Hi 👋 welcome to Recompound Blog - The Investment Mindshift. We help you better your mindset on investment and economics one article at a time. More: Our Values | Advisory | Get to know us | Picks | YouTube

Announcement from Toby: we will be posting more regularly on YouTube as well. So if you are so kind, give it a visit. Only subscribe when you feel that we deserve one. Thank you for your continuous support!

Disclaimer: This post is for educational purposes and is not investment advice. Figures and stock ticker cited are point-in-time snapshots that change frequently. Past performance does not guarantee future results. Index data and third-party sources are believed reliable but not guaranteed.

Same FOMO, New Story—Why “This Time Is Different” Still Hurts the Same

We didn’t set out to write a gloomy post. But the truth is personal.

Among our own families and friends—including people close to both of us (Toby & I) — many were pulled into euphoric trades and left carrying life-altering losses.

One story that hit us hard was a retiree Bapaks Bapaks who went all-in on a “can’t-lose” digital bank at the peak — with pension money he had earned over decades —only to watch it evaporate when the narrative collapsed.

You may have seen similar stories shared online lately; behind every chart is a real human trying to do the right thing for their family.

We’ve written before about how 2025 has felt—volatile, confusing, humbling.

As we approach October 2025, the mood reminds us uncomfortably of late 2021: the air was filled with optimism, the narratives are everywhere, and critical thinking is outdated.

Back then it was “digitalization” born in the COVID era — everything would go online, so anything with “digital bank” in the label “had” to be worth any price.

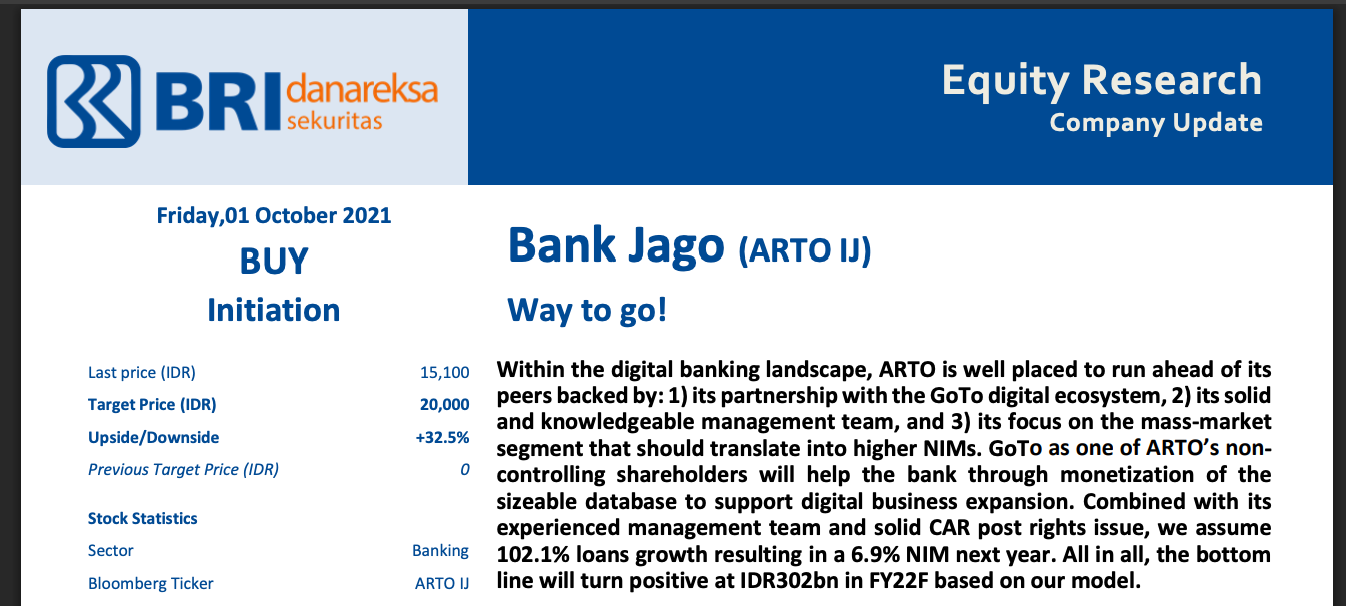

Research notes flowed, valuations floated, and serious people on Sudirman Street put out serious numbers.

Then gravity returned.

Receipts from 2021: what we were told—and what happened

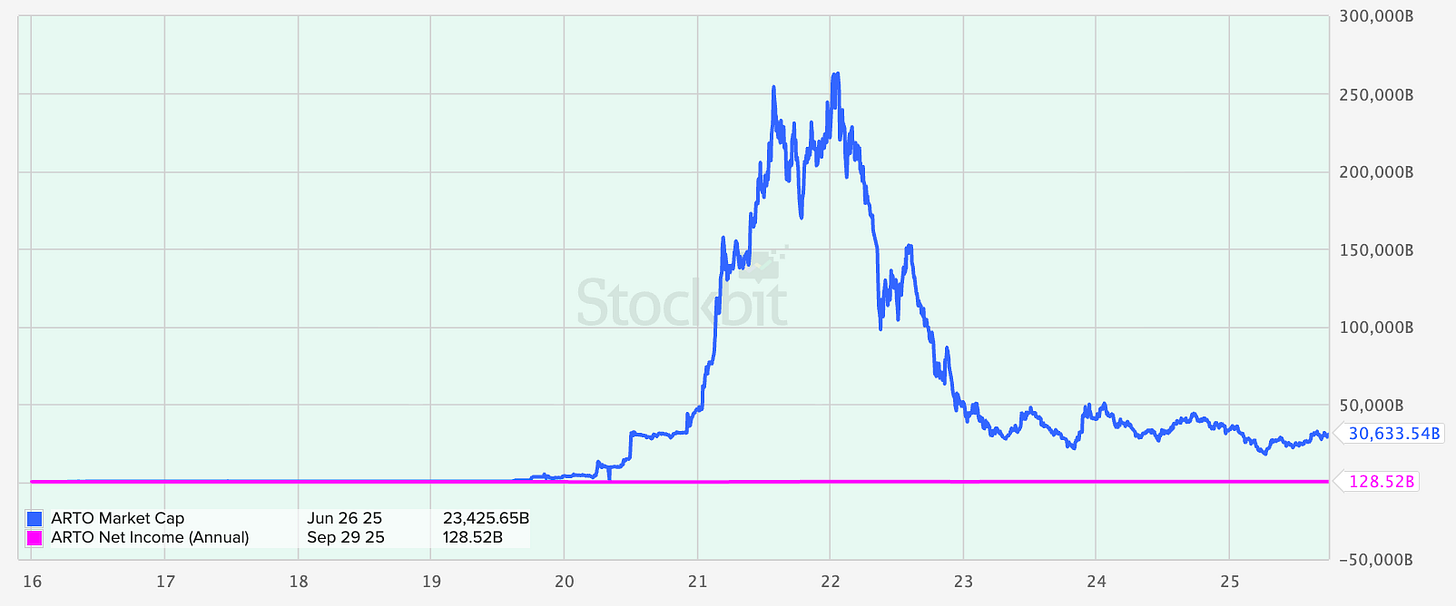

ARTO (Bank Jago) — A widely-circulated note in Oct-2021 initiated with BUY and a TP of Rp20,000, anchored on customer lifetime value and the GoTo ecosystem as growth rails; the TP explicitly implied ~29.7× 2022F PBV. The same report leaned on pandemic-accelerated online adoption and e-commerce flywheels (Tokopedia / Shopee) to justify runway.

It even compared EV/users and argued ARTO’s valuation was “reasonable” given GoTo-enabled growth.

AGRO (Bank Raya Indonesia) — RHB’s 2-Dec-2021 Initiating Coverage: BUY, TP Rp4,000 framed a “captive market + right platform” thesis, highlighting a hybrid on/offline model, the reach of BBRI’s nationwide network & BRILink agents, and a transformation that would clean up NPLs and drive CASA and NIM higher. It quantified the upside using a blend of GGM and value-per-customer (global digital bank comps).

The same report projected CASA ratio rising toward ~78.6% by 2025 and NIM in the 7–8% range, consistent with the digital thesis.

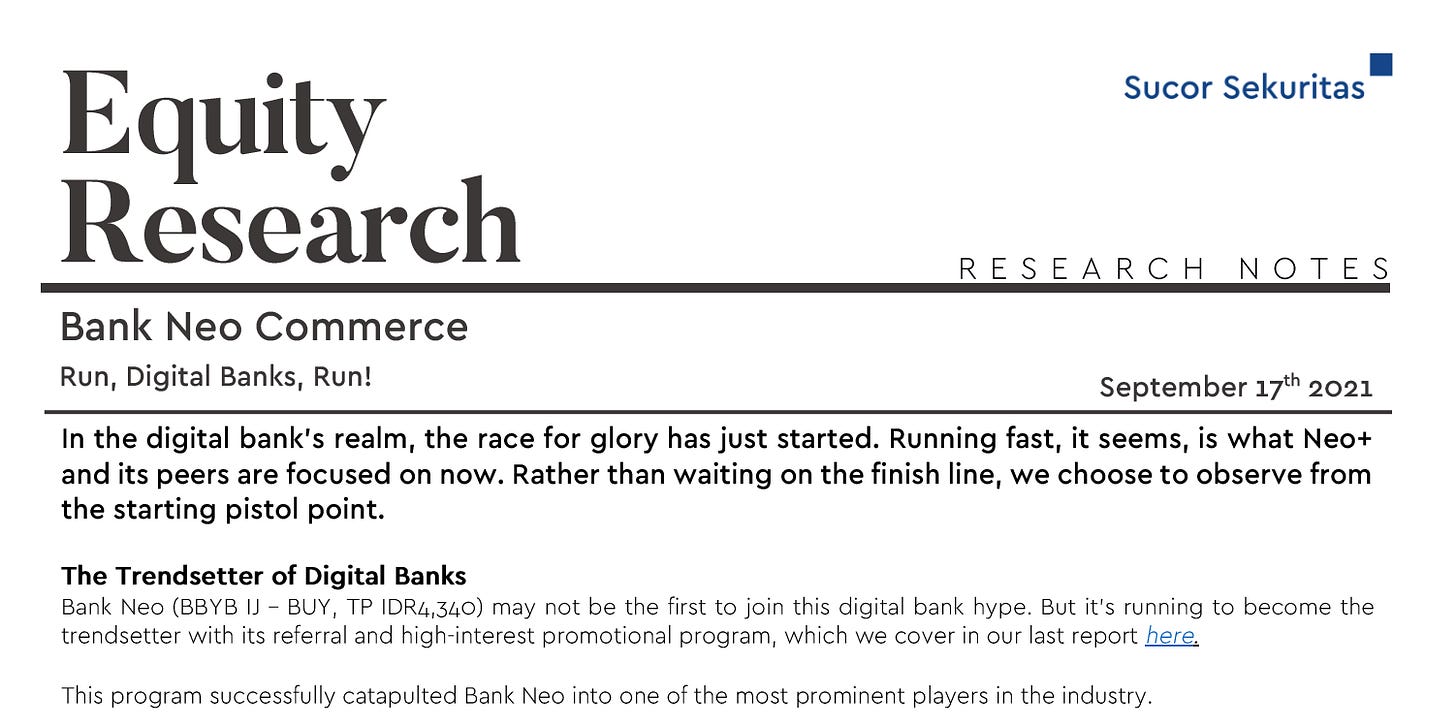

BBYB (Bank Neo Commerce) — Sucor Sekuritas’ Sept 17, 2021 “Research Notes” carried a BUY stance; the file we have is a truncated scan, but the saved title itself references a TP of Rp4,340 (document title alone captures the optimistic mood).

Prices? You know the rest.

ARTO ran to ~19,000 then closed 2022 around 3,000 —> -84%

BBYB surged to ~2,600, finished ~600 —> -77%

AGRO touched ~2,800, ended ~400 —> -86%

The narrative was airtight—until it wasn’t.

2025 rhymes with 2021 — different cast, same plot

Today’s trendy topic isn’t “digitalization.” It’s index inclusion.

Indonesian conglomerates are pushing hard to qualify for global benchmarks like MSCI and FTSE.

The street consensus:

“Prices can’t fall !! These konglos need to maintain prices for the indices.”

That story feels safe, institutional, almost mechanical.

But what’s safer than a narrative everyone believes — right at the top?

Sir John Templeton warned us:

The four most dangerous words in investing are: “This time it’s different.”

Those words glow brightest at the Pucuk.

Our north star (and why we’re writing this)

We believe one rule above all:

Long-term stock prices are pulled by long-term earnings power.

Short-term prices are pushed by short-term expectations.

Don’t believe us? FuNDaMenTal iS DeAd ? Just look at these charts:

10 year Price vs Earnings chart of ITMG, a major Indonesian coal mining company:

10 year Price vs Earnings chart of BBCA, virtually everyone uses this bank in Indonesia

10 year Price vs Earnings chart of OCBC NISP: A bank with origins from Singapore

10 year Price vs Earnings chart of HMSP: The myth the legend DJI SAM SOE !

10Y Price vs Earnings chart of UNVR: Probably the largest consumer goods company in Indo

When expectations sprint ahead of what a business can earn, sooner or later, prices mean-revert to the earnings reality.

When a company compounds earnings faster than the crowd expects, sooner or later, prices eventually catch up — and often overshoot the other way.

That’s why we’re not against “irrational” cycles.

If you’re a true pro who spotted the wave early and managed risk well—seriously, well done. It can change your life for the better.

Our concern is for late-arriving retail investors who enter when expectations are already sky-high, believing “it cannot go down !” often with savings they cannot easily replace.

That’s where real lives get hurt—and where the stock market earns an unfairly bad reputation in Indonesia.

The market is not a casino by design. It can be a path to financial freedom—if you let time, discipline, and real earnings do the heavy lifting: diversify across quality, pay attention to margin of safety, and be humble about what you don’t know.

Closing Remarks

We’re sharing this because we’ve seen the cost up close on our own close friends and families.

Btw this is why we built Recompound at the first place:

If this post helps even one person pause, ask a harder question, or size a position more safely, then it’s worth it.

Invest safe.