The Mythical Stock Target Price

On Why We Shouldn't Get Fixated on it Too Much While Investing in Stocks

We write this blog post because this topic has become one of the most frequently asked question by our clients

Hi guys, what is the target price of stock ABCD? When are you guys going to sell it?

It has become so frequent that we have decided to write a blog post just to answer this question in a comprehensive manner.

The Reasons

These are the top 3 reasons why Recompound does not have a fixed price targets.

1. Poorer Risk Management Practices

In the previous blog post titled “There is No Free Lunch In the Stock Market”, we discussed that “free information” usually contains a price target. In our opinion, it would make people have poorer management practices.

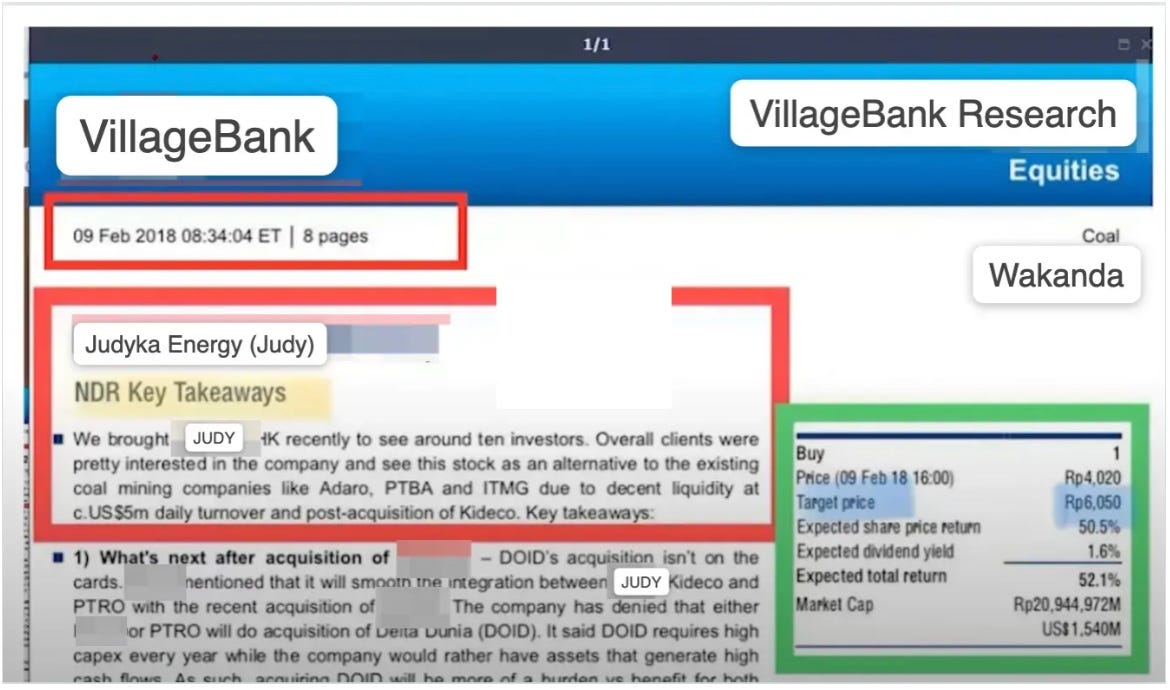

For example, in February 2018, a foreign bank published a target price of Rp 6,050. The stock price at that time (when the research report was published) was Rp 4,020, implying a ~50% upside.

After research was published, the stock price keeps going down and seems like the Rp 6,050 target price was forgotten.

If one buys the stock after reading the research report and keeps believing the Rp 6,050 target price while the stock price consistently going down, they are in a big trouble, because after February 2018 until the day this blog post is written five years later, the stock price never really went back to Rp 4,020 anymore, let alone Rp 6,050. Without proper risk management, they will have a floating loss of more than 50%.

When we are certain that price is going up to the said target, our risk management would go down the drain. We would wait for the price to go back up and achieve the target and not look more closely on the reasons why the price fail to be achieved.

Furthermore, we actually never know someone’s agenda when publishing a price target for a stock. Or the target price publisher might simply miss an important fundamental aspect of the company, hence hampering the price target calculation.

Hence, as price targets are known to cause people to pay less attention on risk management, we decide to not have it altogether.

2. The Stock Market is Dynamic

When a target price is published, that target is usually never fixed. There are a plethora of variables that may impact the fundamentals of a company, and those variables change everyday. By the time a revision is published, stock price might have moved against your favor.

When someone buys a stock, it is their obligation to regularly perform due diligence and monitor the fundamental & prospect of the stock.

That is why in our humble opinion, stock investing / trading is a full time job. We discussed about this in more details on our previous blog post “Why You Are Still Losing Money in the Stock Market”.

With this dynamic nature of stock market in mind, we do not think that updating our clients with revised price targets frequently is desirable.

3. Target Price Can Never Be Accurately Predicted

No one knows the real peak price of a stock, probably except God & the Bandar (the market maker).

This is because there are so many parameters that can influence stock price, and those do not only come from company fundamentals, but also including market sentiments as well.

Let’s say an equity research house sets a target price of stock A at Rp 800. You purchase the stock at Rp 500. Within 1 month, the stock target price is hit at Rp 800. You then sell the stock at Rp 800 (handsome 60% profit) knowing that the “target price” of the stock has been reached.

However, for the next 2 months, the stock keeps rallying and hits Rp 2,000. You might regret the decision of having sold the stock at Rp 800 because of that target.

Worse still after you have sold the stock at Rp 800, the same research house upgraded the target price of the stock to Rp 3,000 because of a huge positive catalyst to its fundamentals.

Hopefully, you get our point.

What is More Important Than Target Price ?

Consistent Portfolio Value Growth Overtime.

We have discussed this north star metric on our previous blog post “Why You Are Still Losing Money in the Stock Market” as well.

Conclusion: Is Stock Target Price Entirely Useless?

From this blog post, we do not mean stock target price is useless at all. Quite the opposite, we also use it to evaluate our stocks, however, what we are more interested (and far more important) is in the reasoning behind that stock’s target price. Because that is how the stock target price is produced, after all.

When that reasoning is no longer valid, it becomes our responsibility to update our investment strategy and decisions accordingly to meet our investment targets.