A 4-step guide to automate your stock investment workflow

For busy Indonesians wanting to buy Indonesian stocks

Hi 👋 welcome to Recompound Blog - The Investment Mindshift. We help you better your mindset on investment and economics one article at a time. More: Our Values | Advisory | Get to know us | Picks

Last week, we wrote about our shenanigans with clients and a little bit of behind the scenes. I realised that a lot of clients are super busy. It follows that probably our newsletter subscribers are also super busy. Therefore, our subscribers might appreciate a zero-cost tools to help them save time to invest passively and consistently in the stock market.

Am I making a slippery slope argument? Let me know by answering the polls below.

This article assumes that you are a person who is ready to invest passively. Meaning:

You have a 3 - 6 months emergency fund

You have an active income every month

You are not here to trade, but to invest for the long term. This means that you are looking to buy and hold for at least 3 years.

This approach is simple and you don’t have to know how to code. But you can actually automate your investment workflow and you don’t have to manually invest once the system is setup. The outcome of following through this guide is:

Staying consistent in putting in more funds into your investment portfolio.

Optimise on time in the market (not timing the market). You can stay invested and not have to worry about price fluctuations or market panics.

Save time. You’re busy and you know that money does not buy you time. But automation saves you time 🙂

Also, the goal is not to download the sekuritas app

Sekuritas app is mostly optimised for active traders because they earn their revenue from their users buying and selling securities. Since you are not an active trader, perhaps you don’t have to clutter your phone with a sekuritas app 🙂

Do you want to check on price? Don’t as it is usually noise, not signal. Or if you have to, you can Google the share price.

Want to check your official portfolio holdings? Sekuritas sends you a client statement pdf document every month right to your email inbox.

Without further ado, let’s get right into it.

Step 1: Get a brokerage account that has a broker (a person that can help you enter your trades).

This could be any brokerage firm that is not yet completely digital like:

NH Korindo

KB Valbury

Trimegah

RHB

and so on.

No, you don’t have to have a minimum amount of investments in your investment account to have these folks help you input your trades (usually). But what I personally prefer is that:

Broker needs to be responsive when I message them through WhatsApp

Broker needs to be able to accept my orders off market hours so that I can send the orders at night, and they execute when the market opens in the next trading day.

If you need a sekuritas (brokerage firm) with a broker, I personally have Kevin Pranata from NH Korindo to help input my investments. Some of our clients have Ola Pinata from KB Valbury to help them input theirs. All are super responsive (even during weekends). I’ll put the their codes in the appendix below if you want to have any of them as your broker.

Step 2: Set an amount and then fund your Rekening Dana Nasabah (RDN) automatically

Once the brokerage account is setup, now it is time to get the money into your RDN automatically.

I am quite sure that most banking apps these days can do a recurring transfer. I use MyBCA and setting up a recurring transfer is straightforward:

Make a transfer

Select your investment bank account

Input the nominal (For example Rp 5.000.000,-)

Select the transfer type to “berkala” or “periodically”

Then you can set which date you want to have the periodic transfer. For example, you can have the periodic transfer one day after your salary day.

Step 3: Pick a stock or a basket of stocks

The methodology is endless for this one:

You can of course, use Recompound 😀

Consult independent investment research houses

Select a stock with the best reputation in the market

Select an equity mutual fund (like Sri Kehati) and then list the top 10 stocks holdings

and many more. Assume that you have the following stocks:

OCBC Indonesia (NISP) because you want to be exposed to the Indonesian finance sector. (Actually I don’t use BBCA as an example because it gets thrown out as an example quite a lot by people).

Sido Muncul (SIDO) because you are a big believer in the Indonesian herbal medicine giant

Prodia (PRDA) because you believe the company is going to benefit from the expansion of health industry

Telkom (TLKM) because you want exposure to the telco company in Indonesia

You get the drift. From the above, you’d get a portfolio exposing you to multiple industries.

What’s important in my opinion is not to overthink the above at the start because:

You are investing for the long term (3+ years) and equity tends to do well in the long term.

You are dollar cost averaging anyways. If it goes down, the subsequent month, you get to average down.

You are most likely starting with a small amount of money, bear in mind not to touch the emergency fund that you have setup. As the money grows, you can always engage with external help to be on the look out of the fundamentals of the businesses that you are actively putting money into.

Learning by doing is often better and quicker than learning by studying.

Step 4: Automate your orders

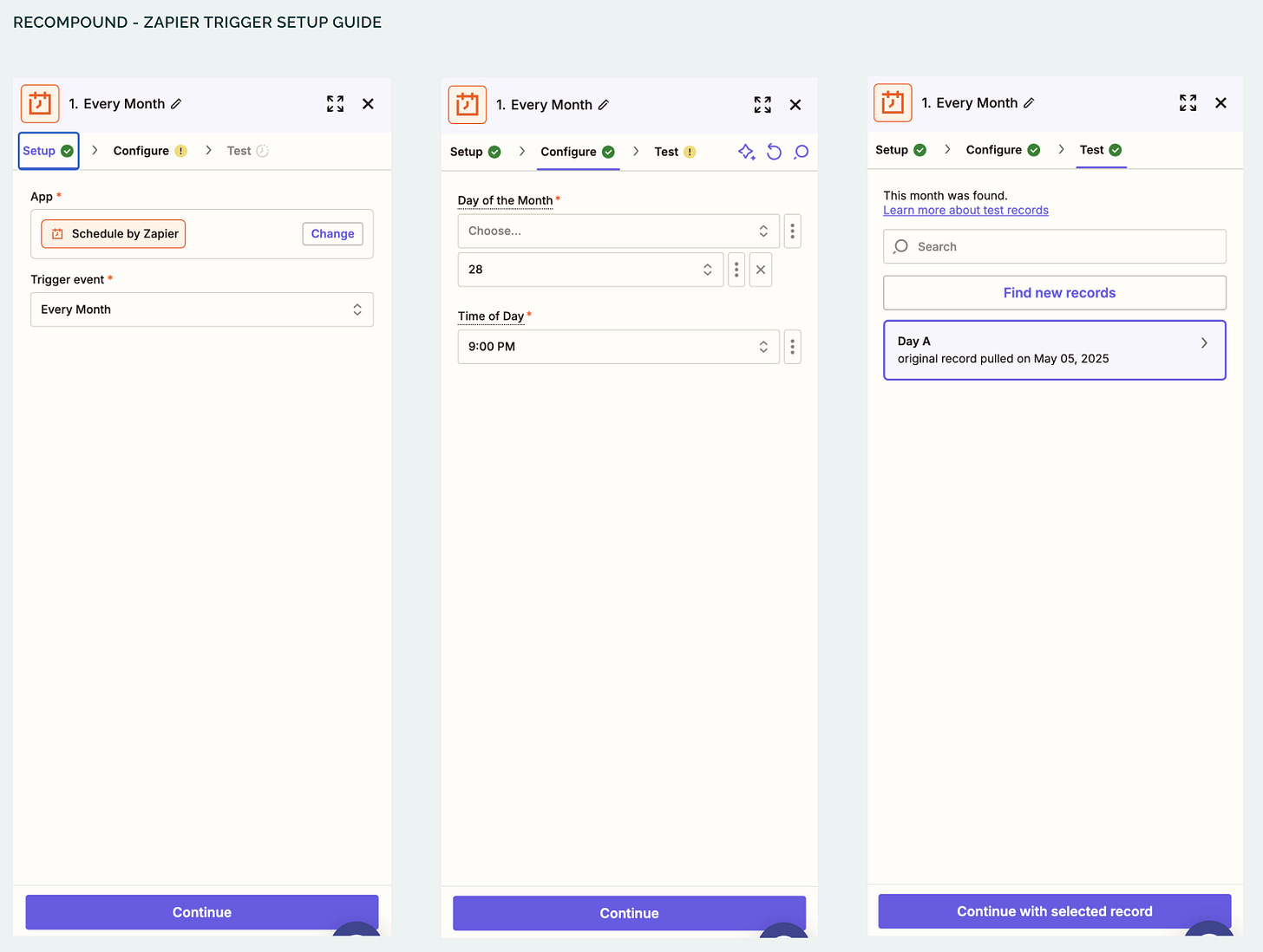

The way you automate your order is as follows. Go to Gmail or an email provider that is registered to your brokerage firm. Then you could send a recurring monthly message to your broker that you’ve registered. To do this with no code, you can use Zapier. In the dashboard, you could go to Zapier and connect your gmail account like so.

Then, you can create a new zap

Create a New Zap

Go to your Zapier dashboard, and click "Create Zap".

Trigger: "Schedule by Zapier"

Choose Schedule by Zapier as your Trigger App.

Set the frequency:

Daily / Weekly / Monthly / Custom (e.g., every month on the 28th at 9:00 PM)

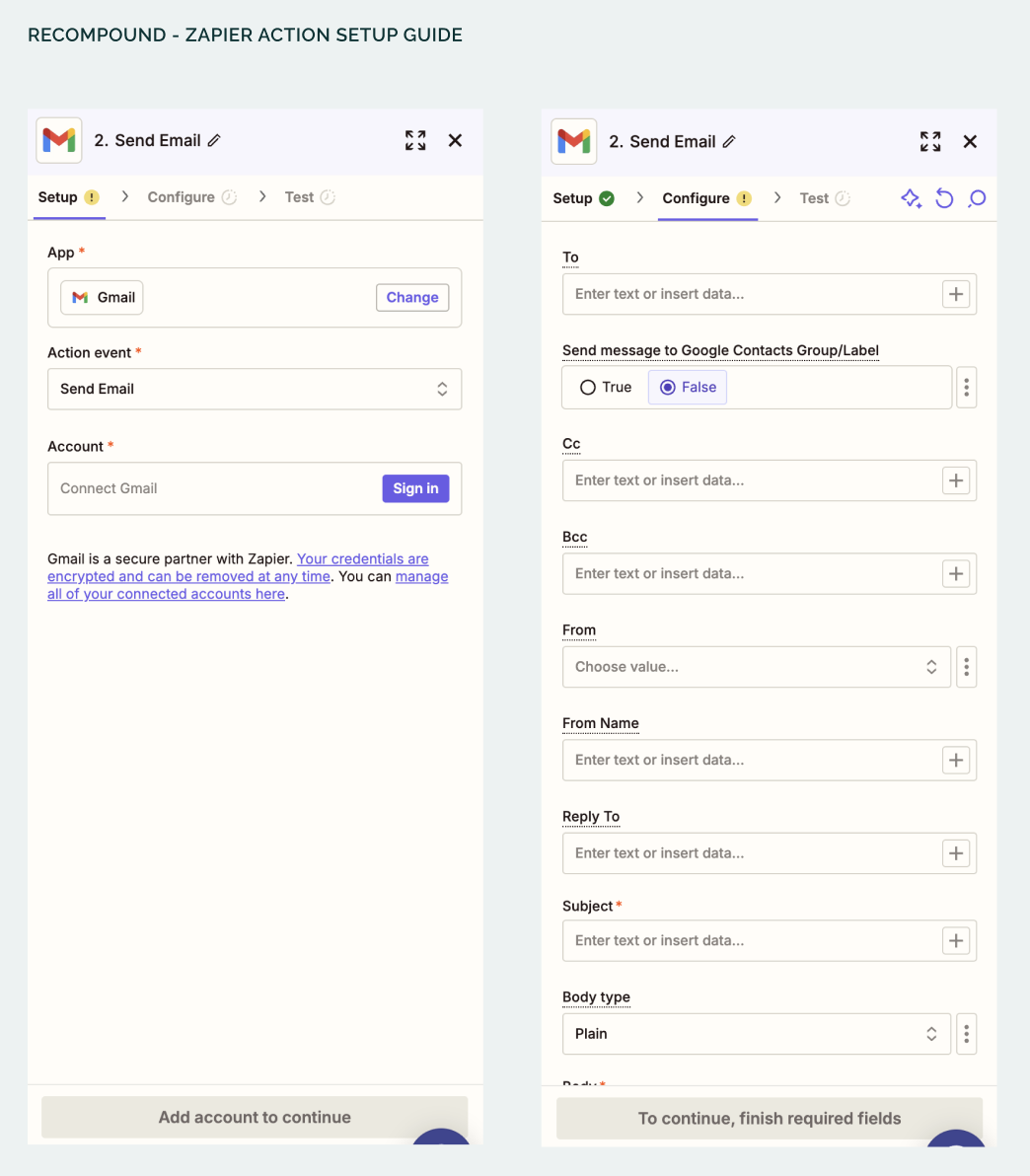

Action: "Send Email"

Choose Gmail, Outlook, or Email by Zapier.

Fill in:

To: recipient’s email

Subject: your subject

Body: your message content

(Optional) add dynamic content if needed

Test & Turn On

Zapier will send a test email. Once it works, turn the Zap ON.

Notes:

Make sure, you send the recurring message after you’ve funded the account with fresh funds.

Make sure the email recipient is your broker (the one you signed up with earlier)

To populate the Body, assume you want to order those 4 stocks with equal weighting, you can send something of this flavour

Hi Pak Kevin, dengan cash Rp 5.000.000,- saya ingin melakukan pembelian saham:

1. NISP | Budget Rp 1.250.000,- | di harga market

2. SIDO | Budget Rp 1.250.000,- | di harga market

3. PRDA | Budget Rp 1.250.000,- | di harga market

4. TLKM | Budget Rp 1.250.000,- | di harga market

You can literally copy paste the template above and change the stocks and budgets to fit your personal circumstances. Once the recurring message is set, you are good to go.

Once everything is setup,

Let your broker know that you will be sending them an email order every month through your email account that has been registered with the brokerage account. Let them know as well to inform you key information that is important. Here are 3 things that are important to me:

Whatsapp me if the cash balance turns out to be less than 0

Whatsapp me if the stocks don’t get bought out

Whatsapp me if the stocks have been successfully purchased

Then you know on the fly if the system has worked as you would have expected it or not.

If you’ve made it this far and actually implemented the guide

Congratulations! You’ve made a big step to:

Automate your stock investment workflow to make your money work harder for you

Potentially receive passive income if the stocks you purchase distributes dividends. As of 2025, IHSG stocks offer attractive dividends. Our clients on average gets a yield of 5.6%.

Compound your wealth. It won’t seem like its a lot at the start, but compounding effect is felt in the later years, not the start.

Be better than speculators who often make reckless investing decisions based on emotions derived from sentiments be it from news, social media or other unreliable sites instead of a fixed investment strategy.

All this benefit, you get by setting it up once and you don’t have to spend more time to think about your investments unnecessarily. Such that you can channel your energy and focus on things that really matter for you at the present moment.

When do I seek external help?

If you are starting out, I believe that help (that costs money) is not necessary. Likely you won’t put your entire savings account to your stocks investment account (don’t). And the mistakes you make won’t cost much, if you end up making any.

Seek external help when your money gets really big and you don’t know how to manage it. Or when it gets big enough that passive investing does not feel comfortable. Then you might need an active investment advisor that helps to look out for your investments.

When does Recompound enter the picture?

In case you are wondering if you are our client, the main benefit that you get is:

You don’t have to setup Zapier, you can regularly wire money to your RDN and let us know that you want to topup regularly. Our system will get your confirmation and our team will get to propose the investments for you.

Therefore, you don’t have to actively look for stock opportunities when you want to buy.

That’s all for today’s write up and hopefully it is helpful in any way.

Appendix

Kevin Pranata from NHKorindo

Ola Pinata from KB Valbury