Hi 👋 welcome to Recompound Blog - The Investment Mindshift. We help you better your mindset on investment and economics one article at a time. More: Our Values | Advisory | Get to know us | Picks

Disclaimer: This post is for educational purposes and is not investment advice. Figures cited (e.g., P/E ratios) are point-in-time snapshots that change frequently. Past performance does not guarantee future results. Index data and third-party sources are believed reliable but not guaranteed.

Ask any random strangers about BBCA and most likely you’ll hear:

“It’s the best bank in Indonesia, it is safe and it is always growing. Just buy that damn thing!”

My uncle is like that — he religiously buys BBCA every month, no matter the price. Like attending the church every Sunday. He buys BBCA every month.

To him and to many people, this makes a tonne of sense. Analysts on Sudirman Street (a.k.a the Indonesian Wall Street) loved it too.

Back in Dec 2023, BRI Danareksa restarted coverage on BBCA with a BUY and a target price of Rp12,100, using a valuation anchored on the bank’s returns and a low “required return” (their term for the return investors demand).

In Sep 2024 (~1 year later), UOB Kay Hian also had BUY with TP Rp12,000, based on a simple Gordon model that assumed ROE ~21.5%, growth 8%, cost of equity ~10.7%—and at that moment their screen even showed consensus at 100% “Buy.”

I am sure that at this point, you might be expecting us to roast BBCA as a company. Well we posted an article about being idiots last week. But I don’t think we are that crazy in trying to convince you that BBCA is a bad company. As a matter of fact, BBCA is a superbly great company.

It has a market leading CASA ratio of around 82-83%

It is a money making machine that produced north of Rp 50 Trillion in net profits last year

Strong and reputable management. I mean what do you expect from Djarum Group. They are as solid as it could get.

So BBCA must have been a great investment… right?

Well, not recently.

If you bought BBCA on 1 Sept 2023 and held until 25 Aug 2025 (~2 years), including dividends, your total return is about negative 2.9%.

Your money basically stood still and got nibbled by inflation.

Comparing returns between BBCA and ASII for the past year

Meanwhile, the “doomed” Astra International (ASII)—which the news said would be eaten alive by Chinese EV makers—returned +34% from Feb 2024 to now (dividends included).

If you bought BBCA in Feb 2024 instead? Negative 3.9% (also already included dividends).

How can the crowd favourite go nowhere, while the doomed child surges? Let’s break it down in plain language.

Why start the comparison with ASII in Feb 2024? Because that’s when J.P. Morgan published its ASII downgrade 2nd time in 6 months. We anchor the start date to this moment to reflect peak negativity—right when sentiment and expectations were most pessimistic.

Quoting the folks in the research report below: We downgrade Astra to UW for the second time in six months. Our downgrade this time is primarily attributed to BYD’s faster than expected entry into the Indonesian market, and we believe the market share loss for Astra could be faster and more severe than earlier expected as BYD delivers start in Mar24 (vs. initially 2H24). Based on our visit to BYD’s first mall exhibition, consumer interest was palpably high and the price range of cars is in-line with our expectations. It is also now confirmed that Astra is not distributing BYD and thus, we see higher downside risk for its auto distribution & manifacturing margins in the next two years. We now forecast Astra’s FY24-25E NPAT to decline -10/-6% y/y (vs. consensus flat y/y for both years).

You could clearly see that the author is deeply pessimistic about ASII’s business performance from the released research report. Because of his mall visit and people’s reactions towards the new line of cars. It was said: Astra’s FY24-25E NPAT to decline -10/-6% y/y. What does it mean even? So I chatgpt-ed it.

So from the mall visit and seeing people liking the car, folks at JPMorgan forecasted that the company’s net profit will decrease by 10% in year 2024. And it will be reduced further by 6% in 2025 compared to previous year, 2024.

But returns from investing in ASII is showing a different result. Including dividends, it has returned +34% from Feb 2024 to Aug 2025 at the moment this article was written.

ASII vs BBCA: Dividends adjusted, Feb 2024 until Now (Duration: ~1.5 years)

Why is this the case?

Expectations > Events (good news can make stocks fall)

The market doesn’t react to the news. It reacts to whether the news is better or worse than what everyone already expected.

Imagine going to a recently opened restaurant that has your favourite Masterchef celebrity cooking its main dish. You come in, super ready to have a bomb of a meal. Now it turns out that the meal is really great, fancy and instagram worthy. But it is not the best meal because maybe the portion is a little bit too small and it is a little bit too salty overall for you.

Despite the great experience, you might still be slightly disappointed. 9/10 instead of 10/10.

Now on the contrary, if you heard that Bakmi GM (noodle chain in Jakarta) has been reducing its portion since it got acquired by Djarum (the company that owns BBCA)! You go there expecting to have a shit experience. But when you sit down and order its chicken noodles and it just tastes like home. You are pleasantly surprised. A meal that you expect to be so-so, is “surprisingly not that bad”. A 7/10 instead of a 5/10.

Stocks are like that:

If expectations are high (everyone is bullish, headlines are glowing, target prices are stretched), even good results can feel “not good enough,” and the price can stall or fall.

That’s BBCA recently: amazing company, but priced for perfection. When the “price tag” cooled a bit, the stock went sideways even though the business stayed strong. (Those BUY calls and rosy inputs show how much good news was already baked in.)

If expectations are low (people are pessimistic, the story sounds broken), you don’t need miracles—just “less bad than feared”—and the price can rise.

That’s ASII: the crowd expected disaster and a fatal knock out from Chinese competition. When results turned out not that bad, the stock re-rated upward.

In investing, the gap between what’s priced in and what actually happens is where returns live.

Lets hammer the point home

A great company, as it turns out, is not always a great stock to buy at the moment. It can be too expensive.

Think of stocks like buying houses.

Company quality is the house itself—structure, location, service, finishing.

Stock price is the price tag stuck on the house.

BBCA is the luxury house — Crème de la crème — top location, perfect finishing. Flawless.

But if you buy it at a top-shelf price, you don’t get a bargain just because it’s nice. If the market later decides that price tag was a bit too rich, even a well-kept house can fall in value or move sideways.

This is what often trips people up.

We blur “great company” with “great investment at today’s price.”

So what went “wrong” for BBCA holders ? (in simple terms)

TLDR:

BBCA has a “A” business with a “A+” price:

1) Expectations were already sky-high.

When almost everyone already agrees a stock is fantastic—remember that 100% buy consensus snapshot—there’s very little surprise left to push the price meaningfully higher. Good news = “as expected.” Any wobble (slower growth, currency swings, higher rates) can disappoint.

2) The “price tag math” moved against you.

Return over time ≈ business progress (profits grow) + cash paid out (dividends) ± what people are willing to pay for each rupiah of profit (the “multiple”).

If profits rise but investors later decide, “we won’t pay quite that much for BBCA’s profits anymore,” the multiple shrinks and cancels out a lot of that progress. Both Danareksa and UOB show BBCA trading at premium P/B/P/E versus peers—great business, rich price.

3) Rates & “required return” went up.

When safer yields rise, investors demand a better deal to hold stocks. Danareksa explicitly based fair value on a required return (“cost of equity”); as the market repriced that higher, valuations drifted down, especially for already-expensive “quality” names.

4) Low dividend won’t bail you out.

A ~3% yield is nice, but not enough to offset a stagnant or slipping price. (UOB’s table shows sub-3% yields across the forecast years.

Why did ASII, the “doomed” stock, outperform?

TLDR:

ASII has a “B” business with a “C-” price, Expectations were the mirror image:

Bad news was already in the price. Many investors assumed Chinese brands would steamroll ASII’s entire business. When everyone prices in disaster, the bar to beat expectations is low: reality only needs to be “less bad than feared.”

Starting price matters. From depressed valuations, you don’t need perfect news to rise—okay news is enough.

Astra isn’t just cars. It owns financing, Astra Honda Motor with 70% market share, heavy equipment (Komatsu), coal contractor (Pama Persada Nusantara), coal mining, gold mining, nickel mining, automotive parts, used vehicle marketplace (OLX Mobbi), IT services, agribusiness, property, infrastructure, etc. That “conglomerate cushion” helps earnings even while its auto 4W division fight harder battles.

Put simply: BBCA started from perfection pricing and slipped ever so slightly to very good.

ASII started from doom pricing and crawled up to not that bad. The second path often makes more money (for us investors).

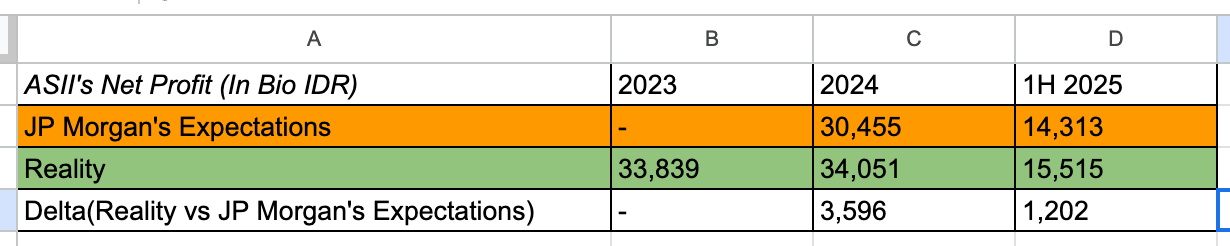

Below you can see how ASII’s actual net profit cleared J.P. Morgan’s Feb-24 downgrade bar—by about Rp3.6T (+11.8%) in 2024 and Rp1.2T (+8.4%) in 1H25. That “better than feared” gap is what fueled the rerating.

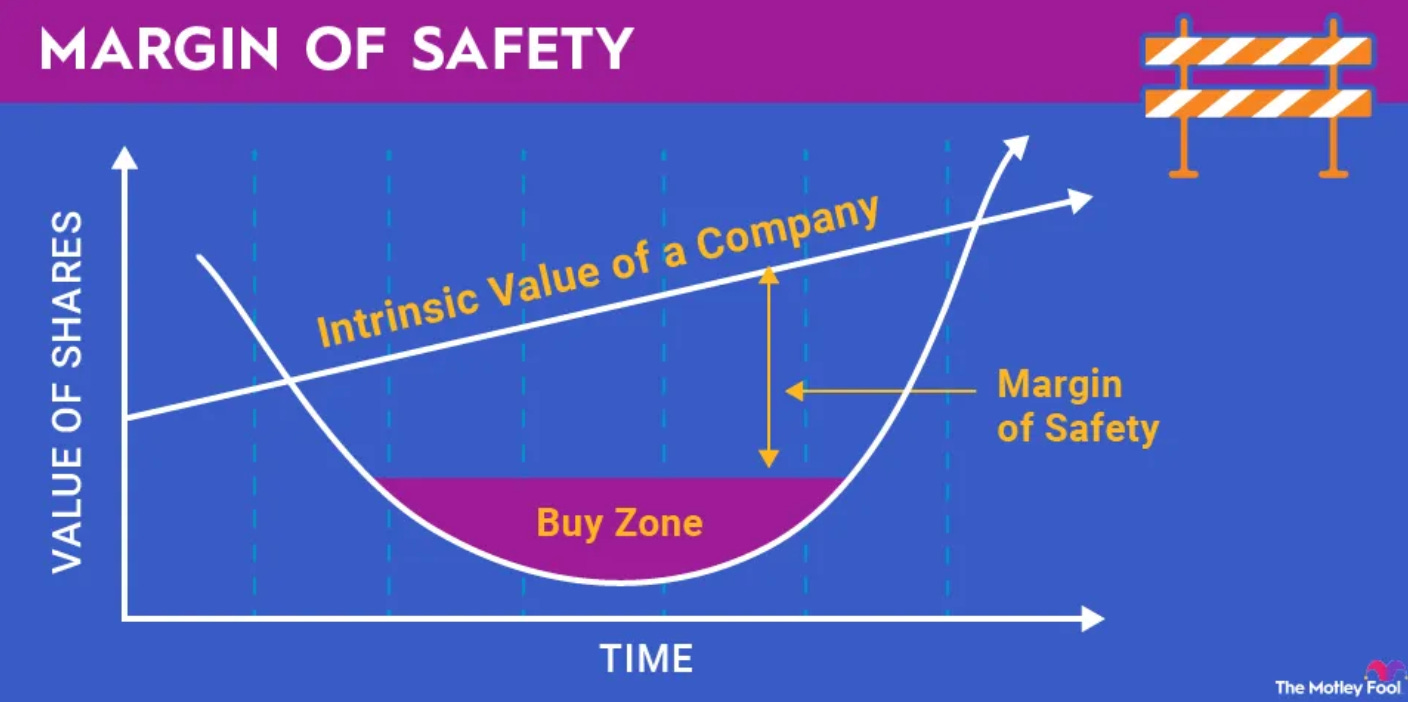

Margin of Safety: buy when expectations are already low

Buying when expectations are low gives you a Margin of Safety—room for things to go a little wrong without destroying your investment returns. Another analogy is like paying a discount price for an OK house; you found out that even if the kitchen needs work, you didn’t overpay overall.

Low expectations ≠ buying junk. You still want decent businesses with real cash flows and sensible balance sheets. The key is the combination: reasonable quality at a reasonable (or cheap) price when sentiment is down.

So, what to do? Buy ASII? Sell BBCA?

As mentioned in the disclaimer, article is not investment advice, but we can offer a simple checklist.

Use this before adding to a position:

What am I paying compared to its intrinsic value ?

Know your stock’s intrinsic value, and buy only if there’s a significant discount (relative to its value)

Shameless plug: read our handbook to know how we value a stock here —> https://www.recompound.id/handbook/how-we-invest

Premium + high expectations = fragile. Discount + low expectations = forgiving.

What’s the crowd’s mood?

Are headlines uniformly positive / negative on that particular stock ?

Are most brokers on one side (all BUY or all SELL)?

If “everyone loves it,” upside surprises are scarce. If “everyone hates it,” the bar is low.

How does price react to news?

Good results but the stock falls → expectations were too high.

Bad headlines but the stock holds/rises → bad news likely priced in.

What’s my “required return”?

With rates higher, demand a better entry price. Don’t pay “any price” for quality.

A 3% dividend won’t save an overpay.

Closing Remarks

We would like to emphasize that nothing is “wrong” with BBCA the business.

What hurt BBCA hodlers was the price they paid 1 - 2 years ago and the expectations embedded in that price.

The market re-priced that perfection a bit lower; the share price stalled.

At the same time, ASII was priced for disaster; when reality came in a little better than feared, the stock bounced hard.

Price matters. Expectations matter. Margin of Safety matters.

Or, channeling Howard Marks: don’t just buy good things—buy them well.