Equity Investment Can Be Low-Risk High-Return, IF …

But instead, many tend to make it High Risk Low Return

Equity investment is often seen as risky, but it doesn’t have to be. If approached correctly, it can even become low-risk with high returns. Yet, many investors make it riskier than it needs to be due to certain behavioral traits. Let’s look into the two biggest culprits:

1. Impatience: The Urge to Keep Moving

Impatience is a major reason why investors miss out on potential gains. When people feel they must act constantly—rebalancing portfolios and attempting to time the market—they drive up brokerage fees and miss out on gains from stocks that needed time to mature.

While I've already touched on market timing in a previous post, where it is scientifically proven that doing market timing without sound reasoning damages your investment returns, it’s worth emphasizing again: in their haste, investors often sell too early, just before their stocks have a chance to reach their true potential.

The results? Higher trading costs and the loss of value that could have materialized with a bit more patience.

2. FOMO: The Fear of Missing Out

FOMO is equally dangerous. It lures investors into buying stocks at overly high valuations, hoping to catch a trend.

But by the time many jump in, they’re paying a premium price—sometimes far above the stock's intrinsic value. This behavior increases risk, because now there's little margin for error. When you are buying at high prices, even a slight correction can lead to steep losses.

Investors who let FOMO and impatience affect their decisions tend to see their portfolios suffer in the long run.

But rest assured, this is perfectly normal behaviour — Even for Geniuses

It’s not just you or me; even the smartest minds fall prey to these traps. The famous physicist Isaac Newton is a prime example.

In 1720, he invested in the South Sea Company, a British joint-stock company that saw its stock price skyrocket amidst wild speculation.

Newton initially sold his shares for a nice profit, but as the stock continued to rise, he couldn’t resist the urge to reinvest. He bought back in at a much higher price, only to see the bubble burst soon after, wiping out most of his investment. His estimated losses amounted to around £20,000—a huge sum in those days, equivalent to millions today.

Reflecting on his loss, Newton is believed to have said, “I can calculate the motion of heavenly bodies, but not the madness of people.” This quote perfectly captures the danger of letting emotions override logic in investing. Newton fell victim to the same irrationality of many investors today. FOMO and impatience can undermine even the best-laid plans and the smartest of the geniuses.

I can calculate the motion of heavenly bodies, but not the madness of people.

A Good Tip: Study History

Yeah the common behavioural pattern you see today has existed for longer than you might have expected. Studying history is often times useful for us to reduce FOMO. Markets have always moved in cycles, and each new wave of excitement is rarely unique. Recognizing this can keep you grounded when it feels like you're missing out. FOMO has been an inseparable part of human behavior throughout history, showing up time and again:

The 1630s Tulip Mania in the Netherlands: This was one of the first recorded speculative bubbles. At its height, tulip bulbs were being sold for the same price as houses, purely based on the belief that prices would keep rising. When the market for tulips collapsed, prices plummeted, leading to financial ruin for many who had invested at the peak. It shows how irrational exuberance can inflate asset prices far beyond their intrinsic value.

Japan’s Real Estate and Stock Market Bubble in the 1980s: During the 1980s, Japan experienced a massive economic boom, leading to sky-high prices in real estate and the stock market. Investors believed that Japan’s economy would continue its upward trajectory, jumped onto the bandwagon and consequently pushed prices up even more. But in the early 1990s, the bubble burst, leading to a prolonged economic downturn known as the “Lost Decade.” It’s a reminder that even the most prosperous economies can see a sudden and painful correction.

The 1990s US Dot-Com Bubble: The rise of the internet created a wave of speculation in the late 1990s, with investors pouring money into tech stocks at astronomical valuations. Companies with no proven business models or profitability attracted massive investments. When the bubble burst in 2000, it wiped out trillions of dollars in market value and left many investors holding worthless stocks. This event underlines the importance of sticking to fundamentals rather than chasing hype.

The 2006 US Housing Bubble: The widespread belief that housing prices could only go up led to reckless lending and borrowing practices. As people speculated on real estate, prices surged, fueled by easy credit. When the housing market collapsed, it triggered a global financial crisis, highlighting the danger of speculative bubbles and how deeply interconnected global markets can be.

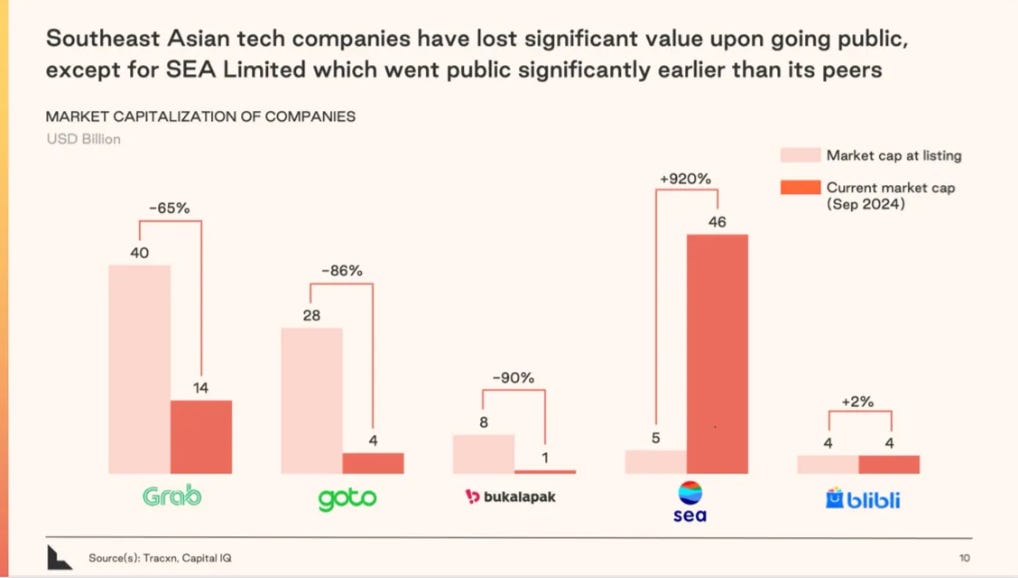

The 2022 Indonesian Tech Bubble Burst: Closer to home, the excitement around tech companies like GOTO and Bukalapak in Indonesia led to inflated stock prices. Investors rushed in, believing these companies would reshape the digital economy. However, as reality set in and growth prospects were reevaluated, stock prices tumbled, leaving many investors with heavy losses. It’s a contemporary example of how FOMO can drive valuations to unsustainable levels.

Source: Lightspeed Venture’s report titled “Southeast Asia: Resetting Expectations”

The share price of other Indonesian tech related stocks which burst on 2022. Imagine clueless people jumping on the bandwagon and bought the top! Investing: 20% hard skill, 80% managing your emotions

So, what does this all mean for us? Investing is fundamentally simple—but not easy. It’s not the technical side that trips people up; it’s the psychological challenge. How do you resist the urge to follow the crowd? How do you maintain patience when it seems like everyone else is recording sizeable GainZ 💪?

This is where the 20% hard skill comes into play. It’s the ability to identify undervalued opportunities before they become widely recognized. It’s spotting potential where others see uncertainty, getting in before the hype builds up and prices soar. This requires deep research and having the foresight to see what others might miss.

But mastering this 20% is only part of the equation. The remaining 80% is managing your emotions—overcoming FOMO, sticking to your strategy, and being patient enough to wait for the right time.

Investing is 20% about finding opportunities, but it’s 80% about the discipline to hold on to them. Mastering this balance is what truly sets long-term investors apart.