Disclaimer

The performance figures presented in this article are provided for informational and educational purposes only. Past performance does not guarantee future results.

While we strive to ensure accuracy, the data shown may contain minor inaccuracies due to rounding differences, timing differences, or variations arising from trade confirmation documents.

This content does not constitute financial advice, investment recommendations, or an offer or solicitation to buy or sell any securities. Investment decisions should be made based on your own financial circumstances, objectives, and risk tolerance, and—where appropriate—in consultation with a licensed financial advisor.

It’s that time of the year again, although we are a bit late this year due to some travelling and time off from work. The close 2nd order of priority is to shave down excess weight accumulated during the holiday period. But 1st order of priority is, you’ve guessed it, review our own performance. Mostly for our own evaluation so that we can do better, but also to satisfy the curiosity of some (kaypoh) clients.

In the last 2025 meeting with our investors in December 2025, our investor made a remark that truthfully made me slightly sad.

Seems that the growth in 2025 is a bit slow ya

Even after the call ended, that remark kept ringing in my head. I had mixed feelings about all this, which I don’t really know exactly how to describe. On one hand, our books were in the green. But it still fell short of the 10x expectation that a freshly injected start-up has to bear.

Rather than wallowing in sadness or trying to comfort myself by telling myself that “at least we grow”, I think what is most helpful is to evaluate objectively what happened, what went well, and what fell short of our own expectations.

So here comes the juicy part.

Soft New Customer Acquisition

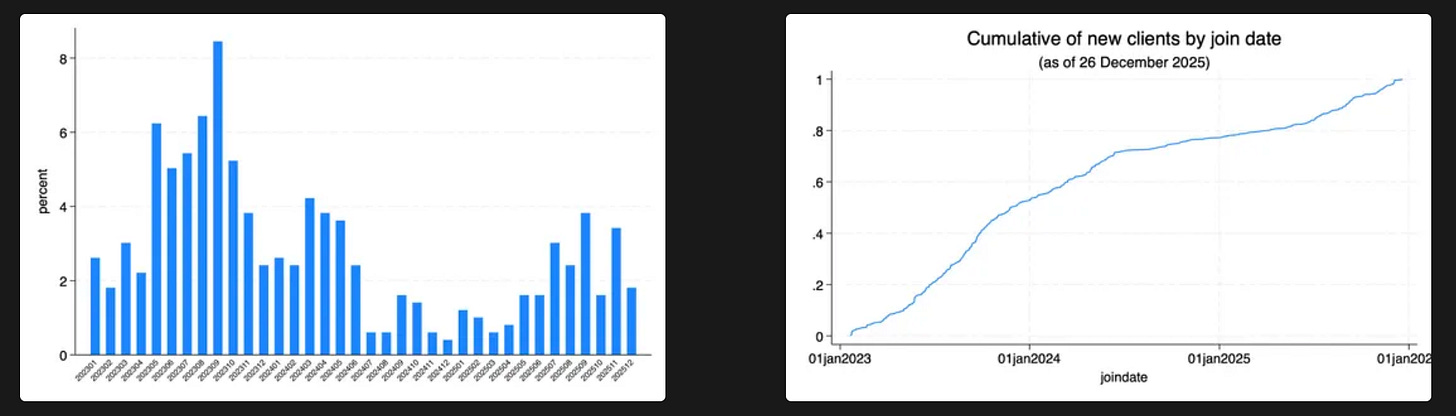

The number of new clients in 2025 was rather muted, especially in the first half of 2025. If you look at the chart on the right, we get 50% of our clients within the first year of our operations in 2023. In 2024, we acquire about 30% of all our existing clients. In 2025, we only acquired 20%.

The first half of 2025 was rather brutal for us. If you recall in your not so distant memory (although perhaps it’s better that you don’t keep in your memory anymore), it was the period where Trump announces trade wars with China, the times where Indonesia’s youths saw the country as dark and hopeless, and the era where companies with real business and solid financials were deemed repulsive. Capital market participants way prefer companies with narrative plays.

We would actually count ourselves as extremely lucky to still be able to acquire that 20% of customers. So thank you to all those who still chose to join us despite all the signals to do otherwise.

What about churned clients?

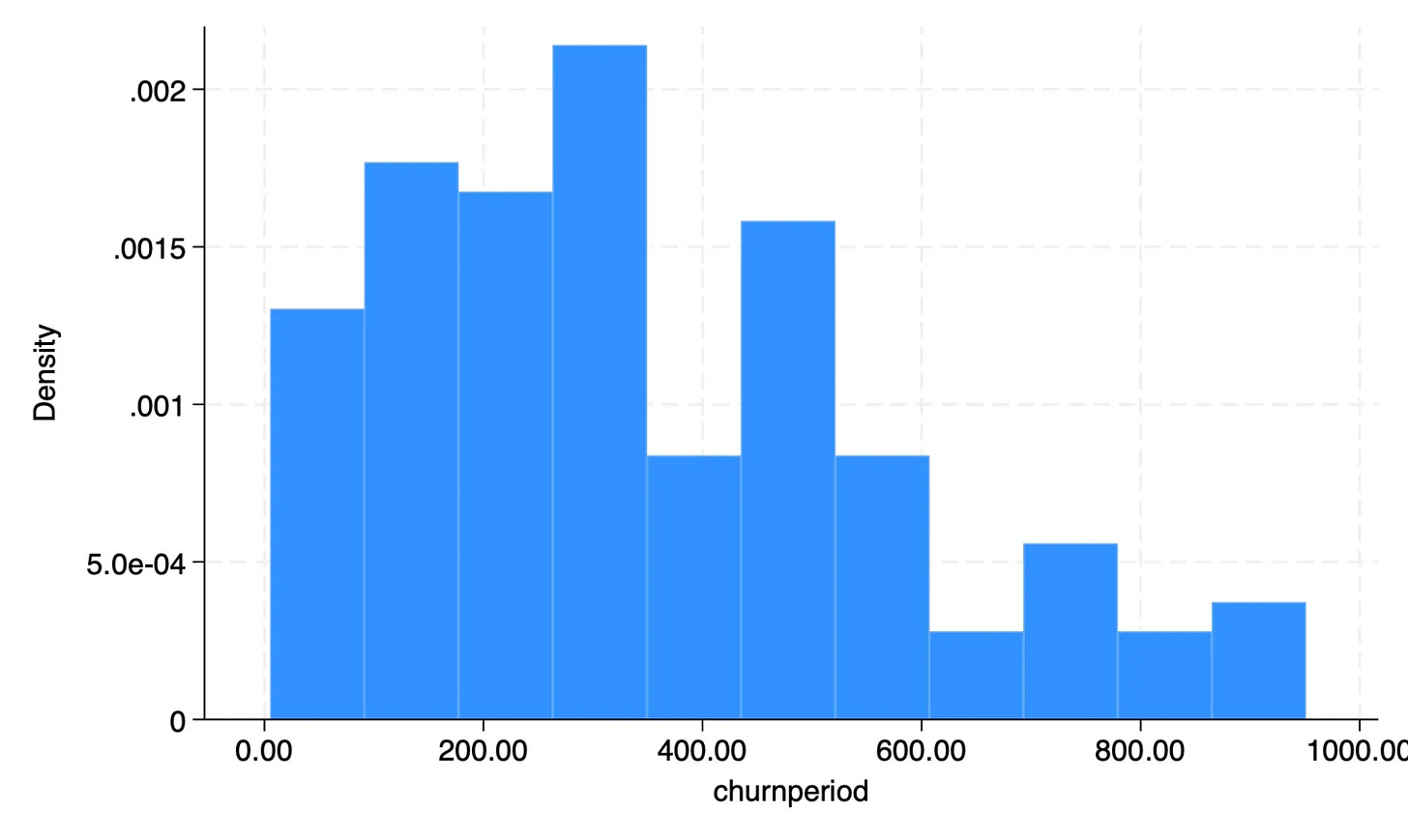

So far, out of all clients who signed up, 26% ended up leaving us.

Among those who churned, the median length they stay with us is 319 days or about 10 months. The average length is 351 days or close to 12 months.

There are some common reasons people leave us. One of the main ones is needing extra cash for their life circumstances, such as capital expenditure for their new business ventures, house renovation, wedding expenses, big ticket items, etc etc. When clients leave us for these reasons, usually we are extremely happy for them because most of the time, they leave with positive growth in their portfolio. This makes us happy because we feel that have done them right, playing a small role in giving them additional funds for their life milestones. We are altruistic in some sense, but I suppose we are ultimately self-interested, because we feel good when others feel good.

The second biggest reason is usually feeling dissatisfied with the slow and boring growth of their portfolio. And we cannot blame them for feeling so. Usually, our clients’ portfolio will take some time to show significant price movement. For 80% of the time, their portfolio will look like a straight horizontal line. Meanwhile, if these people are active on social media or on trading groups, they will see their friends bragging multibagger returns of 100, 500, or even 1000%. Some will inevitably boil with the envy of those who flex their rolexes and lambos. And so they leave us in the pursuit of these rolexes and lambos, both of which Toby and Budi have yet to have.

Committed fund growth

Despite the slow client growth, 2025 has taught us an important lesson. When market is pessimistic and fearful, there lies opportunity. We are very fortunate that our existing clients know not to be fearful when the market seems gloom and doom. Rather, they inject more capital. Kudos to them really for having a steel and contrarian mentality. We are even more honoured to serve those who stick around and had the courage to believe in us in difficult times.

The first half of 2025 saw our clients topping up the most. This is a good practise that we hope to keep.

Be fearful when others are greedy. Be greedy when others are fearful.

Special Client Shoutout

I have to give a special shout out to our scariest client CS (or ChaoS, if you remember from our previous blogpost) also known as the VVIP Client (yes, the title belongs to you sir). On top of being awarded the most chatty and demanding client, he also won the award of the largest number of topups, at 91 top ups over the course of his 959 days with us. This means that he topups almost every 10 days. I know this guy is crazy, but I did not know that he is this crazy.

Performance

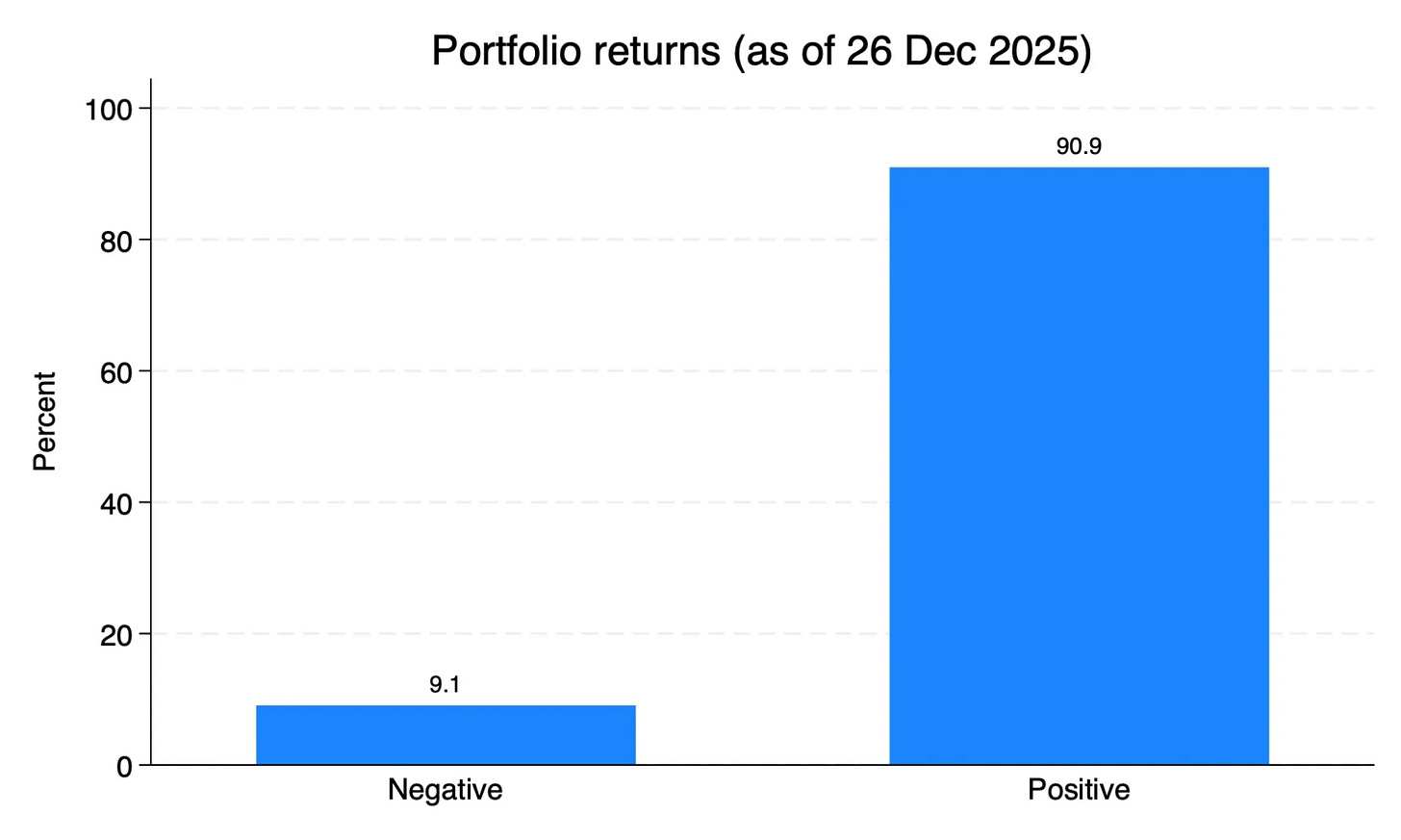

Since our inception in January 2023 until December 2025, 91% of our clients’ portfolio are in the green, while 9% are still in the red.

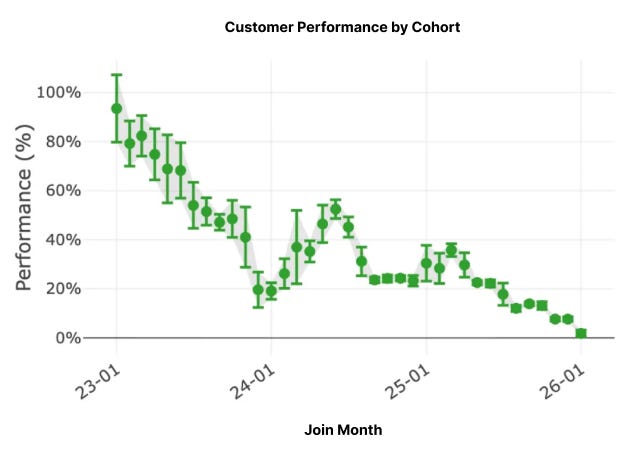

Although fast forward to today (as this blogpost is posted), I am happy to say that 100% of our customers are in the green, including those who just joined most recently. Yep, thanks to unexpectedly large interim dividends from companies that we invest in 🙂 We keep boxplots like below to keep track of our customers’ performance by cohort since their join date. Oh and it is updated live too at our landing page. We think that this type of performance chart is superior to the simple line chart that most funds use.

Why? Because our income largely relies on each and every one of our customer’s performance. So we are not interested in “aggregated returns” if on average, our customers are not making money. Also, 1 customer not performing to us is 1 customer too many. We want all of our customers to profitable for as long as possible, not because we are saints, but because we are self-interested. We want our customers to be grow their portfolio again and again so that we can be earn again and again.

Our profits come from yours.

Furthermore, the chart above tells us a really important information. It manages expectation of our prospect customers because it most likely would be sucky if a customer only has been active for a month. But on the flip side, the longer the customer wait, by and large would give larger and larger returns. Again, we are self-interested: we want our customers to recompound their wealth so that we can recompound our profits (very much pun intended).

Did we beat the index?

Actually in 2025, we did not beat the index. Boohoo.

Despite the crazy saga that happened to Indonesia in early 2025, IHSG grew by a whopping 22.1% in 2025! Even more difficult was the driver of growth happens to be stocks with narrative plays, having large market caps that are beyond our risk appetite. I.e. fundamentals do not match the prices that these companies were trading at. So we sat the narrative stocks rally out.

But does it matter though? Nope, because our performance was about 17.5% in 2025. Not stellar, but pretty decent. To us, all that matter is consistent performance rather than beating the index. If one year the index is -10%, we won’t be happy beating the index with a -9% performance. We’d be a happy with a +10% performance. Although that probably would be a super hard year.

Closing Remarks

What’s up on 2026? Well, we have written about that. In a nutshell, it contains our thoughts on Artificial Intelligence and how our investments are uniquely positioned to capture its growth. If you are curious, you can always read it here. I promise you it is interesting 🙂