Recompound is risky af?

We recently came across a reddit discussion about Recompound.

A person came across Recompound and was intrigued. But he wasn’t sure whether Recompound is legit and wanted to hear from others - be it their thoughts (as non-Recompound clients) or hopefully their experience (if someone is a Recompound client).

We thought the discussion was very useful. Of course, we should be skeptical of anyone who offers investment products. Heck, Recompound team members themselves are even skeptical of any financial, investment, insurance, even health and beauty products.

We fully respect the opinions posted. After all, we are free to like/dislike something. For example, I like to buy coffee from Kopi Kenangan while Missy thinks it’s better to brew her own coffee at home. Budi does not drink coffee at all.

But let’s look at the reddit conversation. We would like to address them from our own perspective. However, note that we are not trying to defend ourselves or claim that we are the best service for everyone. Ultimately, we all have our own tastes and preferences, and we have the freedom to buy/not buy something.

How it all started

The person who started the thread was someone who had little time and interest on investing (we assume he meant on learning investing). His question was whether Recompound would suit him.

If we were to answer this question from Recompound’s perspective, we would further ask him the following questions:

What do you see investing as?

If your answer is a quick money-generating source (cara untuk cuan cepat) → then Recompound would not fit you, because we focus on long-term value investing. To have a quicker growth, there are other ways to do so, such as day-trading although we don’t recommend this at all because it typically carries more risk too.

What is your investing horizon?

If it is less than a year → then Recompound would not fit you, because again, we focus on long-term value investing. If you foresee that you would need this money you intend to invest with us within a year, then Recompound is not the best product for you. We have written about how you can be unprofitable with us.

“Looks risky and shady af”

People who responded to this initial question felt that Recompound is “risky and shady af” because of the profile of the founders and the team.

Indeed, I look like a secondary school student. Although Budi and Erik look like secondary school students with muka boros.

But jokes aside, we would say that these comments do make some sense.

I graduated from university in 2020 (pretty fresh as a grad, indeed). I had ~2 years working at Goldman Sachs Singapore. Previously, I also worked at other financial institutions (UBS, Refinitiv and Creador), as an analyst. Also true that I am not a professional in the Indonesian stock market. For what is worth, I started investing in the Indonesian market on my own in 2017, but maybe that doesn’t count much.

Budi graduated from his undergraduate study in 2018 (also somewhat fresh, but not very). He was previously a data scientist at GoTo and Shopee. But Budi later quit his full-time job and wanted to become a full-time trader in 2021 because he felt he could earn more than his salary.

Yes, Budi and I started building Stockpeek in early 2022. And yes we don’t work on it anymore as there are other co-founders that should probably be still working on it (last time I heard from them). Budi and I have a different vision from the co-founders of Stockpeek had. But at its core, Recompound was built from our experience at Stockpeek, from the conversations we had when doing market research with Stockpeek. You can think of Recompound as a spin-off.

Imagine this: you want to open a healthy-food restaurant to make people healthier. You thought people like salad and therefore your restaurant is called Salad House. But after a year, you realise that people don’t like salad and prefer shirataki fried rice, and so you renamed your restaurant Shirataki House.

So now here comes Erik. Erik graduated from his undergraduate study in 2013 (I don’t think he is a fresh grad although he will take it as a compliment if you think he looks youthful). He was a financial analyst at a securities company for close to 3 years, later became the head of research for another 3 years, and became fund manager in 2020. Some people may think this is enough experience, some may not think so. But we leave it you to your opinion. He is a Chartered Financial Analyst (CFA) and has WMI license.

Again, is he a famous investor wizard like Lo Kheng Hong? Of course not. But is he good? I think he is exceptional.

15 years of (combined) experience?

Doesn’t make sense unless they have traded/invested since they were primary school kids

We combined the experience of Erik, Budi, Toby, and other team members behind the scenes.

Erik has 9 years. Budi and I also started investing since 2017, but became much more serious in 2020. But it doesn’t count that much so lets discount it heavily. So let’s say we have 3 years of experience, each. Total 15 years. At the moment we also happen to have 2 analysts and 1 intern. If we combine their investing experience as well, the numbers become kind of absurd.

So we are really not lying, but it’s fine if our audience really want to be very pedantic. We revised our website to just 5+ years of experience to capture Erik’s experience alone. Erik is only 1 year away from the 10-year mark, but we’ll be precise and keep it at 5+ years.

Perhaps that smaller number would capture the notion that we don’t want to claim to be a know-it-all investment guru. We keep learning from Mr. Market who is the best (although sometimes brutal) teacher.

Natural selection

With questionable track record, let’s see if Recompound will still exist in 5 years’ time or during market crash. In other words, let natural selection does its work.

This cannot be more true (on natural selection).

Recompound will only exist in 5 years’ time if we are really that good. If we are not good and our clients’ portfolios don’t grow, we won’t have any profit. If this continues year after year, we will die. But what does this mean for you as our clients:

If we are really that good and we survive: good for you too, because it means you will profit from your investments

If we suck and get eradicated by nature (the stock market): your portfolio size shrinks. This is unfortunate indeed, but at least you don’t pay any Recompound fee and your money is with you still. Not ideal but I think it is still somewhat better than having to pay fixed management fees for mutual funds. Again, that’s just my opinion. If you think that paying fees through mutual fund even when you lose money is okay, you are entitled to your opinion.

I have 500 million, but only disclose 50 million

How do they (Recompound) know?

Now it seems the issue has morphed from not trusting us at all, to over trusting us :)

Yes, we have thought about this.

And yes, we cannot stop you from gaming our system. In fact, information leakage is always a problem. If you trust a famous investor so much let’s say Lo Kheng Hong, you can technically see his investment holdings and copy it by heart. Or if you trust an equity mutual fund, you could take a look at their top holdings and buy them yourself without paying the management fee.

Also from our perspective small versus big cheque sizes have different strategies. If 2 clients come to us, 1 with 50 million portfolio value and another 1 with 500 million portfolio value, they will receive different portfolio. The diversification and risk management strategy will also differ.

But if you trust us enough to use a 50 million portfolio strategy on a 500 million one, feel free to do so 🙂

Better to start with standard mutual funds and slowly learn about risk management?

One responder recommended starting using standard mutual funds using Bibit, Pluang and Bareksa, slowly learning risk management, or even opting for low-risk low-return like fixed deposits.

Yes, these are all valid options. Comparing mutual funds, fixed deposits and Recompound - each of these products have their own pros and cons. Ultimately it all comes back to you as the investor to determine what you want and what you feel comfortable with. But if we are given the chance to make our case, here’s how we differentiate ourselves from the other 2 alternatives:

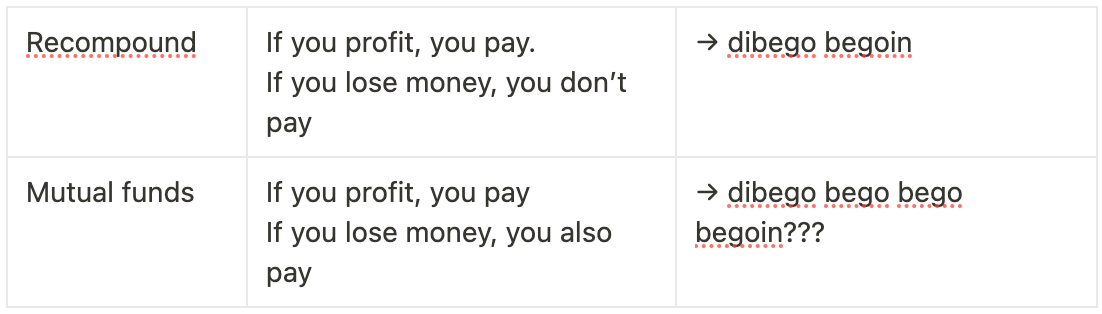

Mutual funds: in some sense, we are like mutual funds. We create a portfolio, but just more tailored to your cheque size and timing. Also, we take away all the fixed fees you have to pay, so you really only pay if you profit (see our discussion on this here).

Fixed deposits: fixed deposits are indeed more low-risk as they guarantee fixed returns. But you have a limited upside. With stocks, you have greater upside but greater risks too.

You should know what your money is used for

100% couldn’t agree more. This is why we have a couple of features (shameless plug here):

For all of investment information we issue to our customers, it comes with an investment thesis and justification. Our customers will then actively execute the transactions themselves.

We issue monthly updates on people’s portfolio to talk about updates. We also periodically update our customers on our views regarding the stock selections.

With Whatsapp signals, there is no learning curve.

Precisely. And that’s why our service is tailored for people who don’t have the time to learn, nor the interest to learn. If you are keen to learn investing, we are happy to refer you to other good communities / people (such as Midascuan, Thinksite, etc).

An analogy for you: Budi orders food from Gofood every day, but Missy cooks most of her meals every day. If Budi orders food from Gofood, he never learns how to cook. But this doesn’t matter for Budi because he doesn’t have the time nor the interest to learn cooking. In contrast, Missy loves cooking and doesn’t mind spending the time and effort learning to cook.

“Kalau untung bayar kalau rugi ngga mau tanggung renteng … dibego begoin iyaa ”

We’ve talked about this extensively in this blog post.

But let us give you a preview of our thoughts:

Just put all your cold money to SBN or RDPU, my dude

Yes, we think it’s a good idea to do so if you prefer something that is low-risk low-return.

“No downside in trying”

“Coba dulu aja, nanti hasilnya kayak apa tolong kabarin kesini ya”

We would be more than happy if you want to give us a try.

Or you can try to get to know us first through a conversation, feel free to schedule a call with us via this link.

Closing Remarks

Thank you Reddit folks for the discussion and we invite you to keep them coming. We are at an early stage of our journey and we take constructive feedback and criticism very seriously.

Our mission is to help busy professionals in Indonesia to invest more intelligently for the long term. With this, we hope that retail market penetration in Indonesia would continue to grow bigger and healthier.

Cheers!