The truth about margin of safety: How to buy good assets the right way

and stay fearless in volatile markets

I used to think Howard Marks was being a bit too simple, maybe even a little naive.

In his famous memos and talks, he often hammers home points like:

“Macro-forecasting is not critical to good investing”

“Disavowal of market timing”.

I thought:

Really? In a market as volatile as Indonesia, you’re just going to ignore the macro and not try to time the entry / exits?

Then, the last week of January 2026 happened.

The 2026 MSCI Fiasco: A Reality Check

The recent IHSG crash was a brutal wake-up call for many.

After the election of Thomas Djiwandono as Deputy Governor of BI, the market didn’t just stumble—it went into a full-blown “trading halt” as over-inflated “Konglo” narrative stocks melted down. The fear was real: rumors swirled that Indonesia could be downgraded to a Frontier Market, a move that would have a catastrophic domino effect on our fixed-income & currency markets as well.

Many social media influencers were still shouting “Bull Cycle!” just days before the crash.

Their logic? Indonesia’s weighting in the MSCI is only about 1.25%, so global institutions wouldn’t bother being dumped by us.

They were dead wrong. The institutions did care. The bubble didn’t just leak; it popped. Overnight, reforms were swept in, and leadership at the OJK and BEI were replaced as the government scrambled to fix the coordinated trading activities and “gorengan” actions that led to this mess.

The Report That Saw the “Pucuk”

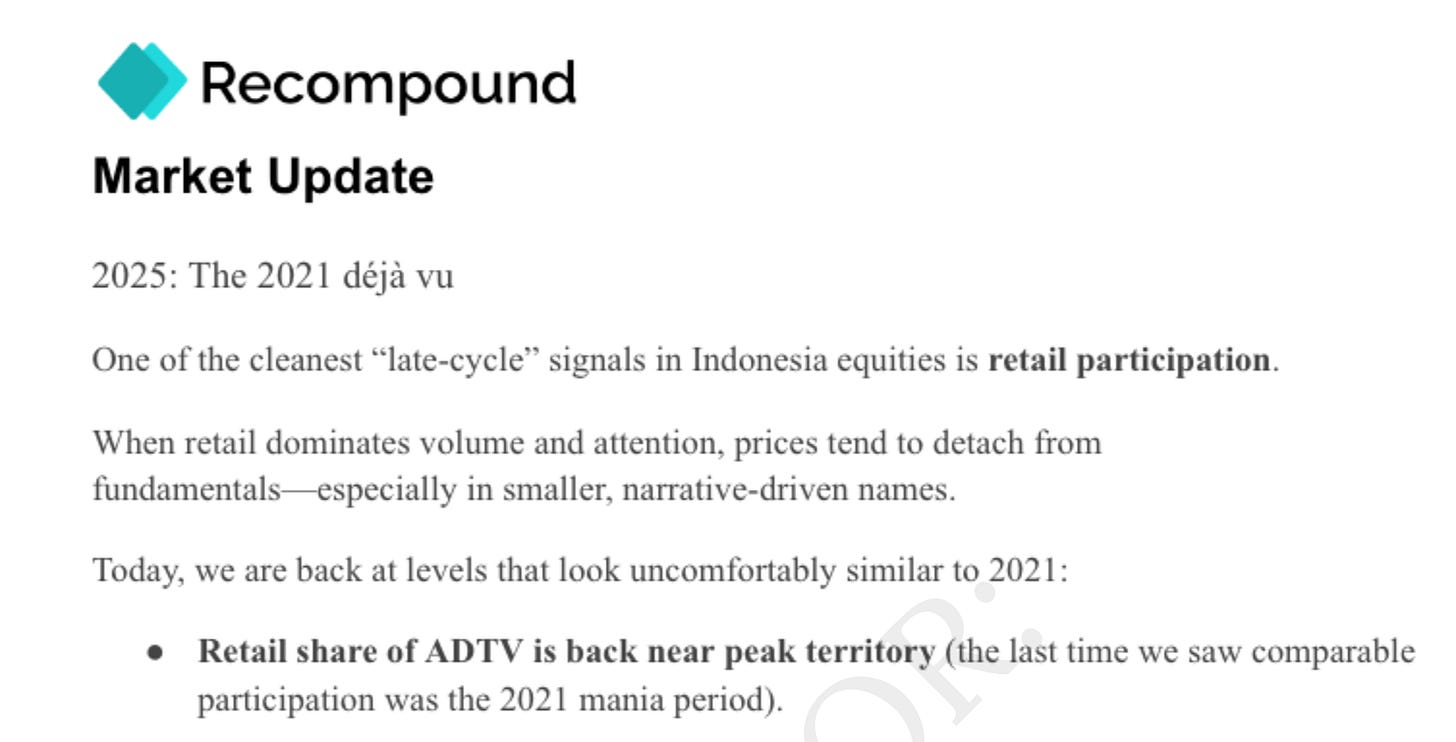

Just six days before the crash, on January 22, we released our Recompound Monthly Report to our clients:

Excerpt of our January 2026 report to clients

Within the report, we said that we didn’t have a crystal ball.

We didn’t know the MSCI fiasco would happen exactly on January 28.

But we did see the “late-cycle” signals that Howard Marks warns about:

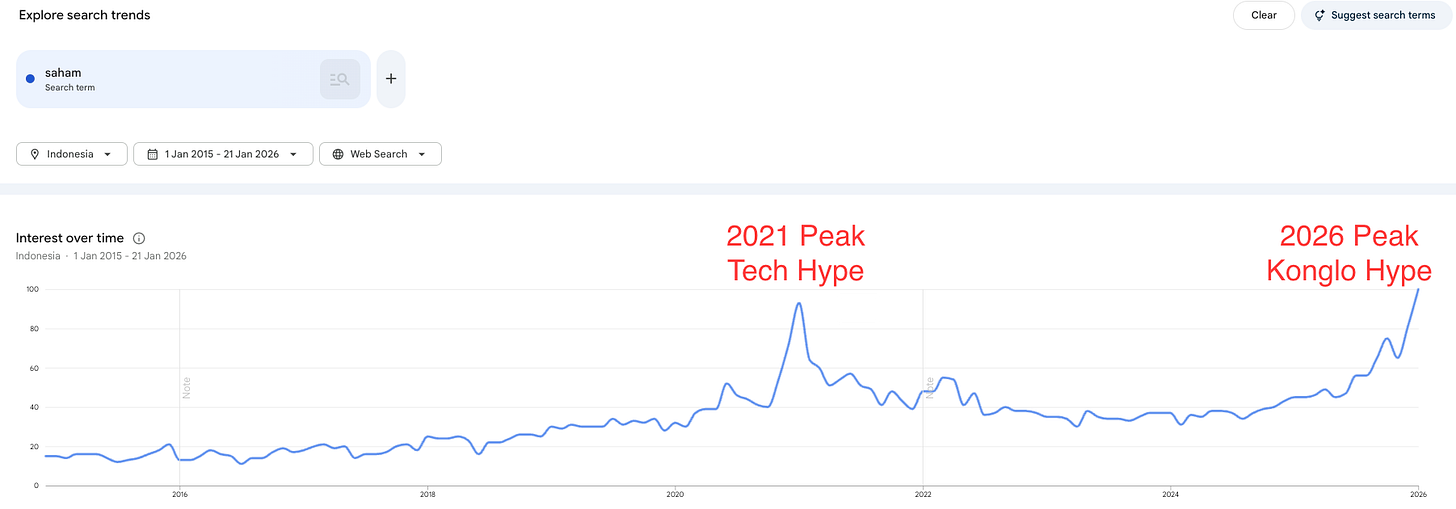

Retail Participation: Share of Average Daily Trading Value (ADTV) was back at the “mania” levels of 2021.

Narrative Chasing: Money was crowding into “Konglo” stocks where price action was driven by stories and momentum rather than actual earnings power.

Public Euphoria: Google search interest for “saham” was printing fresh highs—a classic sign that we were super close to the “Pucuk” (peak).

Risk Control, Not Market Timing

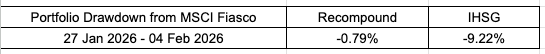

When the crash hit, the IHSG dropped over 9% in a matter of days. But our portfolio’s drawdown is minimum:

This wasn’t because we “timed the market” and moved to cash at the perfect second.

It’s because we followed the Oaktree philosophy: The primacy of risk control.

We didn’t just buy “good assets” (read: stocks); we bought them well.

Earnings-Backed Stocks: Our holdings are positioned as cash-producing assets with high dividend yields (~9% p.a.). Dividends reduce your reliance on price momentum. When the “narrative” dies, the cash flow keeps you afloat.

Margin of Safety: We stayed disciplined. Even when names looked attractive, we stayed on the watchlist if the “margin of safety” was too thin.

Avoiding the Crowd: While retail was rushing into the trendy tickers (I won’t name names here, but it should be obvious to you), we were researching companies with stabilizing earnings quality in the real economy.

Buying Well is Your Only Protection

Who could have timed this pop beforehand?

Honestly, no idea. But you don’t need to time the pop if you aren’t holding the balloon.

As we wrote in our report: “Be a student of history, not the victim of history”.

If you buy assets with a wide Margin of Safety and strong cash flows, a broad market correction becomes an opportunity, not a thesis break.

Success in investing isn’t about being the smartest person in the room who predicts the crash. It’s about being the most disciplined person in the room who buys well enough that the crash doesn’t matter.