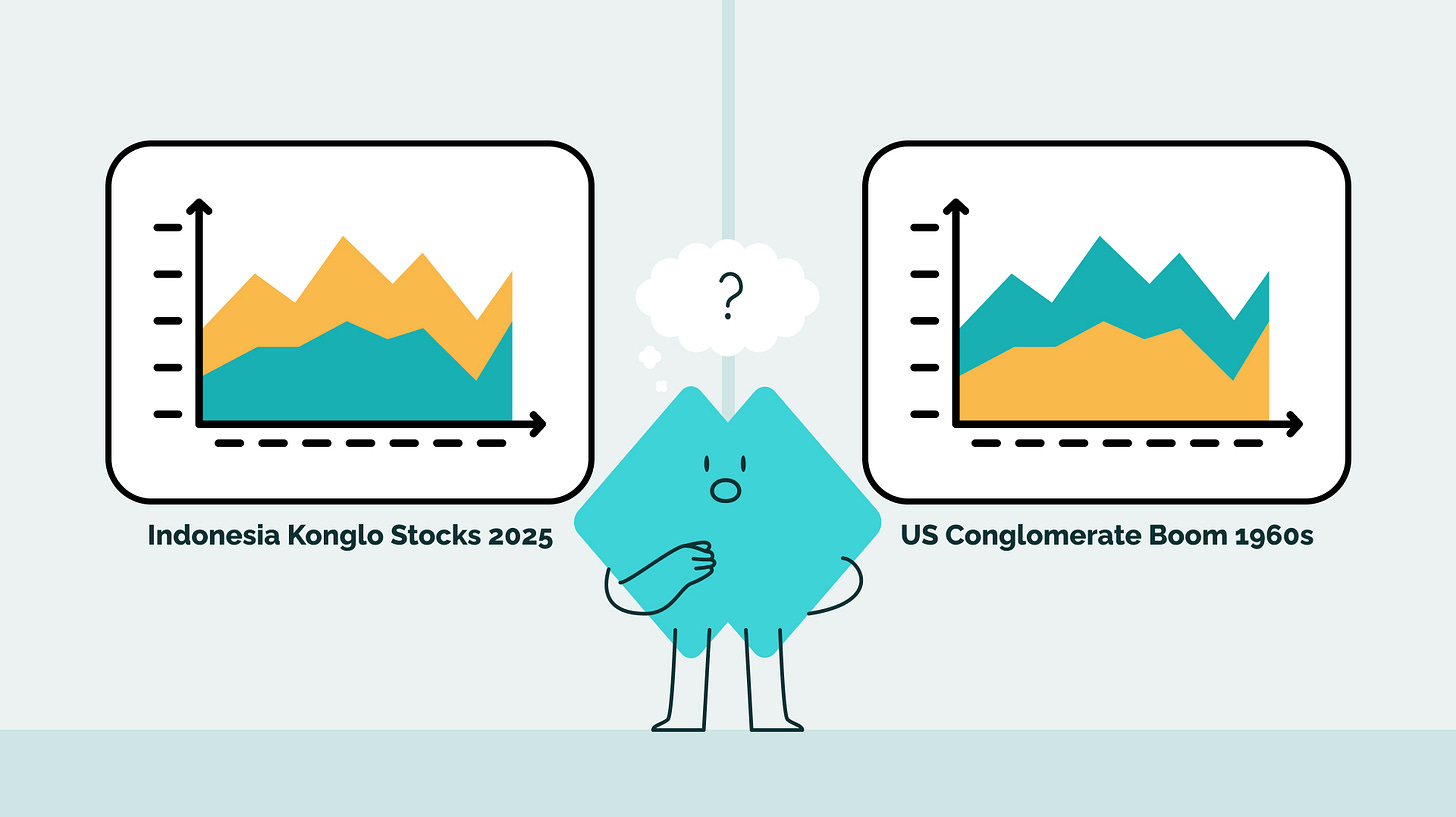

If you’ve been watching the IHSG lately, you’ve probably felt the FOMO.

You’ve seen the charts of certain IDX conglomerate stocks defying gravity, moving in vertical lines that make physics blush.

The common chatter in Jakarta coffee shops goes something like this: “Ah, this is just the Indonesian market being shallow. It’s a ‘bandar’ game. This doesn’t happen in sophisticated markets like the US”

To that, we say: Hell no.

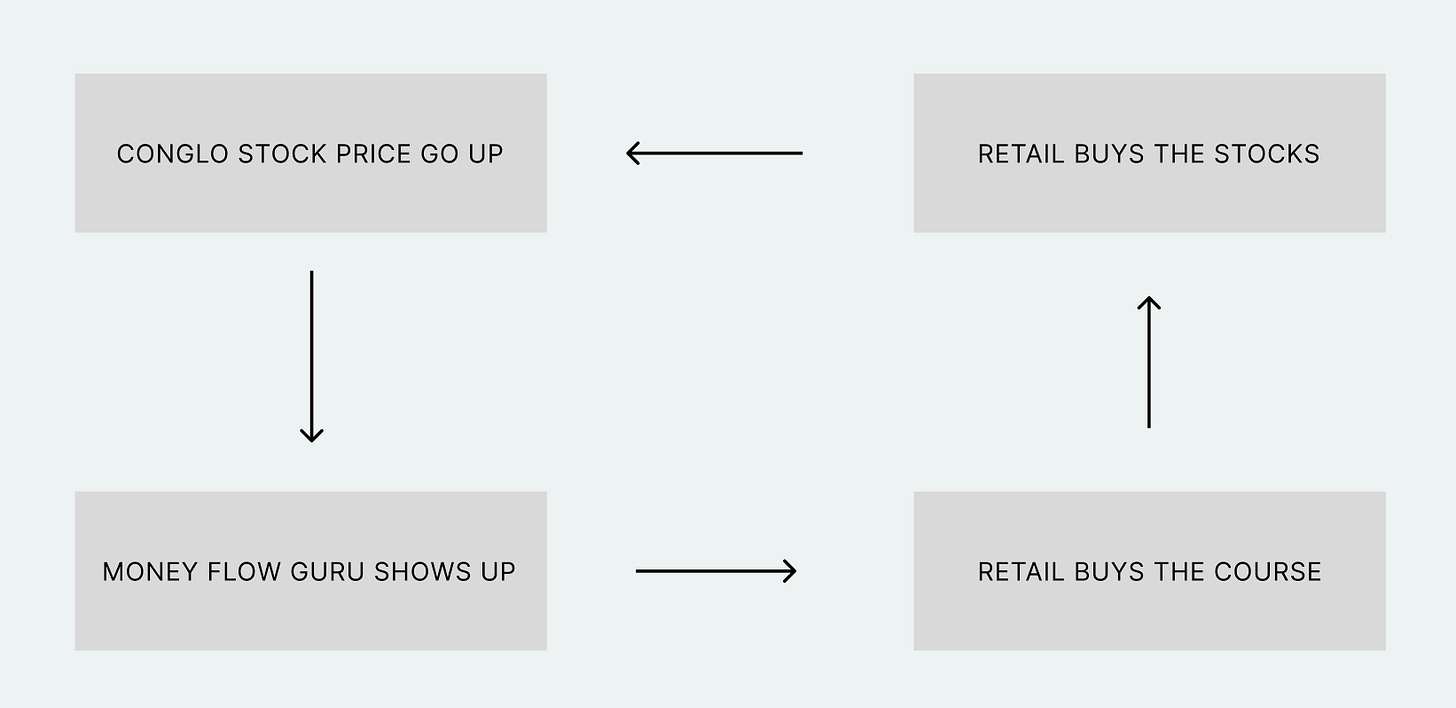

If you want to describe the phenomenon into a single flowchart, this is what is essentially happening.

From the flowchart above, it is quite clear that “Konglo stocks” can be replaced with any other stocks such as digital bank stocks, sub-prime mortgages, etc.

Money flow guru can also be replaced by other gurus that pertains to the assets that are pumping. Retail can be replaced by anything that is essentially “dumb money”. People who buy stocks without a rational investment thesis.

So clearly this is not an “Indonesia problem”. It’s a human nature problem. We have seen it again and again in multiple different context that it really gets quite boring. And if you are reading this blogpost, hopefully you would “get” it and take the necessary caution.

As one investor Tiho Brkan noted, successful long term investing is the intersection of three disciplines: Philosophy, History, and Psychology.

If you want to understand why Recompound is sitting this one out, we have to look at all three.