Introduction

Pak ayo beli saham PT BULAN RESOURCES Tbk, saya baru dapet Insider Info, katanya investor XYZ mau [insert_some_corporate action_jargons_here], sahamnya bakal di GORENG ke 400!! Harga sekarang masih 150 upside-nya masih jauh banget loh Pak, coba bayangin kalo taro 500 juta duit Bapak yang nganggur, bisa jadi berapa tuh!

Ini saya kasih tahu info ini ke Bapak karena Bapak dekat sama kami, jadi info nya jangan disebar - sebar ya!

We often hear this kind of solicitation happening to our friends and families, most often done by their stock market “gurus”.

“Oh great! I don’t have the time to perform due diligence because I am too busy working, and now these gurus want to help me achieve instant return from my idle money!! 🤑🤑” - says the victims.

Most of the time, it does not end well. 6 months later, their stock portfolio would end up like this:

While the stock price movement usually goes like this:

When the victims open their trading app and saw these atrocities, their usual actions are:

Panic for X minutes. X tends to be higher in value as one puts more money into purchasing the stocks

Call their “gurus” and complain: “Huh! I thought Bulan Resources was going to the Moon 🌙 What happened with the deal from investor XYZ who is doing [insert_some_corporate action_jargons_here] ? “

Usual reply from the “gurus”: “Calm down Pak / Bu, these deals usually take time. I can assure you it has already reached green light status. The stock price now is stupid cheap! You should add more!

Victims add to the position, wait another 6 months, then cry again

Victims do not know what to do, hoping 1 day the stock will fly to the moon (don’t know when)

Victims resign stock investment, calling the stock market a casino

So, What Happened?

We had a chat with a friend of ours who work as a fund manager in an asset management company.

In most cases, these victims are targeted as exit liquidity by a consortium who wants to gain profit by stock price manipulation.

The consortium can be anyone: high net-worth individuals, security brokerages, or even the companies themselves.

The Business Model of Stock Pumping / Goreng Saham

The Objective

At its core, Goreng Saham is a business. A consortium spending some “working capital” to achieve their objective.

The objective is simple, which is to obtain profits. But sometimes it can be used by the stock-issuing company itself to make their corporate action a success.

For example, a company who is looking to be acquired by another company may need to jack up their stock price so they have more bargaining power on the negotiating table.

Another example: a struggling company needing to do right issue to obtain fresh cash from the public may jack up their stock price so the public is more enticed to participate in their corporate action.

The Planning

Let’s assume you have a huge amount of cash to be used as a working capital to open up a new business.

Rather starting some traditional & boring businesses like opening a restaurant or a coffee shop, you want to profit from the stock market in a bombastic way.

Here are what you need to get started with this business:

Consortium formation:

Just like any business, you may need partners who can add value. The “value” does not have to be money, it can also in the means of a strong network in traditional media, social media influencers, or any means to influence a large mass

Working capital:

You need this for 3 purposes:

Accumulating stocks from the public: You need to do this so you own the majority of the stock’s inventory

Jacking up the stock price into a target price you desire without the need to worry someone is going to dump on you because you have collected majority of the stock inventory in step (a)

Media promotion after the stock has reached your stock price: pay news outlet, organizing webinars, endorsing social media influencers, etc.

Story & Prospects

Your jacked up stock price + media will not mean anything if you don’t have a reason for the public to buy your stock at a jacked up price. There are several manifestations of this:

Strong fundamentals: huge net asset value, growing earnings, etc.

“Hype” sector: electric vehicle, green energy, technology, Artificial Intelligence, or anything which is deemed “cool” by the public

Corporate actions: right issue, acquisition, private placement, etc.

The Execution

After explaining the planning phase, the execution is simple:

Accumulate the stock until you own majority of the stock inventory

Jack up the stock price

Unleash your media to dump your stock supply to the public

Profit 💰

The Takeaways

It Does Not Have to be a Bad Thing!

Why?

Because you will not be able to gain significant profit from your favorite stock if there is no-one pumping your stock up.

Only ~9% of the entire Indonesian population invest in the stock market. You cannot expect normal retail to drive a stock price up significantly. It will be a different case if it is the US stock market.

You are not That Special

Are you feeling privileged because you are:

Being told you are part of that “bandar’s exclusive inner circle” ?

Being told an “insider info” which is super rare that you cannot spread out?

Being told as a super special banking / brokerage client?

However, if you are:

Not a part of the consortium jacking up the stock price from the start

Do not have any resources in the form of working capital / media to help the consortium

Do not have any information on the stock inventory ownership

Then sorry, you are most likely just an exit liquidity for the consortium to achieve their objectives. You are not that special.

There is No Free Lunch

“Insider Info” is overrated. Your stock’s fundamental & prospect matters more. Because your stock cannot go up unless there is a strong reason to.

So if you are trading or investing by yourself, you have to make sure that you perform your due diligence consistently before buying stocks. After buying the stocks, you should also ensure that the stock price and company performance are monitored periodically in a regular manner.

Here is a famous quote by Peter Lynch:

Behind every stock is a company. Find out what it’s doing.

Incentive Alignment

“But guys, I simply do not have the time to perform due diligence because I am too busy doing my daily job. What if I still want to consume this ‘insider information’?”

Well, you still can, but make sure you do these steps:

What’s the incentive alignment? What’s in it for them to tell you this “insider info”? It has to be a win-win scenario for both sides. If you are aware of this, you probably have lowered your probability of getting dumped by a thick margin

This is hard, but ask your “guru” to share their shares ownership / DPS (Data Pemegang Saham). Ask them:

How many shares do they own? (Berapa lot?)

What’s their average buying price?

Make sure to do this even for their nominee brokerage accounts

Nominee means they control several other brokerage accounts not using their own credentials e.g. using their friends’ or family’s name

You know something is fishy when they refuse or something is not transparent

A Case Study from the Land of Wakanda

Appreciate you read this far 🔥.

You may close this article if you have finished reading until the “The Takeaways” section.

In this section, we want to show you that even large institutions such as a foreign bank in the “Land of Wakanda” may even become the exit liquidity of a stock pumper.

We do not claim that this actually happened nor do we have any blatant proof, we are just showing you some facts that may give a thought exercise for the weekend.

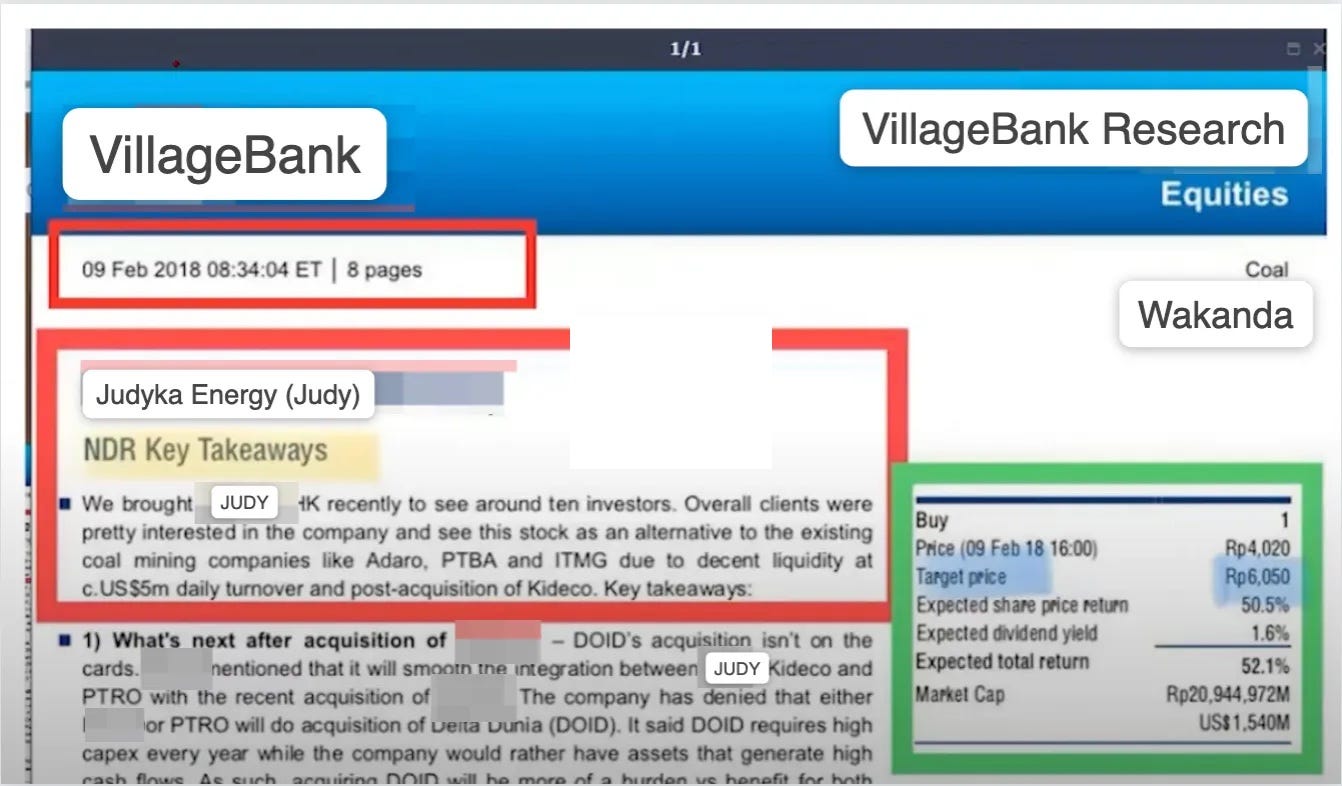

The name of the bank is “VillageBank”, the stock involved is a publicly listed company in the land of Wakanda, PT Judyka Energy Tbk (JUDY). This phenomenon happened in the year 2018.

The Setup

On 9 Feb 2018, VillageBank published a research report on JUDY

Stock price at that time is Rp 4,020. Based on the research, VillageBank has a target price of Rp 6,050 (50% upside)

What Happened to the Stock Price After?

Any Takeaways?

No, there is no takeaway, make your own conclusion 😏

Thank you, and have a great day!