This might be mind numbing. Because saying fundamental is dead and fundamental is not dead appears contradictory. Yet I think there’s merit to be accustomed with paradoxes in the real world. The examples are everywhere and I can’t help but notice it.

In physical sciences

The most fundamental theory on light presents that light exists as a duality. Light behaves as a wave and it behaves as a particle.

A German Physicist, Max Planck, showed that light energy is not released continuously, but rather, it is released in a tiny discrete packets he called quanta. This led to the concept of Planck Constant (h), which is a number that relates a light’s frequency (f) to the amount of energy that is being carried by a single unit of light (E).

But at the same time, light also exhibits in wave like property in the double slit experiment. Because as light travels through a double slit (imagine below)

Light source shining → | | → creates an interference pattern

Note: | | illustrates double slit that light passes

This experiment showcases that light behaves as a wave as it forms an interference pattern after passing a double slit. Therefore, light exhibits a contradictory nature by being a particle and a wave at the same time.

How do we reconcile the contradictory nature of being a wave and a particle at the same time? Well, it is (or at least attempted to be) reconciled by doing quantum physics, which is beyond my pay grade. But the point is, saying that light only acts as a particle or light only behaves as a wave is now accepted to be incorrect.

In running a startup

Dalton Caldwell, in the video about How Impatient should Founders be in the Pre-AGI era describes the seemingly contradicting advice: As a startup founder, you have to be both impatient and patient.

Impatient in getting the work done and making sure that progress is made. But also patient in understanding that hard problems requires time to solve. A skill requires time to be acquired and crafted. Michael even mentioned

“Look at the 20 software companies that you respect the most. Tell me which one of those blew up super fast. Which one was like they made it in a year?”

So day to day, founders should be impatient to get the ball going. But long term, founders ought to be patient because hard problems take time to solve. Sound piece of advice.

There are many more examples of truths that appear to be contradicting each other. In Islamic studies, in Al-Ghazali’s work Tahāfut al-falāsifa (incoherence of philosopher), he appears to be against Avicennian metaphysics. While later on he relied heavily on Avicennian philosophical tools in his work. Which seems contradictory.

But later on Frank Griffel argued for a resolution by distinguishing philosophy as method vs. doctrine. So Al-Ghazali rejects metaphysical conclusions that went against the revelation of the Qur’an but accepts the philosophical methods (logic, demonstration, classification of sciences) to serve the truth when properly used.

In investing

It really becomes apparent to me, at the very least, that fundamental is dead. But it is also not dead. Let’s discuss fundamental is dead first.

Fundamental is dead

We refer to the experiment that is run in UC Berkeley experimental social lab, presented by Dr Greg La Blanc. The experiment was originally designed by Prof Vernon Smith who won the Nobel prize in economics. And it was an eye-opening one in trying to discern how a bubble is formed. By definition, a bubble is formed when

The price of an asset continues to rise up far beyond its true fundamental value (or intrinsic value).

Famous bubbles in recent memory include the Dot Com bubble in 2000 and the housing bubble in 2008.

But one can argue that the existence of bubbles themselves is not a strong enough reason to say that fundamental is dead. Because the information that is available to market participants about the true fundamentals of the asset that is being traded can be different. Beauty is in the eye of the beholder.

For example, if a MacBook Pro is traded at $5,000 in the market, Toby might think that this MacBook Pro is worth $10,000. That’s why he buys at $5,000. But Budi might think that this MacBook Pro is worth $20,000. That’s why despite the price rise to $10,000, we still have a buyer, Budi, who expects the price to be traded at $20,000.

Now this experiment eliminates the uncertainty in terms of the fundamental value of the asset that is being traded. So the fundamental value of the asset is known to all market participants. No shocks, no nothing.

My dear reader, how do you think the market participants behaved?

Experiment setup

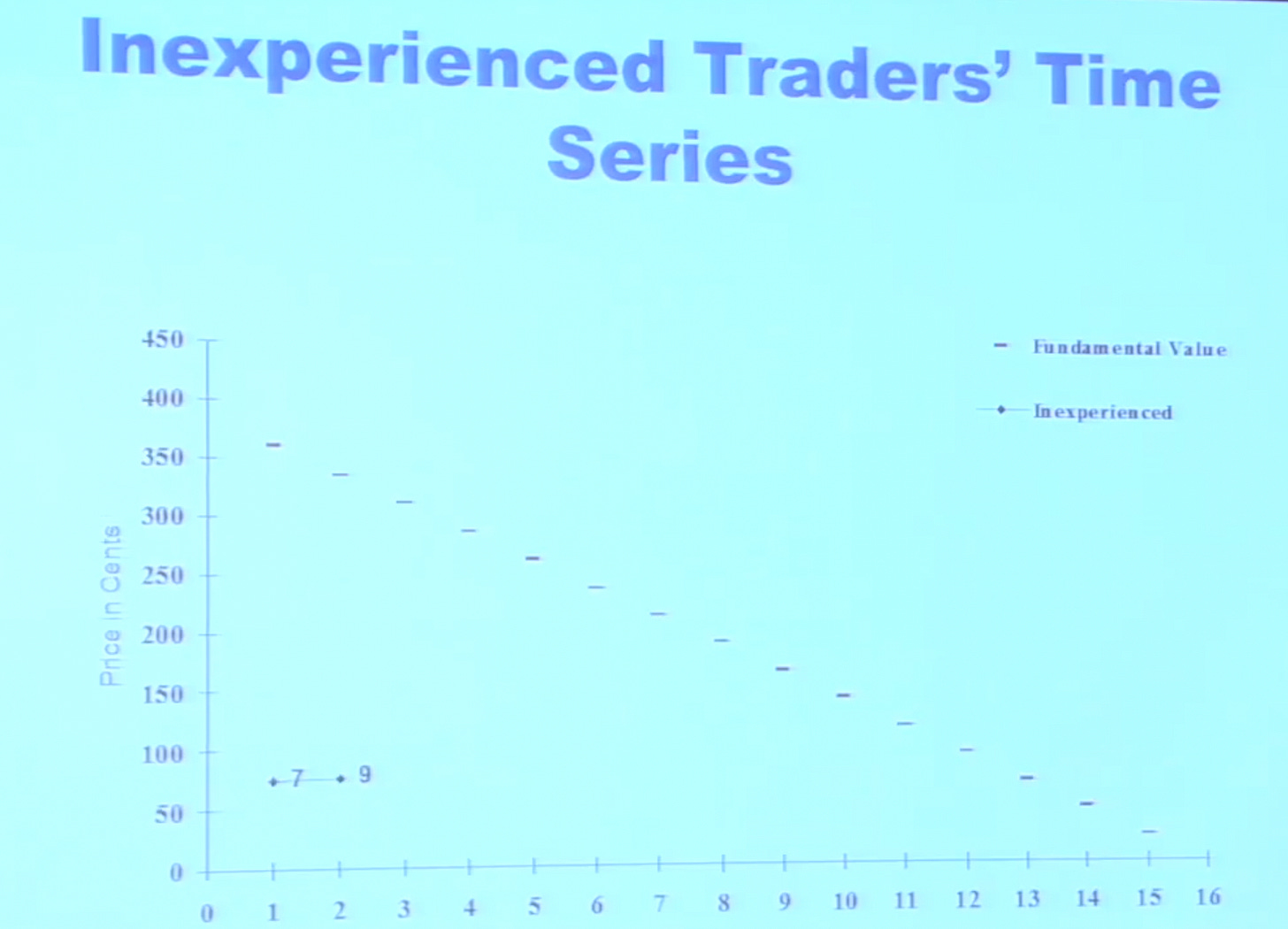

The experiment setup is as follows:

The fictional asset has 15 trading periods. So 15 trading days in the stock exchange if you will.

The fictional asset has a known fundamental value which is time period in the market multiplied by 24 lab dollars. So for example:

Period 1 → value of the asset is 15 * 24 = 360 dollars

Period 2 → value of the asset is 14 * 24 = 336 dollars

and so on.

…until the final period when value drops to 0.

Some participant received cash to buy assets. Some participant received asset to sell assets. This creates variation.

During a trading period, participants are free to input bids or offers (buy or sell) of the asset that is being traded.

At the end of the period, participant with the asset will get dividends ($24) that’s why the value drops all the way to 0 in day 15 . The distribution of the dividends is also known.

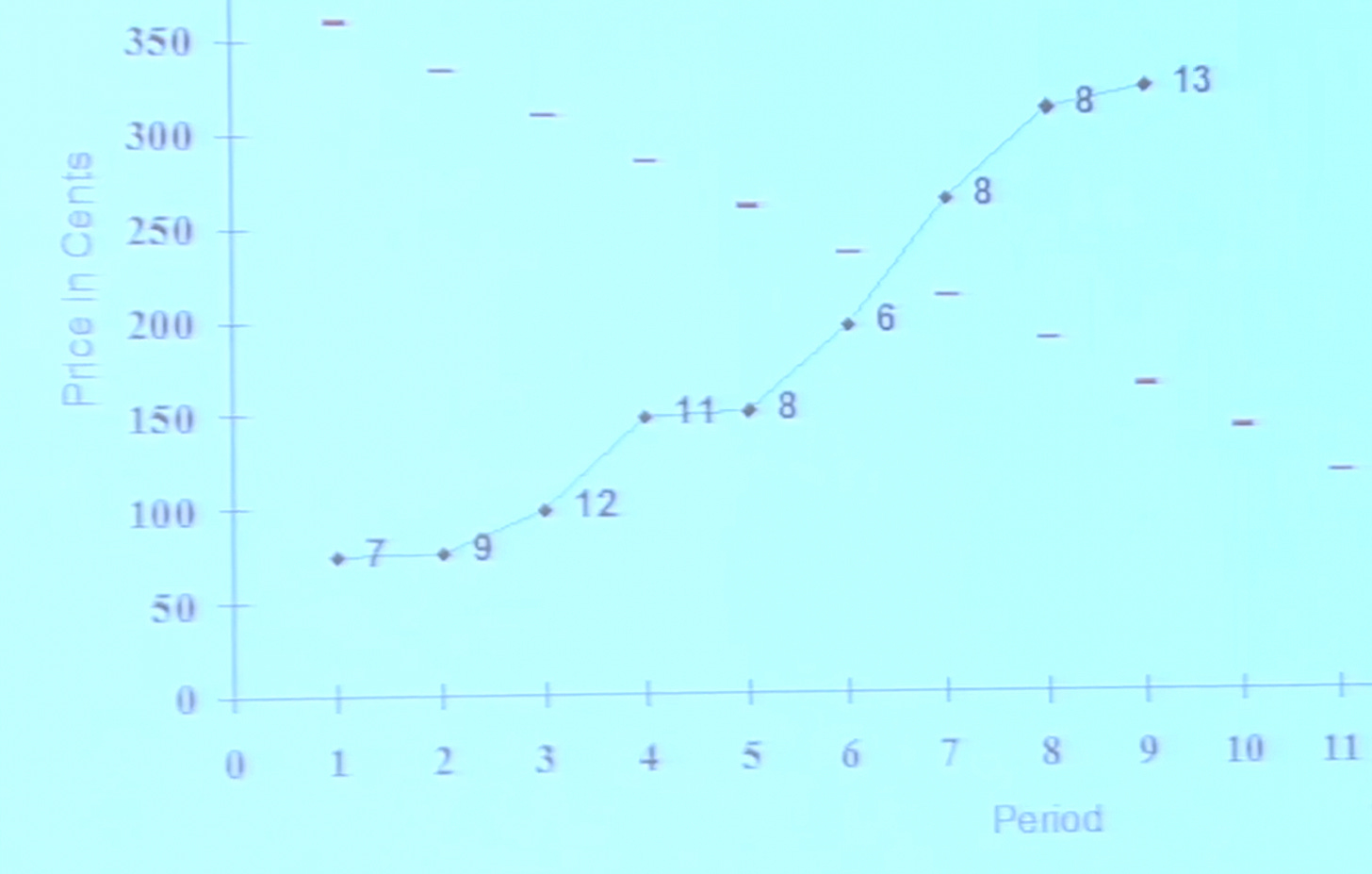

Fictional asset trading below fundamental value. Screenshot taken from Behavioral Finance and Investment Strategy from Berkeley Haas Alumni Network

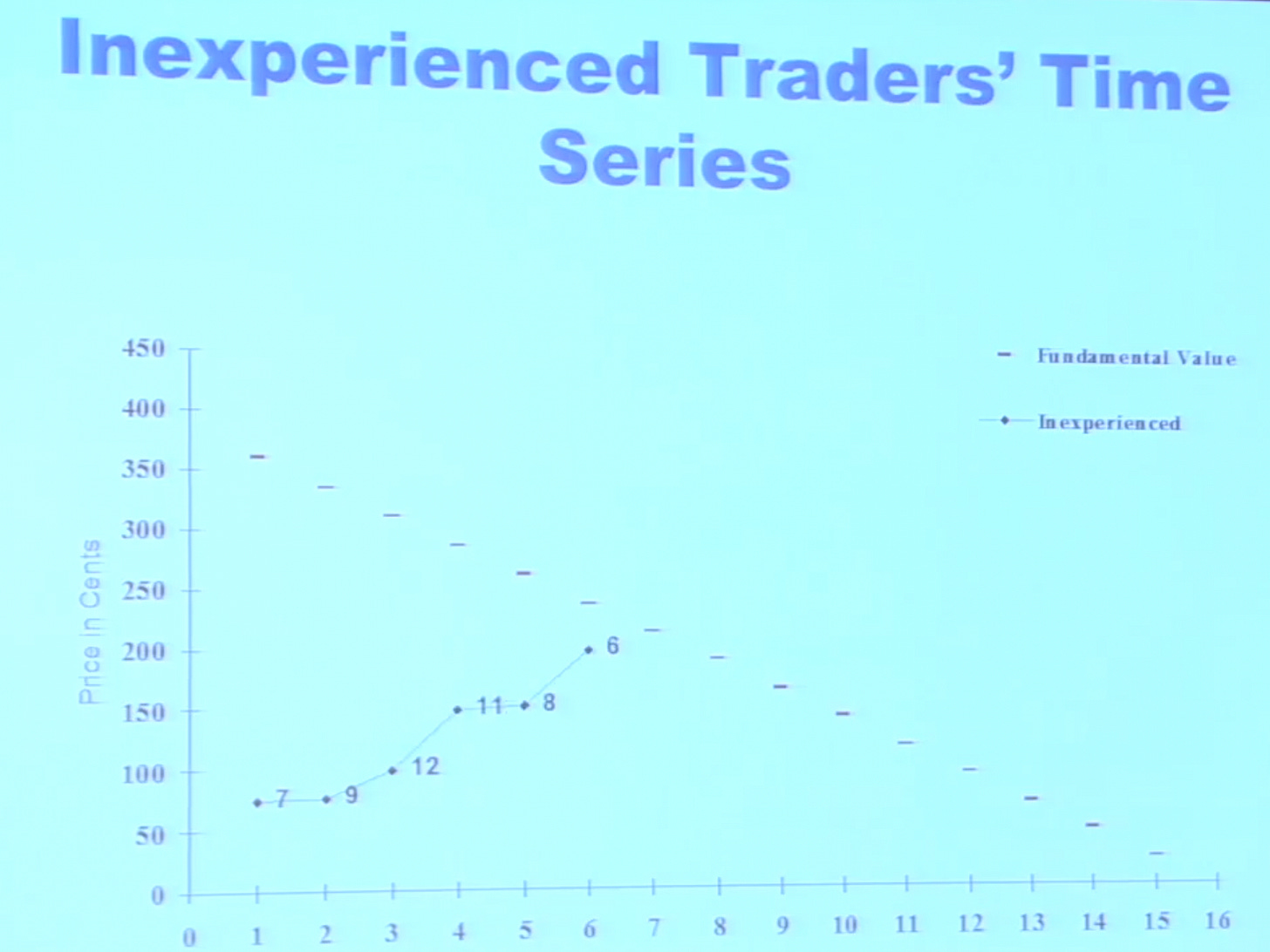

In the image above, you could see the flat line at each time period displaying the fundamental value of the asset. At the end of day 1 and 2. People are still generally timid. Only wanting to buy the asset far below its fundamental value (See price is only about $70 while the intrinsic value is at $300++). As more trading days have passed, we see that there is an increase of the asset price nearing its fundamental value as shown in the image below.

As the price now is almost equal to the fundamental value, we should be seeing that people would start to sell their assets and be more cautious of purchasing the assets beyond its fundamental value. But nope, it keeps going up.

The price starts to come down as people start to notice that the game is about to end. So they quickly sell their assets to lock in their profits as the price of the asset converges back to its fundamental value.

The best thing is, they repeat the same experiment to the same set of participants and they see similar bubble charts forming.

What does this tell me

It simply tells me that fundamentals of the asset doesn’t matter to market participants even when the fundamentals is non-contentious. They are still willing to sell assets below its fundamental value. And they are still willing to buy assets way above its fundamental value.

But when we zoom out

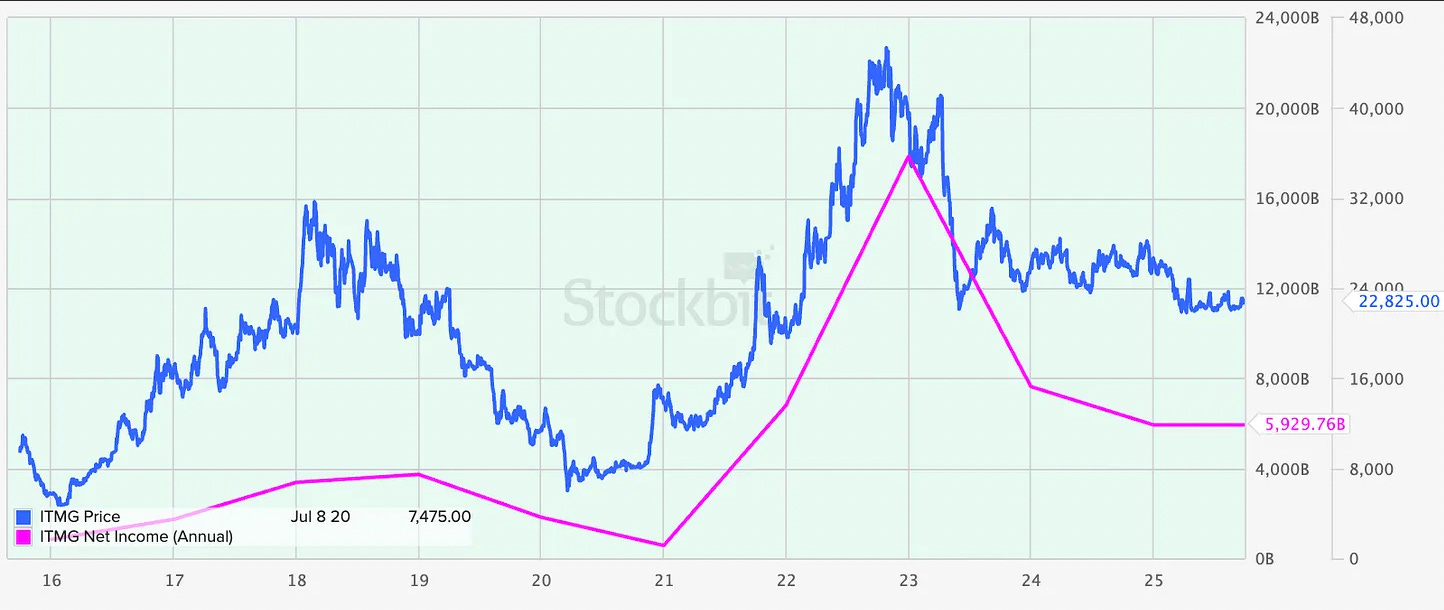

We know that fundamental is not dead. This is 10 year price vs earning chart of ITMG

This is 10 year price vs earning chart of BBCA (biggest non SOE bank in Indonesia)

This one is ARTO (a digital bank in Indonesia). Its price was far beyond its fundamental value and it ended up reverting back.

We also have an example of a price catching up to company earnings (TAPG). Examples are plenty.

After seeing these pictures and plenty of evidence, we can see that price tends to gravitate towards the fundamentals of the company in the long term.

Howard Marks in his recent memo Calculus of Value, mentioned that the price of an asset reflects the consensus of opinion of market participants surrounding the present and future value of the asset. But in the moment, the opinion does not has to be correct. If market participants are generally pessimistic, assets can be priced much lower compared to its intrinsic value. If market participants are generally optimistic, assets can be priced much higher compared to its intrinsic value. In the short run, price can move in any direction relative to its value.

But in the long run, he said that “value should be thought of as exerting a magnetic influence on price”. Exactly how it is illustrated in the charts I shared with you above.

Closing Remarks

If you are investing with a short time frame, it is likely that you will not consider company fundamentals (it is dead to you). But if you intend to invest with a much longer time frame, you might want to stick to the fundamentals. We happen to want to be in this game for a long, long time, so we are sticking to the fundamentals.

Now that you are aware of this paradox, you are already thinking on a level that 99.9% of investors never will. You are reflecting deeply, while the crowd is reacting emotionally.

But here’s the critical question: Why? Why is the crowd always so emotional? Why are they so obsessed with short-term stuff?

It’s because they are driven by a psychological force that is incredibly powerful. And if you don’t understand this force, you risk being pulled back into the crowd, no matter how smart you are.

So, what is this force? And more importantly, are you immune to it?