Why are we so afraid of cutting losses

Cut loss saves life?

Today we are going to be discussing about why is it exceptionally hard to cut loss, in stock investments. We begin by defining what is the act of cutting loss really mean. When a person purchases a stock at a certain price, the price can go up or down. If the price goes down, then a person has an unrealised loss because the person has not sold the stock yet. A person cuts loss when they sell the stock at a cheaper price than they originally bought.

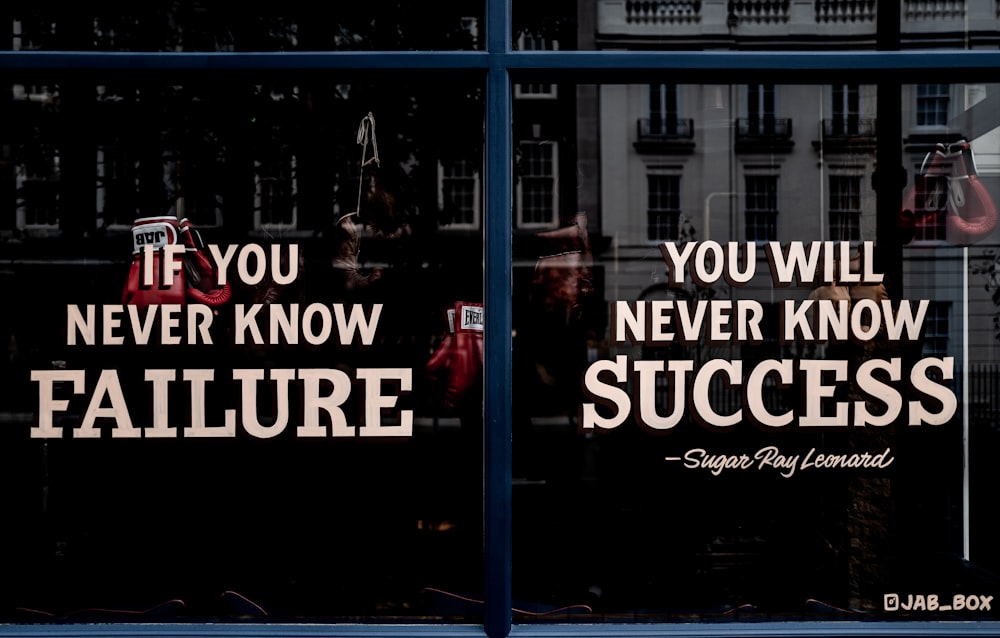

Notice that cut loss is an act that requires real action from a market participant. Many people say that generally one is reluctant in cutting losses because one does not want to admit one’s mistake. But we don’t think that that is the real reason. The root of the problem is that people are afraid of failure.

That’s really it, we are afraid of failing. If you have read this post up till this point, feel free to bounce, but we hope that you will continue reading along 🙂

Why do we behave this way? There are two reasons which are psychological and biological

Psychological Reason (easy)

Ever since we are a young child, most of us go to school. Our main responsibility as a child is to study well. That usually means that we should get good grades and we cannot fail our tests and exams. We are not pointing fingers or blaming schools because we think that education is great. The unintended outcome, however, is that people’s trained behaviour is to avoid failure, at all times.

What if we fail? In school, there is a system in place to rectify that failure. You should take an extra class or you should get help from tuition centres and many more. And it usually sucks to have to attend those programmes. We’d prefer spending our time doing something else like playing video games or sports like any other student would like to.

In the context of stock market, there is no such system in place. Rather than rectifying it, we let it be. Especially because it is often not our main responsibility to become a great investor that makes money from the capital market. So, our natural habit dictates us to let our stock investments be, while we preoccupy ourselves with our daily activities.

This, to us, is most people’s psychological approach to cutting losses. They do not want to do it because their fear of failure is already baked in. Ideally, this behaviour should change so that we could look for better opportunities and invest better in the future. As the subsequent section uncovers, it is biologically difficult to do so.

Biological Reason (less easy)

Note: this section is referenced from Huberman Lab Podcast: Using Failures, Movement & Balance to Learn Faster.

By the age of 25 or so, our brain loses our plasticity. This means that we simply cannot passively experience to learn new things. We have to put a deliberate focus and attention into the material that we are trying to learn, be it dancing, playing the guitar, picking up a new sport or learning a new behavior: cutting losses.

In particular, focus and attention should be done to make failures repeatedly in order for the brain to notice that we are not doing things correctly. Then when we do something right, albeit small, dopamine is released which makes us feel excited and more energised.

Ever feel the noticeable joy when we finally check mated the opponent after losing so many times at chess? Or the successful free throws after consistent failed attempt at basket ball? That’s when the brain learns. After a series of deliberate failures.

Fortunately or unfortunately, the same things happen to cutting losses in the stock market. We think that cut loss should not be a one time event because it is incredibly difficult to do so. We think that it should be done in small steps that are accompanied with investments with better opportunities. When we see that the re-allocation of investments (often times) is performing better, we get the excitement, and we learn the benefits of this new behaviour of cutting losses. Incredible isn’t it?

Now we are not a financial advisor and none of the paragraph above is financial advice. We only want to inform you a scientifically backed method to overcome fear of cutting losses behaviour that is extremely natural and how we can overcome it.

To conclude

If you are hesitant or afraid or annoyed of having to cut loss, congratulations! You are a normal human being. And it is incredibly difficult to change that behaviour at all ages. When you are under 25 years old, your surroundings and system usually dictates that you should not fail when learning new things. When you are above 25 years old, it is already extremely difficult to change that behaviour because your brain is no longer plastic.

Ultimately, do not beat yourself too hard for having this behaviour. Just know that there is a way to change, bit by bit so that we can stride into a new and hopefully better investment behaviour.