TL;DR: We get paid when you make money—20% performance fee above a high‑watermark—so we work hard to avoid big drawdowns. That’s why our picks can look “boring”: sturdy balance sheets, steady cash flow, sensible dividends, and saner volatility.

In contrast, many paid “group saham” communities run on fixed subscription fees (for example IDR 13 juta or even more per year).

Whether members profit or not, the fee keeps coming—so the incentive is to sell excitement, not to manage risk.

Different incentives → different behavior.

But our returns aren’t that “boring”

Playing it safe doesn’t mean boring results. We’ve published our performance transparently since Aug 2022 and we’re proud of it versus common alternatives.

We also update our portfolio performance live, daily—you can even “stalk” it every day if you’re kurang kerjaan 😉.

It might not buy a Ferrari or McLaren in 1–2 years—but it does compound, and compounding is the point.

Our model in plain words

Registration: one‑time IDR 2 juta (stays active as long as you remain a member).

Performance fee: 20% of profits above your prior peak (the high‑watermark).

If your account goes from 100 → 80, we earn zero until it climbs back above 100. No new high, no fee.

Why this matters: big losses are business‑ending for us. A −30% needs +42.9% just to break even; −50% needs +100%.

We can’t live on hype—we only live on new highs.

Why we often pass on the “hot stories”

You might hear exciting rumors: “Stock A will be acquired by B from China!” or “Stock C will do a massive rights issue and inject assets from D!”

These are workouts/special situations—they can win big if everything lines up. But many things can go wrong (approvals, funding, terms, timing), and the wins are hard to repeat quarter after quarter for most people.

Because our income depends on your new highs, we:

Prioritize capital protection over screenshots.

Size carefully and demand evidence (filings > rumors).

Prefer repeatable quality to lottery tickets.

Different incentives, different outcomes

Subscription groups: recurring membership fees regardless of results; if you don’t renew, you’re out. Revenue keeps coming even during drawdowns.

Recompound: tiny one‑time fee; we only earn when you reach new highs. If we drawdown, we eat nothing until we recover. So we choose the dull, durable path on purpose.

Why we don’t publish “alpha” in public

Our revenue depends on your new highs. It would be irrational for us to post our best ideas publicly for free—doing so would dilute any edge our paying clients have and make it harder to reach the next watermark. In contrast, some subscription models can benefit from public hype to attract renewals—separate from member P&L.

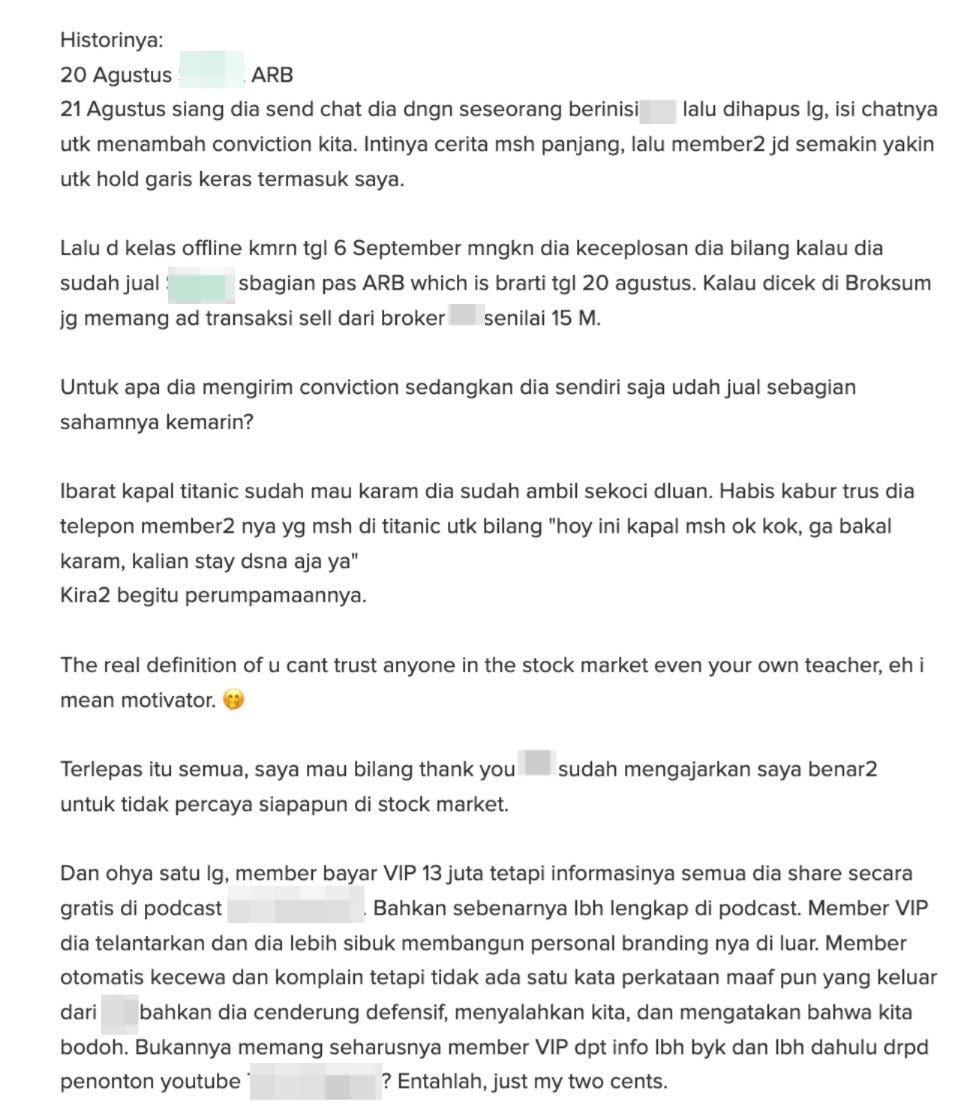

For context, here’s a public post from an investor describing their experience: https://stockbit.com/post/20826313 .

We won’t name any individuals or brands, but the author alleges (not necessarily true though ☺️), among other things:

Sparse interaction from the group’s lead inside the private group.

A confidence‑boosting message after a sharp drop, followed by an admission later that part of the position had already been sold earlier.

“VIP” information showing up on public media (e.g., public podcasts) while members received it later or not at all.

This mismatch of incentives is exactly what our model avoids. Because we only earn above a high‑watermark, saying one thing and doing another—or giving away client “alpha” on public channels—would directly hurt our ability to get paid. So we don’t do it.

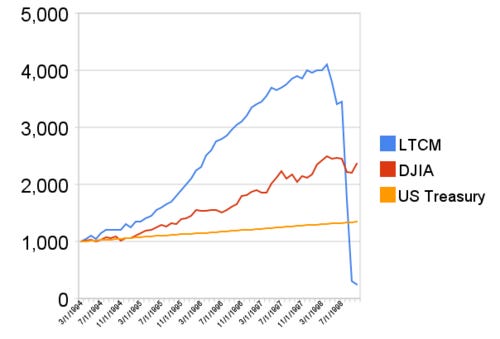

The LTCM lesson: great until it wasn’t

If you want a famous example of returns that looked amazing for a few years — until they didn’t, look up Long‑Term Capital Management (LTCM).

For a few years in the 1990s, their model delivered strong, smooth gains.

Then a sudden market shock in 1998 (Russia default / liquidity crunch) caused massive losses.

Leverage magnified the hit; the fund had to be rescued and was effectively wiped out.

The lesson is simple and timeless:

Short periods of smooth returns can hide fragility.

Leverage and crowded trades work—until they all need the exit at once.

Survival beats optimization. If you don’t survive, compounding stops.

At Recompound, our goal isn’t to “look brilliant” for 3–5 years and then blow up. We want to still be here in 25+ years. That’s why we:

keep position sizes sane and avoid one‑trade heroics,

favor balance‑sheet strength and fundamentals,

demand evidence over rumors, and

design for drawdown control because our high‑watermark means no recovery = no revenue.

(Background reading: Wikipedia’s overview of LTCM)

How to judge us (and anyone else)

Incentive alignment: Do they earn only when you win?

Repeatability: Is the process repeatable consistently for its members to follow and grow their portfolio sustainably over the long run ?

Risk rules: Position sizing and potential risks stated before the trade.

After‑fee clarity: Net results, not headline claims.

Bottom line: Compounding loves boredom. Our job is to protect the downside so the upside can take care of itself.

Disclaimer: For education only; not investment advice or a recommendation to buy/sell any security. Past performance is not a guarantee of future results.