Disclaimer: Not a recommendation to buy sell or hold the stocks that are mentioned in this article. No information in this article shall be construed as a financial advice especially when looking at the “safe” portfolio construction presented in this article. This article is purely to express author’s opinion. Company’s views might not necessarily reflect author’s views.

In doing investments, what is risk?

If you’ve taken a corporate finance class at school, you might have been taught about how an investor should define risk. A tool that is often introduced, with a fancy name is none other than sharpe ratio. Non-finance readers please stay, I promise it is very simple.

In a mathy way of expressing, sharpe ratio is the difference between portfolio returns and risk free rate divided by standard deviation of returns over the same period of time. Like this:

Where R is your portfolio return and r is risk free rate. Risk free rate simply means returns you get without taking any risk (like buying US bonds because the US never fails to pay its obligations by taking more debt indefinitely and Federal Reserve just prints more money to buy the US bonds. So of course the US will never default on their debt).

Then sigma is standard deviation of returns overtime. Or in friendly words, how volatile is your portfolio overtime. In an even friendlier word, does your portfolio value go up and down like crazy or does your portfolio value stays relatively the same overtime.

The higher the sharpe ratio, the better because either you get more returns or your portfolio is less volatile.

If your portfolio has more returns, great!

But if your portfolio does not move as much, it is also great because it is less risky.

That is why, portfolio volatility is often perceived as risk in the finance industry.

Makes sense right?

If the above makes sense to you then congrats! You’ve been brainwashed into thinking that if an asset is more volatile in terms of its price, then it has to be riskier.

Lets apply this sharpe ratio way of thinking into creating our own hypothetical fund.

Idea: In 2023, buy stocks that have been priced at Rp 50 for a year. Then hope at least one of the stocks would go up. Portfolio would look something like this:

When you buy this fund in 2023, oh my it is “very relaxing”. Price is stable and therefore using the sharpe ratio line of thinking, there is very little to no risk.

Sharpe ratio is definitely going to be a positive figure because price cannot go below Rp 50,- right? Right??

Fast forward to 2024

OJK implements full call auction and these stocks drop below Rp 50,- to a staggeringly low level. Fund performance is therefore adversely impacted and loss of invested capital is an absolute possibility.

So how should we look at risk more broadly then

When we are given an extreme example like the above, it is immediately clear to everyone that only looking at historical price action to determine risk is not only degenerate, but also risky. Yet I cannot stress enough that people do this all the time. (not you who’s reading this article of course, but other people).

When the price of a stock drops by 5% in a day, they would think that the stock is dogshit. So what they do is to sell this stock. If the stock price continues to increase 2x, 3x in a month or two months, that stock is Gold. Then what they do is to buy more of this stock at higher prices. And you know what happens next usually.

Side note: Those who like to invest in property frequently think that property prices keep rising up. Therefore, they would also think that there is no risk in buying any property.

So, it is clear that from the extreme fund example above, the way we should be thinking about owning an asset is not based on its historical price fluctuation, but based on its value. Risk materialises if that value is threatened or if there is no value in the first place (i.e. you buy a snake oil).

If you are investing in a company (a.k.a. buying a stock), the value is a company’s ability to make profits, period. If that ability can be objectively threatened, because of regulation, disruptive technology, competition etc etc, then that is the risk of owning that stock. I cannot stress this enough but short term price fluctuations is not important in the long run.

Therefore, hopefully this section hammers down the point that more price volatility does not necessarily mean more risk and less price volatility does not necessarily mean less risk.

If you are an investor, how often do you check stock prices?

The less frequently you check stock prices, the better. Don’t believe me? Let me ask which asset class would you choose.

This one,

this one,

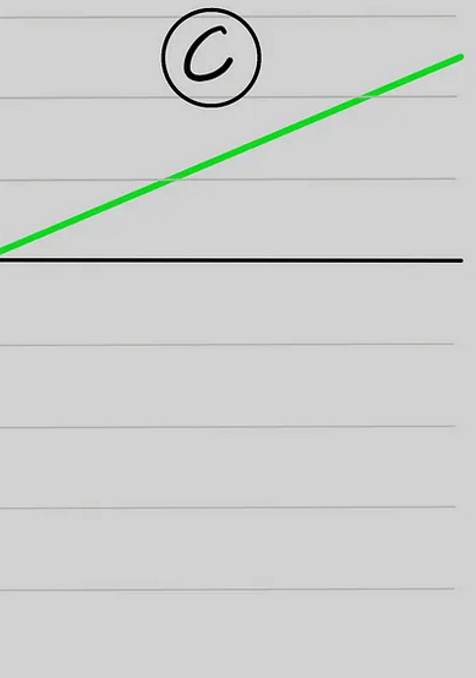

or this one?

All have the same returns (~15% per year). Unless you like to ride roller coaster and have a heart attack along the way, you would choose C.

But actually all assets shown are the same, which is the global equity market in 2020. The only difference is how often you check the price.

The first one, you check every day

The second one, you check once a month

The last one, you check once a year

So perhaps, instead of checking prices every day, lets check prices less often.

Not checking price often is not equal to not monitoring your investments btw.

How do we monitor our investments then? Check the business activities periodically (like every month). How’s their:

earnings,

expansion plans,

competition,

corporate actions, etc looking like?

Then you can update value of business based on their key activities and business results.

Closing Remarks

Short term stock price fluctuation is usually noise especially when you are investing for the long term. And they shouldn’t be your sole indicator of “risk”. Even uncle Warren agrees :)

"You know, I think people’s investment would be more intelligent, you know, if stocks were quoted about once a year."

Warren Buffett