I don’t have enough [insert_xyz]

We are all poised to think of insufficiency as a bad thing. We complain about not having enough time, not having enough money, not having enough friends, not having enough financial innovation in the Indonesian stock market, etc etc.

But here I would like to share how “not having enough xyz” can be a good thing, and that sometimes “having enough or too much of xyz” can be a bad thing.

I don’t have enough time

One of the most common complaints we hear today is not having enough time, which we can’t seem to escape regardless of which stage of life we are at.

Let’s reminisce that good ol’ times when we were all still students. You might remember having 5 exams coming up next week (Ujian Nasional, Ujian Akhir Sekolah, I am giving you nightmares I am sorry), on top of 3 group projects due. In the midst of all that, you still have to attend extra-curricular activities, attend tuition classes, and cannot miss hanging out with your friends (because how could you?!). But miraculously you still manage to go through that “hell week” somehow. To this day, you still don’t know how you did that.

Fast forward a little bit to one of your working days. You are given a big task to complete, and you clear one whole week to focus your energy and attention on that. You remove all sorts of meeting and other less important tasks. Great, this whole week is dedicated to that big project — you have 5 full working days, uninterrupted. Today is Monday. I am going to be super productive and get this done by Friday.

Only to reach Friday and realise that you are merely halfway through the task. What happened? You have all the time in the world, but why are you working slowly and become less productive than when you are pressed on time?

Let’s bring in some ideas about productivity to help explain this. Suppose there is a mapping from number of hours work to output. You can think of this in many scenarios, for instance:

In 1 hour, I can write 1 blog post

In 1 hour, I can make 100 cookies

In 1 hour, I can write 1000 lines of code

Let’s call the hours H and the output Y. The relationship between H and Y is given by some function F, hence we have Y=F(H). In the case of the examples above, it would be:

Number of blog post (Y) = 1 x number of hours (H)

Number of cookies (Y) = 100 x number of hours (H)

Number of code lines (Y) = 1000 x number of hours (H)

Now let’s introduce 2 people and call them Budi and Toby. Budi is an extremely productive coder. In 1 hour, he can write 5000 lines of code, while Toby can only write 1000. So Budi is 5x more productive than Toby in terms of coding. Let’s call this productivity level A. Now the relationship between H and Y becomes

Going back to the question why sometimes having less time may make us more productive, one way to think about this is through the productivity level A. When you know you only have limited H amount of time to complete a task, you increase your productivity level (you increase A). In contrast, when you know you have lots of time, you become more relaxed and “take it easy” and may inadvertently lower your productivity level (you lower A).

(I can’t help but draw some graphs for you because I love explaining things through pictures). The graph above shows one potential relationship between Hours (H) and Output (Y). The blue line shows the time-constrained scenario and the red line shows the ample-time scenario. The only difference between the two lines are the productivity levels (we call A).

Suppose A2 = 2 * A1, meaning that you are 2 times more productive in the time-constraint scenario. This means even if you have the same amount of time, your output is 2 times greater when you are time-constrained. You can see clearly in the graph that at time x*, the red line only accomplishes y1 and the blue line can accomplish y2. Where y2 > y1 of course.

Now you are in a situation where you boss gives you a target to produce y2 amount of output.

If the deadline is x* (time constrained), then you are “pressured” (or “kepepet”) into finishing y2 within the time constraint. You have no choice but to have a productivity level of A2 (blue line).

If there is no deadline (ample time), you can take your own sweet time and reach y2 output at x’, which is much longer than x*. Your productivity level A1 is lower than what you are actually capable of.

So the blue line is what we often call “the power of kepepet” (the power of urgency).

Why is this the case? In the time-constrained scenario, you have no choice but to increase your productivity level to A2. Otherwise you won’t meet your boss’ expectations. Compared to the ample-time scenario where your productivity level is A1. Time to take into the same level of output is much longer because you have a lot of time.

So counterintuitively, having less time, can often be a solution to getting more things done.

I don’t have enough money (part 1: individual)

Another very common constraint: money.

I have to admit that being a student at almost 30-year-old can sometimes be disheartening. When I look at my peers, many of them are already transitioning into mid-level professionals in their career, starting managerial positions. They have accumulated 5-10 years of working experience and by this time, would have accrued enough savings to do many things that adults can do. Among the things that I envy the most are: bringing their parents to vacation, pay for family meals when they eat out with their parents, go on vacation several times in a year, start paying mortgage for their own house, eat at fancy restaurants at least once a week without feeling like breaking their wallet.

Compared to the relatively big(ger) monthly paycheck that they earn each month, I receive a meager monthly stipend that is sufficient for my sustenance: pay rent, do grocery shopping, cook at home and treat myself to nice pastries on Saturday mornings. Given the constraints in my budget, the choices of things that I can do differ from my peers’ who face less budget constraint (relative to me).

But before getting into these choices, it is probably useful for me to introduce some context. Upon reflection, I know that the things that are most important for me right now are: focus on my research, make my parents happy, lead a healthy lifestyle, engage in activities that make myself happy.

Then I imagined myself if I have all the money in the world, while also incorporating the things that I see my well-paid friends do on social media. With unlimited money, these are the things that I could do:

But given the budget constraint that I have, these are the things that I can do instead.

I noticed that the choices that I have changed dramatically. Due to that budget constraint, I have to adjust my choices such that they rely less on money and consumption goods; but because I still want to achieve the things important to me (research, family, self-improvement, health) I need to consider choices that rely more on actions and efforts, with less money involved. But upon reflection, I realise that this set of choices is not too bad after all. In fact, I gained many benefits from having such different choices:

Many of these activities help me build new and improve my skills

For instance, I started practising the piano again, after not playing for many years. I end up spending time writing blog posts for Recompound and while doing so, hone my writing skills and conceptualise my learning in Economics.

Less dopamine spikes and crashes

By eliminating activities/goods that rely on money, a significant amount of mental space is freed up. I no longer think about what is the next thing that I want to buy, what is the next restaurant I want to try, what is the next vacation destination I want to go. Because of this, I don’t receive that much dopamine highs from thinking about “what is the next thing that I want?” and the dopamine lows afterwards.

Getting closer to my parents

One of the biggest goals that I want to achieve is to make my parents happy, and I used to think that the best way to do so is to pamper them. But because I cannot do that with money, I end up spending more time talking to them and getting to know them all over again. And getting to know your parents as an adult is a whole new experience.

Live a boring life

Now that I have much less activities in my choice set, my life has become significantly boring. Day-to-day is just wake up, work, exercise, work, play piano sometimes, dinner, sleep, repeat. But this makes me sleep early every night and I inadvertently get to dedicate more time to my career as a researcher.

Less dissatisfaction

One of the central topic in Economics is utility (or happiness), and we like to model utility as a function of consumption. The classic way of modelling utility is to assume that utility is increasing in consumption (can be goods or services, not just food) — the more you consume, the happier you are. But what I notice these days, with the rise of social media, is that utility may be a function of (i) the difference between our actual consumption and our desired consumption and/or (ii) the difference between our actual consumption and our peers’ consumption. Furthermore, the relationship between utility and this difference may be governed by the following relationships:

\(\begin{align*} \frac{\partial U(C_{wish}-C_{actual})}{\partial(C_{wish}-C_{actual})} <0 \\[10pt] \frac{\partial U(C_{peers}-C_{me})}{\partial(C_{peers}-C_{me})} <0 \end{align*}\)The above equation simply means that if the difference between your desired consumption and actual consumption (C_wish - C_actual) increases, you become less happy. This sounds sensible, doesn’t it? When you have 10 things in your wish list, but you only have 1, you are dissatisfied with your life because you feel that your life is full of inadequacy. But if you only want 2 things and you achieve those 2 things, you will feel like your life is extremely satisfying. Now also notice that you will become more unhappy if the gap (C_wish - C_actual) is bigger. This gap gets bigger when your C_wish increases, C_actual decreases, or both. And the tendency of people is, when they start earning more money, things that previously was beyond their reach now comes into their purview, which increases C_wish (faster that C_actual increases).

I call this the power of being broke.

I don’t have enough money (part 2: firm)

If you’ve read some of my past blog posts, you might know by now that I am highly critical of start-up operations in Indonesia and the entire VC-funding scene. I have talked about how it can harm the quality of human capital and lead to imprudent use of capital in my previous posts. Now let me talk about this issue from the perspective of constraints.

To make the discussion more interesting, let’s use Recompound as an example. Knowing the co-founders and a little bit on how they run their business, Recompound in some ways seems to resemble a traditional business more than a start-up.

Recompound embodies both aspects of a start-up and a traditional business.

It is like a start-up because: it indeed received pre-seed funding from a venture capital and it had limited revenue within the first year of operations

It is not like a start-up (and hence resembles a traditional business) because: it did not launch with high costs, it did not take them too long to make positive profits, it did not require that “significant” of an investment

For one, I know that the Recompound team has operated under very significant budget constraint. I was intrigued by what kind of business expenses Recompound made under such constraint. Conversations with the co-founders led me to understand that their expenses mainly fall under 2 categories: labor and tech/software services.

Almost 2 years into this business (since January 2023), they only have 2 full-timers (the co-founders themselves). For the most part of the last 2 years, they have a part-time engineer and a few part-time investment personnel. They can manage such a lean team because they rely heavily on technology, hence the second category of expenses are tech/software services. The Recompound team spends practically nothing on fixed capital (think: office space, computers as they use their personal computers) and barely spends on marketing (they don’t pay influencers / kpop idols, and don’t place billboards).

Naturally, the first question I asked them was: Why do you spend so little? Why don’t you try to get more funding like all the start-ups out there?

Toby and Budi: “Call us unlucky, but we got into tech winter”

For the most part of 2023 and the whole of 2024, VC-funding scene in Indonesia is as barren as it could get. After the great start-up expansion throughout 2020-2022, VCs seem to be unable to reap the fruits of their seeds. Start-ups that they invest in cannot give them the returns they expect, and VCs become more cautious and conservative. When they hear about Recompound, their responses were mostly:

“Yeah, it sounds great, but I’m not sure if it can grow 100x”

“You guys don’t sound exactly like a start-up. You guys sound more like a hedge fund”

So Recompound had no choice but operate within the budget that they have.

What’s with the 2 full-timer situation?

What struck me the most was that Recompound was made up of 2 full-timer and ≤10 total employees (full-time + part-time) even after 2 years. This stands in great contrast of other start-ups that usually go on a crazy hiring spree after receiving investments from VCs. Probably it is precisely because of this budget constraint (lack of VC money) that causes them to stay a 2-men team.

Getting into the rationale of their hiring process sheds some interesting insights.

Toby and Budi decided not to hire a full-time software engineer because the current part-timer is sufficient to meet the extra engineering work that Recompound has, with the main engineering work done by Toby and Budi themselves.

Toby and Budi did not have a specialist marketing personnel because at the stage they are at right now, it is not the most “bang for the buck” solution. Instead, they learned marketing from their marketing specialist friends, download Seth Godin’s book, and learn from podcasts.

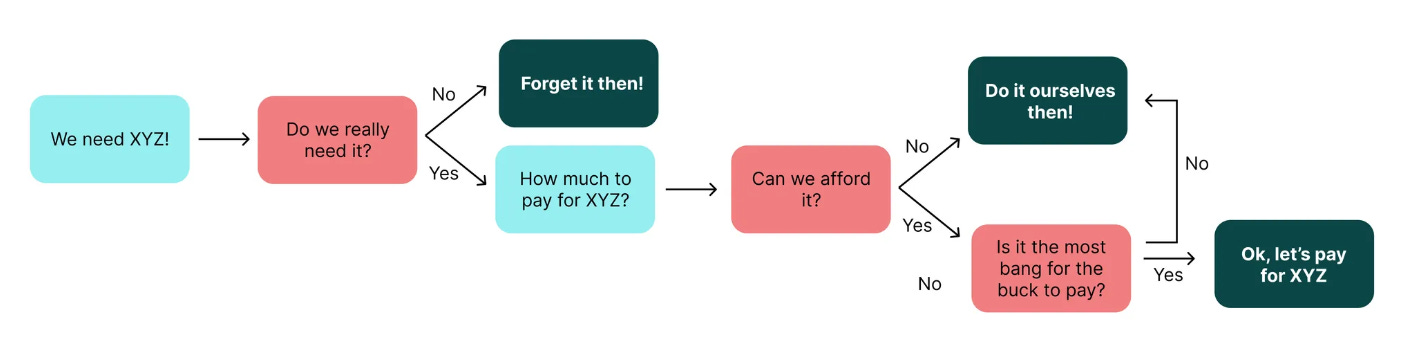

It seems that the decision-making practise uses the following process. Note the critical questions in red box arise because of their budget constraint. Due to limited financial resources, the question of need, affordability and returns (whether that is the best use of their money) becomes critical. As a result, they have to rely on 3 solutions: (i) forget about it (ii) solve the problem themselves (with creativity) (iii) solve the problem with money.

Contrast this with an alternative scenario where Recompound does not have any budget constraint. They might end up using the following framework, where the 3 critical questions now become non-critical. In fact, they can skip those questions altogether and go straight to paying for XYZ.

The difference between the money-constrained Recompound and money-loaded Recompound is in their asking of those 3 critical questions and the solution set that they have.

Channels for creativity, innovation and learning

In this section, let’s focus on the DIY solution, which exists in the solution set of money-constrained Recompound but does not exist in that of money-loaded Recompound.

Now, because they have to consider DIY solutions, this actually becomes an opportunity for creativity. Clients of Recompound (which I myself am) must know how Recompound uses a very hacky way to monitor your portfolio daily (iykyk) and may wonder how they manage all clients — do they have an excel spreadsheet for each client containing their portfolio and payment history?

If you get to talk to Recompound co-founders, don’t skip the chance to ask about all these, because they are a testament of technological innovation and creativity. They have to automate all these processes using technology precisely because they don’t have the money to hire 100 relationship managers to take care of their clients’ portfolio.

Also, with a 2-men team, does that mean the co-founders themselves have to do admin work, operations, marketing, finances, legal, etc etc? Does that mean on top of being tech specialists, they also have to become investment, marketing, legal, ops, and customer service specialists also? Isn’t it crazy how the lack of money can make you a superhero?

Going back to production function: taking productivity and marginal returns seriously

Let’s now focus on the critical question on returns: “Is it the most bang for the buck to pay?”

This is a very economically loaded question. Essentially, the question asks:

Is the benefit I get ≥ than the money I pay for this solution?

This is the concept of marginal returns, which essentially means what is the return from spending that extra dollar on something? The concept of marginal returns is what determines the profitability of a company.

Remember that:

It seems that because of the budget constraint that they face, they have to make sure that the business spending that they make give them returns that is at least higher than that expense. Therefore, because:

Money earned from hiring full-time engineer < salary of full-time engineer ⇒ don’t hire

Money earned from hiring the engineer part-time > salary of part-time engineer ⇒ hire

Money earned from hiring a specialist marketing personnel < salary of the marketing personnel ⇒ don’t hire

Money earned from learning marketing themselves > cost of learning marketing themselves (0 monetary cost) ⇒ learn themselves

Therefore, when you skip asking the question “Is it the most bang for the buck to pay?”, you might end up incurring the expense on XYZ even when the marginal benefit is less than the marginal cost.

Do we really need it? Demand-induced expansion vs supply-induced expansion

This section focuses on the critical question “Do we really need it?”

I am going to a different (but delicious) analogy, so please bear with me. One of my relatives run a rather successful dimsum restaurant. Today, the restaurant space takes up 4 buildings and has 80-100 tables. But it was not always that big.

In fact, it started in my aunt’s own dining room in her house with 6 tables. But because her hakao and siumay was the best one to exist in the city and the price point was right, the restaurant slowly gained popularity and constantly has queues forming in front of her house. She slowly expands her restaurant, first by renovating her house to accommodate 20 tables, then buying the house next door to expand to 40 tables, then buying the house behind, and then another house behind. All of these happen progressively in 20 years, and each expansion only happens when (i) the queue becomes too long and unbearable such that customers complain and (ii) they have accumulated enough profits and savings to fund the expansion.

Now note how the business expansion happens because there are more customers than tables — because they really need that extra tables.

This stands in contrast to many of the ways start-ups operate these days. The business expansion (renting a big fancy office at SCBD, hiring 100 extra employees, paying for billboards) all happen because the founders “believe” that customers would be queueing in front of their doors, so they have to prepare 1000 tables ready for when these customers come in, without knowing if there are indeed going to be 1000 customers coming in.

Risk-taking: to bet big or bet small?

One thing with having lots of money is that people become more risk-loving — people become more courageous in taking risks, because that’s the point of receiving that VC money right?

On the other hand, people with tighter budget are more risk-averse, because losing that money may mean losing one’s entire livelihood, or in the case of a company, bankruptcy.

This is where the idea of making small bets versus big bets matter.

Suppose we believe that the relationship between investments and returns follow an exponential relationship as the blue line above. This means that the higher investment (in monetary terms) that you make, the higher your returns are. With this belief, it may make sense for an entrepreneur to make a big bet so that he/she can earn higher returns. For instance, if you invest IDR 10 million, you can get IDR 12 million (20% return). But if you invest IDR 100 million, you can IDR 250 million (150% return). So it may make sense if you want to make a big bet (IDR 100 million) rather than making small bet (IDR 10 million). Plus, you have the money to do so.

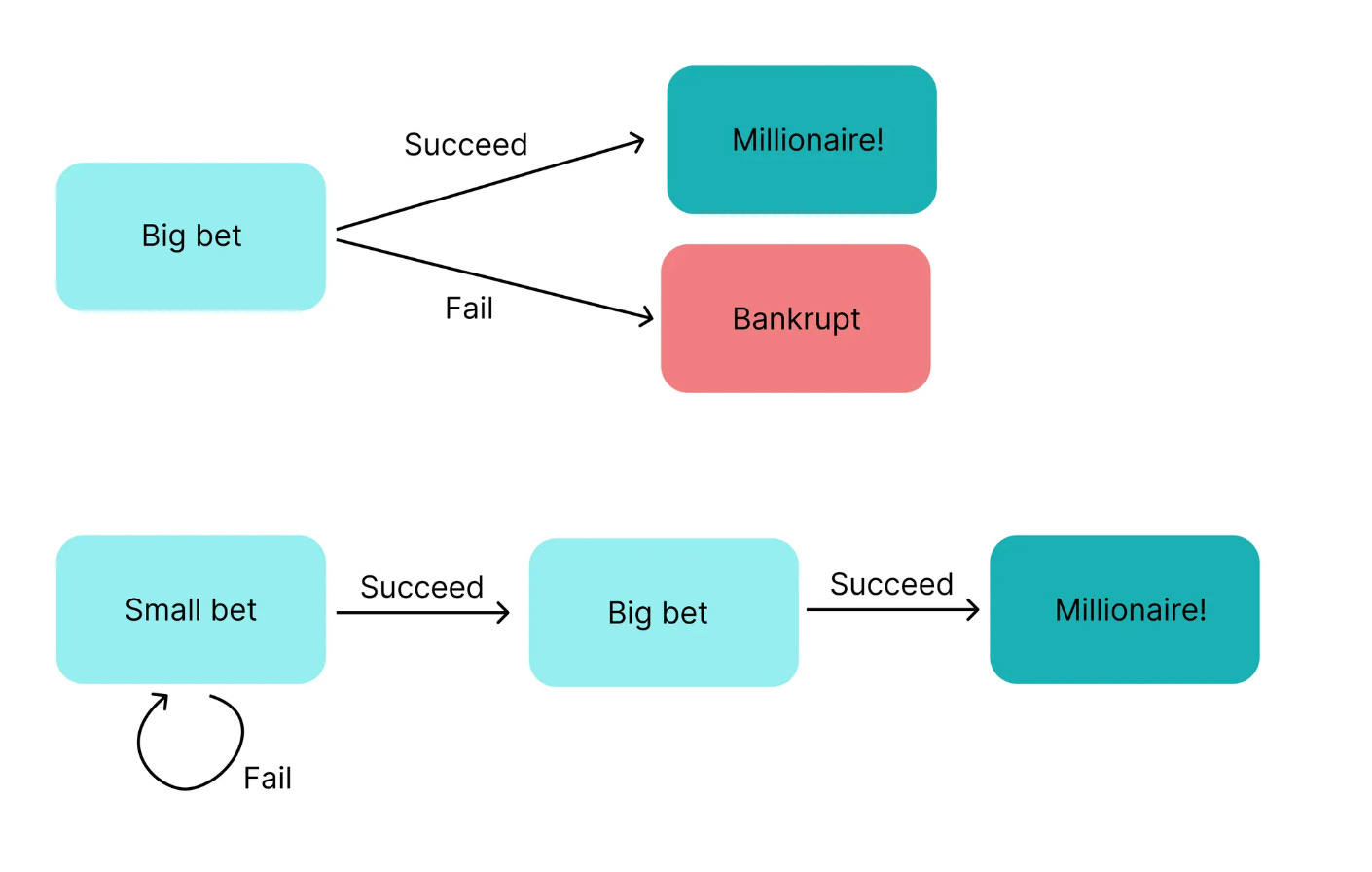

But let’s think about this from the perspective of risks. Your bet does not guarantee a 100% success chance.

If you make a big bet and you succeed, congratulations, you’ve become a millionaire. But if you fail, that’s the end of your story :(

If you make a small bet and you succeed, you can then go on and make the big bet but now your probability of success has become significantly higher (close to 100% even), so you are guaranteed to succeed and become a millionaire. But if you fail, you can always try again and make another small bet, since that small bet is only a small fraction of the total money you have (you don’t go bankrupt).

Notice how the possible outcomes differ for the big bet and small bet scenarios?

Conclusion

Thank you for reading this far and indulging in my somewhat preachy, nerdy and lengthy rambles.

The key message of this post is not that living adequately and comfortably is bad and that everyone should live under pressing constraints all the time.

Rather, my hope for this blog post is so that you can start thinking of constraints from a positive perspective, and make them work for your benefit.

Cheers!