Why the Era of Blindly Buying US Stocks Might Come to an End

Past performance does not guarantee future performance

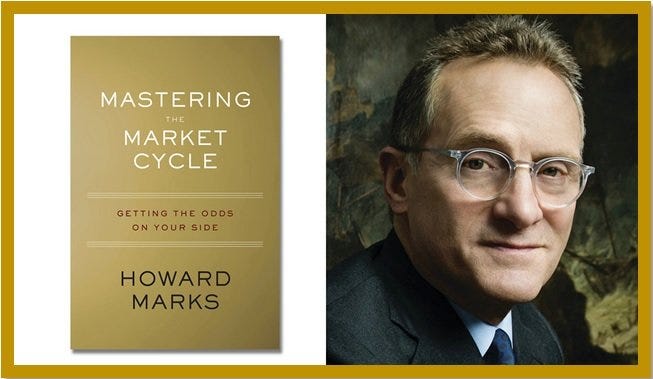

Markets move in cycles. This fundamental insight, eloquently emphasized by Howard Marks in his seminal book "Mastering the Market Cycle," reminds investors that no market remains exceptional indefinitely—not even the seemingly unstoppable U.S. stock market.

Lessons from History: U.S. Exceptionalism Isn't Permanent

Consider these surprising historical insights:

From 2000 to 2014 (a full 14-year span), the Indonesian equity market (IHSG) astonishingly outperformed major U.S. indices, even when measured in USD terms:

IHSG: +435.94%

S&P 500 (SPX): +35.78%

Nasdaq (NDX): +11.88%

Contrast this with the subsequent period from 2014 to 2025, where U.S. markets reclaimed their dominance:

IHSG: +21.7%

SPX: +223.01%

Nasdaq: +503.08%

Clearly, outperformance shifts over time rather than being permanently fixed.

Unfortunately, many retail investors — particularly in Indonesia — have overly focused on the exceptional U.S. market returns of the past decade, often overlooking the broader historical perspective. This narrow viewpoint could expose them to unexpected risks when the cycle inevitably shifts.

Cycles of Emerging vs. Developed Markets

Historically, the U.S. and Emerging Markets / EM (such as Indonesia) have alternated periods of outperformance:

1988 - 1994: EM significantly outperformed the U.S.

1995 - 1998: U.S. markets outperformed EM.

1999 - 2010: EM once again dominated U.S. stocks.

2011 - today: U.S. stocks have notably outperformed EM.

Why Did the U.S. Underperform from 1999-2014?

The major reason behind this extended underperformance was the massive overvaluation from the dot-com bubble era. Sky-high valuations and unrealistic expectations led to a prolonged period of stagnation, often referred to as the "lost decade."

Additionally, the 2008 Financial Crisis played a major role in exacerbating U.S. market underperformance, creating widespread economic uncertainty, significant asset price declines, and leading to a sluggish recovery that extended for several years. This crisis itself was largely fueled by greed and unrealistic expectations in the U.S. housing market, highlighting how unchecked speculative behavior can severely disrupt markets.

Key Factors Influencing Market Cycles

At Recompound, we emphasize using data-driven insights to understand where we stand in the market cycle:

1. Valuation & Retail Ownership: