Recompound is at the business of helping people invest in equity more intelligently.

What is the original meaning of investing in companies?

Let’s borrow some ideas from the field of Economics.

Wearing the economist’s hat

Economics is a field that tries to understand human behavior. To better understand what I mean by “understanding human behavior”, let’s draw some parallel with the field of Biochemistry.

We know that if we drink too much Coca-Cola and eat too much doughnuts, we will grow fat. Why is this so? I will try to explain this in terms of its biochemistry in a very simple manner. And I promise you it will make sense later, so read on :)

Coca-Cola and doughnuts contain a lot of sugar — in the form of sucrose. When we drink Coca-Cola and eat doughnuts, the sucrose in them will be broken down into glucose and fructose, which will enter our bloodstream and stimulate the release of the hormone insulin. If you don’t exercise or you are not active, you don’t really need too much energy — you don’t need this excess glucose and fructose. So insulin convert them into glycogen (another form of carbohydrate) and fats, to be stored. If you are a naturally non-active person but eat a lot, you will never need to convert these stored glycogen and fats to be used. But if you continue drinking lots of Coca-cola and eating lots of doughnuts, you will continuously add glycogen and fats into your body for storage. You keep adding but you don’t take anything out — this is why people grow fat.

Now let’s go back to human behavior. Economists assume that we are rational beings, and that our behavior can be summarised by the following:

Humans try to maximise their happiness (the economists call it utility) subject to a budget constraint

Maximising utility is generally referring to maximising your lifetime consumption of goods and services (a.k.a you want to buy many things, eat food that gives you maximum happiness, go on as many vacation as you can, watch lots of movies at the cinema, etc.). Note the term lifetime, which means that you are not only thinking about today, but your entire lifetime.

But you have a budget constraint — the money you own is limited. Where this becomes relevant to equity investing is in the budget constraint part here. The budget constraint is typically written as:

First things first, that (scary looking) Greek symbol is called sigma. It represents summation (in excel it's denoted as “=sum()”) of the expression. T represents total number of days/years you have in your life. So you sum an expression on day 0, 1,…, T which is your final day as a human being.

On the left hand side: we have consumption (C_t), purchase of stocks/equity at the current price (p_t s_{t+1}), and purchase of bonds / your savings in the bank (b_{t+1})

On the right hand side: we have income, which can come from your full-time job wage or business profits (y_t), return from the bonds you bought in the previous period ((1+r_t) b_t), and the returns from the shares you own, which comes from the current price of the share and the dividends you get ((p_t + d_t) s_t).

This is called a budget constraint because what you consume and invest (left hand side), ideally cannot be more than your total wealth (right hand side).

There are a few interesting things to note just simply from this budget constraint alone. These things pertain to the philosophy of investing:

Investing is something you do if you have excess wealth

Investing is a forward-looking activity for the purpose of smoothing consumption, insure against future income shock, and better manage your wealth

The different investment classes have different types of returns, each with their own level of (un)certainty

1. Investing is something you do if you have excess wealth

Given our total wealth, we will allocate this wealth into three possible categories: consumption, savings, and investment.

Now as a rational human being, you would first ensure that you satisfy your basic human needs (food, shelter, healthcare, some leisure) through the purchase of goods and services — denoted by C_t.

Upon meeting these needs, if you have remaining money (we often call this disposable income), you can then choose to either buy bonds (you can think of this also as putting your money in the bank) or buying the shares of companies.

The message that we want to impart here is that you should allocate your money step-by-step into these three categories of spending. First, make sure that you can meet your basic needs. Second, put them into bonds / savings that give you easy access to your funds in the scenario of emergency. Only after you have ensured that you have comfortable amount of savings, then start thinking about equity investing.

So if you are still in the early part of your career, don’t concern yourself too much with equity investing. Invest in yourself first so that you can grow your income and have this excess wealth.

2. Investing is a forward-looking activity

Note the summation operator (the big and scary-looking E-like letter) included in the budget constraint. The reason why you have to think about properly managing your finances is because you live for many years.

Imagine that you only live for 1 day. The logical thing for you to do then is to spend all your money within this day. There’s no point in saving / investing if you are going to die tomorrow.

You don’t spend all your money today because you think about the future. You save some of this money for emergency funds. You invest some of this money so that you can earn returns in the future, which allows you to consume in the future (e.g., for your child’s university tuition fee, for your retirement). Furthermore, if something unexpected happens (e.g., you lose your jobs, you want to migrate to another country), you have this portion of your money today which has been growing in its amount.

The key message here is that investing is something you need to do for your future, once you have the capability to do so. This may not be limited to equity investing, as long as it is something whose value will continue to grow. When talking about investing options, the common ones that people talk about today in Indonesia are property and cryptocurrency. We are not going to debate whether you should / should not invest in these. The key is, you should evaluate for yourself if they are something whose value will grow over time. Remember, the main reason you invest is so that your wealth can grow for future consumption.

3. Understand the source and nature of the returns to your investments

In the simple budget constraint that I show above, I have only shown two asset classes: bonds and shares. While the left hand side of the budget constraint shows how much you would need to spend to buy these assets, the right hand side shows your returns to these investments.

The key message here is that as an investor, your objective is to earn positive returns from these investments. But you have to understand the nature of their returns.

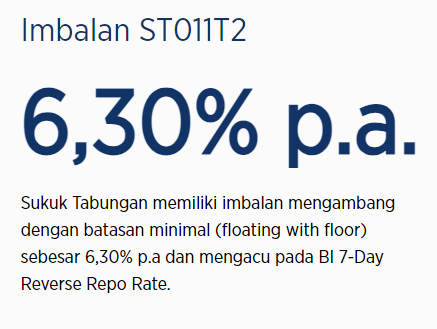

In the case of bonds, you earn fixed returns. For instance, if you buy the Indonesian government bond ST011T2, your return is 6.3% per annum.

In the case of stocks, your return is the sum of (i) the price of the stock today (or on the day your are selling it) and (ii) the dividends that you have earned from that stock. We would just like to remind you that when you buy a stock, it is easy to get very caught up with the day-to-day price fluctuation. But don’t forget that you may have received / are going to receive dividends in the future.

After knowing the source of returns from your investment, the next step is to understand the nature of these returns.

Going back to the example of government bonds, the return to such bonds is fixed. This is good because you know that you will receive some amount of positive returns (providing that this return is higher than inflation rate). But this also means that there is an upper bound to your return.

In the case of stocks, you should first understand that both the price and dividends are not fixed — you are not guaranteed an X% return. For price, you have to understand (and please drill this into your head) that it can go up and it can go down — a.k.a. you can lose your money. If you are not willing to accept this possibility, stay out of equity investing. Second, you should find out if the company whose stocks you buy give out dividends or not. If yes, then you should do the proper research on how much dividend the company typically gives out, how often do they do so, whether the company’s financial situation is good enough to give good dividends to their shareholders. If not, then it means that the only way you earn positive returns from that stock is through price appreciation.

Now price is a trickier metric to understand. There are various frameworks and techniques people use to predict prices, although we claim that most of them are trash. Stock prices may inherently reflect the value of the company, but most of them time, they go up and down because of factors that are unexplainable, unpredictable, and uncontrollable.

A case in point: who would expect in November 2019 that COVID-19 would happen and caused the stock market to crash?

Another case in point: what kind of financial analysis would predict that the price of BREN would increase 10.5x in 2.5 months, scoring a P/E ratio of 391 and PBV of 172 at its highest point? To put the absurdity of these numbers into human language, imagine this: my company earns IDR 1 million rupiah this year. The company has 1 share (1 lembar saham).

Then, I sell this one share at the price of IDR 391 million. Somehow, by some miracle, someone in the market accepts this offer. If this sounds crazy to you, well that's because the market is known to be irrational. But participants (you and I) don't have to be.

Now, after understanding the nature of the returns to equity investing, what we (Recompound) think is a wiser and smarter way to invest, is to choose companies based on sound fundamentals. If they give out good dividends consistently and have a trajectory of (somewhat) stable prices, it is more likely that we as investors can earn positive returns in the future. Basically, we pick something with greater element of certainty and less element of absurdity.

Invest with the right mindset

After knowing all of this, if you get lost in the details of all the things we discuss above, and can only remember 1 thing, remember this:

Have the right mindset to equity investing

If you are investing to become rich overnight, because you think it’s cool, because all your friends are doing it, or because you like the feeling of winning — then you are bound to feel disappointed along the way.

If you come to Recompound with any of the above reasons — to get rich overnight, because investing sounds cool, because your friends are doing it — then we are going to tell you upfront that we are likely to disappoint you, especially during turbulent and irrational market conditions.

But if you have the right mindset to equity investing, then you should go on to the next step and start doing it. Do it right and hopefully you’ll have a fulfilling time participating in the building of great companies 😀

As always, we will be right by your side if you need our assistance.