The Story of Recompound’s Performance Based Fees

Pure performance-based fees: stupidly naive or innovative?

After running Recompound for about a year, many have been asking us whether our performance based fee model make sense for the long run.

Some of them even criticized our model as “stupidly naive”, because they argued that this is unproven and there is no comparable companies, even outside Indonesia, relying solely on performance fees.

Therefore, rather than repeating ourselves multiple times to different people, perhaps it would be more efficient to write a post on this matter.

However, before continuing, let us be clear that we are not a hedge fund. While the fee structure clearly resembles one. There are some fundamental differences, for example, we do not hold custody of our clients’ funds.

Good Artists Copy, Great Artists Steal

Surprise surprise! We are not the first one to adopt this model.

The 0% management fee, purely performance based fee portfolio management service has been around for at least half a century in the fund management business.

In 1996, Steve Jobs misquoted Pablo Picasso and said:

Good artists copy, great artists steal

It means: you may not be the first to try something, but you did it so well that everyone thinks of you when they see that style.

I’m quite confident Recompound did that, being perceived as the pioneer in purely performance based fees, in Indonesia 🇮🇩

Fun fact:

Very few people noticed our fee structure is actually based on Warren Buffett Partnership in the 1960s.

We are not ashamed of doing anything that is proven to work & has value. If it its not broke, don’t fix it. 👨🔧

The Warren Buffett Partnership

Before Buffett started turning Berkshire Hathaway from a dying textile business into a multinational conglomerate holding company, he actually ran an investment fund between the years of 1957 - 1968, called the “Buffett Partnership”.

Back then, Buffett was a handsome 27 year old lad, started his own fund with a 100 USD capital, with his limited partners chipping in 105,100 USD.

He regularly wrote letters to his Limited Partners. The letters are online and can be read here: https://www.ivey.uwo.ca/media/2975913/buffett-partnership-letters.pdf

Along those years, Buffett killed the general market & the competition. Here’s how his performance looked like compared to Dow Jones Industrial Average (DJIA) and other funds:

However, the purpose of this blog is not to discuss about his godlike consistent performance & his investment philosophies. But rather, his unique fee structure.

Here’s how he structured the fees to his clients:

0 - 6 - 25

0% management fees: if the fund does not perform, clients pay nothing to Buffett

6% hurdle rate: Clients pay nothing for the first 6% of their returns

25% profit sharing: Once the fund crosses the 6% hurdle rate, Buffett charges 25% of the rest of what the fund returns

High watermark: clients only pay performance fees when the portfolio is at its peak value. Let’s do a simulation:

If a client invests $100,000 in Buffett and he gain a net of 20% the first year, that client now has $120,000 which is his high water mark

If the next year he loses 16.67% they’re back down to $100,000

In year three, if he gain 15%, Buffett gets paid nothing because that only gets the client’s account to $115,000

The account has to get back over their high water mark of $120,000 before Buffett gets paid and he only earn performance fees on returns above that mark

For more simulations, you may watch this YouTube video:

Recompound’s fee structure is the same as Buffett’s, with the following relaxations:

We don’t have the 6% hurdle rate

20% profit sharing fee (instead of 25%)

Charged monthly (instead of yearly)

There’s a fixed registration fee

The purpose of this is to set realistic expectations with clients and filter out gamblers & speculators who get in only for short term gains

This acts as a “lock up mechanism” since we do not hold our clients’ money

And these are the reasons why we cannot copy Buffett’s structure as is:

We are not Warren Buffett, he is the G.O.A.T

We are not able to hold people’s money due to legal restrictions in Indonesia. We are targeting the vast Indonesian retail population, not only the rich ones (although we welcome rich people too!)

We are a startup and need to survive the early days with limited budget + cashflow restrictions

The fairest fee structure in the World

Here’s what Buffett’s BRK partner Charlie Munger said on the fee structure:

The philosophy behind this is pretty clear:

Incentive alignment: the fund manager wins if and only if the clients win

Skin in the game: If a fund manager is so good at capital allocation, why shouldn’t he put his money alongside his investors and go up and down with them?

If a bad period hits, why should the clients pay the fund manager when no value is delivered to them?

But that is the 60s, right? Surely no one does this scheme nowadays?

Not really,

Mohnish Pabrai, a renowned investor, copied Buffett’s fee structure verbatim. He is still managing his funds until this day, managing ~1 billion USD in AUM (https://en.wikipedia.org/wiki/Mohnish_Pabrai)

Here’s what he said regarding the fee structure:

My investors love my fee structure. In fact, if the entire fund invest industry adopted my fee structure the industry will disappear.

So my fee structure which was copied straight from Warren Buffett is there are zero management fees. I don't get paid anything by assets management. The first 6% of returns go to the investors. Above 6%, I get 1/4 and they get 3/4 so if you are up 10% I get 1%.

It's subject to high watermarks. If you're up 5% we get nothing and if we're down we get nothing. And like I said if the industry adopted that fee structure which I would love them to do, they would just disappear.

Besides Pabrai, more funds nowadays are championing for 0% management fees. You may see the list of funds which implemented the fee structure here: https://www.guyspier.com/zero-management-fees-a-survey/

Pure performance fee structure is a natural fit for a low-trust society like Indonesia

We are confident this is what Indonesia needs embedded in its investment products.

This is because Indonesia is a low-trust society.

There is just too much bs (read:fraud) happening in the investment space here:

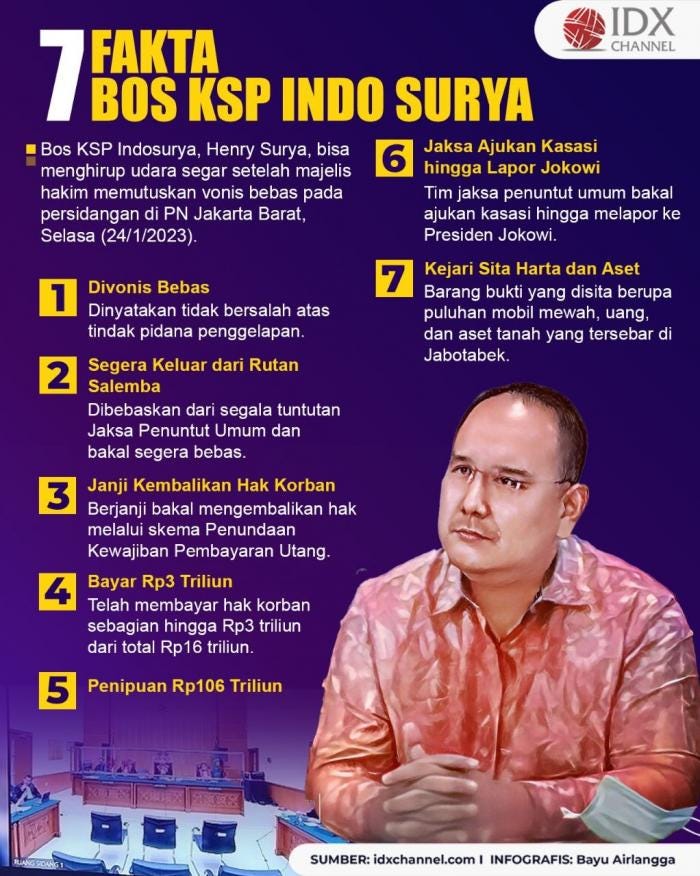

Indosurya, Binary Options, Asabri Jiwasraya, …

p.s. If you are not Indonesian and have no clue on what those names are, just Google them, you’ll be amazed 😎. Do you think Sam Bankman-Fried’s FTX & Do Kwon’s Terra Luna scandals are big enough? Think again.

Btw the scandals above are the well known ones, there are another thousands not covered by media happening daily.

We can do another blog post discussing the popular investment frauds in Indonesia in details. If you are interested, let us know in the comments section.

Having an OJK stamp on your website does not help either

Heck, even investment platforms which are officially regulated by OJK (the Indonesian Monetary Authority) like P2P lending are starting to go under.

The fact that their business model does not make any sense but OJK still approved them, really appalled me. I did an article on Indonesian P2P lending, go give it a read if you are interested!

In fact, the P2P bubble is starting to burst, with many victims starting to speak up. Here’s one of them speaking up on 1 of the popular media outlet eCommurz.

What really stuck me is when the lady in the interview said she is already tired of investing in any forms (even time deposits!), and just prefer put her hard-earned money in her 0% yield savings account, while daily goods inflation in Indonesia is around ~10% per annum (btw I don’t believe the government’s 2% official figure).

The son of the renowned Indonesian lawyer Hotman Paris Hutapea, Frank Hutapea, even claimed that OJK has a huge risk of losing their credibility if the Investree scandal is not well managed.

This is further exacerbated by the fact that the official mutual funds (especially the equity ones) here are not performing (https://www.bareksa.com/id/data/reksadana/index/detail/3/indeks-reksa-dana-saham).

All these reasons contributed to why Indonesia becomes a low-trust society. Everybody is just tired with all the mishaps happening in the investment space, with their money just sitting idly in their little-to-no yield bank accounts, rotten by rising inflation year by year.

And the numbers do not lie, Indonesia’s % Savings to GDP ratio keeps rising, even surpassing India’s:

This is why Indonesians need an investment solution which:

Has incentive alignment baked into the system (I win if and only if you win)

Skin in the game: the fund manager put his money alongside his investors and go up and down with them

Hence the pure performance based fees.

I win if and only if YOU win.

No one is implementing this in Indonesia at scale, so we are becoming the pioneer who jumped on the opportunity

Before Recompound, I was a Data Scientist at one of the Indonesian decacorns, building credit scoring models for their “Buy Now Pay Later” product, which is a consumer financing product for buying small check items.

Between this job vs building Recompound, I was faced with 2 options:

Making Indonesians poorer by lending them money with exorbitantly high interest rate, for buying useless shit and get instant gratifications

…Or making them rich enough in the long run so they can retire peacefully when they are unable to obtain active income anymore

I chose the latter, even if that means forgoing that big fat paycheck and live like a student for the first few years.

Don’t get me wrong, I’m not a saint and I want to get rich too. But the temptation after looking at the market size & opportunity, is too hard to ignore 😋.