

Previously, AAI sold 2.6 billion ADMR shares to ADRO for Rp 3.5 trillion on June 20, 2024. The profit from this ADMR share sale contributed to PT AAI's nonrecurring gain of $322.9 million.

Now, let’s move on to AAI’s divestment transaction plan.

There are several important points that we have highlighted:

The sale of AAI shares will be offered to ADRO shareholders who are registered on a specific date. This is similar to the cum date in dividend distribution, where there is a “special” date for ADRO shareholders to subscribe to AAI shares.

The shares will be offered based on a specific ratio. If there are no changes in the corporate actions of ADRO or AAI, the estimated ratio is 1:4.39, meaning that for every 4.39 shares of ADRO owned, shareholders are entitled to 1 share of AAI. (This is still an estimate; the final ratio will be confirmed in the prospectus).

The third point is still somewhat confusing. The offering price to ADRO shareholders will be based on the weighted average price formed after the close of trading on AAI’s listing day on the stock exchange. In our view, AAI will first undergo an IPO, and then the shares will be offered to ADRO shareholders at the average price of AAI’s first trading day.

Any remaining AAI shares that are not subscribed or sold will continue to be held by ADRO. This means ADRO will likely still own a certain percentage of AAI shares, but it won’t be significant or consolidated again due to ADRO's initial intention of divesting in line with its “green energy” focus.

So, is PT Adaro Andalan Indonesia (AAI) valued at $2.6 billion an attractive valuation?

Let’s wait for the official prospectus, and we’ll discuss it in another article.