Hi 👋 welcome to Recompound Blog - The Investment Mindshift. We help you better your mindset on investment and economics one article at a time. More: Advisory | Get to know us

This is an article for all subscribers. It seems like uncertain time is just right ahead of us because of the recently announced tariffs. Market crash, panicky investors pulling out from capital markets around the globe might very well happen. Toby wrote an article earlier on what to do during a market crash. This article is more event specific that briefly touches upon the key differences in behaviour between common investors and legendary investors during a market crash.

Disclaimer: this article is not an investment advice and shall not be construed out of context. You remain responsible of your own investing decisions.

On 2nd of April 2025, Trump announced a reciprocal tariff, shaking financial markets worldwide. In just two days, major US indices such as Nasdaq and S&P 500 plunged by -11.33% and -10.6%, respectively.

We understand it’s natural to feel anxious and worried seeing your investments might drop significantly in value overnight. You're not alone—many investors are experiencing similar feelings of uncertainty.

This article won’t delve into tariff specifics—excellent resources already cover that.

Instead, we will focus on what this means for long-term investors, particularly in Indonesia.

At the time when the article was written, the Indonesian stock market has been temporarily shielded due to the extended Idul Fitri holiday (March 28 - April 7, 2025). This unusual timing has prompted many investors, including our clients, to wonder:

What will happen when markets reopen on April 8, 2025?

Will Indonesian stock market mirror the US markets’ downturn, potentially dropping by around 12%?

Should investors panic and sell all their holdings, hoping to re-enter at the "bottom"?

Historical Perspective on Indonesian Stock Market Crises

Historically, the Indonesian stock market has faced multiple crises and consistently recovered and grown stronger over time. Here’s how the Indonesian stock market performed during significant past crises:

This historical data clearly illustrates that Indonesian stock market rebounds following crises typically surpass the magnitude of the drawdowns.

But why is this the case?

1. Decision making is always emotional

Every active decision you make is always emotional. Yes, even when you want to take a shower after you finished exercising earlier; you don’t do it because bacterial build up got multiplied by two folds on your skin that increases likelihood of acne by 21.3%.

You take a shower because likely an unpleasant odour comes out from your body and you become rather uncomfortable to be around other people with that odour.

Same as selling stock during a perceived crisis. You sell your investments because of the emotional impulse that the stock market crash will jeopardise your investments forever. Therefore, you derive a sense of safety by pulling out from your investments momentarily.

2. Crisis feels like forever, but is not forever

When there is a crisis, we feel like there is a need for us to sell as we are in a rush to safeguard our capital momentarily. This is because our primal instincts tell us to pull out from our investments, first regardless of however cheap we sell our assets at.

It is akin to a person having a burning house. You probably want to sell it to another person don’t you? So that you could just cash out quickly and let the other fella deal with the burning house?

Maybe that is rational, but what if you sold the burning house at a super tiny fraction of the cost of the land? Well that can become a good deal to the buyer. Once the fire stops, they can rebuild the house and sell it at a super premium. Or even, just sell the land because you sold the property at a super cheap price.

Therefore, when you are experiencing a crisis, it feels like forever. But time and time has shown us again that we don’t really have a crisis with a forever duration. Therefore when the crisis ends, prices tend to get reevaluated to the up side.

We also know that biggest fortunes aren’t made in times of optimism - but by staying invested in moments of maximum fear

When quality assets are underestimated and abandoned, generating very high margin of safety for investments.

Consider the inspiring examples of Lo Kheng Hong, who invested in United Tractors (UNTR) amid the turmoil of the 1998 Asian Financial Crisis, and Multibreeder Adirama Indonesia (MBAI), a chicken feed producer, during the 2005 H5N1 bird flu pandemic in Southeast Asia.

It's safe to say that without these moments of crisis and his bold, contrarian actions,

we might never have known his name today.

I hope it is very clear to readers why investing is hard. Because all sorts of news and information regarding impending doom seems to point to the fact that investing is a “bad activity” in times of massive uncertainty.

However ironically, it usually gives the best opportunity to buy companies at a severely discounted price.

So, What Should Investors Do?

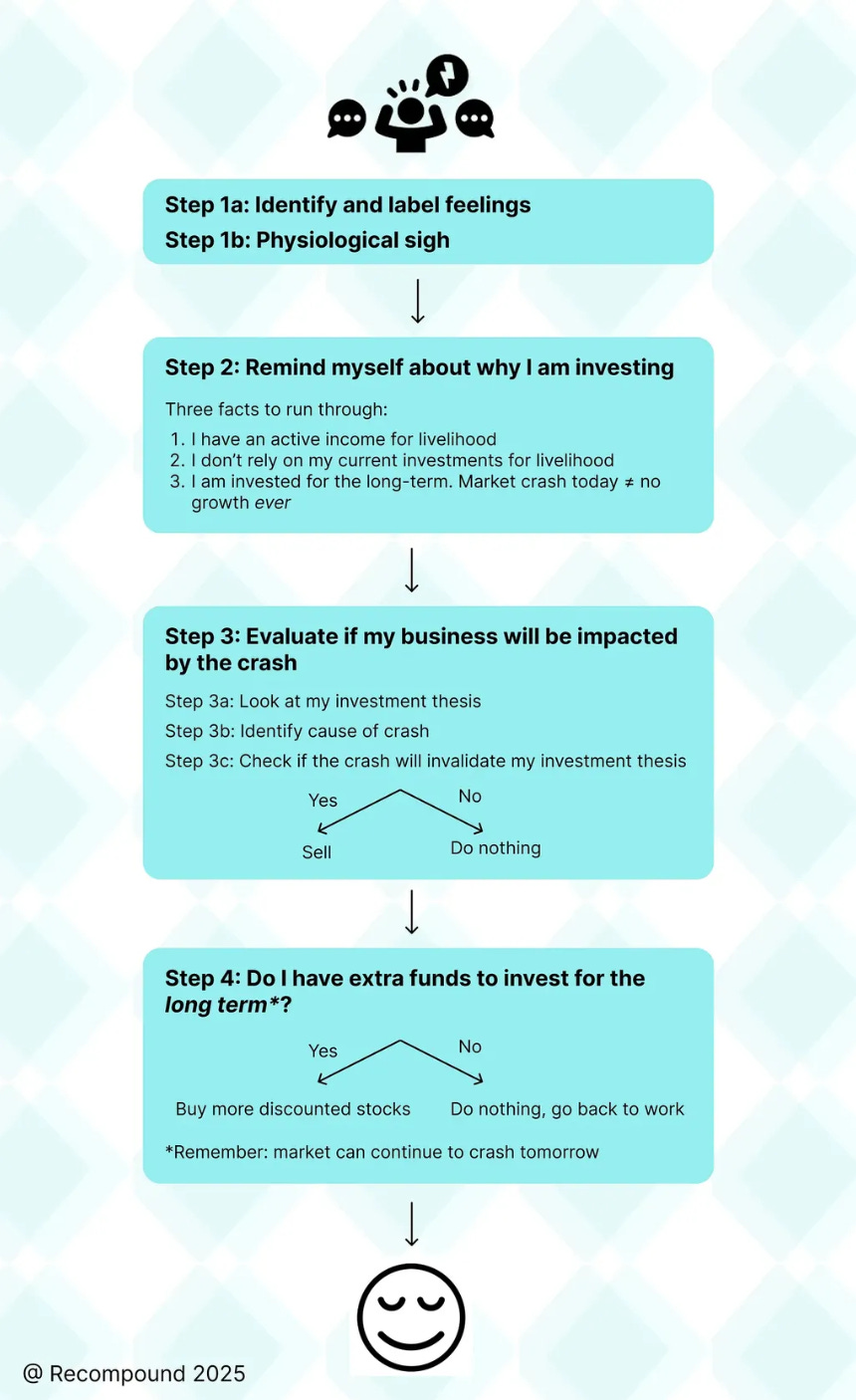

We’ve previously covered this topic extensively here. To summarise the key things clearly:

We would like to re-emphasize on step 3:

Think like a business owner. Buying a stock means owning a part of a real business. Over the long term, a stock’s price tends to align with its underlying earnings.

Objectively assess whether Trump’s tariffs directly impact your business’ core operations.

For example, if you are a restaurant owner selling nasi padang to blue collared workers in South Jakarta area, will you be afraid of going out of business because of Trump’s tariffs? Maybe not really.

Another example, if you are a wood producer in Cirebon exporting wood to the U.S., will you be anticipating a reduced demand of your produce? Certainly!

If tariffs significantly affect your business’ key revenue streams, reconsider your position. However, if the impact is minimal or non-existent—and provided you purchased your stocks with a robust Margin of Safety —then there is little reason for immediate reaction, especially if you’re still benefiting from consistent dividend cash flows.

To clarify further, here's Indonesia’s top 20 exports to the US (as of 2023):

Ask yourself:

Do my businesses (stocks) rely heavily on exporting these products to the US?

If yes, what portion of total revenue does this represent?

If the answer is negative or insignificant:

Is panic necessary?

Remember, your diversified portfolio was designed precisely for situations like this—to cushion the impact of unexpected downturns.

Focus on What’s Important & Knowable

While second-order effects of tariffs are possible, many investing factors remain beyond our control, such as:

The exact short-term market reaction when Indonesian stock market reopens on April 8.

Precisely predicting the stock market bottom.

Exact long-term effects of tariffs on Indonesia’s 2025 GDP growth.

These uncertainties, though significant, aren't within your control. Instead, focus your energy on aspects you can know and influence:

The long-term sustainability and growth prospects of your invested businesses.

Ensuring a strong margin of safety (discount) at the point of purchase.

Maintaining proper portfolio diversification.

Evaluating financial prudence and capital allocation effectiveness of management teams.

Successful investors like Warren Buffett and Lo Kheng Hong built their fortunes precisely by resisting the urge to panic sell during market turmoil.

Parting Remarks: does a US crash mean the whole world crashes?

When the US indices declined sharply between April 2-4, 2025, here's how global markets performed:

Contrary to widespread media-driven fear, the substantial US downturn wasn’t uniformly reflected across Asia-Pacific markets. This emphasise a crucial investment lesson:

Predicting short-term market movements is extremely difficult. Investors are better served by focusing exclusively on what's fundamentally important and knowable—the resilience and value of their chosen businesses.

Extra note: if you’re still feeling uneasy, we are happy for you to reach out to us for a personal discussion where we are more than willing to listen to any concerns you have regarding the prevailing situation.