Based on our experience, These are the top 3 mistakes / misconceptions we always encounter on people close to us, while investing / trading stocks by themselves (family, friends, acquaintances, colleagues, etc.).

This includes our existing clients before they subscribed to Recompound.

Like seriously, they always fall into these same loopholes all the time that we might as well create a blog post on this.

1. Focusing On the Wrong Northstar Metric

The number one misused metric people use to measure the success of someone investing stocks is “Win Rate”:

Some of our prospective clients usually ask this question: “Out of all the stocks you guys recommend, what’s the percentage of green vs red stocks?”

We answered: “Oh it’s usually 30 - 40%”

The prospective clients: “Loool you guys suck 😛”

Not to worry, because the thing is, we will most probably have a hard time if we enroll these kind of customers into our service. However, we will show you why “Win Rate” is such a sub-optimal metric to optimize for stock investing. Specifically, we will show you a simulation why a high win rate still does not make you money overtime.

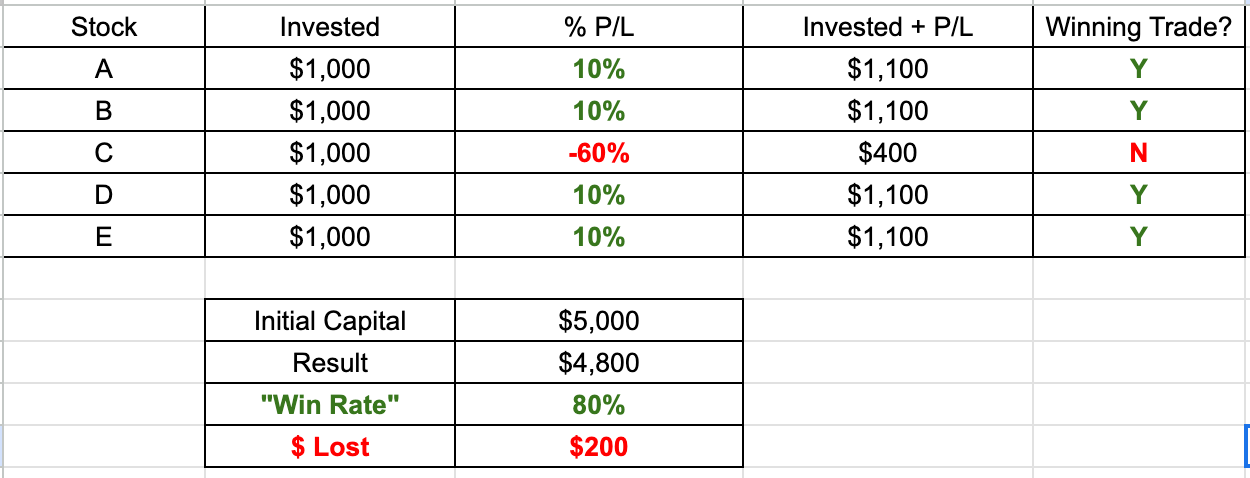

Simulation

You have $5,000 invested into 5 stocks, each with equal weighting

Your “Win Rate” is 80%, but at the end you still lose $200 (down 4%)

Why? Because a high “Win Rate” with a poor Risk to Reward ratio will not make you rich

You might as well put your $5,000 in a bank time deposit, you still gain 4% p.a.

Then, Which Metric to Focus On?

Instead of “Win Rate”, focus on your Consistent Equity Growth Overtime. You need to make sure your equity / portfolio value grows consistently:

2. Cutting Your PROFIT SHORT & Letting Your LOSSES RUN

Instead, do the opposite: “Cut Your Losses Short & Let Your Profit Run”.

This is also the core principle to achieve consistent equity growth overtime.

Why?

There are countless times we hear people around us saying things like below:

“Yay! I have realized the 10% profit of stock A, although stock B has 60% unrealized loss, I am confident stock B can go up again 1 day”.

Then when we do a cursory research on stock B, we find that sometimes the owner is already in jail or the company is already technically bankrupt, etc. But people can still believe that one day the value of the stock can more than double.

Ultimately, their portfolios usually end up like this:

Instead, what we think should happen is the opposite:

Cutting your losing stock when they are still early, and you are sure that the fundamentals / prospects have changed for the worse

Never sell your winning position and let its profit run until the uptrend ends. Because in the market there is no notion of “expensive”. Expensive will become more expensive if the market allows, and why not utilize this greediness to enrich ourselves? Especially if our stock buying price is so low!

3. No Discipline, Focus & Consistency

Stock trading / investing is really hard. In our opinion it is a full time job by itself. We highly admire people who can juggle their full time job while their portfolio equity is still consistently growing.

We are usually incapable of multitasking because there is a cost to switch from one task to another. On top of our obligation as a full time professional or entrepreneurs, there are usually other responsibilities such as raising a family, being a community leader, and many more.

It seems that only Naruto who possesses the power to Kagebunshin and multitask.

Like any other professions or commitments, stock trading / investing needs discipline, focus and consistency.

The year 2020 - 2021 makes it feels easy to invest in stocks because of the drawdown caused by COVID. If you purchase any stock during that period and just hold, you will most likely experience profit.

Now comes the real challenge in 2023. Any person who is able to outperform index and being profitable will likely succeed in stock market in the long run.

Conclusion

Losing money in the stock market is an incredibly common occurrence amongst retail traders / investors. We are of the position that they are not at fault for not having an investment team that is dedicated to work for them full time to monitor their portfolio performance.

Fortunately, that is the reason why Recompound is built. If you are too busy, not to worry, because we are here for you to be a team. Visit us at https://www.recompound.id/id to explore how we can help you with your stock investment.