Disclaimer: This is an editorial on market timing practices that are observed from time to time and nothing in this article shall be construed as investment advice. Author’s opinion does not mean Recompound’s opinion.

Let’s be honest, timing the market sounds like a good idea at first.

You might think you can:

get out right before things get bad

and buy back when it’s all cleared up, right before things recover

But the reality is this: trying to time the market in reality is really, really hard nigh impossible. In trying to do so, it can hurt your returns more than you think.

Just Do the Math, Guys

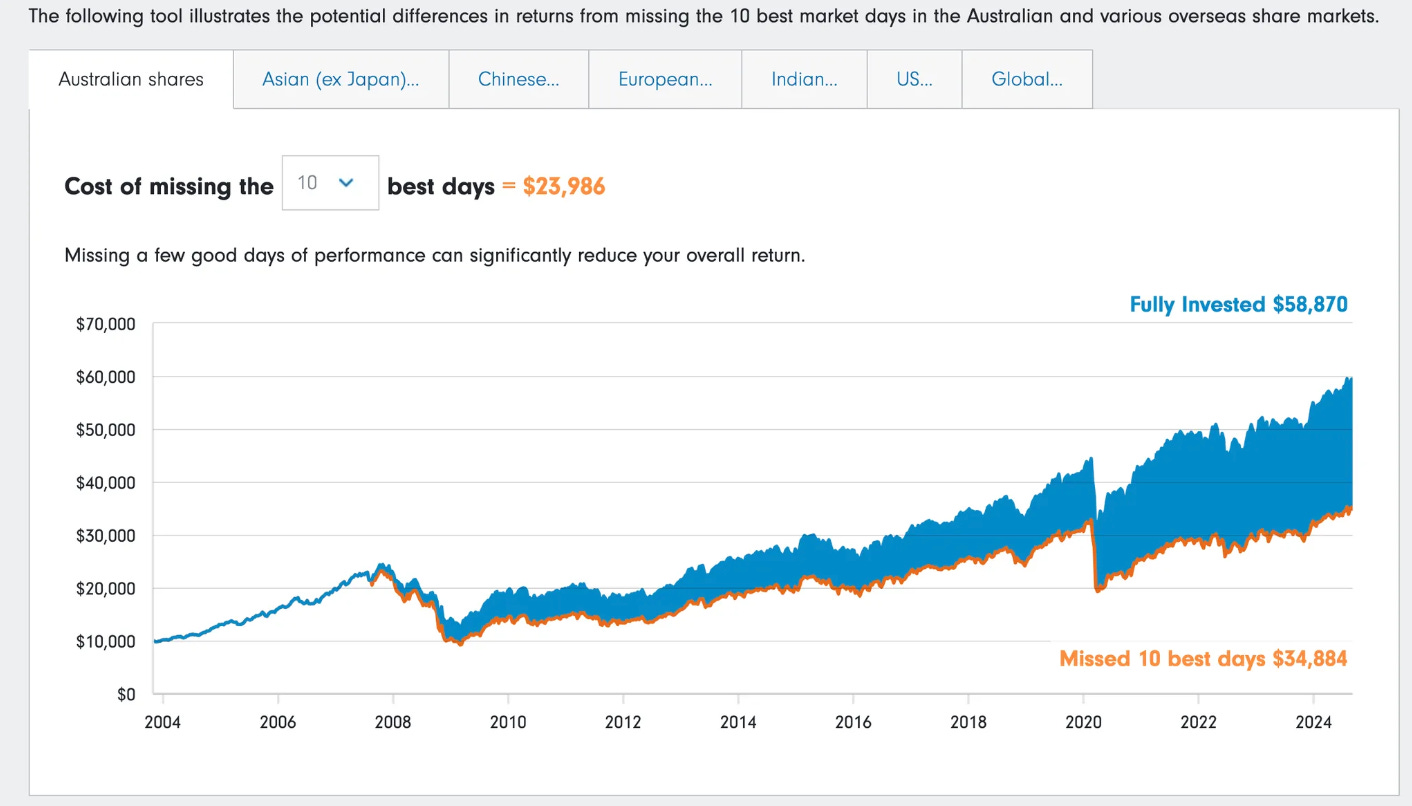

Take this example from Fidelity. If you were invested in the stock market from 2003 to 2024, just missing the 10 best days would reduce your returns by 40%.

Out of a total of 5,739 trading days (excluding weekends), missing just 10—less than 0.2%—could slash your returns almost in half.

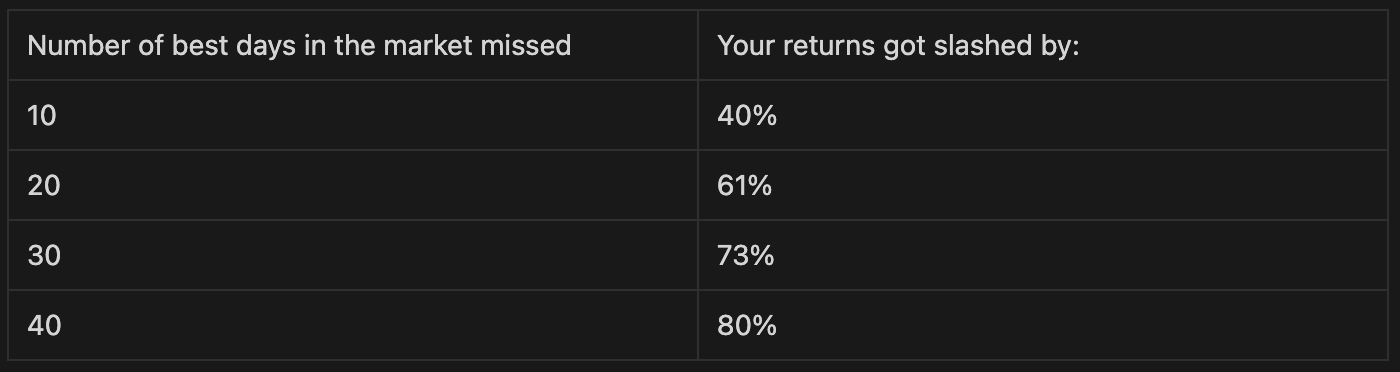

The number gets even worse if you miss the 20, 30, 40, … best days:

Let these statistics sink in. The market’s best days often come right after its worst ones. So, when you pull out due to bad news (which has nothing to do with the fundamental of the companies you are investing in), chances are you’ll miss those big rebound days.

Now, let’s talk about your chances of actually timing the market correctly. If you’re just guessing whether to buy or sell on a particular day, you have a 50% chance of getting it right. But to perfectly time the 10 most crucial days over a span of 20 years? That’s a whole different story.

Let’s do some simple math:

Total Days in the Market: There are 5,739 trading days between 2003 and 2024.

Critical Days (Best Days): Missing just 10 of the best days reduces returns by 40%. So, these are the days that would really matter for market timing.

If we assume that timing the market means perfectly predicting whether to be in or out of the market on just those 10 crucial days, and each decision has a 50% chance of being correct (random guess), the probability of correctly guessing all 10 days is:

So, the probability of an average person without any special insight, guessing correctly on each of those 10 critical days is just 0.5 raised to the power of 10. That’s a 0.098% chance, or roughly 1 in 1,024.

Think about that — your odds of correctly timing the market are far worse than correctly guessing a rolling dice in a casino.

The Emotional Trap

Headlines like “strong job market data” or “country X attacks country Y” might make the market drop. But those events rarely change the long-term value of a company. They cause short-term panic, but the business you’ve invested in? It’s still the same. Yet, many people sell when these headlines hit, thinking they're being smart. What they’re really doing is hurting their own long term returns.

We see it all the time with investors, including some of our own clients. They react to news that doesn’t change anything about the companies they’re invested in. Emotional decisions like these often lead to missed opportunities when the market inevitably bounces back.

Please note that we are not saying that the concerns above are silly or wrong. It is understandable for people to worry when they are given “warning” that things are going to be bad. And the rational thing to do is of course to take the necessary precautionary actions.

Think about this: if you live near a volcano, and the Meteorology, Climatology, and Geophysical Agency (BMKG) gives you warning that the volcano is going to erupt in the coming week, of course you would want to evacuate for the time being to save your family and yourself. But if the BMKG announces that there is going to be an increased intensity in the magnetic fields on the Sun and they are going become too tangled (a phenomenon known as solar flares) and will produce high energy particles and radiation — are you going to pack your bags and leave the earth?

What we are trying to do here is to analyse these “warnings”. What do these “warnings” truly mean and how would it affect you and your original investment thesis?

Isn’t Recompound Market Timing?

Now, you might have a counter-argument:

Doesn’t Recompound do stock picking and actively buy and sell stocks? Isn’t that market timing? Aren’t you contradicting yourselves?

Well, not really. While we do stock-picking and occasionally rebalance portfolios, our approach has nothing to do with market timing. Before we buy a stock, we:

Study the owners, business model, and future prospects thoroughly.

Only buy when there’s a big margin of safety — at least a ~40% discount to its intrinsic value.

Once we’ve bought, we’re prepared to wait patiently as long as:

There’s no change in the thesis that would alter the intrinsic value.

The stock has not reached its intrinsic value.

We only sell when:

A fundamental change in the stock drastically decreases its intrinsic value.

The stock price reaches its intrinsic value.

Other than that, there’s absolutely no market timing involved.

Think of it like buying an undervalued house: you wouldn’t sell it just because of some random macro news appearing which has nothing to do with the fundamentals of the house itself (location, occupancy rate, quality of the building material, etc.).

You’d wait until it’s worth what you think it’s truly worth.

We have covered our investment framework extensively on another blogpost, go take a look if you are interested:

https://blog.recompound.id/p/investing-with-recompound-starter

Focus on What Matters

Here’s a kicker - Trying to time the market is NOT impossible, if only you’ve got the resources of hedge funds like Citadel / Jane Street / Renaissance Technologies, with their advanced machine learning algorithms, access to real-time data, dozens of math and physics PhDs at your disposal - maybe you have a chance.

But if your strategy is solely based on reading mainstream news outlet like CNBC, CNN, or relying on your favorite “Bullish Penant” / “Breaking support resistance” chart patterns:

Your odds are worse than just gambling at your favorite casino. The math speaks for itself.

At Recompound, we believe in focusing in what matters most in the long run: The fundamental of the companies we invest in.

Don’t let short-term noise distract you from the bigger picture. Stay focused on the fundamentals, stay invested, and you hopefully you will be in a better position to succeed in the long run.