Hi 👋 welcome to Recompound Blog - The Investment Mindshift. We help you better your mindset on investment and economics one article at a time.

This is a continuation to the article navigating Indonesia’s Investment Terrain. One sentence summary:

Being a working adult in Indonesia is hard especially if you want to accumulate wealth. The only options available seem to be short term in nature. Chasing hype, gunning for returns, etc.

What to do..

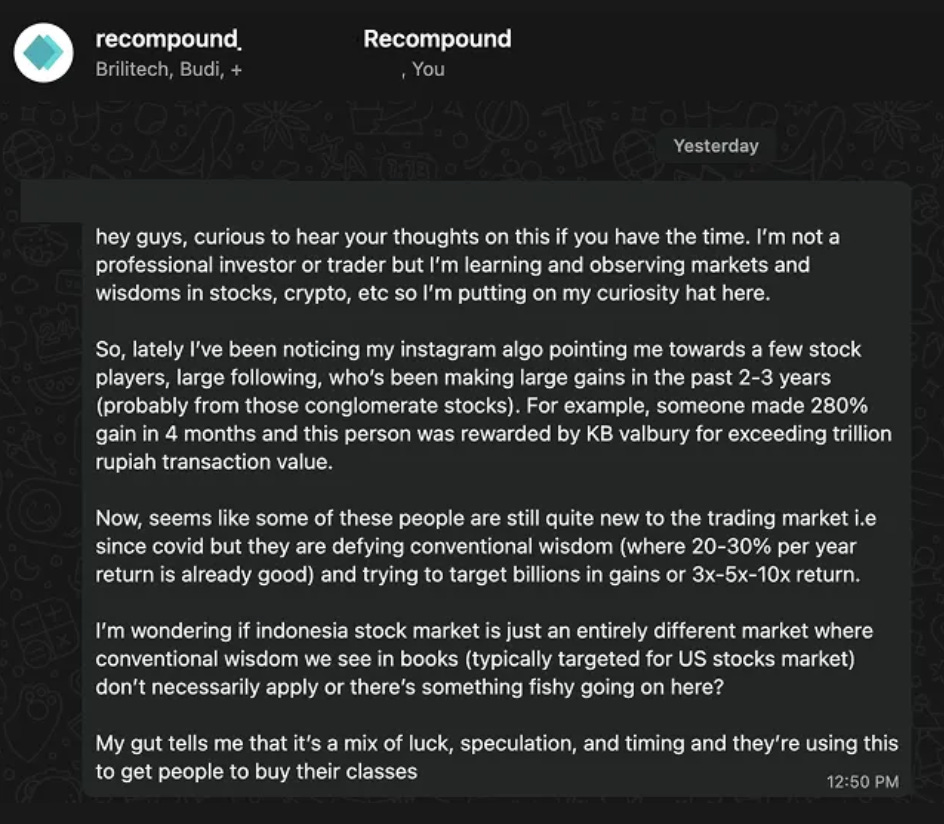

And the problem is so real that it is also felt by many of our clients. One of them is Sherwin.

If the image is not clear enough, here’s what he asked:

“hey guys, curious to hear your thoughts on this if you have the time. I’m not a professional investor or trader but I’m learning and observing markets and wisdoms in stocks, crypto, etc so I’m putting on my curiosity hat here.

So, lately I’ve been noticing my instagram algo pointing me towards a few stock players, large following, who’s been making large gains in the past 2-3 years (probably from those conglomerate stocks). For example, someone made 280% gain in 4 months and this person was rewarded by KB valbury for exceeding trillion rupiah transaction value.

Now, seems like some of these people are still quite new to the trading market i.e since covid but they are defying conventional wisdom (where 20-30% per year return is already good) and trying to target billions in gains or 3x-5x-10x return.

I’m wondering if indonesia stock market is just an entirely different market where conventional wisdom we see in books (typically targeted for US stocks market) don’t necessarily apply or there’s something fishy going on here?

My gut tells me that it’s a mix of luck, speculation, and timing and they’re using this to get people to buy their classes”

This is a very good question that is not easy to answer

Because we don’t know two things:

How lucky is the influencer in question

How skilled is the influencer in question

And therefore, how legitimate is the influencer in potentially bringing or inspiring returns for their followers. But aside from individual brilliance, there’s another layer to the question:

if we play it right in Indonesia, we could “3x-5x-10x return”. And this potential returns is unique to Indonesia.

I will answer the easier question first: is Indonesia unique as a market to bring in crazy returns?

No, I don’t think so. There’s a possibility of getting crazy returns in virtually any market given extreme individual brilliance or extreme luck. Even in the slow, boring Japanese market, if you all in on MUFG stock in late 2023, you would more than double your investment by early 2025. And MUFG is not a penny stock, it is a large cap company.

But did you all in on MUFG? Probably not.

But there might be someone in Japan who did. We don’t know.

That person in Japan might attribute his investment success on MUFG doubling to their luck and/or individual brilliance. And here’s the thing:

Possibility sells. Probability confuses.

In Daniel Kahneman and Amos Tversky’s seminal 1979 paper, “Prospect Theory: An Analysis of Decision under Risk,” they explained a powerful, predictable pattern in how humans make decisions under uncertainty.

It really was not about complex math, but a simple psychology. They presented subjects with two choices.

Problem 1: The High-Probability Choice

In this scenario, the odds of winning are substantial.

Overwhelmingly, people chose B. The near-certainty of winning $3,000 felt much better than the riskier, coin-flip chance at $6,000. When the probability of winning is high, we become risk-averse. We prefer to lock in the more probable, although smaller, gain.

Now, watch what happens when the context shifts.

Problem 2: The Low-Probability Choice

Go ahead. Take your time to choose.

…

…

Now most probably, you’d choose C. I mean I would choose C too. But here’s the thing.

Mathematically, Problem 2 is just Problem 1 with all probabilities slashed by a factor of 450. A rational person’s preference shouldn’t change. But it does.

Again in problem 2, an overwhelming majority of people flipped their choice and picked C.

Why? Because when probabilities are minuscule, our brains stop processing them logically. The difference between 0.1% and 0.2% feels irrelevant. Both are just “long shots.” or “mere possibilities”.

So our brain focuses entirely to the prize.

The decision-making process becomes:

“Well, if I’m going to get incredibly lucky anyway, I might as well get lucky and win the big prize.”

This is the Possibility Effect. We don’t value tiny probabilities linearly; we massively overweight them. The simple shift from 0% (impossible) to 0.1% (a possibility!) is a huge leap in our minds. To repeat, it is the change from 0 to 0.1% that our brain processes, not the concrete 0.1%.

0 → 0.1% is a big change!

0.1% → 0.2% is meh of a change.

Although mathematically, the magnitude of the change is equal. Now that right there is the psychological engine that powers the entire lottery industry.

The Influencer’s narrative to turn their success story into yours is “Problem 2”

Again, I am not saying that influencers are fraudulent (although probably some really are just insiders). But even if they are really that brilliant, their success story translated to your success story is a mere possibility.

Remember, it is not about the influencers that are smart or highly skilled. It is about you.

When they show you their portfolio, they aren’t offering you a 90% chance of making a safe 15% return. That’s boring. That’s probability, and probability is confusing.

Instead, they are selling you a “Problem 2” scenario. They are selling you Possibility.

They are implicitly presenting you with a choice:

Option C (The Influencer’s Path): A tiny, undefined possibility of a 10x return.

Option D (The Recompound Path): A less tiny, but still small, possibility of a 2x return.

So here’s why are you drawn to Option C: Influencer Path

Implicitly, I have mentioned that Influencer (Option C) and Recompound (Option D) only offers a possibility. That is why you are drawn to Option C. A big prize: life changing money! but at a very small percentage. While the Recompound path is boring. 20% on a good year?? Skip.

That’s one reason. But I am arguing that there’s another more powerful reason:

You think that Recompound path only has a probability that is slightly higher than option C.

That is where we (operators of Recompound) disagree whole-heartedly with you.

We think that the probability of achieving 10%+ returns is much much higher than just a mere possibility of achieving a big prized money. So to us, problem 2 is seen as follows:

C: A 0.0001% chance to win $6,000,000

D: A 95% chance to win $3,000

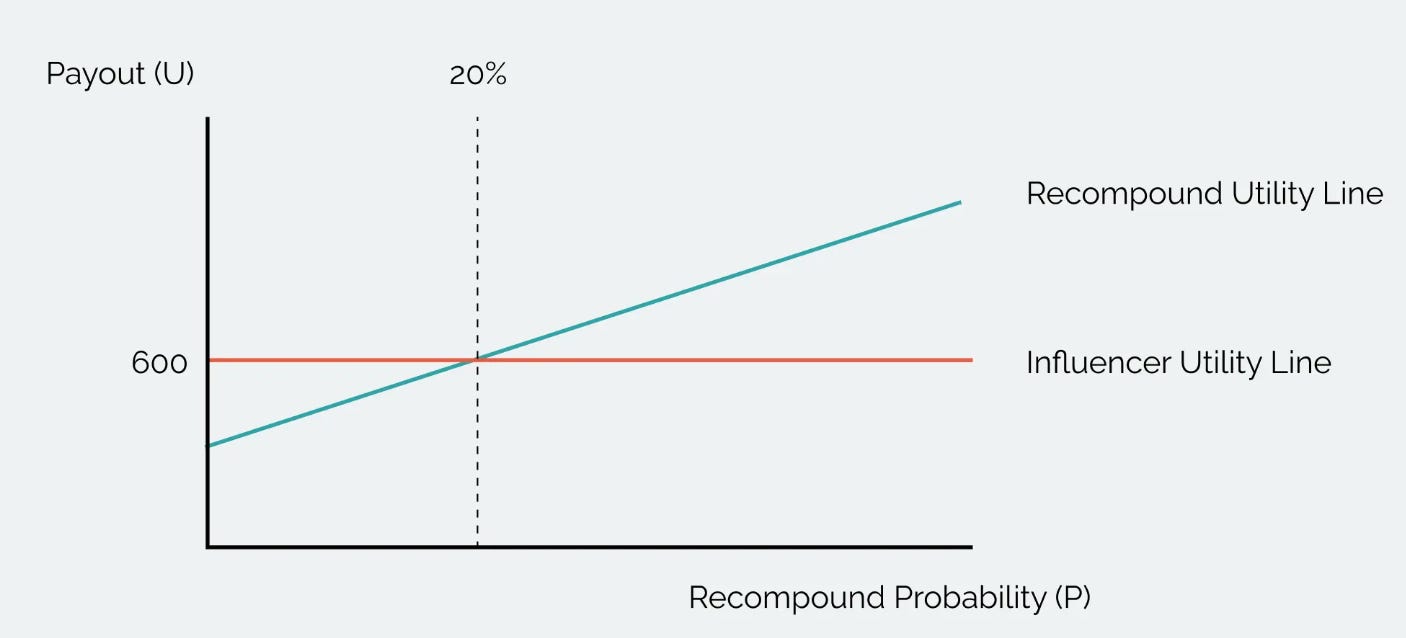

But then, at what probability does it mathematically make sense for you to choose option D? 20%. Now, look at this:

C: A 0.0001% chance to win $6,000,000

D: A 20% chance to win $3,000

That 20% still looks very uncertain psychologically! It is worse odds than a coin flip. Although you’d argue that 0.0001% to 20% is a mega leap. But still, you’d focus on the prize. $3,000 looks like a joke compared to a life changing $6,000,000.

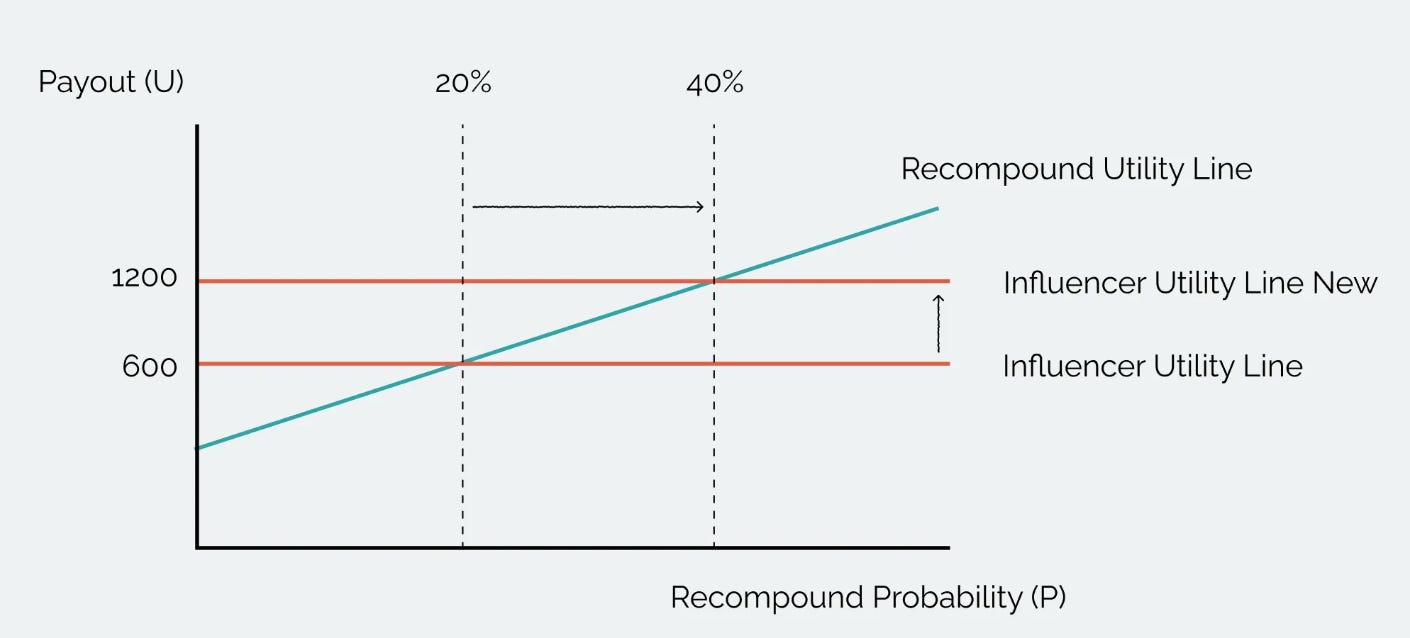

Furthermore, if the influencer does a very good job in marketing:

Using Ferraris, expensive watches → it increases the payout

Using smart jargons that you are quite fuzzy → it increases the perceived possibility

The next thing you know, the payout for influencers shift upwards and the probability for Recompound to be mathematically convincing enough for you needs to be doubled:

Just like in Kahneman’s experiment, your brain ignores the near-zero probabilities and fixates on the jackpot. The influencer’s success story, however rare, makes the 10x outcome feel possible. And that feeling is intoxicating enough to make you forget that the real probability of you replicating their success is likely closer to 0.001% than it is to 1%.

The influencer’s strategy less about financial education; it’s about exploiting a well-documented cognitive bias. They are selling lottery tickets disguised as stock market wisdom. They know, consciously or not, that the dream of a life-changing gain is a much more powerful motivator than an analysis of likely outcomes.

But what should you be doing then?

Well, for starters, you kinda need to consciously fight your own brain’s programming. That’s hard. So kudos to you if you’ve been doing it successfully overtime 🙂

Especially since you now know that bad influencers are framing their pitch as a “Problem 2” (lottery ticket) scenario, your job is to re-frame it as a “Problem 1” (risk management) scenario.

You have to force your brain to do what it hates doing: ignore the glittering prize and focus on the cold, hard probability.

Ask yourself these three questions:

What is the real probability of me losing? Don’t focus on the influencer’s win. For every one of them, how many people tried the same strategy and failed? 100? 1,000? If you conservatively assume a 99.9% failure rate, the choice is no longer about the size of the prize. It’s about accepting a 99.9% chance of a failed execution of an investment strategy.

What is the pain of that loss? Prospect Theory’s other great insight is loss aversion: the pain of losing hurts far more than the pleasure of an equivalent gain. The influencer only shows you the joy of winning. How about the loss? How bad does it sting? What happens if that investment does not work out? How does that really impact your life, your stress, and your future plans?

What is my certainty price? Instead of chasing the 10x dream, what is the guaranteed outcome you would accept right now? Would you take a guaranteed 6%? Or 10% return? over a 0.1% shot at 10x? If you’re honest with yourself, the answer is almost always less than 10x moonshot that is promised.

By deliberately asking these questions, you shift from the emotional, possibility-driven part of your brain to the analytical, probability-driven part. You stop buying lottery tickets and start making investments.

You will be minority

Let’s be honest. Very few people will read this article, even fewer will understand the argument (although if you read this, most likely you will understand the argument), and even fewer fewer will actually implement it.

Expecting everyone to fight their cognitive biases is like asking every smoker to quit cigarettes tomorrow after telling them that smoking causes people to get lung cancer. Logical yes, but it is not happening. Smokers love their cigarettes. It’s addicting. The same goes for the pull of greed, the promise of a quick jackpot, and the dopamine hit of a “hot tip”. They are addicting.

The financial market, especially on social media, is a terrain that thrives on this weakness. It wants a majority of people to keep buying lottery tickets. It wants them to chase possibilities, not probabilities. Why? Chasing possibilities, trading in and out every second the price moves is a good business if you earn from people’s trading activities.

But that’s the point. You don’t need everyone to be sober. Only you need to be.

By choosing to see the world through the lens of probability and risk, you are stepping out of the majority and joining a small, quiet minority. This group is really not looking for a miracle. This group looks for a small edge over and over and over again. We are not playing for a one-time jackpot (although a jackpot sometimes do appear and they are very much welcomed); but we are playing for replicable growth.

The good news is that this minority is where the real, lasting wealth is built. While the majority is busy chasing the next influencer’s dream, you will be quietly compounding. And overtime, you can take a guess who would finish strong 🙂

Closing Remarks

But this raises a critical question. We just talked about the majority “chasing the next influencer’s dream.”

How about your friends? Or that cool aunt who works at an investment firm? Surely it is alright to listen to them right?

Well, if you glean knowledge from them only, this means that you are doing social learning. And it can be dangerous… So let’s use mathematics to show its danger.

Understanding this mechanism is a step in protecting yourself against the madness of the crowd.

Truly a small and quiet minority.

Been reading somewhere that true value investing is a lonely journey after all. :)

Thank you for the piece!