Toby just released a blogpost talking about Recompound’s performance in 2025.

A tiny minority of our clients are concerned, we didn’t beat the index (IHSG) in a calendar year. We did 18% (roughly 14% after fees), while the index did 22%.

But honestly? I’m not concerned.

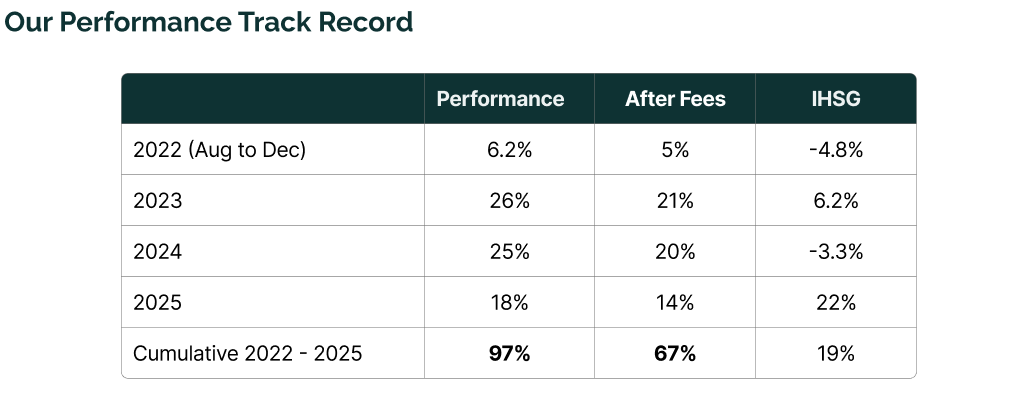

If you zoom out and look at the performance since we started in August 2022, the picture looks very different. Here is the track record of our very first client — who happens to be Toby’s own Aunt (shoutout to Tante!):

(Note: Performance varies depending on when a client joins, but this is the “OG” benchmark).

We are sitting at a 97% cumulative return vs the index’s 19%.

We are doing just fine.

The Parallel Multiverse

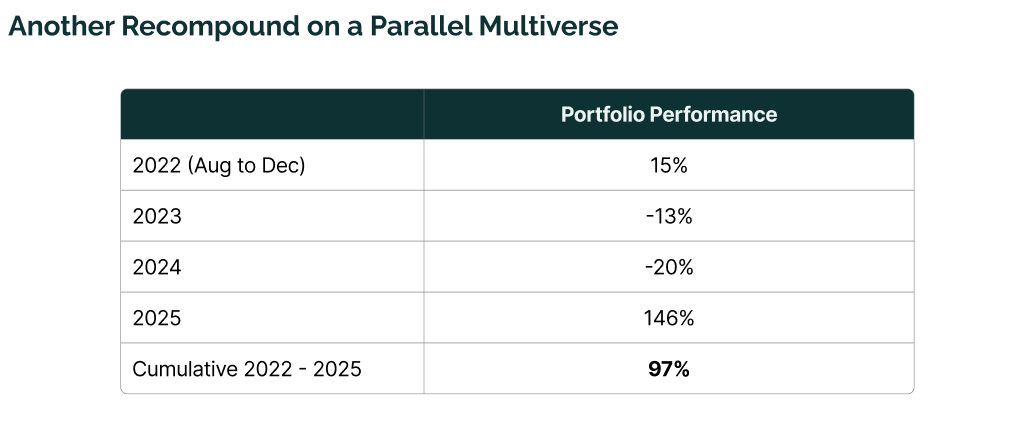

To explain why I’m not losing sleep over 2025, let’s look at a “Parallel Multiverse” version of Recompound.

In this universe, there’s a second version of us. Let’s look at their numbers:

Look at that 2025! They didn’t just beat the index; they basically 1.5x-ed their customers’ money in twelve months. Their cumulative return is also 97%—exactly the same as ours.

Most people would see that 146% and scream, “Sign me up!”

But here’s the reality: That second version of Recompound would have gone bankrupt in 2024. No client is going to stick around after watching their portfolio drop 13% one year and another 20% the next while the market is relatively flat. They would have fired us long before that “miracle” 2025 happened.

This goes back to our core philosophy:

Our objective is not to have the highest returns in a single year.

Our objective is consistency and, ultimately, peace of mind.

The Power of Being “Above Average”

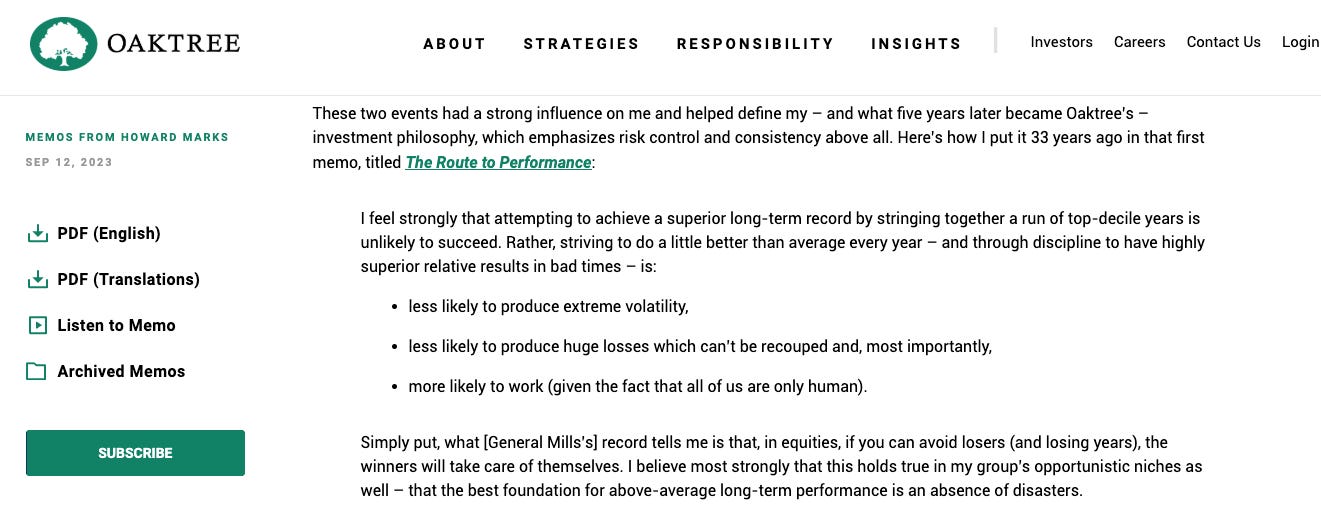

There’s a famous memo by Howard Marks called Fewer Losers or More Winners.

In it, he tells a story about David Van Benschoten, who ran the General Mills pension fund.

For 14 years, the fund’s returns were never “top tier”—they usually ranked in the 2nd quartile (better than average, but not the best). But because they were consistently in that 2nd quartile and never had a “blow-up” year, where did they rank for the full 14-year period?

The top 4th percentile !!

As Marks says:

”Most investors aiming for top-decile performance eventually shoot themselves in the foot.

Why? Because when people blow up, they really blow up… but David never did.”

That’s why I’m not concerned.

By avoiding huge drawdowns and staying consistent, we provide something much rarer than a “hot year”:

We provide a portfolio you can actually sleep with (not in the way you’re thinking of).

The “McLaren” Trap

We know right from the start Recompound isn’t for the mass market.

Most people are easily distracted by short-term “outperformance.” They see social media influencers “flexing” sport cars and luxury lifestyles, claiming they made 500% in a week.

What these influencers don’t show you is their consistency (or lack thereof) and how many times their portfolio went to zero before they got that one lucky screenshot.

And more importantly, they don’t show you the “bracketed” reality.

In reality, the formula is more like:

Pay some exorbitant amount of tuition fee

[Do a crazy amount of work and spend years acquiring the taught skill]

Buy McLaren

Most of our clients have full-time jobs or run successful businesses.

They don’t have the time (or the desire) to do the “crazy amount of work” in those brackets. They want their money to grow steadily while they focus on their own lives.

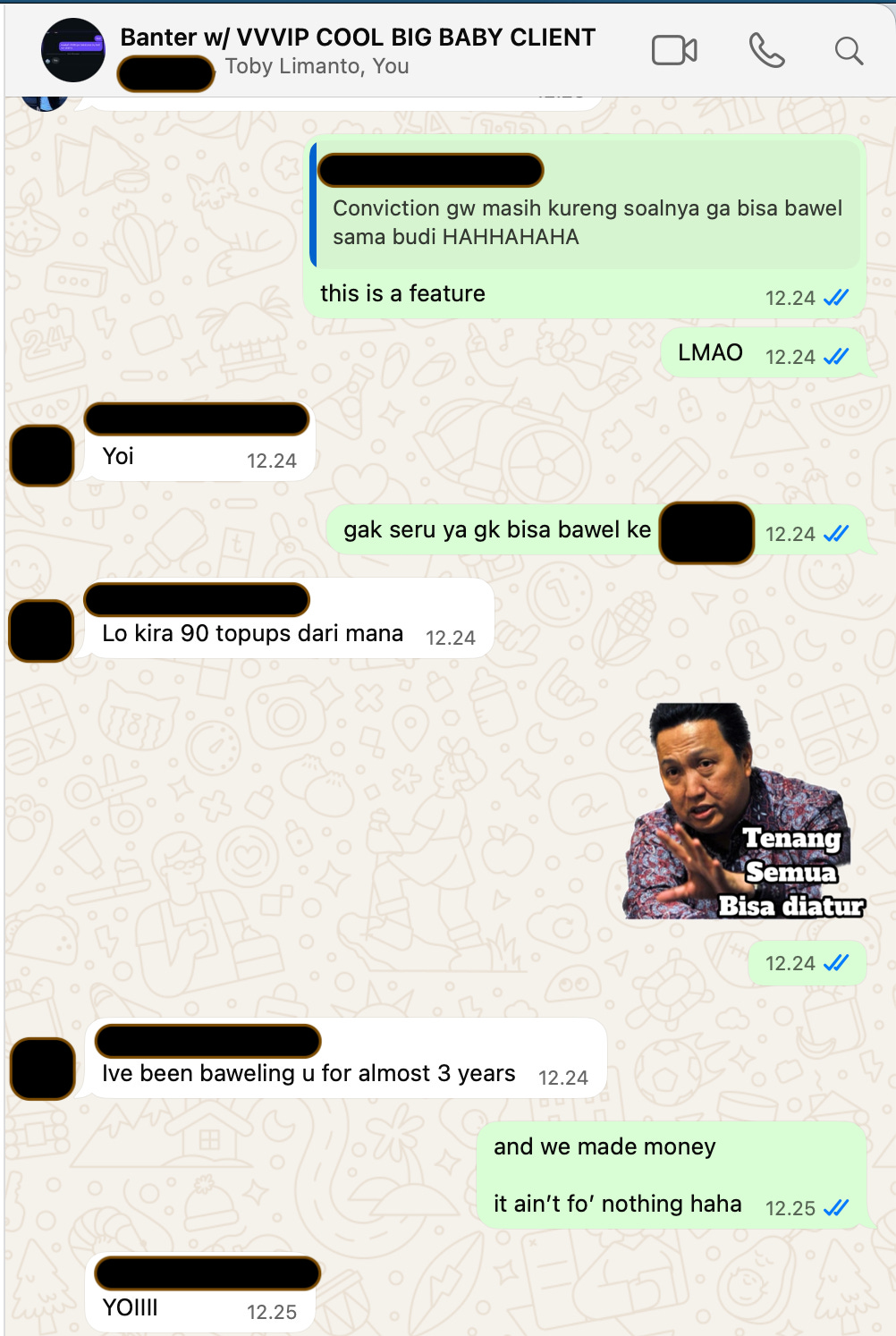

Transparency is a Feature

The final reason our clients stay with us—some for three years now—is transparency.

We don’t hide when the market is tough. We stay in the trenches with them.

Every single client has their own dedicated WhatsApp group with us.

If they’re feeling nervous or need some “penguatan iman” during a market crash, we are right there to explain our conviction.

That trust isn’t built on flashy marketing; it’s built on 1-on-1 communication and being easily accessible just 1 WhatsApp away.

Let’s Conquer 2026

If you’re looking for a “get rich quick” scheme, we are not the right fit.

Our approach is built for a different kind of investor.

We are for those who value Consistency, Transparency, and Peace of Mind on their path to retirement.

This strategy is less about market noise and more about a foundational investing mindset. If you share this perspective, you might find value in an article we wrote on this exact topic: “The Right Mindset to Equity Investing.”

2025 was a solid year of building. We stayed the course and kept our clients’ portfolios healthy.

Now, let’s go and conquer 2026 together.