Before we begin, I’d like to stress that we strongly condemn war and violence of any sort and do not wish war to happen in any way shape or form. We understand that situation in the middle east is extremely complex and do not claim to be a subject matter expert in this issue. We genuinely hope that war and suffering would end swiftly in all affected regions not just in the middle east, but around the globe.

This article aims to address a common question that are raised amongst our circle: How is the war in the middle east going to affect the Indonesian market and our investments at large? Nothing in this article shall be construed as financial advice. Please do your own research before making investment decisions.

Over the past few days, you must have been flooded by the news of Iran 🇮🇷 attacking Israel 🇮🇱 with hundreds of drones and cruise missiles:

Some people think this event is a prelude to World War 3:

…with “World War 3” being the trending topic on X.com:

Rightfully so, some of our clients are a little bit concerned and want some clarifications from us:

Rightfully so, some of our users are a little bit concerned and want some clarifications from us.

Will this be another stock market crash like 2008 Global Financial Crisis / 2020 COVID-19 pandemic?

If we were to answer these questions in a diplomatic manner:

Yes we are expecting stocks to drop based on the recent event (Iranian attack on Israel), but we are still confident that businesses of companies invested should not be impacted. We will continue to monitor the situation if it is necessary for us to rebalance portfolio accordingly

However, if we were to be 100% honest:

We don’t know how the market’s going to move in the short term because it is not within our control.

We focus on what matters most for long term portfolio performance: buying great businesses (stocks) at bargain prices.

Here’s why.

It is very very hard (read: futile) to correctly time & predict short term market movement

This recent tweet by Pak Tigor Siagian (Bank Indonesia Deputy Director) on the event is extremely spot on:

From the recent event (Iran attacking Israel), you might think this way :

Israel got attacked by Iran

Therefore, Israel will get into war with Iran

Therefore, all assets (stocks, crypto, etc.) across regions should crash

Let’s say number 2 is true, does that necessarily make number 3 to be true as well?

Here’s a kicker:

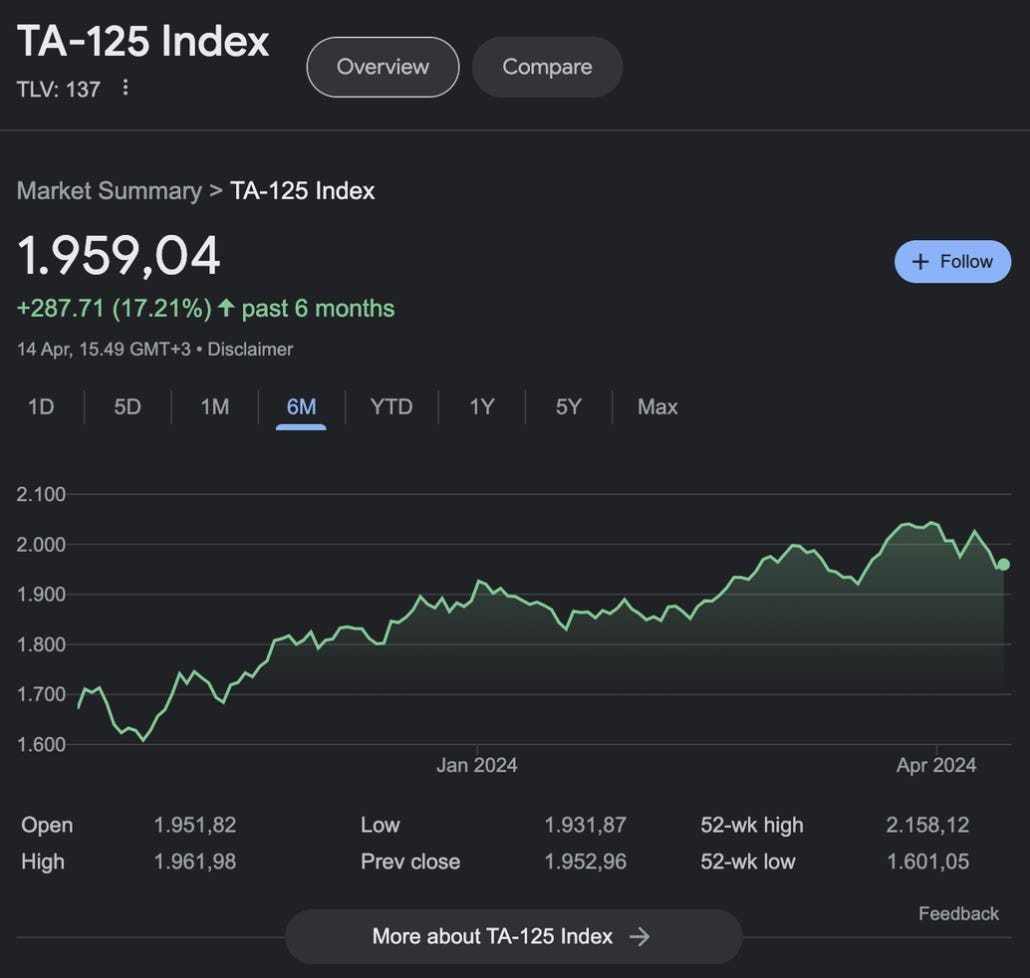

Iran declares war against Israel, so its stock market should crash, right? Well, not really so far.

This was how the TA125 index (TASE’s equivalent of S&P500 index) performed during today’s trading hours on Sunday, 14th of April 2024 (Iran attacked Israel the day before):

Note that the Tel Aviv Stock Exchange opens Sunday - Thursday. Due to Jewish tradition, Israelis’ weekend is Friday and Saturday, rather than Saturday and Sunday.

Not what you would have expected, huh? Why is the stock market still not crashing? We honestly don’t know.

Here’s a fact which is even more fascinating:

Even before the recent attack by Iran, Israel 🇮🇱 has been at war with Palestinian Hamas 🇵🇸 for the last 6 months, costing them a fortune to sustain the war.

How has their stock market performed in the last 6 months? Here’s a cold fact: their index went up by 17% in the last 6 months.

Again, not what you would have expected, right?

From the illustration above, I hope it is quite clear that it is mostly counter productive to time & predict short term market movement. We don’t know if the war is going to escalate (touch wood) or end (hopefully) tomorrow.

We would rather concentrate our precious resources in spotting new investment opportunities, and for sure it’s not from free CNN / CNBC news articles which has a business incentive to clickbait you.

Geopolitical events always have an element of “surprise” to it

and unless you are connected to policymakers and decision makers themselves, it is impossible for you to know what’s going to happen next and when. Only Iran’s supreme leader Ali Khamenei knew when Iran was going to attack Israel. Only the President of Israel, Isaac Herzog, knows if they are going to wage war against Iran as well. Only Joe Biden knows if America is going to be declaring war against any nation in the middle east.

Even if you manage to predict with great accuracy of this world leaders’ geopolitical decisions, mr. market also has an element of “surprise” to it.

We might think that Israel’s stock exchange is going to collapse when the war started. But I’d bet that most people don’t expect Israel’s market to go up by 17% over the last 6 months.

Does this mean that IHSG will rebound in the coming days then?

Again, we don’t know. We don’t and will never claim that war is a bullish event for the market. If anything, large geopolitical event like this one is a huge lesson for every investor in the public and in the private market.

What’s your investment thesis and framework? Note that there are specialised hedge funds and professionals that focus on identifying black swan events (war, financial crisis, market cornering, housing bubble, etc) such as Universa Investments and Michael Burry. They probably are super busy right now trying to predict the likelihood of market crash so that they can profit accordingly across different capital markets.

They are heavily invested with extensive resources, with a dedicated team to analyze these events, so if your knowledge is purely based on a free CNBC article or a fearmongering WhatsApp text in your family group chat, probably it is not a good idea to compete against them (?)

But if your investment framework is based on company’s ability to payout dividends, it would probably be wiser to check the company’s cashflow statement and the owner’s incentive to distribute dividends.

If your investment framework is based on growth of Southeast Asia, perhaps look more into Southeast Asia more than look into the Middle East.

And so on you get the idea 😄

To close, I personally hope any form of war or violence would end swiftly. And I sincerely hope that people remain calm and rational in uncertain times. If the past century have taught us anything, it is common to expect the unexpected. One could only react as best as they can to be well now and in future.

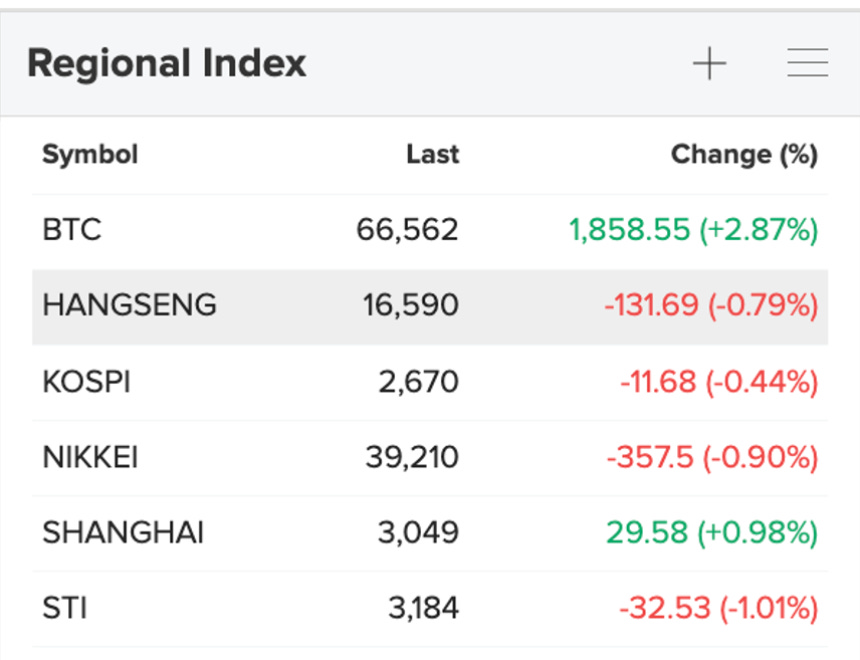

Monday 15th of April update:

We took a closer look on Asian countries stock market indices + the cryptocurrency market which are open for trading. From this table below, it is too early to claim that the stock market is crashing just because Iran attacked Israel.